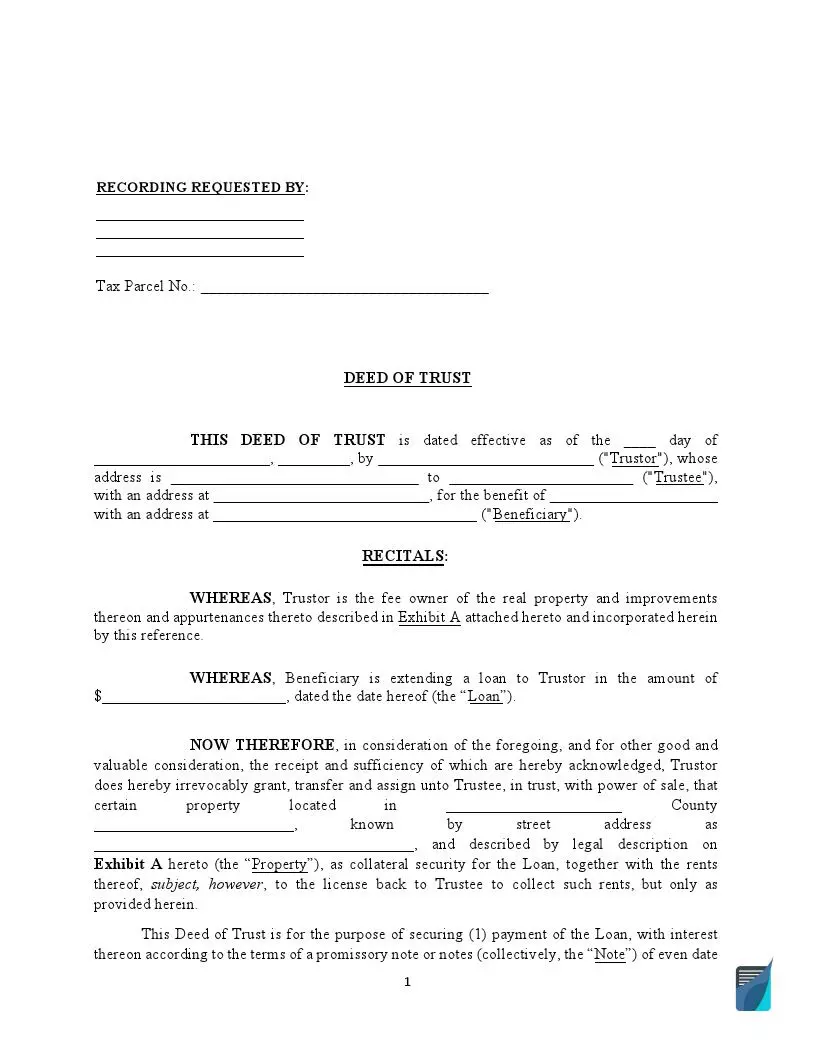

Deed of Trust Form

The deed in question is somewhat different from other legal instruments used in the real property business since it does not transfer the ownership of the asset. Instead, it creates a security interest for a loan and thus works as a mortgage, giving the beneficiary the right to sell the asset and repair their losses if the borrower fails to repay on time.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Is a Deed of Trust?

This type of deeds serves as one of the instruments applied to guard a lender’s interests in real estate transactions, be it land or house, where borrowed funds are used. Unlike usual mortgage agreements, this document involves three parties instead of two — a mortgagor, a mortgagee, and a trustee, with the latter one being an independent entity. Common trustees in deeds of trust are banks, attorneys, and title or escrow companies. A trust deed transfers legal title to the mortgaged property to the trustee, while the equitable title remains with the debtor. Thus, the actual ownership of the property passes to the neutral third party, which allows it to perform legal actions concerning the asset. However, the borrower retains the enjoyment of the property rights within the equitable ownership, which makes the loan recipient eligible to use the property.

The trustee holds the title as collateral for the promissory note throughout the loan period until the last payment is made. Then, the debt is released, and the trustee reconveys the title to the borrower. Yet, if the borrower defaults on their loan obligations, the third party that holds the title is eligible to sell the security asset and cover the outstanding debt. While most of the receipts from the sale are assigned to satisfy the lender’s interest in the property, the debtor can receive an excess amount if any.

As to the sale itself, the trustee is entitled to put the real estate in question on the block without judicial review. In contrast to judicial foreclosure, which requires going through court actions and can take months or even years to complete the process, a deed of trust opens the way to foreclosure through the power of sale clause. If the borrower defaults on their loan obligations, the clause allows the trustee to sell the security asset without any supervision and confirmation by the court. It speeds up the foreclosure process and usually reduces the trustee’s obligations to notifying other parties to a trust deed about the upcoming sale. In this respect, the right of foreclosure is typically satisfied faster than with a standard mortgage agreement.

The actual actions required from the trustee under the clause, as well as specific timeframes to stick to, are regulated by local legislation adopted in many US jurisdictions. Anyway, in case of default on a loan, a deed of trust implies holding a public auction with the aim to sell the real estate at its fair market value.

To come into effect, the document must be recorded in the county where the property is located. It will be mailed back after recording, so the mailing address and the name of the beneficiary have to be specified.

When to Use a Deed of Trust

First of all, it makes sense to visit the official web page of your county or state to learn whether these deeds are recognized at your location. If the official information is not available, you may want to seek legal advice. In some jurisdictions, a borrower and a beneficiary must sign a deed of trust, while in others, there is no such option at all. You can also get legal advice if your state provides mortgagors and mortgagees with the possibility to choose an instrument based on their preference.

Basically, deeds of trust are very attractive for a beneficiary because if a debtor fails to pay off a loan, the creditor can recover compensation in the fastest way and with little hassle. They are especially helpful when the funds are borrowed not from banks or other traditional institutions but from individuals, including friends, family members, or private investors and mortgage companies.

Deed of Trust vs. Mortgage

While both of the documents are created to formalize a relationship between mortgagors and mortgagees and the two are equally instrumental for placing a lien on a property, the following differences make one of them more beneficial to the lender provided there is applicable law adopted in the state.

As it was already mentioned, a mortgage agreement and a deed of trust differ in a pool of participants. The first one is limited to two parties only:

- a borrower who receives outside funds to buy a property;

- a lender who provides the funds in exchange for a lien placed on the property.

A deed of trust includes one more party and, thus, expands to:

- a trustor who owes money borrowed to purchase real property and needs to service the loan while being in possession of the real estate;

- a beneficiary who credits the trustor and for whom a corresponding promissory note is issued;

- a trustee who is a third party holding legal title to the asset until the indebtedness is not settled.

To even better shield the beneficiary’s interest in the property, deeds of trust can involve a guarantor, who confirms the borrower’s ability to clear due payments and thus undertakes the responsibility for the loan to be repaid. So, if the borrower defaults on the obligations, the lender is eligible to address the guarantor based on the terms and conditions of the deed.

The second key difference between a mortgage agreement and a deed of trust is that the first one may or may not permit non-judicial foreclosure. This depends on local regulations and covenants provided in the agreement. For example, in California, both judicial and non-judicial foreclosure procedures are legislated, and a mortgage may contain a clause that allows the lender to foreclose sidestepping any additional proceedings. However, standard mortgage agreements do not typically include such terms, which makes them subject to judicial foreclosure.

In contrast, a deed of trust implies non-judicial foreclosure, giving the trustee all the rights to sell the property without filing a lawsuit and getting a court order. As the trustee holds legal title to the property, this party is eligible to initiate the foreclosure process on behalf of the beneficiary if the borrower fails to make duly payments and the parties cannot make terms as to loan modification.

Benefits of Using a Deed of Trust

The advantages the lender might enjoy with a deed of trust arise from the above-described possibility to sell the property with no court proceedings involved. The trustee can get into action as soon as the beneficiary authorizes them to do so, which is not the case with judicial foreclosure. Apart from 120 days allowed for the borrower to be in default on the mortgage before the lender can file a lawsuit, the whole process depends on the court calendar and includes many procedural activities. The party presenting a claim has to participate in a formal trial and argue against possible counterclaims of the defendant before obtaining a verdict. However, there is always a chance that the judgment will be given in favor of the borrower. As a result, the process may last up to several years with its outcomes being unclear.

A deed of trust offers a more straightforward way for the lender to obtain compensation and can cut the time up to several months. Yet, the actual time required for selling the security property varies across states as permitted under applicable law or regulations. For example, California Law gives a borrower 90 days to cure their default after receiving a corresponding notice from the lender and 21 extra days after getting a Notice of Trustee’s Sale. In Texas, on the other hand, a borrower is given 21 days to cure their default after they receive a notice from the lender and the same amount of time after the trustee posts an advance notice of sale. However, in both of the cases, a deed of trust is likely to let a lender sell the property faster than through receiving a court order.

Moreover, this option allows for cutting fees usually associated with litigations, although there is at least one point against a deed of trust when it comes to saving the lender’s funds. If the amount of an outstanding loan is bigger than the proceeds received from the property sale, a court can place a lien on the debtor to cover the deficiency. This is known as a deficiency judgment, which is typically unavailable for lenders who opt for a deed of trust instead of a mortgage agreement. On another note, if the amount earned from the property sale exceeds the sum required to pay off the mortgage, the excess passes to the borrower.

Also mind that a debtor does not have the right of redemption under a deed of trust, which they can otherwise use with an agreement. So, the mortgagor will not be able to get back the property by paying the amount due after foreclosure. Yet, the lender can get hold of the property provided there are no bidders at the auction — in this case, the trustee conveys the property out of the trust.

What Should Be Included in a Deed of Trust?

Apparently, it would be much simpler to execute legal documents when having a fillable form at hand. But unfortunately, there is no universal deed of trust form to meet the legal requirements of every state or even county. In some states, such as Texas, the law does not provide a mandatory form of the document, and its provisions may vary from lender to lender. But one does have a chance to find a deed of trust form on the official website of their county. For example, Sacramento County has published a deed of trust form along with a promissory note template to refer to when drafting these legal documents. So, it is better to start writing this type of agreement by searching for information on the official web resources.

Generally, the uniform part of the agreement must specify the following information:

- the full name and mailing address of each party, i.e., the lender, the borrower, and trustee;

- the property identification, including its legal description and address (mind that the section with the legal description must duplicate the language used in official records);

- the principal amount, i.e., the amount of loaned money without interest payments and other fees included in the promissory note.

The next section covers uniform covenants, such as:

- applicable law

- provisions related to payment, including interest and principal payments

- funds for escrow items

- charges, fees, and liens

- property maintenance and insurance

- mortgage insurance

- warranties

- ownership transfer

- events of default

- power of sale clause

- acceleration on default

- protection of the beneficiary security

Besides the basic elements, the agreement may contain additional information and provisions the parties agreed upon. Also, the document must contain a section to specify the date of its execution and to place the signatures of the beneficiary, the borrower, and the trustee (a particular state may require only the borrower’s signature). The document must be acknowledged by a notary public before it is recorded. After recording, it will be mailed back, so it is necessary to specify the mailing address and the name of a recipient.

Frequently Asked Questions

Who can be a trustee in a deed of trust?

Both business entities and individuals can act as trustees as long as it is permitted by state laws. Usually, they are chosen by a lender, but in many cases, attorneys who draft the document simply specify the name of a title company to hold legal title to the property in question. Among business entities, other options are trust companies, escrow agencies, or insurance enterprises. The choice of individuals who can serve as a neutral third party to hold a security interest in property includes attorneys, real estate brokers, or bank employees.

What is the power of sale?

It is a mortgage clause that entitles the lender to initiate foreclosure if the borrower fails to make payment by due date. The clause implies selling the property in circumvention of court proceedings.

Are there any states that do not recognize deeds of trust?

Yes, a borrower and a lender must sign mortgage agreements in many states. Actually, almost half of the US jurisdictions do not recognize this type of deeds. They include Alabama, Florida, Louisiana, New York, Pennsylvania, and Wisconsin among others. However, other states either require deeds of trust or provide an opportunity to choose between the two options.