Special (Limited) Warranty Deed Form

Some deed forms used in real estate transactions come with a certain set of warranties, which is reflected in their names. A special warranty deed form can be helpful to those property sellers and buyers who have agreed upon transferring the asset with a limited warranty.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Is a Special Warranty Deed?

As the second name implies, this document does not provide a buyer with a full set of warranties to protect the new owner from litigations and losses related to the property he or she acquires.

Any property has its history of ownership known as a chain of titles, which may or may not be clear enough to ensure a flawless title. A defective title, i.e., the one that has claims, liens, levies, or other encumbrances attached, can question the legal ownership and make a new owner responsible for resolving the encumbrances.

Obviously, a buyer wants to acquire a property that is free of claims, which is confirmed by a seller through a deed. A special warranty deed serves this purpose but limits the warranty to the period of the seller’s physical ownership of the real estate. Thus, the seller promises only two things:

- He or she owns the title and, thus, has the right to transfer it to the new owner.

- No liens were placed on the property in question during the time of his or her ownership.

So, should any claims as to this period arise, the buyer will not be held liable and can demand compensation for any losses they suffer as the result of these title defects. However, the deed does not cover encumbrances that might have arisen before the seller’s ownership and that might emerge after the title is passed to the new owner. As such, the protection granted by a special warranty deed has a limited scope, hence the name. It works better than no-warranty deeds, which often do not even promise that the seller owns the title, but it is still less advantageous if compared with general warranty deeds.

What is a special warranty deed with a vendor’s lien?

Sometimes, a buyer fails to obtain a mortgage from traditional financial institutions but has a chance to borrow the funds from the seller of the property. In this case, the seller places a vendor’s lien on the real estate to secure their funds and issues a special warranty deed that allows them to seize the asset if the buyer fails to pay off. Thus, the deed works as a mortgage where the vendor holds the legal title to the property until the loan is repaid.

When Is It Used?

Apparently, a person who purchases real estate would prefer to get it with a clear title and a warranty against any defects whenever they might arise. Moreover, since a residential property is often acquired with borrowed funds involved, lenders have every right to weigh in on the warranties they want to see attached to their security interests. Thus, many mortgagors tend to insist on settling general warranty deeds with the highest protection possible.

Yet, limited warranty deeds can be beneficial for buyers of foreclosed homes, which are usually cheaper deals than other comparable options. As foreclosures are sold by lenders who are not interested in issuing warranties outside the period of their ownership, they offer a lower price and a fast lien release in exchange for a limited warranty. Besides, this deed type is often a preferred option for developers, trustees to a living trust, and commercial property sellers who did not personally own the property to bear liability for the clean title. In these scenarios, purchasers can protect themselves against possible problems by buying title insurance, which will cover financial losses if they arise.

Pros and cons

A limited warranty deed can give access to attractive deals while providing a certain level of protection to the buyers, especially when backed up by title insurance. However, it is not the best choice when there is the possibility to gain a general warranty deed.

Special vs. General Warranty Deed

As it was already mentioned, general warranty deeds ensure the best possible protection to real estate buyers, and they are usually required to purchase a property with borrowed funds. This is because the selling party to such a deed promises a clear title with no encumbrances or limitations imposed either during the seller’s ownership or prior to it. While the deeds differ in the timeframe covered by warranties, they both guarantee that the current owner is a lawful titleholder and eligible to transfer the ownership to the purchaser.

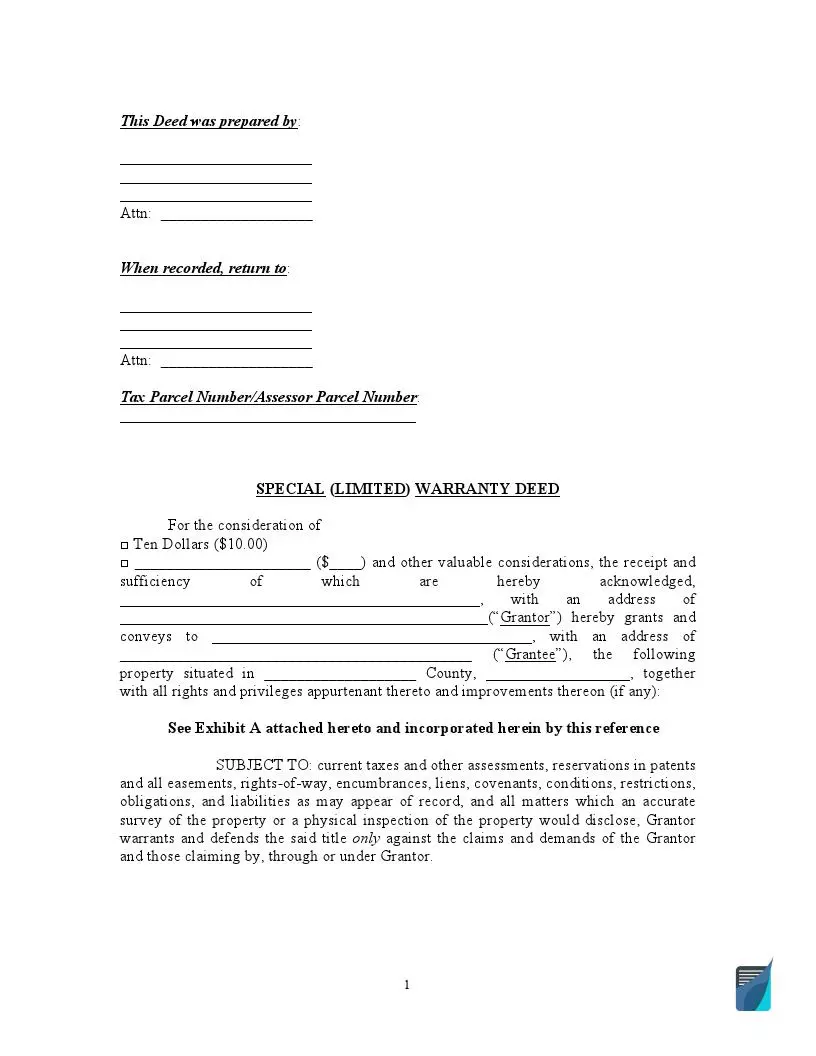

Details to Include

For a deed to be accepted by a clerk’s office, it has to comply with local requirements. Since they vary across states and even counties, it is recommended to visit the official website of the county where the asset is located and search for a special warranty deed form. Still, some pieces of information are common for this deed type, as it is illustrated through the example of the form in the Utah Code. Make sure your deed includes:

- the full names, marital status, and mailing addresses of the parties, which are usually referred to as the grantor and grantee;

- the legal description and address of the property, which can be found in official records;

- the consideration paid

- the execution date

- the grantor’s signature

Besides, the deed must contain certain legal wording to avoid any vagueness as to the parties’ intentions. Namely, the grantor must clearly state that they:

- guarantee their legal ownership;

- convey the title to the grantee;

- promise the lack of claims against the asset during their ownership;

- undertake to compensate any losses the grantee might suffer if the promises are broken.

Frequently Asked Questions

Can a special warranty deed be contested?

Any deed can be challenged based on an accusation of fraud, forgery, undue influence, or lack of competency. But if a special warranty deed is executed in full compliance with legal requirements, it is no more vulnerable to court actions than a general warranty deed.

Is using a special warranty deed safe?

As long as the deed is accurately executed, properly recorded, and accompanied by title insurance, it is quite safe, although it basically provides less warranty coverage than a general warranty deed.

What does encumbrance for owelty of partition mean?

Owelty of partition is often used within divorce proceedings to create a lien in favor of the grantor when the co-owners of the property agree on dividing the equity. It secures payment of a certain sum from the grantee through a special warranty deed with encumbrance for owelty of partition.

Can you change a special warranty deed to a general one?

No, but no one prevents the parties to the agreement from adding other covenants into the deed if they see fit. Further, the new owner is not obliged to sell the property with the same warranties. When preparing a new deed to transfer the title, the owner is free to give general warranties, for example, if the title was proved to be clean through a title search.