Ohio Small Estate Affidavit Form

When a person dies, the heirs create, sign, and file various documents regarding sharing the estate. A small estate affidavit form is one of them. It is usually signed if the deceased person (or the decedent) died intestate, meaning they did not have a will.

Every state has different laws that regulate the creation of these affidavits in its way. Although they differ, every small estate affidavit must contain these items:

- Names and addresses of the successor(s)

- The decedent’s details (name, address, and the date when they passed away)

- Value of the decedent’s estate in US dollars.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Ohio Laws and Requirements

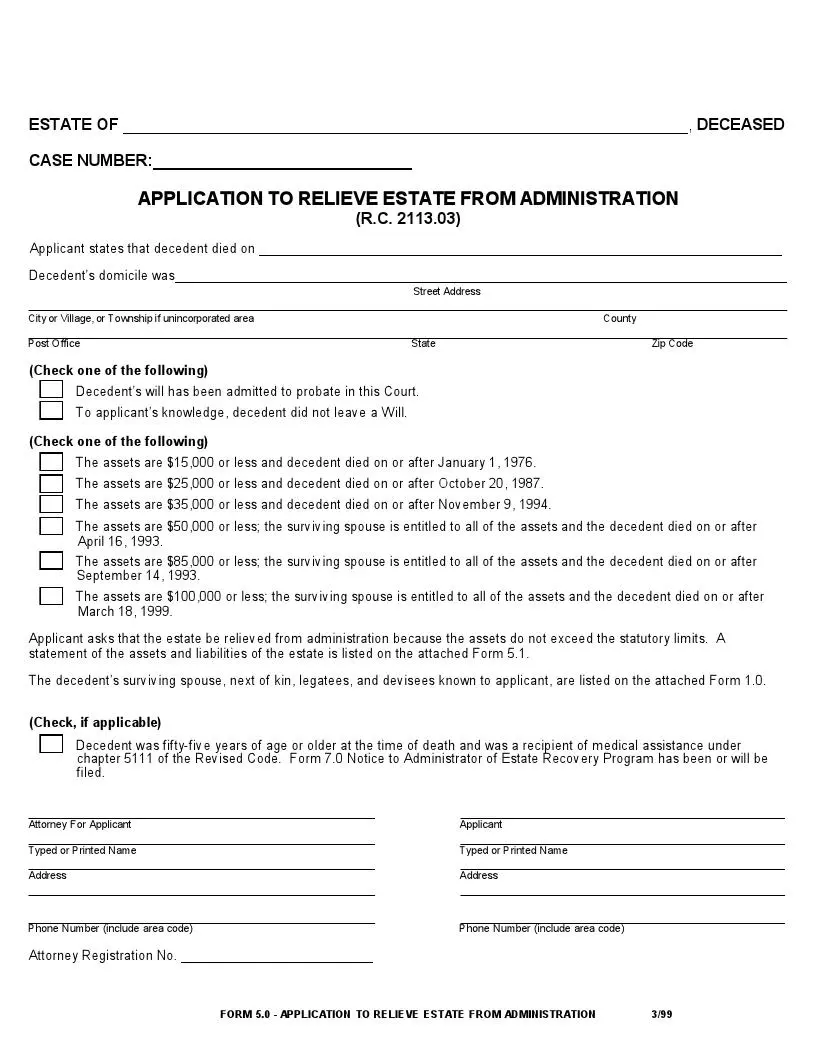

Chapter 2113 of the Ohio Revised Code contains laws regulating matters to do with Ohio small estate affidavit form. The document’s official name is the “Application to Relieve Estate from Administration.”

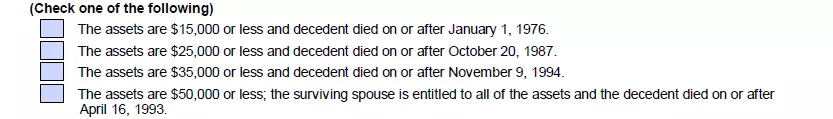

Section 2113.03 sets conditions under which the form may be used to claim the decedent’s property. One of them is that the property’s value should not exceed 100,000 US dollars if the applicant is the decedent’s spouse. For any other applicant, this amount should not exceed 35,000 US dollars.

Ohio Small Estate Affidavit Laws Details

| Max. Estate | $100,000 (for spouse) and $35,000 (for other claimants) |

| Min. Time to Wait After Death | Not specified |

| Filing Fee | Not specified |

| State Laws | Ohio Revised Code, Section 2113.03 |

We provide a variety of major Ohio templates to anybody seeking convenience when dealing with various paperwork in the state.

Filling Out the Ohio Small Estate Affidavit Form

Completing legal forms in the United States appears to be a challenging endeavor. However, you won’t have problems filling out the Ohio small estate affidavit form with the instructions below.

1. Download the Form Template

Having the correct template is vital. There is a separate form for claiming the decedent’s vehicles only, so be careful with the template you use.

You can create and download any form using our online form-building tools.

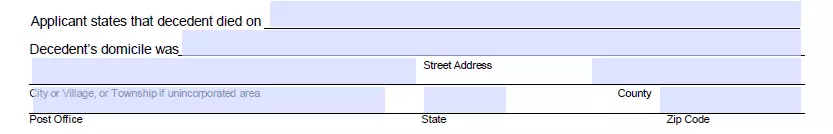

2. Write the Decedent’s Name

The application begins with the deceased person’s name, former address, and the date they passed on. The address should include the county and ZIP.

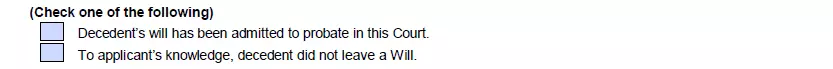

3. State if the Decedent had a Will

The Ohio small estate affidavit may be filed regardless of whether the decedent left a will or not. Choose the suitable option.

4. Describe the Assets

Detail the properties (bearing in mind the date of death) and choose a suitable option.

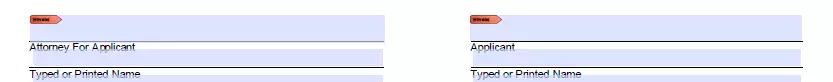

5. Sign the Document

Append your signature and write your name, address, and valid phone number.

6. Complete the Assets Form

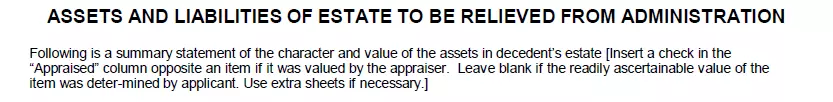

You must create another form that describes the decedent’s assets (also referred to as Form 5.1 or the “Assets and Liabilities of Estate to Be Relieved from Administration” form). It requires you to list all the decedent’s properties and debts with the creditors’ details.