North Carolina Small Estate Affidavit Form

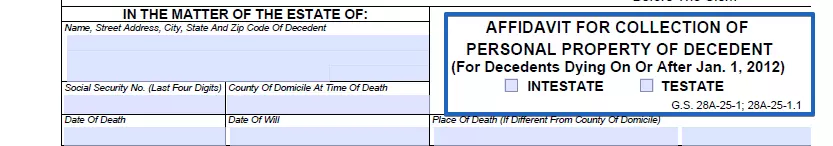

North Carolina Small Estate Affidavit Form establishes the heir(s) ‘ legal rights to the decedent’s personal property. Following the state laws §28A-25-1.1, the form is also recognized as Affidavit for Collection of Personal Property of Decedent. It contains regulations and directives on how to proceed with the estate application.

The affiant (a person who claims to collect and distribute the deceased person’s property assets) is empowered to conduct the property distribution procedure and reimburse any debts left by the decedent.

Applying for a small estate affidavit form allows the relatives to avoid tedious court schemes and take possession of the assets instantly. There are compulsory terms that one should respect to run the process legally.

North Carolina Laws and Requirements

North Carolina small estate affidavit form relies on some mandatory conditions introduced by the state Statutes §28A-25-1. The following qualifications must be provided to make the procedure successful:

- The decedent’s assets and personal property must be worth 20,000 USD or less.

- If the surviving spouse solely applies for the small estate, the decedent’s property’s value may exceed 20,00 USD but be under 30,000 USD.

- An authorized copy of the will (if any) of the person who passed away should be added to the small estate application.

- At least 30 days have to pass since the individual’s death.

- An itemized list of the property should be filed.

- The small estate conduction might be canceled if the decedent’s property is to be sold within two years after the moment of death.

- The record must be filled out in black ink.

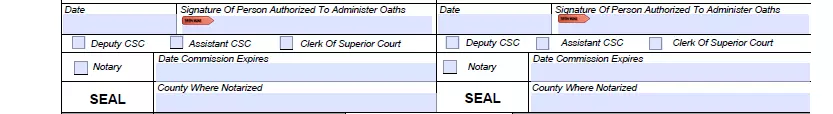

- The affiant must affix their signature in the record and acknowledge the paperwork by a notary public, Clerk of Superior Court, or Assistant CSC.

- The authorized court representative or a notary must affix a seal.

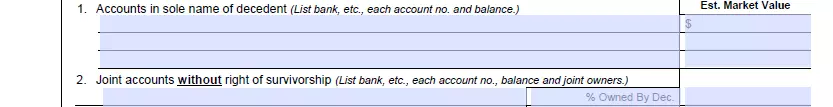

The North Carolina small estate affidavit form considers the following elements as the deceased person’s property: bank accounts, insurance, retirement plans, stocks, bonds, cash, checks on hand, vehicles, household property, equipment, real estate willed to the estate, and personal items.

To generate a small affidavit process, one should follow these guidelines:

- Complete the North Carolina Smal Estate Affidavit form (AOC-E-203B)

- Provide the Death Certificate to prove 30 days have elapsed

- Introduce all heirs and successors in the template

- Provide the Estate Tax Certification record

- Satisfy the Court charge of 120.00 USD

- Attach a probated Will (if any)

- Prepare a Petition of Collection Disbursement and Distribution

If you are a resident of a different state, you should designate an agent and provide a notarized Resident Process Agent document. The appointed person will render court services.

North Carolina Small Estate Affidavit Laws Details

| Max. Estate | $20,000 |

| Min. Time to Wait After Death | 30 days |

| Filing Fee | At least $40 |

| State Laws | North Carolina General Statutes, Sections 28A-25-1 to 28A-25-7 |

Try our document maker to personalize any template available on our site to your requirements. Here’s a range of other popular North Carolina forms we provide.

Filling Out the North Carolina Small Estate Affidavit Form

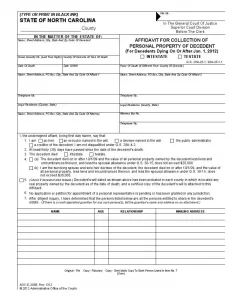

To provide a relevant record, you must print or type the North Carolina small estate affidavit template in black ink. Officially the paperwork is recognized as AOC-E-203B Form. Our online form-building tools will help you generate the required template effortlessly. Please make use of them. Below are guidelines that will lead you through the completion process.

Generate a Template

The form consists of two pages and directives to execute the inventory sections. Insert the County and leave the File Number box for the court clerk to indicate.

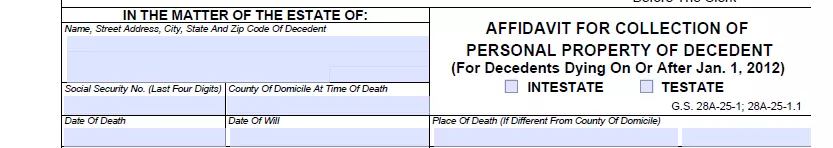

Provide the Decedent’s Data

Introduce the identity of the person who has passed away, including

- his or her legal name

- residence (street, city, state, ZIP)

- county on the moment of death

- date of passing

- place of death

- the date the will was issued

- social security number

Determine the Existence of a Will

Clarify whether the estate is intestate or testate by checking the relevant box.

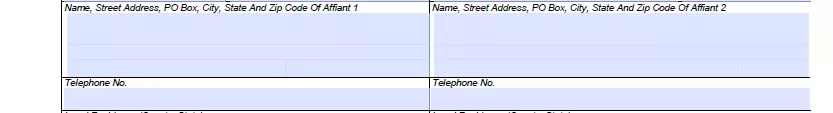

Introduce the Affiant(s)

The next section covers information about the successor(s). Submit their

- legal name

- full address

- contact phone numbers

- contact data of their attorney (if applicable)

Clarify Your Relation to the Decedent

Pick the relevant alternative and tick the box.

![]()

Clarify the Will Existence Once Again

Choose the appropriate variant and tick the box.

![]()

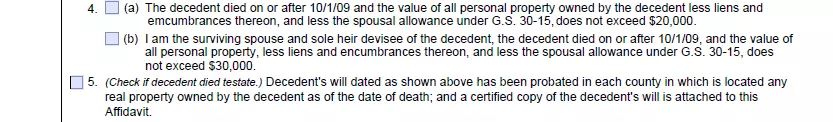

Specify the Value of the Assets

Here, you should clarify the worth of the decedent’s property and check the fitting alternative. If you are a surviving spouse solely applying for the estate of 30,000 USD value or less, choose the second variant.

Should the deceased leave the will, follow the directions, and check Section 5.

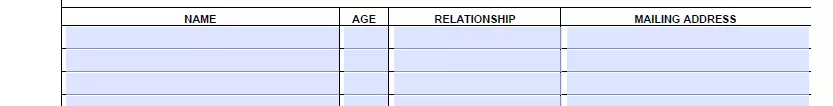

Complete the Table

Insert the names, relation to the decedent, and contact data of the heirs.

Complete the Preliminary Inventory Parts

Give a description and market value (on the moment of death) of the deceased person’s property. Complete the three parts. If any additional space is required, attach the separate lists to this form.

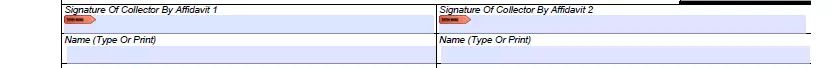

Submit Your Signature

The affiant(s) should provide the signature(s) and name(s) in the presence of a notary or Superior Court Representative.

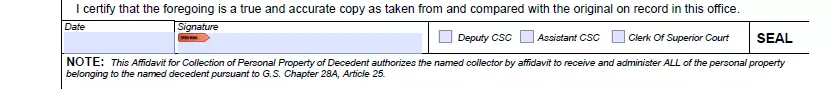

Verify the Form

Authorize the small estate affidavit form by a notary public or Superior Court Clerk (assistant, deputy) with a signature and a seal.

Certify the Template

Obtain the CSC or CSC representative validation.