Free Real Estate Power of Attorney Forms

A real estate power of attorney is a common but limited power of attorney that’s useful anytime you want someone else to deal with your real estate. A real estate POA isn’t difficult to put together, but you do need to be careful that you don’t give your attorney-in-fact more powers than you wanted to.

This guide will help you learn how to get a real estate power of attorney form, what steps you need to take to fill out the legal document, and some tips to make the whole process easier.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What is a Real Estate POA?

In the most basic terms, a Real Estate POA is a form that gives someone else the right to buy and sell real estate in your name. They can also handle the management of your real estate and execute any additional powers you give them. Your free power of attorney form will give the chosen person, your attorney-in-fact, the right to act on your behalf unless and until you are incapacitated.

That’s because Real Estate POAs are almost never durable power of attorney forms.

So, while you do not have to be in the country or nearby for your attorney-in-fact to act on your behalf, they will not retain their power as your attorney-in-fact if you are incapacitated. You will also need a separate form if you’d like to create an agent with power of attorney for real estate after you’ve passed.

Your agent can be anyone you trust and who has the common sense to manage your real estate. You should be sure that anyone you’re considering will act in your best interests, and it can help if the person you choose has some basic skills when it comes to managing finance or real estate.

If you have any close friends who are also real estate agents, they may be a good option since they have the specialized knowledge you want in an attorney-in-fact.

When to Use a Real Estate POA

A Real Estate POA gives your attorney-in-fact the power to buy and sell real estate. They can also help manage your existing real estate, including making any important maintenance decisions you need.

These forms are good for when you have more property than you can manage on your own but do not want to start a real estate management company to handle everything.

It’s also a good option if you’re looking at traveling out of the country or are about to have a medical procedure and need long recovery time.

A Real Estate POA is also incredibly useful if you own property far away from where you live and would like to authorize someone else to manage it. They can even oversee the purchase of the real estate in that area to help you grow your Real Estate portfolio without having to travel to take care of things yourself.

The power of attorney for real estate transactions covers almost anything that can be done with your properties. Once granted, your attorney-in-fact can act without having to get the principal’s signature (your signature), so it’s doubly important to make sure that you trust the person you’re naming your agent.

Real Estate Power of Attorney Form Details

| Document Name | Real Estate Power of Attorney Form |

| Other Names | Property Power of Attorney, House Power of Attorney |

| Where to File? | Can be attached to the property deed to reassure the title examiner. |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 40 |

| Available Formats | Adobe PDF; Microsoft Word |

Steps to Getting a Real Estate POA

Getting a real estate POA is usually relatively simple, especially if you don’t need to customize it much. There are free real estate power of attorney forms to print, and those legal forms can be a great starting place.

However, if you’re looking to create a more complicated POA or don’t like the terms outlined by a POA document available for free, you may want to consult with a licensed lawyer to create customized POA specific to your situation.

An attorney can customize the terms and authority provided by the document and can help you limit the power of your attorney-in-fact as needed. For instance, you may want to give your agent the authority to purchase and manage your properties without authorizing the sale of real estate.

It is also possible to customize a template to give your attorney more or less power than included in the original power of attorney form.

Risks of Using POAs in Real Estate Transactions

Your attorney-in-fact has a fiduciary responsibility to act in the principal’s best interests. That means that as principal, your agent cannot just take the money and run without executing their responsibilities.

Despite those legal requirements, there are risks in creating a power of attorney, and real estate agents tend to look very closely at POA in case the document isn’t entirely legal or isn’t being executed in a reasonable manner.

There are even some real estate companies that will not allow real estate closing without the principal’s signature. One of the most common questions you’ll see is why the POA is involved in the first place and if it was made without coercion.

If the company you’re working with doesn’t want to work with your agent, you may have no option but to come and sign their documents in person.

The opposite situation can also cause problems. If your agent purchases or sell your property without your permission, including if they’ve sold it below market value, you may not have many legal options. As principal, you’ve authorized your agent to act on your behalf, and as long as they have not gone beyond the authority you’ve given them, you aren’t protected from their bad decisions.

Here are a few more examples of problems that might arise with a real estate attorney-in-fact:

- May not be able to close a sale if the POA is not accepted

- Can be sued for not closing a real estate sale properly due to delays

- May have more limited bank and real estate company options

- May end up buying a property for more than you wanted to spend

- May end up selling a property for less than you intended to

One common problem in the real estate industry is caregivers coercing a family member into giving them POA to sell a property they don’t want to be sold or to free up financial resources for their care.

The combination of those problems means that it may take some time to establish your agent and work with local real estate companies to know that your agent is authorized to use the power you give them.

One exception is military POA. In the case of military deployment, a soldier can designate an agent and those POAs are almost always accepted and considered valid.

Tips on Avoiding Problems

It’s a good thing that POAs are looked at carefully before they are accepted, but it can cause some problems if you don’t know how to avoid those hiccups. Worse, if you can’t get problems with a POA settled ahead of time, you might lose out on a sale.

Your Agent Should Always Say That They Are Using Power of Attorney

The first tip is that your agent should never represent themselves as the person buying or selling a home. Before you enter into any negotiation, your agent must say that they are acting as a power of attorney.

Disclosing that early does a couple of things. It gives the real estate agent more confidence that they are working with an agent acting in good faith. It also gives them time to back out of a sale or tell your agent that they would need the principal’s signature before continuing.

It also protects your agent. If they hire a contractor to repair one of your properties, for instance, they are not liable for the costs of that repair if they say that they are using a power of attorney to hire the contractors on your behalf. Otherwise, they might get hit with a bill in your place.

Sign the POA with the Real Estate Company

Many companies will not honor a POA that was not created in their office since they want to be sure that there isn’t something wrong with it.

If you’re moving, leaving the country on vacation, or otherwise know that you will not be available for an important sale or transaction, it’s a good idea to schedule to create a POA with the real estate company there as a witness.

Doing this helps your agent get the trust they need from the company and helps reduce the liability risk for both the company and your agent moving forward. They may also ask that you use specific rules and limitations in your POA to help protect all parties involved.

It’s possible that they may ask for a limited POA that expires after the specified transaction is complete. Usually, it’s better to go ahead and use the limited POA instead of asking for a regular POA or a durable POA since the company may not honor the same form in the future.

How to Fill Out a Real Estate POA

Once you have a real estate POA, you still need to fill out the form and customize it to suit your specific needs. You’ll also need to get your POA notarized in most states since it’s dealing with properties.

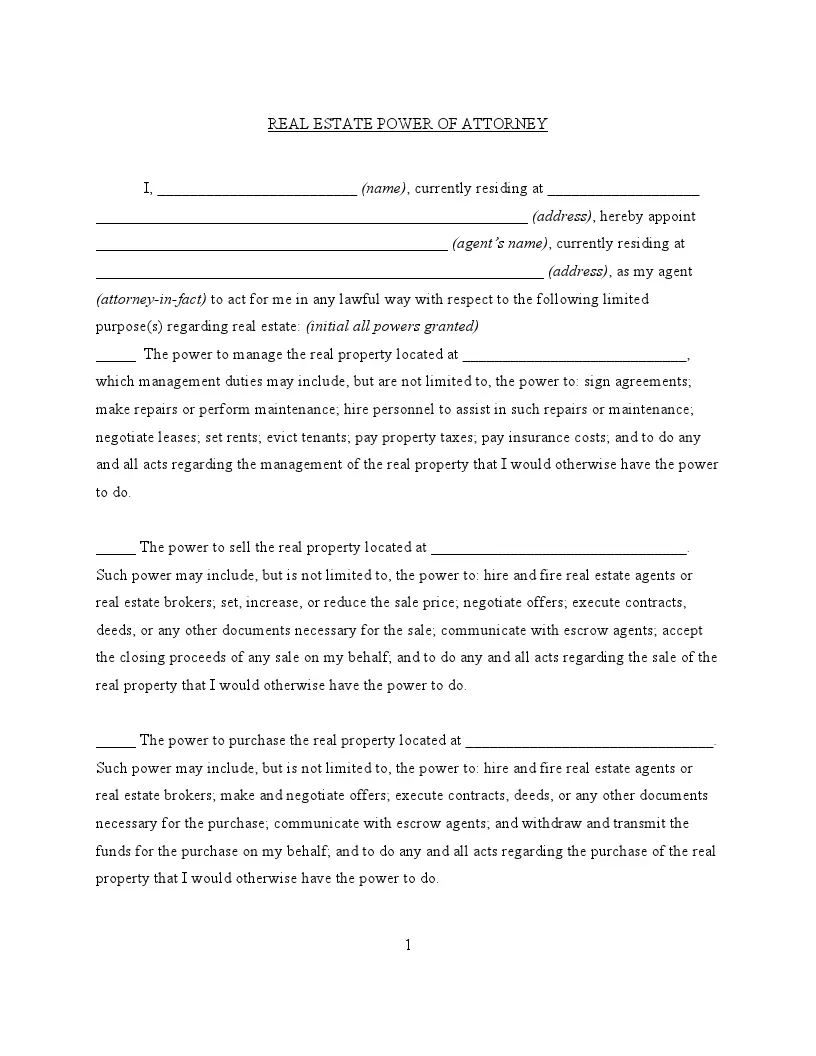

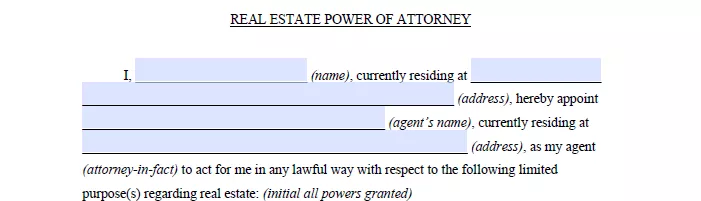

Step 1: Fill Out Personal Information

The first thing you need to do is fill out the personal information for yourself as principal and for your agent. That includes your full legal name as well as your current address. You can also choose to include other contact information as needed, but it’s not legally required.

Step 2: Specify Which Properties Are Covered by the POA

Since you’re dealing with properties in your POA, these documents are usually designed to cover specific properties rather than granting generalized powers. You can add to those properties later on, but you will need to sign the updated document and may need to sign in front of a notary public to certify the additions.

It’s a good idea to use the term ‘premises located at ___’ so that your instructions are very clear. You can list multiple properties under each power as needed.

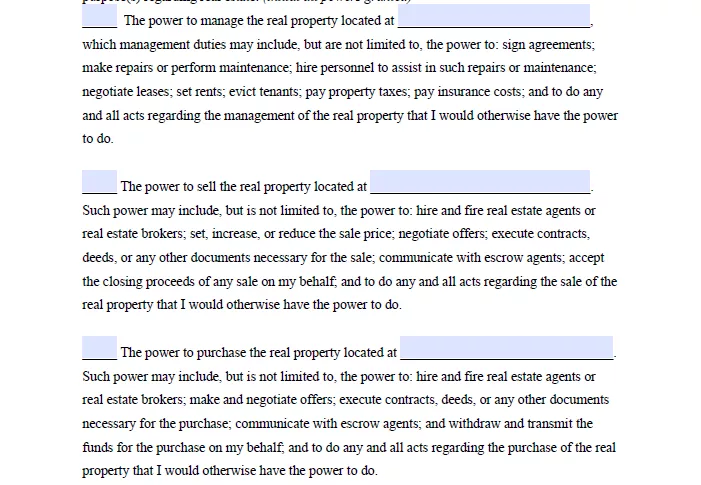

Step 3: Customize Powers

Most of these documents will have a set of power pre-selected for you before you fill them out. That doesn’t mean that you’re married to that list. You can add and remove powers in almost any form.

Our POA template also provides several blank lines where you can further customize the powers granted to your attorney by the POA.

Step 4: Customize the Special Instructions

There is also a section with special instructions that you can use to grant additional power or to place limitations on the POA before it’s signed. These instructions include an effective date and the option of setting a specific date when the POA expires.

You will also be asked to decide if the POA will expire if you are incapacitated, or if it will continue. Remember that you must be of sound mind when you sign the form and that you may be considered incapacitated by a wide variety of illnesses and any injury that affects your ability to think and function, even if only temporarily.

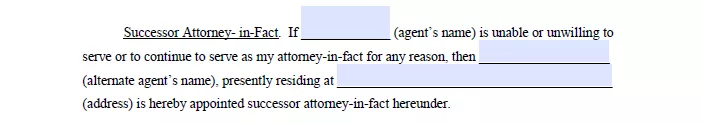

Step 5: Choose a Successor Power of Attorney

The next step is to decide whether you would like to include a successor attorney. This person will step in to execute your POA if your primary agent is incapacitated or unavailable. You don’t need to have a successor power of attorney, but it can provide additional peace of mind.

Having a successor attorney in place means that you don’t have to worry as much about something going wrong with your agent on the day of a sale because there is someone available to step in if needed.

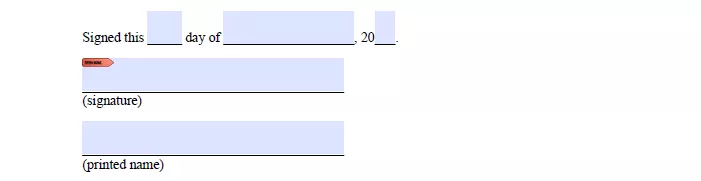

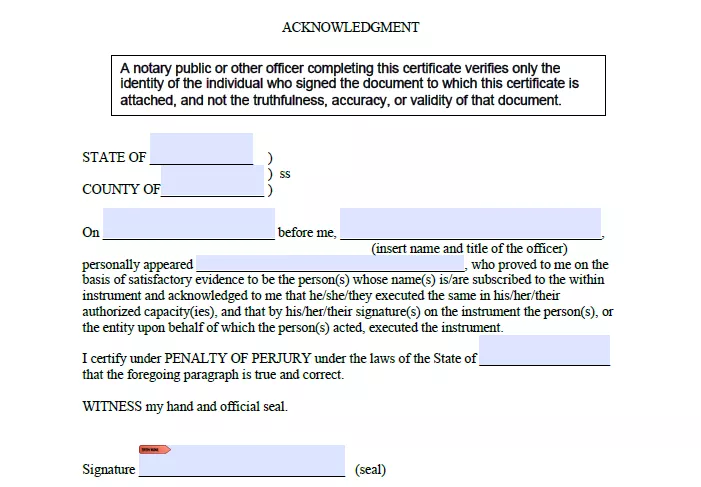

Step 6: Get the Form Signed and Notarized

Almost all states require this kind of power of attorney to be signed and notarized to be considered valid, partially because the state is involved in the transfer of property and titling. Having a notarized power of attorney helps the state validate that the POA is correct and that the person acting as your attorney is acting in good faith.

You, your attorney, the notary public, and at least one witness should all be present for the final signing of the document. You should also make several copies of the finished power of attorney at the same time. Your agent needs a copy, you need a copy as principal, and any successor attorneys are also required to have at least one copy.

Depending on your state you may also be required to file your finished power of attorney form directly with the state.