Short Sale Addendum Form

Depending on the property that you are buying or selling, a short sale addendum might need to be added to your fillable purchase agreement template. The addendum to real estate purchase contracts vary by state and bank, so always check for the specific guidelines you may have when it comes to short sale addendums.

If you need help with short sale addendums, check out this guide to see what they are and when you might need one. You can also use the template to help guide you.

What Is a Short Sale Addendum?

A short sale addendum is when the seller of the real estate owes more money on the property than what it’s worth. The seller will always need to seek a creditor’s expense when it comes to see if they can sell their property or not. In some cases, the seller may still need to pay the creditor for the remaining balance after the sale has been completed.

The seller can negotiate with the buyer on the price to see if they are willing to help pay off the creditor. However, most buyers will still want a fair price and not want to feel they are paying off the seller’s debt.

Usually, a hardship will need to be proved for the creditor to give the short sale. This can vary based on the situation, but they usually need to show a change in economic events, loss of job, or the inability to work due to a medical condition.

When is it Necessary to Use a Short Sale Addendum?

A short sale addendum is required when the market or listing price for a home is less than what the seller owes. This usually happens if the market prices have dropped or if the real estate industry has taken a hit. It’s not an ideal situation, but sometimes it is necessary to get out of your mortgage.

A short sale and foreclosure are not the same and will not affect your credit or finances the same way.

Short Sale vs. Foreclosure

Key components of a short sale:

- Seller is current with their mortgage

- Balance is $0 after the home is sold

- Doesn’t affect the seller’s credit score

- Bank consents before the home are sold

Key components of a foreclosure:

- Seller is not current with their mortgage

- Balance remains after the home is sold

- Affects the seller’s credit score

- Bank consents after the home are put up for auction

How a Short Sale Works

A short sale involves gathering some important paperwork. It works similar to many other real estate transactions, just with added approval from the bank that the property can be sold.

Get a sale comparable in the area

Sometimes a home may be worth less than the amount of the mortgage value. The local market has probably seen a depreciation of the surrounding homes making homes in that area worth a lower amount than what could be expected.

A local real estate agent can look at other homes in the area that are the same size and with the same amenities as your home. This should give them a good idea of how much your home might be currently worth.

Write a financial hardship letter

A financial hardship letter is almost always required because having a low-price home is not enough to be qualified for a short sale. The lender will want proof that you have suffered financially and need help selling your home.

A bank will usually lose more money in foreclosure so they may be more likely to give a short sale agreement. As the mortgagor, you will need to provide paperwork on the loss of employment, loss of income, too many financial liabilities, a medical condition, etc.

Gather financial statements

This goes with providing proof of financial hardship. While the letter will explain why it happened, you will need to also show when it happened and how much loss there was. You will usually have to provide some or all the following:

- A list of all expenses and liabilities

- Last two months of bank statements

- Last two months of pay stubs and income

- Two years of tax returns including W2’s and 1099’s

Attach all purchase documents

You can choose to include the purchase agreements and selling price with the letter and bank information. This may make the process go quicker and give the lender all the information they need.

Make sure to include the listing agreement or real estate purchase agreement with the qualified buyer’s information attached. You should also include the forms from the real estate agent and have them sign the paperwork.

Take the documents to the bank

Take the completed package to the bank so they can review it. It will usually take about 10-45 days for the bank to review it. If you didn’t send the paperwork to the bank for the purchase agreement, continue to look for a qualified buyer with the highest price.

Send the purchase agreement to the bank as soon as it’s signed and completed.

Wait for bank approval

The approval from the bank may take up to 120 days. They may assign you a negotiator and approve or reject the terms of the sale. The appraisal and approval process can take up to 120 days.

The bank and the seller will then negotiate the financial obligations in a separate manner. Each bank has its own terms and conditions.

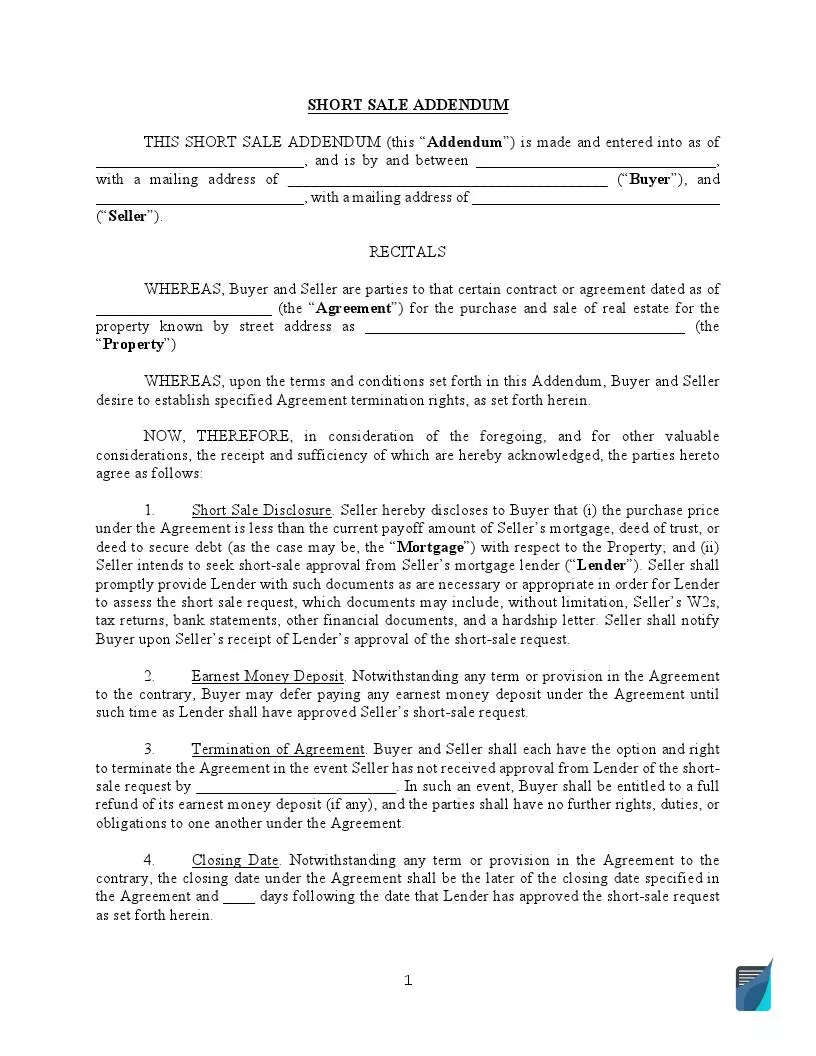

What Are the Main Components of the Addendum?

The short sale addendum should include a few key components to be considered accurate.

Buyer and seller information

This will include the names and addresses of the buyer and seller. It will also include the property being sold and the address.

Closing date

This section should list how many days the seller has to deliver credit approval to the buyer. They will need to supply the buyer with all this information once they have it.

Signatures

The buyer and seller need to sign and date the form. They should also print their names.

Filling Out the Short Sale Addendum Template

When filling out the template, you should be sure everything is filled out correctly.

Indicate parties

The buyer and seller will write their names and addresses. Make sure it’s the same as the purchase agreement.

Indicate the property

List the date of the agreement and the property address in full.

Write the closing date

Indicate how many days after the agreement the closing is and how many days the seller has to give the creditor approval.

Signatures

The buyer and seller should sign their names and date the form.