Free Release of Promissory Note Template

The Release of Promissory Note is a document of record that shows that the loan has been paid back in full and in accordance with the promissory note. It signifies satisfaction of debt and a promissory note paid in full. While a promissory note records the existence of a loan between the parties, a promissory note release form shows that the transaction has been completed between the parties. It records that the borrower has paid back the original amount plus the interest to the lender as per their agreement. It sets the parties in the loan document free from their legal obligations and protects them from future legal action. The release form sometimes also referred to as a Release of Debt Form, a Loan Satisfaction Letter, or a Promissory Note Payoff Letter.

You can create your own Promissory Note Release with FormsPal’s easy-to-use release of promissory note template. Besides that, you can also try out our builder to create a customized promissory note template.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

When to Use?

A promissory note release form is used when the money under the note, which includes both the original amount as well as interest, plus the late fees or penalties, if any, has been paid by the borrower to the lender on the date written in the note. The release form is signed by the lender and provided to the borrower, relinquishing the borrower from all obligations under the law. Sometimes, the parties enter into a settlement where the lender may accept lesser than the original money due or even forgive a debt. Even in those situations, a promissory note release must be used to record that the transaction is complete.

It should be noted that the death of a noteholder does not release the borrower under the law, except where the original note mentions that the death of the noteholder will cancel the debt.

How to Use?

It is important to note that a promissory note release, once signed, is an agreement set in stone and no changes can be made later. The following information should be kept in mind while signing it:

Make sure the transaction is complete

Before putting your signature, make sure that all pending payments from the borrower are completed. All legal terms related to debt money, interest, late fees, penalties, and date must be checked. Once the promissory note release is signed, the original note becomes null and void under the law.

Address the lien

If the note was a secured note, then all documentation to address, cancel, or terminate the lien must be completed. Usually, a release of lien or discharge of security agreement is also signed along with the release form where the note was secured with personal property. If the note was secured with a mortgage on real property, then a release of mortgage should be signed. If there is a deed of trust, then a deed transferring the property to the borrower should be made as well by the trustee.

Check and Recheck the Original Promissory Note Documents

Go through the promissory note to check and recheck that all the terms, steps, and procedures prescribed in the document are complete.

Do I have to notarize the release of a promissory note?

Even though not mandatory under the law, it is advisable to get the release form notarized to avoid any future issues that may arise related to the validity of the release itself. If you decide not to get your release form notarized, make sure there is no mention of a notary in the release form.

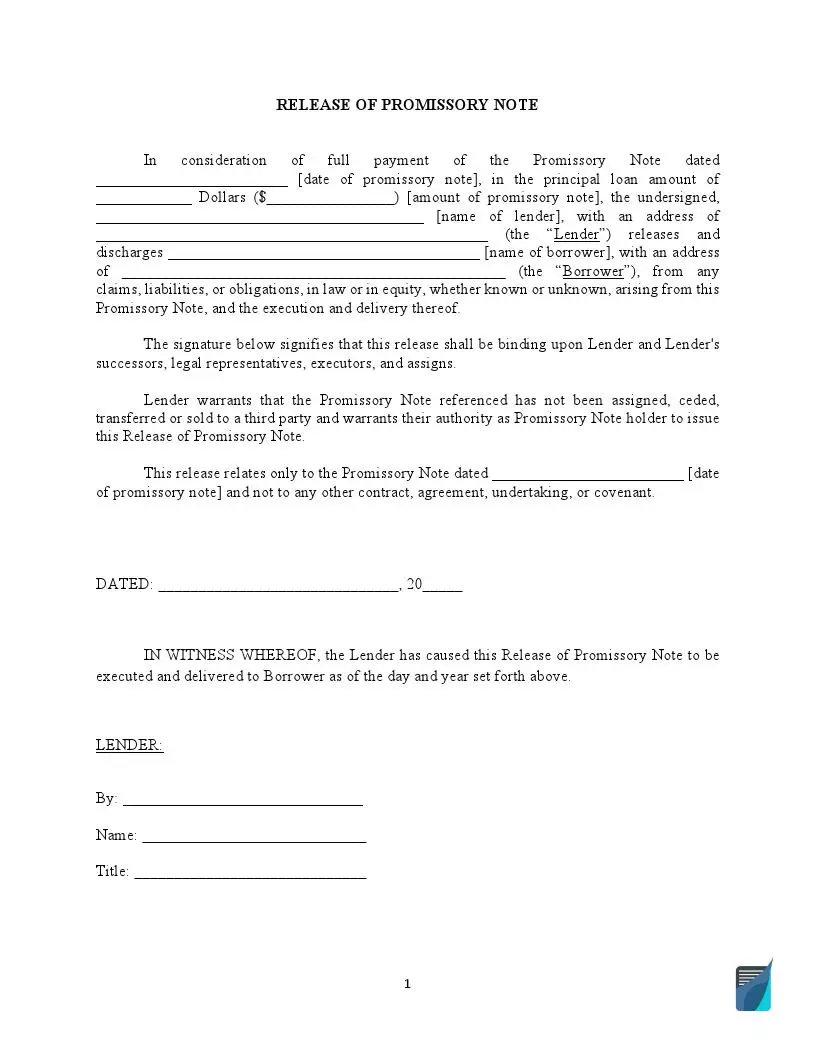

What Details Should be Included?

The release of promissory note form must include the following information:

- Name of the borrower and lender

- A reference to the original note identifying the note by mentioning the date, time, and the place

- The total amount paid back (mention different amounts by identifying them as principal, interest, late fees)

- Date of the release form

- Signature of both the borrower and lender

After putting the signature of both the parties, the signed document must be given to both the borrower and the lender. The release form should be preserved as a document of record by both the borrower and the noteholder.

Filling out a Release of Promissory Note

While filling out a promissory note release form, the following steps must be followed:

Identify the Original Note

In the release form, identify and mention specific information from the original note document like the name of the borrower and lender, date, total amount, interest, and the effective date.

Enter the Repayment Made

In the release form, enter the repayment money and the date of the repayment and also mention that the debt is settled in full after all payment is received.

Enter the Address and Sign

Enter the name and address of the paying and the receiving party in the release form.

After mentioning all details in the release form, the borrower and lender should sign the document.

Provide a Copy

After completing the release form, provide a copy of the documents to both the borrower and lender for legal purposes.

Now that you know how simple it is to fill out a promissory note release form, download and use FormsPal’s free promissory note release form template. Our document building software can make it even easier, just give it a try.