Mississippi Small Estate Affidavit Form

The Mississippi Small Estate Affidavit form is filed by successors of a deceased person to claim the personal property. The document allows the beneficiaries to transfer property ownership without the lengthy and exhausting court hearings. The small estate affidavit form works provided that the assets’ total value does not exceed $50,000.

Upon completing and serving the affidavit form, the decedent’s successor(s) in interest get the right to negotiate and perform any other ownership-related actions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Mississippi Laws and Requirements

Small estate succession matters are regulated by the Mississippi Code (Title 91, Chapter 7). These regulations apply to the recovery of debts and the transfer of the subject property to the decedent’s heirs.

According to the local law, beneficiaries can claim the decedent’s estate by serving an affidavit at least 30 days after the decedent’s death.

If there are people indebted to the decedent, possessing the decedent’s tangle property or any other evidence of a debt, they should recover that debt and return all the property to the decedent’s successor(s) upon receiving the affidavit. A small estate affidavit is applicable when:

- the entire worth of the inheritance, except for all existing encumbrances and possible liens, does not exceed $50,000;

- at least 30 days have transpired since the decedent’s demise;

- the deceased has not selected a personal representative or administrator;

- the affiant legally confirms the point of the relationship with the decedent.

Another important definition is the successor. The Mississippi Code clearly states that the decedent’s successor in interest may be:

- the spouse of the deceased individual;

- the decedent’s children if there is no surviving spouse;

- any existing descendants by branch if there are neither a spouse nor children of the decedent left;

- the decedent’s parents or siblings in cases when there is no husband or wife, children, or successors by branch;

- heirs at law when none of the above can be identified.

If a minor child or an incapacitated adult happens to be the successor, they can be appointed a legal guardian or a custodian by another power of attorney or the court. The legal representative will get the full authority to defend the client’s interests, deal with the paperwork, negotiate, or act on his or her behalf in hearings.

Mississippi Small Estate Affidavit Laws Details

| Max. Estate | $75,000 |

| Min. Time to Wait After Death | 30 days |

| Filing Fee | Not specified |

| State Laws | Mississippi Annotated Code, Section 91-7-322 |

Try out our builder to personalize any template found on FormsPal to your requirements. Here’s a number of various other fillable Mississippi forms we provide.

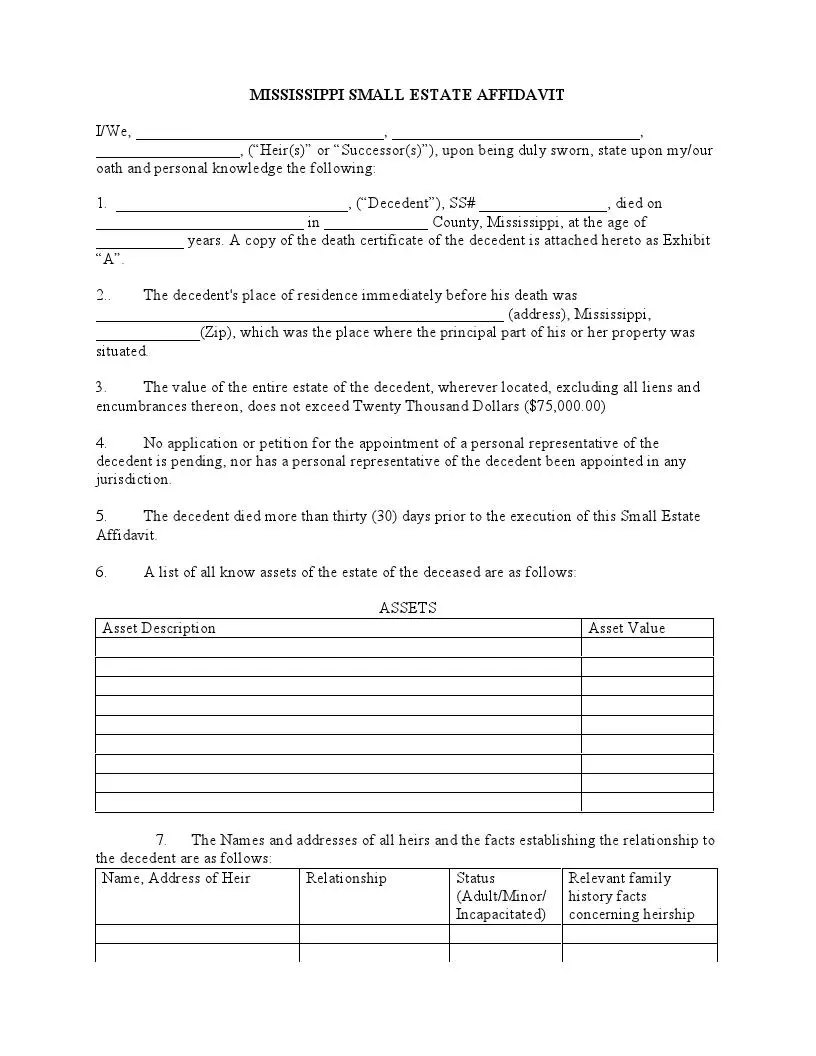

Filling Out the Mississippi Small Estate Affidavit Form

You will need to obtain the correct Mississippi Small Estate Affidavit form before starting to fill it out. We suggest that you use our latest software to do that. Once you have the proper affidavit form, follow our step-by-step instructions to fill it out.

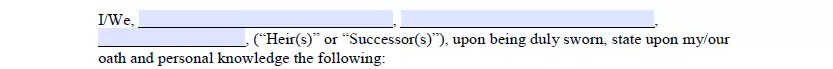

1. Enter the names of all existing heirs-at-law or successors at the beginning of the document.

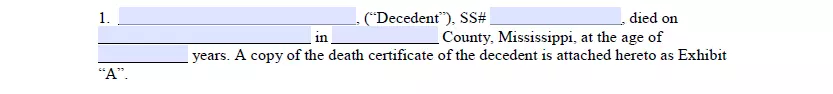

2. Write the decedent’s name and their Social Security Number (SSN). Then enter their time, date, location, and age of death.

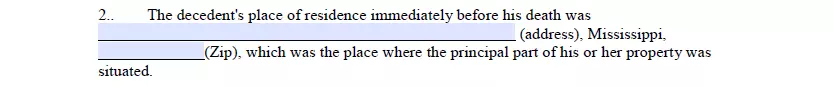

3. Clarify if the location of death was the place of the decedent’s last residence and the principal part of their property. Fill in the address of the mentioned residence.

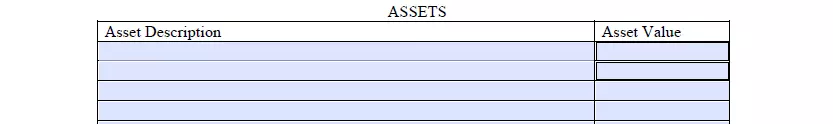

4. In the next section, you will need to make a list of all assets subject to succession and indicate their value.

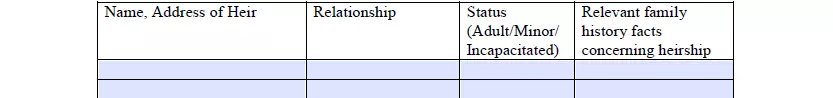

5. Pay special attention to the next segment. Fill out the table with accurate data on the beneficiaries-at-law and successors. Enter the names and physical addresses of the grantees in the first article. Then indicate the relationship to the deceased and special status (minor or incapacitated, if applicable). The last item requires a report on any relevant family background concerning heirship.

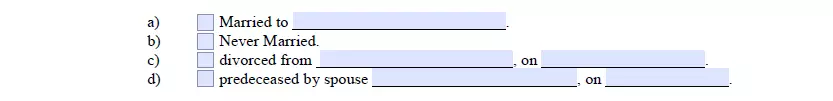

6. Describe the marital status of the decedent at the time of death. Choose among the suggested options and check the corresponding box. Specify if there are any surviving children left after the marriage.

7. Authenticate that there are no other known unpaid claimants against the deceased person.

8. The last section confirms that the decedent left no will. Sign and date the document as a sign of consent under oath.

9. The small estate petition requires notarization. Please make sure that the Notary Public puts their printed name and seals the document.

10. The beneficiaries should have a certified copy of the death certificate with them when collecting the subject’s personal property.