Mississippi Bill of Sale Form

Mississippi bill of sale form is created to detail the essential aspects of private sales and ensure that both parties will not have any claims towards each other after the transaction.

Mississippi bill of sale is a document used for transactions involving various types of personal property: motor vehicles, vessels, trailers, animals, furniture, and equipment. Everything with a particular value can be passed to another person using a bill of sale. However, regarding vehicles and boats, the state may provide specific bill of sale forms that are more appropriate.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Mississippi Vehicle Bill of Sale Form |

| Other Names | Mississippi Car Bill of Sale, Mississippi Automobile Bill of Sale |

| DMV | Mississippi Department of Revenue |

| Vehicle Registration Fee | $14 |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 15 minutes |

| # of Fillable Fields | 62 |

Mississippi Bill of Sale Forms by Type

Here are some bill of sale forms that might fit your specific needs. The templates are free to download and easy to print.

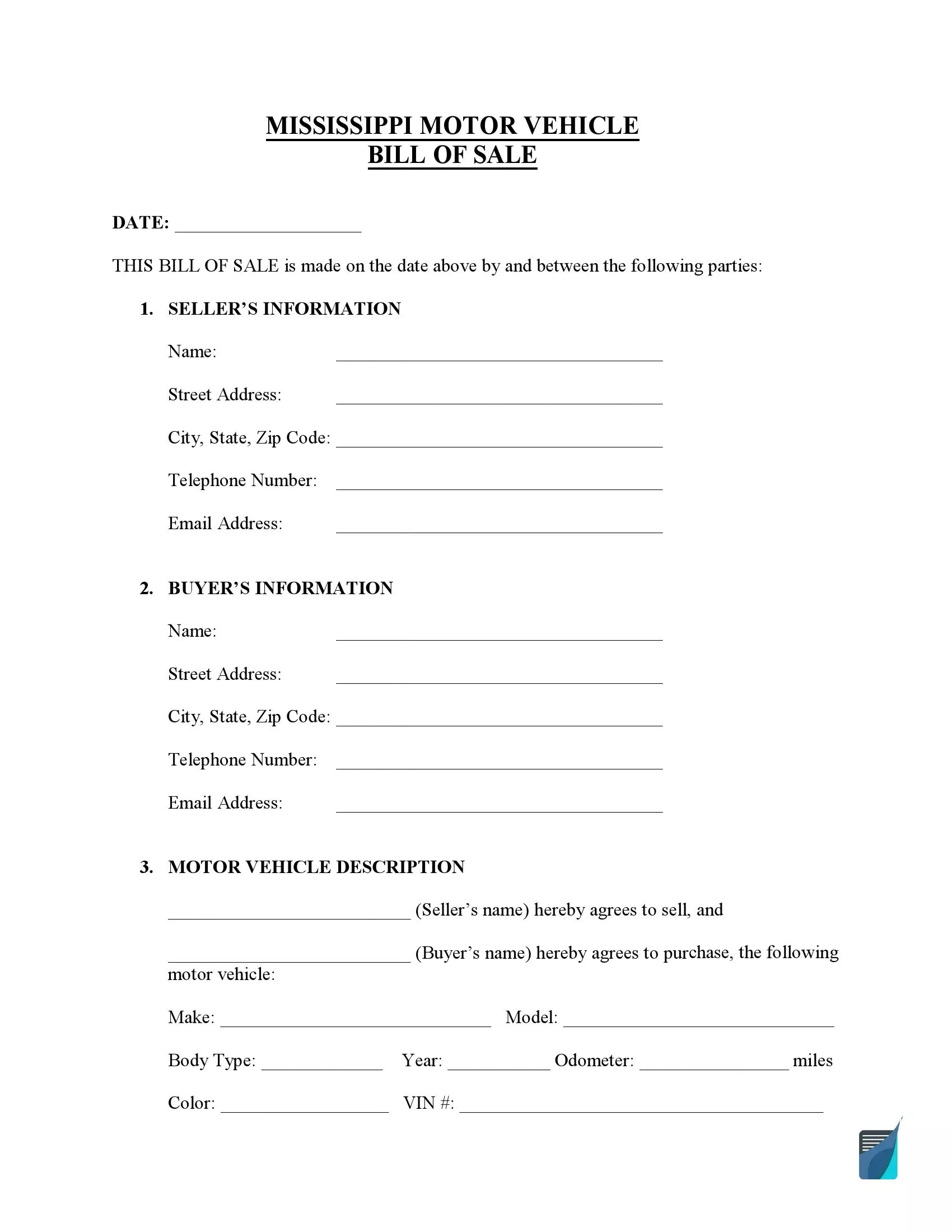

Mississippi vehicle bill of sale, along with valuable information about the parties and the vehicle itself, may facilitate the registration process for vehicle owners. A vehicle purchased in Mississippi must be registered within seven days after the legal sale. The vehicle registration lasts for a year.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

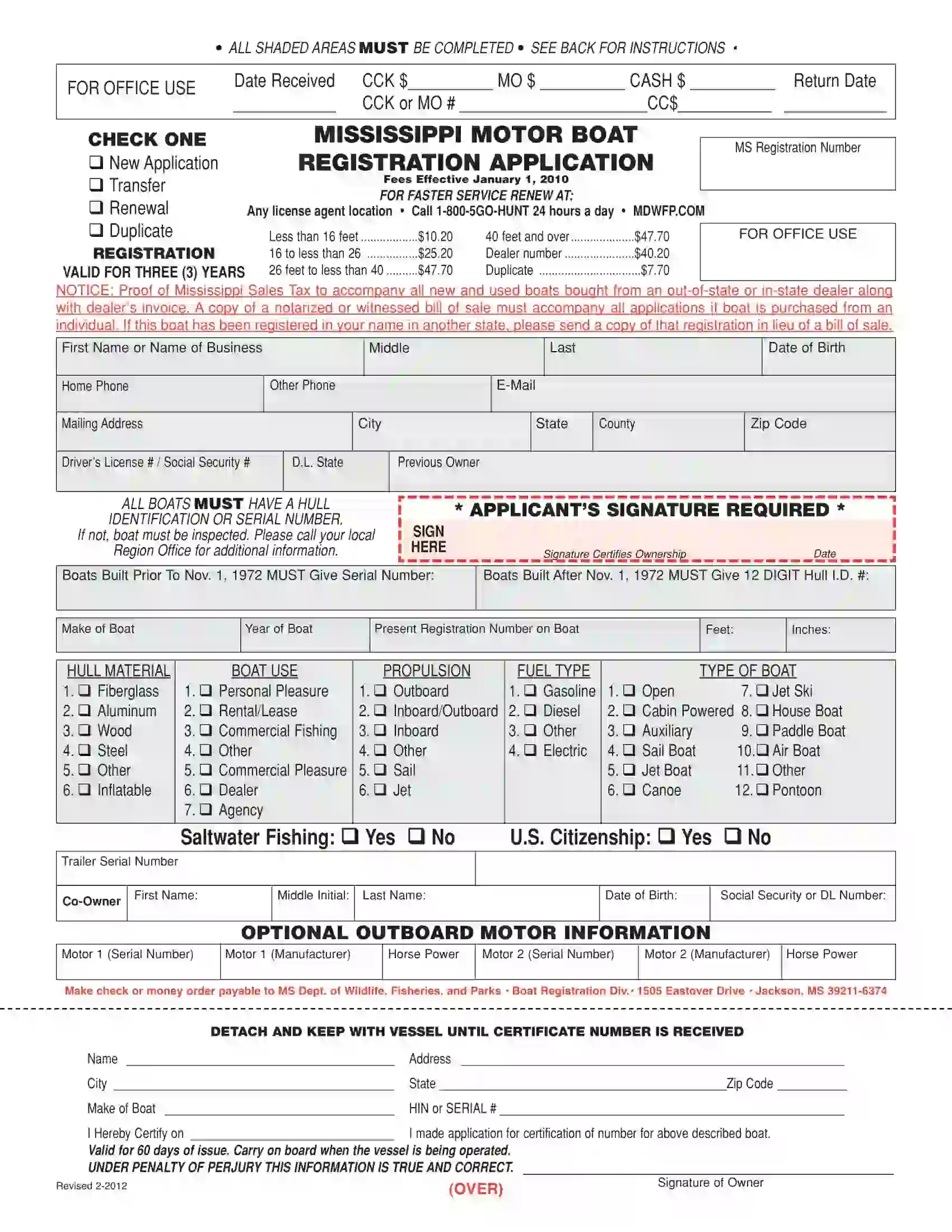

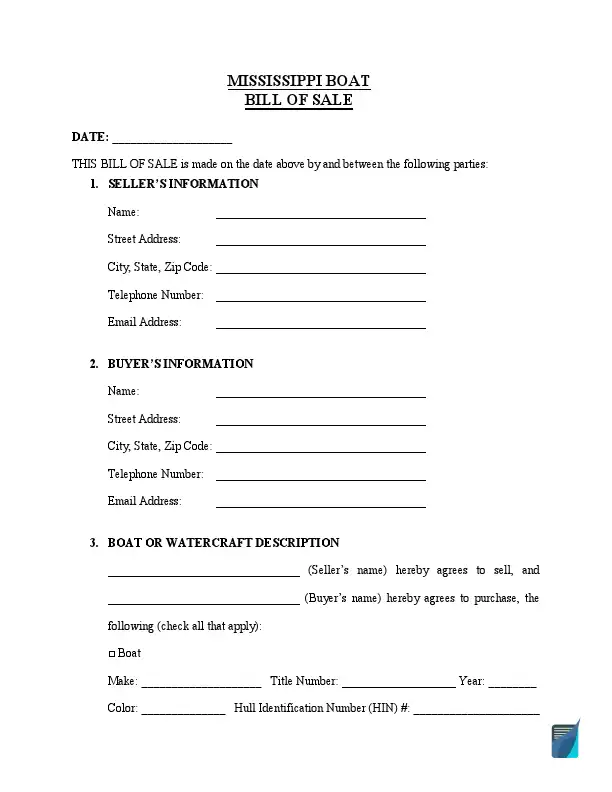

Mississippi boat bill of sale form will allow both seller and purchaser to alleviate their worries regarding possible claims of the opposite party regarding the boat purchase. A boat must be registered in Mississippi if equipped with propulsion machinery. The boat is expected to be registered within ten days after the transaction.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

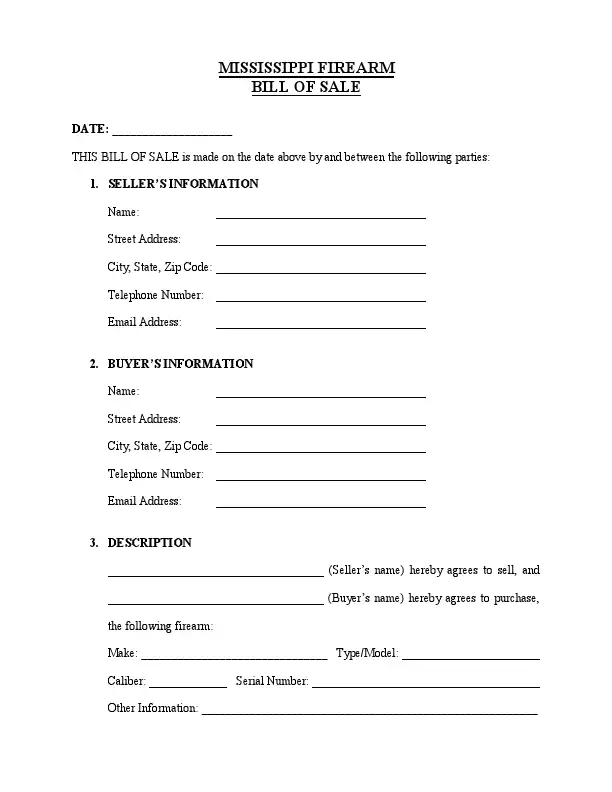

A firearm bill of sale in Mississippi is meant to provide legal protection for both parties of the deal involving a gun. Sales of firearms in Mississippi are allowed for everyone who can lawfully purchase and own guns. A small category of people outlined in the Mississippi Code prohibits buying firearms. A concealed carry license is generally unnecessary, but in some instances, a gun owner will need a Firearm Permit.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

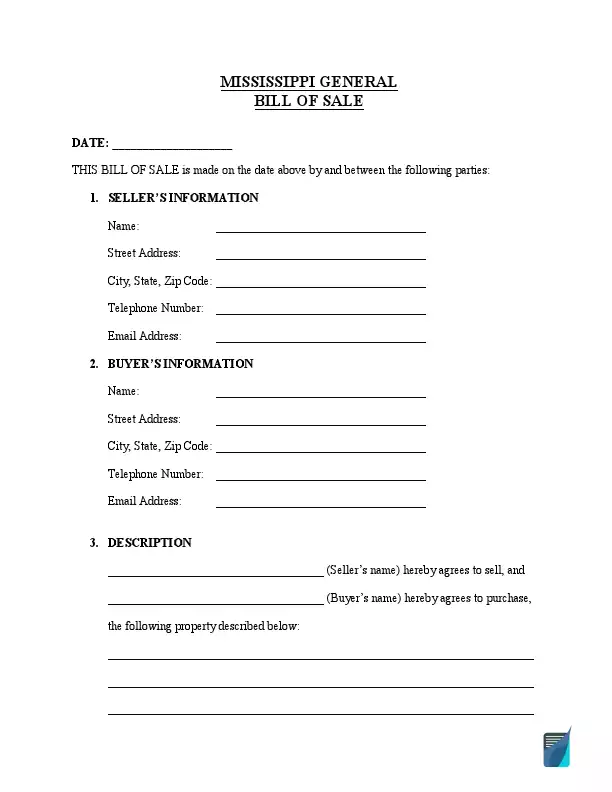

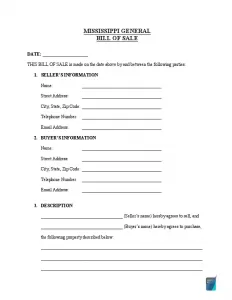

A general bill of sale is a versatile document that lets you safely sell and purchase any personal property in Mississippi.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

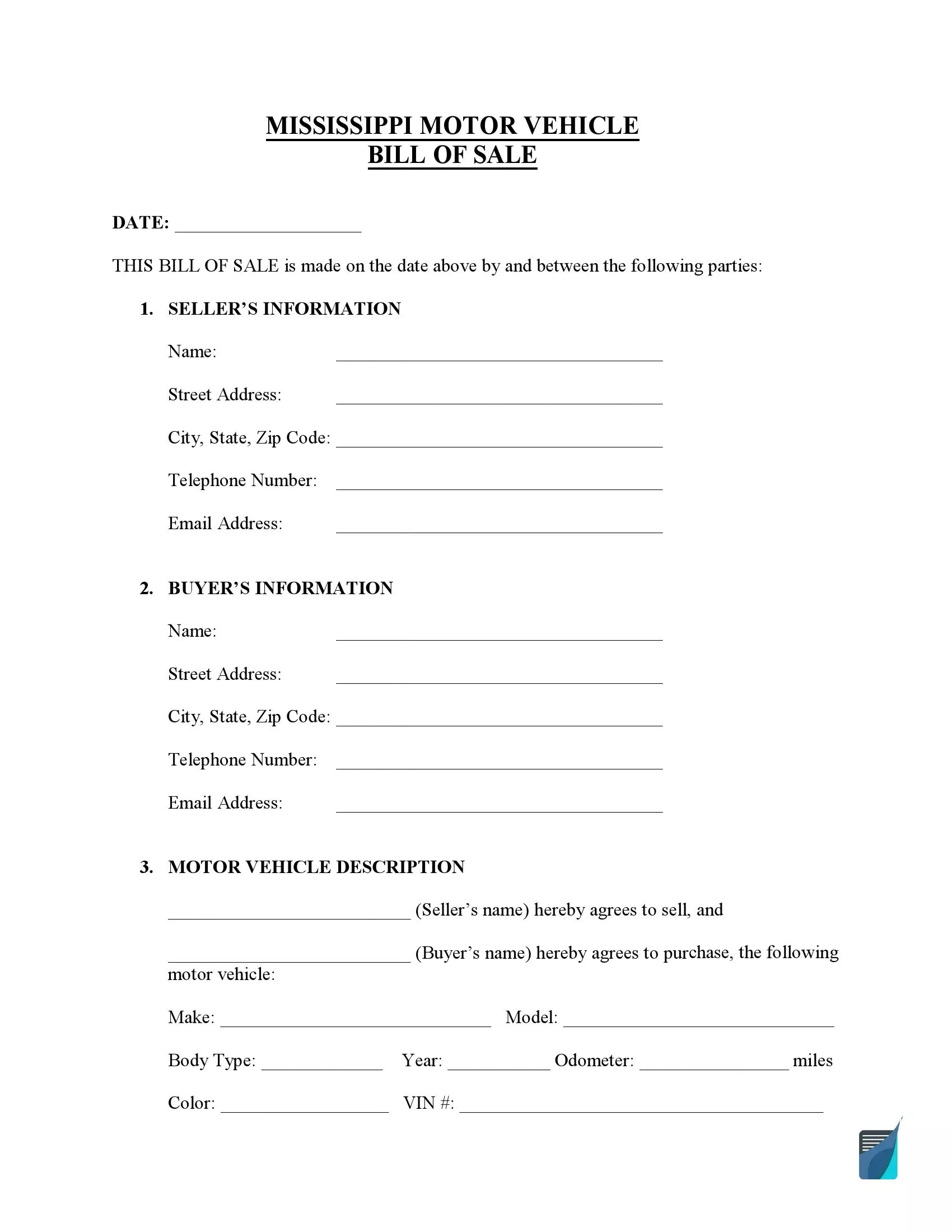

How to Write a Mississippi Vehicle Bill of Sale

There is no official motor vehicle bill of sale form specific to Mississippi. Thus, you can use the general bill of sale template provided and checked by our dedicated lawyer. To complete the bill of sale template successfully, you need to conduct the following steps:

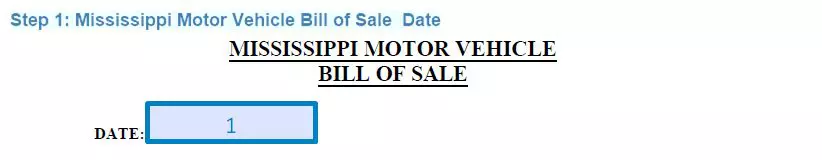

Step 1: Indicate the date of the document

The beginning of the document consists of the date when the bill of sale is conducted. It is recommended to complete the form when the purchase and sale is made to exclude any misdirections and misunderstandings.

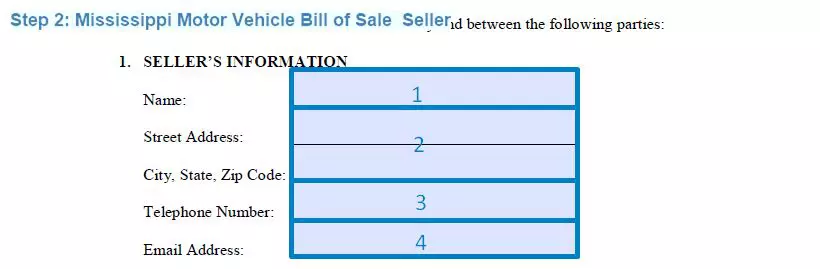

Step 2: Provide the seller’s details

The following section consists of information concerning the person that sells the vehicle. To identify the vendor, you need to provide:

- Full Legal Name

- Residential Address (Street, City, State, Zip)

- Phone Number

- Email Address

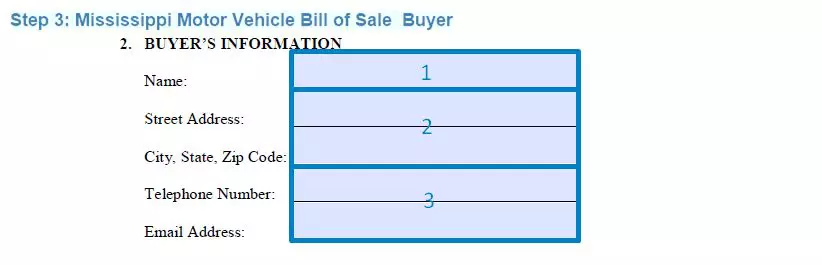

Step 3: Specify the buyer’s details

This section is organized similarly to the seller’s information section. Identify who the purchaser is by writing down the full name of the person who buys the vehicle, their address of residence, and contact information (phone number and email address).

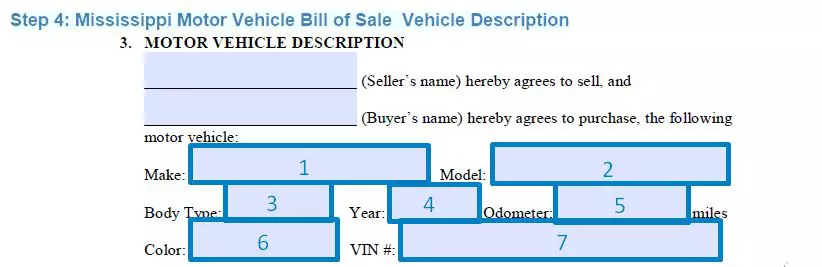

Step 4: Describe the motor vehicle

It is vital to list all the valid information related to the vehicle object of the current transaction. Provide the basic information to ensure the registration process in the future and avoid more severe aftermath of events. Thus, write in the corresponding fields the following details about your vehicle:

- Make

- Model

- Body type

- Year

- Odometer

- Color

- Vehicle Identification Number (VIN)

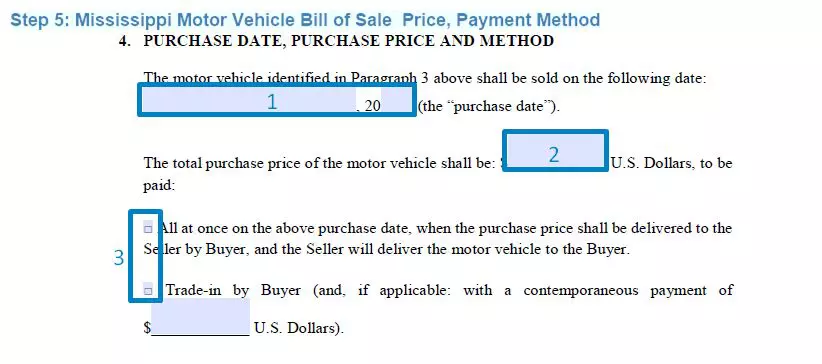

Step 5: Give all the payment details

Here, the vendor must describe the agreed payment method, date, and purchase price. In the upper part of the section, write the day, month, and year when the transaction happens. Next, write down the purchaser’s total amount to deliver to the vendor.

In the following part, the vendor needs to check the box that adequately describes how the price will be paid. There are several options for delivering the payment to the vendor.

- Full-size payment. In this case, the total amount of the money is delivered to the seller the same day the transaction happens (the date indicated above).

- Trade-in. That is the method of payment that implies the exchange of the buyer’s vehicle for the vendor’s vehicle. If applicable, the buyer must also pay the contemporaneous payment indicated in the document. If this is the case, you need to provide the buyer’s vehicle details (make, model, year, color, VIN, and odometer disclosure) in this section.

- Deposit. It implies that the buyer will pay part of the payment immediately or on the day required by the seller, and the remaining part will be delivered the day the vendor and buyer decide. Both dates and the deposit size and complete payment must be listed in the document.

- Gift. If the previous owner decides to present the vehicle as a gift, the receiving party doesn’t need to pay for it. Just select this option if this is the case.

Next, provide the information on how the payment will be delivered to the recipient. It may be cash, cashier’s check, or money order. The document offers all these options, so you need to check the box that suits the case.

Last, indicate if the taxes are paid separately or included in the payment amount.

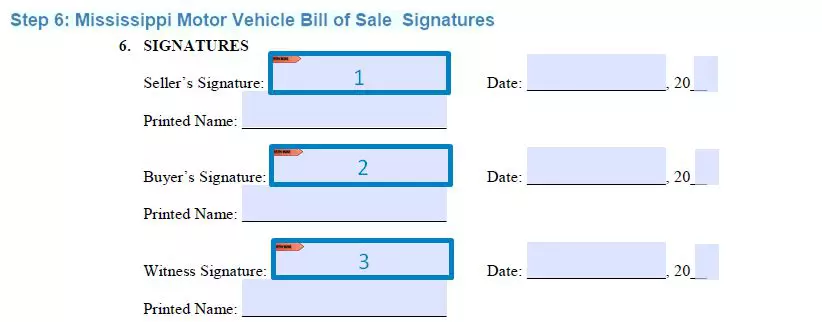

Step 6: Sign the document

The document will be authorized and considered valid only if both parties sign it. It is also recommended that the signature be made in the presence of the witness and notary public of applicable. Indicate the person’s full name that signs the form below the signature and provide the date when the action is performed.

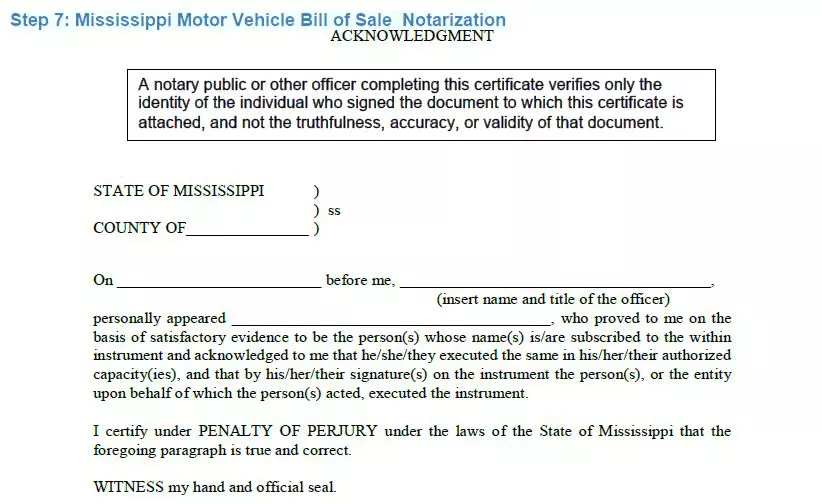

Step 7: Notarize if necessary

The bill of sale form in the Mississippi state must be notarized only when the vehicle is imported from a foreign country.

Registering a Motor Vehicle in Mississippi

To register a vehicle you have purchased in Mississippi, you must go to your local county tax collector’s office. It will register the vehicle at the county where it is stationed or its nightstand parking slot or garage.

You usually have up to seven business days to apply for the registration after purchasing the vehicle. If you’ve got your vehicle in a different county from your domicile address, you will have 48 hours to transport it to your county. But ensure you go to your local Department of Transportation with all necessary registration forms before the deadline, as the penalties will apply once you miss them.

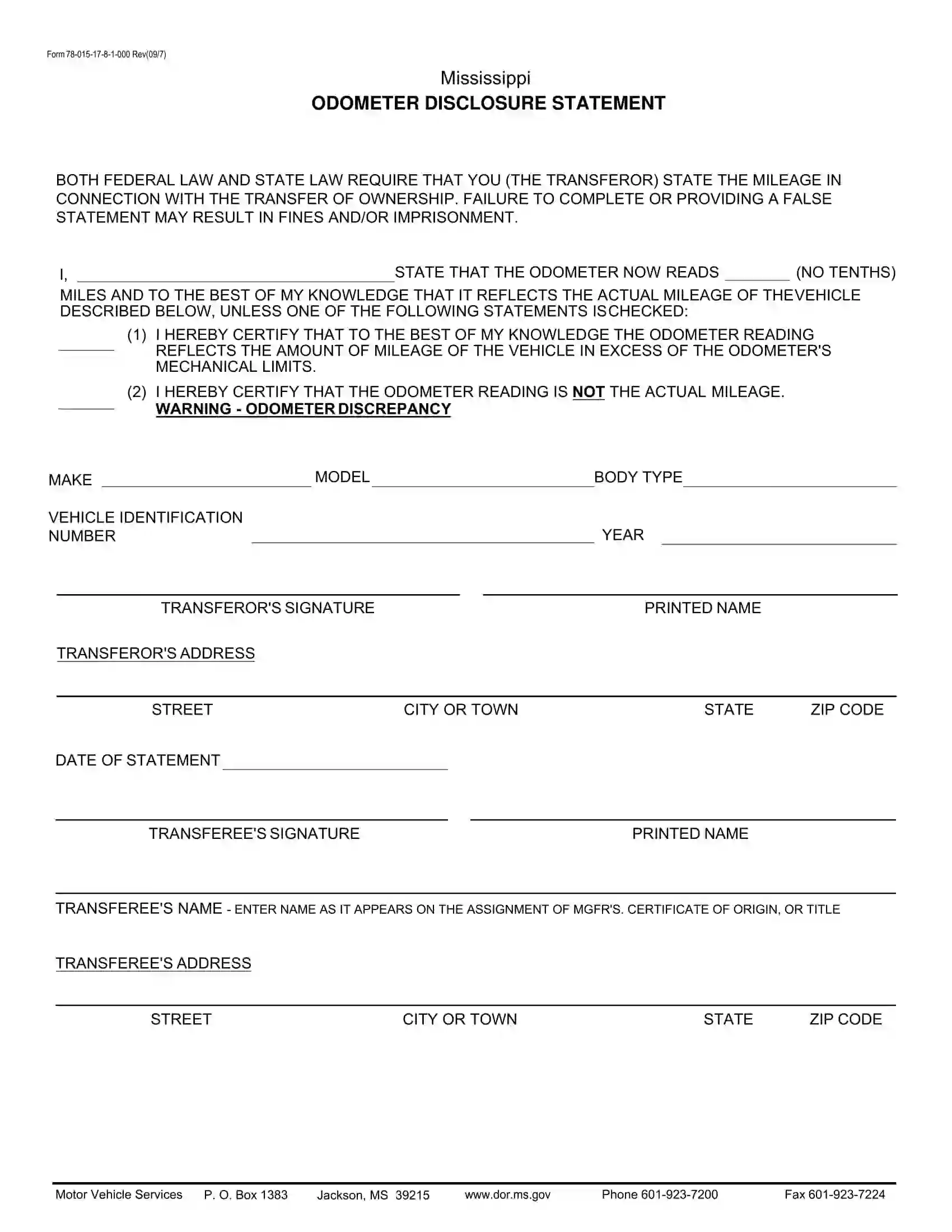

When applying for the Certificate of Title, you must gather the documents the county requires. Usually, it includes the manufacturer’s statement of origin for all motor vehicles produced after 1970. If the vehicle’s year of production is earlier than 1970, the applicant must provide a previous owner’s recent or previous bills of sale, tags, and tax receipts. The DMV office will demand the out-of-state or duplicate title for vehicles purchased out-of-state. Additionally, you will need to have an odometer disclosure statement.

In Mississippi, the vehicle registration fees are $14 for new registration and $12.75 for the renewal application. Besides it, you will need to pay 5% sale taxes (3% for vans and trucks that exceed 10,000 pounds), privilege taxes, and ad valorem taxes. Taxes amount and size can vary depending on your city or county, so you’re encouraged to contact your local county tax office.

The sales tax rate is 5% applied to the net purchase price of your vehicle (price after dealer’s discounts and trade-ins.). The manufacturer’s rebates do not reduce the taxable selling price.

Short Mississippi Bill of Sale Video Guide

Relevant Official Forms

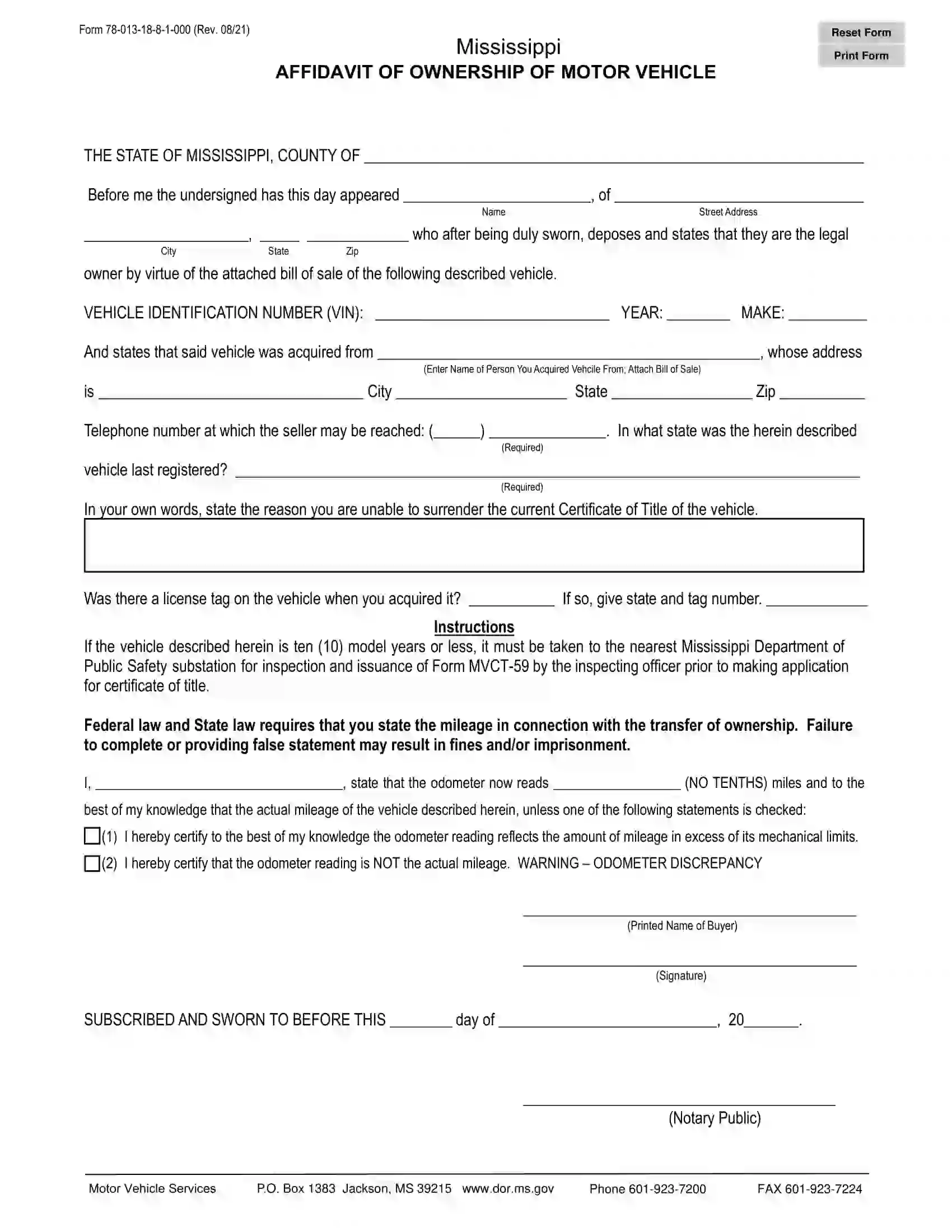

Form 78-013-18-8-1-000 or Affidavit of Ownership of Motor Vehicle is used to prove the ownership of the vehicle in case the certificate of title is unavailable due to a specific reason.

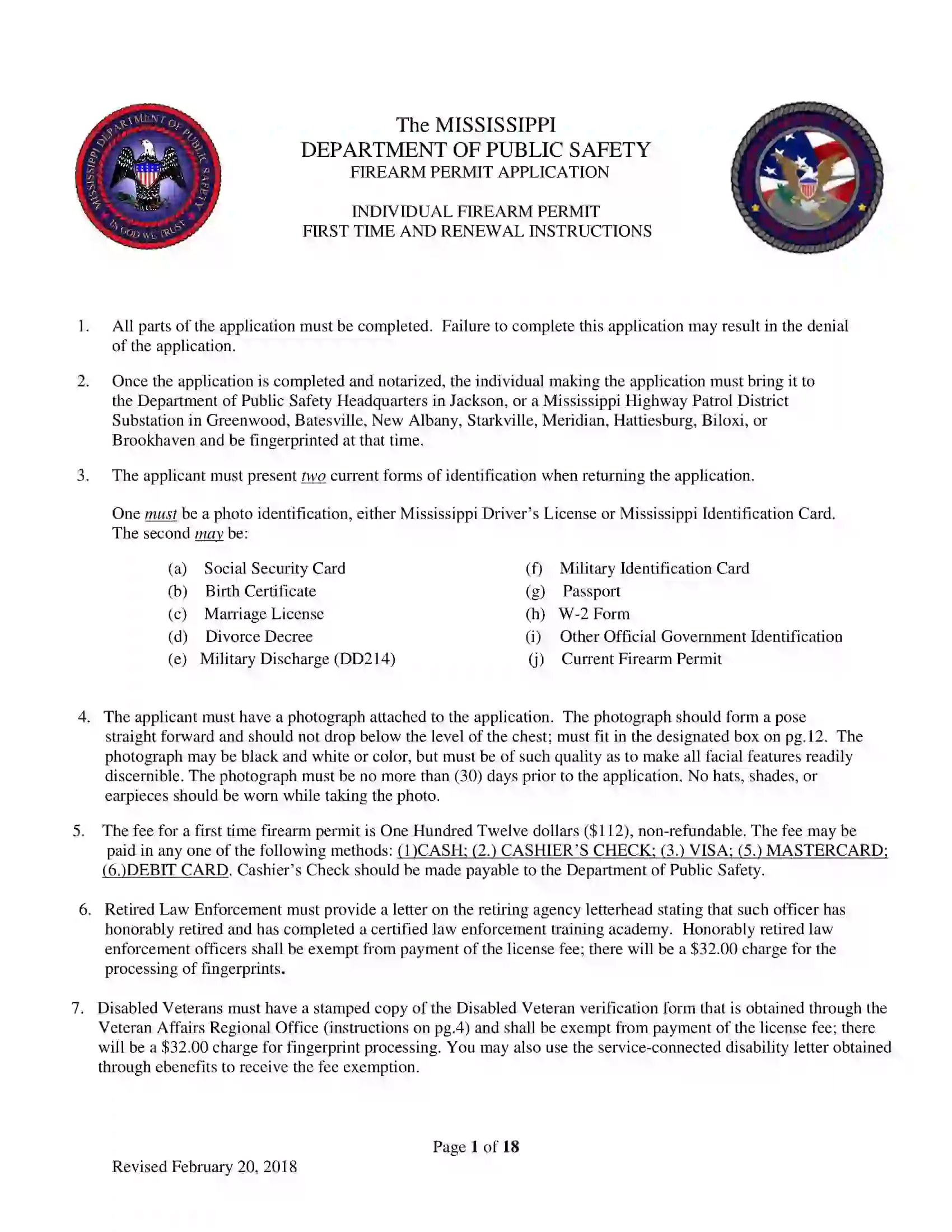

Use an Application for Concealed Carry Firearm Permit (with instructions) if you want to get a firearm permit in Mississippi.