The exchange between a donor and a tax-exempt organization is more than simply a transaction because this partnership fuels change and supports vital causes. The 501(c)(3) donation receipt, a basic but essential document that legally acknowledges a donation to a tax-exempt organization, is fundamental to this transaction.

Why Is the 501(c)(3) Donation Receipt Template Important?

Adhering to the guidelines for issuing donation receipts is not just a matter of best practice; it’s a legal requirement for organizations recognized under Section 501 (c) (3) of the Internal Revenue Code. These receipts ensure that organizations maintain their tax-exempt status by demonstrating transparency and accountability in their financial dealings. Moreover, they’re needed in the organization’s record-keeping, helping to track the generosity that keeps their operations afloat.

Donors also rely on these receipts to claim tax deductions on their annual returns, providing a tangible benefit for their goodwill. By itemizing their donations and presenting the receipts as proof, donors can reduce their taxable income, ultimately receiving recognition from the government for their contributions to society. This tax incentive is a significant driver for charitable giving, encouraging individuals and corporations to invest in the betterment of their communities.

Thus, the 501(c)(3) donation receipt is a linchpin in the philanthropic ecosystem, supporting a cycle of giving and receiving that benefits all parties involved. If you are looking for a sample 501(c)(3) donation receipt letter, just use our PDF editor to fill out the already-prepared form.

Filling Out Donation Receipt Template for 501(c)(3)

Each of these steps ensures that the 501(c)(3) receipt template is filled out and accurately for tax and record-keeping purposes.

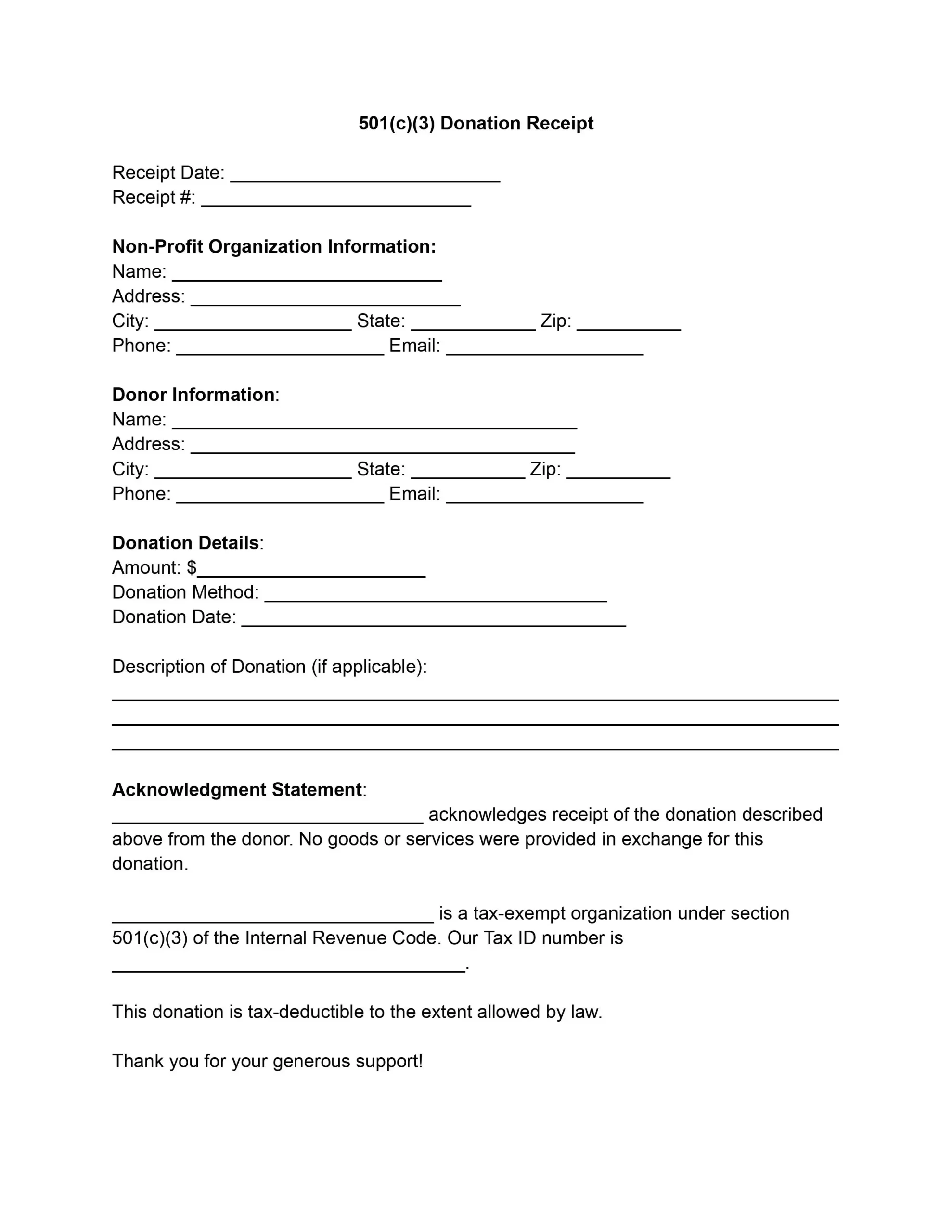

1. Date and Receipt Number

Begin by entering the date when the receipt is issued in the “Receipt Date” field. Next, assign a unique identification number to each receipt for internal tracking and enter it in the “Receipt #” field.

2. Non-Profit Organization Information

Fill in the organization’s name, address (city, state, and zip code), phone number, and email address. This information establishes the receipt’s authenticity and provides the donor with contact details for any queries.

3. Donor Information

Input the donor’s full name and address (city, state, zip code), along with their phone number and email address. This section is critical for personalizing the receipt and ensuring the donor’s information is accurately recorded for tax purposes.

4. Donation Details

Specify the donated amount in dollars under “Amount.” In the “Donation Method” field, describe how the donation was made (e.g., cash, check, credit card). Record the exact date of the donation under “Donation Date.”

5. Description of Donation

If the donation includes non-monetary items, provide a detailed description in the designated section. This description should be comprehensive, including the condition of the items, if applicable, to help determine their value.

6. Acknowledgment Statement

Write the actual name of your non-profit in the acknowledgment statement. This statement confirms the donation receipt and clarifies that no goods or services were provided in exchange for the donation, which is essential for the donation to be tax-deductible.

7. Tax-Exempt Status and Tax ID

Confirm your organization’s 501(c)(3) status by repeating its name and stating it is tax-exempt under the IRS code. Include your organization’s Tax ID number for the donor’s tax records.

8. Signature and Representative’s Details

An authorized representative of the non-profit should sign the receipt. Below the signature, print the representative’s name and title, along with the organization’s name, again for clarity.