New Mexico Small Estate Affidavit Form

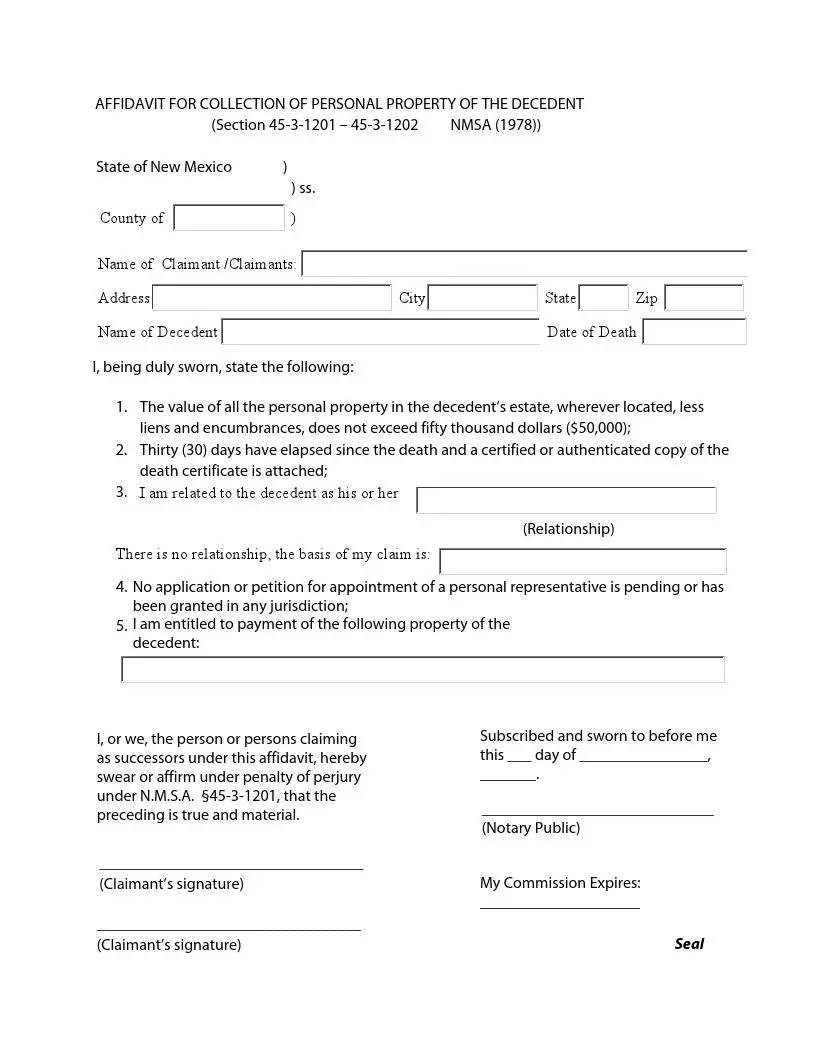

The New Mexico small estate affidavit form is needed when a family member dies “intestate,” meaning that they did not leave a will. In these circumstances, other legal forms and laws will determine how their assets and property will be handled after their death. This is a part of the process called “probate.” It deals with distributing the deceased person’s assets and releasing their debts if there were any.

One of the possible scenarios is that the deceased left assets that fall into the category of a “small estate.” Then the family members (called the “claimants” in the form) and other individuals entitled to the estate can submit a small estate affidavit form to a local court. This can make the process of distributing the assets significantly easier for everyone involved.

The definitions for what can be considered a “small” estate vary from state to state. Keep reading to see what legal requirements apply to small estate affidavits to collect the personal property in New Mexico.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

New Mexico Laws and Requirements

The New Mexico Statutes define how much the value of an estate should be for it to fall into the small estate category and what other conditions should be met for a small estate affidavit in Chapter 45:

- The value of the estate should be no more than $50,000.

- There is no personal representative assigned or no pending applications for one.

- The individual making a claim is entitled to the estate.

- Thirty days or more have passed since the day of death.

If all the conditions mentioned above apply to your case, you can ask the local probate court to implement the simplified small estate procedure is much easier than a typical probate process for larger estates. Remember that the estate’s value should include any valuable property, such as jewelry, art possessions, and vehicles of the deceased.

Relatives of the deceased can take advantage of the simplified process of distributing the estate of the deceased person with the New Mexico small estate affidavit form. Use our form building software for the best experience and create your form quickly with our ready-made template.

New Mexico Small Estate Affidavit Laws Details

| Max. Estate | $50,000 |

| Min. Time to Wait After Death | 30 days |

| Filing Fee | Not specified |

| State Laws | New Mexico Annotated Statutes, Sections 45-3-1201 to 45-3-1206 |

Various other major New Mexico forms readily available for download and that can be modified in our hassle-free document constructor.

Filling Out the New Mexico Small Affidavit Form

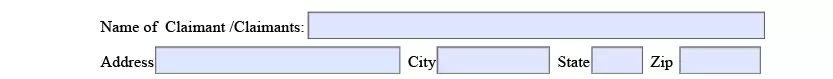

1. Identify the Claimants

Provide the names and addresses of the individuals claiming the estate collection.

2. Name the Deceased and State the Date of Death

Include the name of the deceased and the date when they died.

![]()

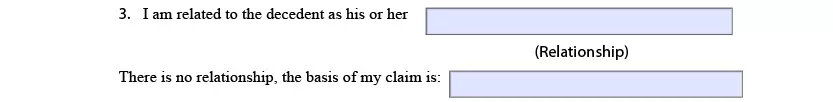

3. Explain the Foundation for your Claim

The form asks you to swear that the necessary conditions apply in your case and specify your relationship to the deceased. It does not matter if you are a relative or not. You need to explain why you can make such a claim.

4. Specify how much of the Estate you are Entitled to

Include how much of the property you are entitled to.

5. Sign the Form

Every claimant should sign the affidavit. The signature mainly confirms that you swear that the information if the form is true.

6. Let a Notary Public Complete the Form

This is the last section of the form. Notarization ensures that an impartial individual with specific legal powers has acknowledged your signature on the form.

7. Submit the Affidavit Form to the Court

Ask if you need to submit any additional documents with your application. It can be especially important for if the estate includes any real property.