Independent Contractor Agreement

An independent contractor agreement is a document that specifies the relationship between a company and an independent contractor—a person who conducts business as a self-employed worker and provides services in exchange for payment.

An independent contractor agreement spells out the terms of the cooperation between a company that gets services and a contractor, an individual providing such services. The document is beneficial for both parties as it includes important details of the working arrangement in a written form, protects both the contractor and the client, and clarifies what both sides expect of each other.

An independent contractor agreement is a relatively comprehensive document, but after reading the article, you will know exactly what to include.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

- What Is an Independent Contractor Agreement?

- What Are the Components of an Independent Contractor Agreement?

- Filling Out an Independent Contractor Agreement

- Who Should Use an Independent Contractor Agreement?

- Independent Contractor vs. Employee

- How to Hire an Independent Contractor

- Frequently Asked Questions

What Is an Independent Contractor Agreement?

One might encounter different names for an independent contractor agreement and think that those are related documents, but technically they are the same. These names include subcontractor agreement, freelance contract, consulting services agreement, etc.

Contracts are the most common form of negotiation in the business field. When it comes to self-employed workers, an independent contractor agreement plays an essential role as it helps them to:

- Ensure their business relations with counterparties are protected

- Establish roles and responsibilities

- Specify the nature of services to be performed

There is no standard form of an independent contractor agreement, so the parties typically decide what to include. The form of the contract will also depend on the industry in which the parties are involved. Regardless of the industry, it is essential to include the expectations of both parties and protection clauses in the document.

What Are the Components of an Independent Contractor Agreement?

Before creating the document, it’s crucial to learn what components it must include. An independent contractor agreement is used to provide services, and you will have to explicitly describe them in your document. The agreement must also contain the parties’ rights, duties, the agreement term, protection of confidential information, effective date, and other provisions, like the indemnification clause and intellectual property arrangements.

- Statement of Relationship

The essential element, but not considered often, of the independent contractor agreement is the specificity of the contractor’s role. This is very important to the contractor for tax reasons as the work provided may be subjected to different taxes. This relationship statement is also crucial for the client as it protects them against misclassification.

Something that is often overlooked is the fact that an independent contractor and client relationship is a business relationship (not an employer-employee relationship). In this section, the contractor should explicitly state that they are an independent contractor. The contractor should also specify that they dictate when, how, and where their contract terms are fulfilled and provide their own tools or anything needed for that specific job.

- Description of the Project

After that, there should be a detailed description of the exact project the contractor will be performing for the client. This should be clearly outlined because it has the benefit of making sure both the contractor and the client are aware of the project’s scope. List and discuss any responsibilities, tasks, or things expected of the contractor as part of the job. A small tip would also be to have a backup plan if something goes wrong or needs to be quickly changed to avoid any setbacks. The description of the project and the backup plan itself will always be specific to the job at hand.

- Payment and Billing Terms

When discussing the contractor’s pay rate, it is essential to know what to expect from this job before negotiations begin. This is one of the trickier parts of negotiations, as payment can create animosity towards both parties. Having a plan is vital, as confidence can help both parties reach an agreement.

Also, the parties need to discuss how the employer wants to be billed for an invoice and, importantly, the billing terms. It includes the amount of time the client will have to pay for the work based on when the invoice is received.

- Responsibilities of Both Parties

It would not be wise to assume that anything is understood when writing an independent contractor agreement. The best practice is to specify everything and get it in writing. Often, multiple departments are involved in projects, so it is crucial to designate a point of contact. With this point of contact, the parties should discuss things such as how much time the client will have to review the contractor’s work or how lengthy approvals for changes might take. Also, it is vital to establish a process for communicating the contractor’s progress with the client. A healthy form of communication where all parties are involved is the best practice for a smooth job.

Independent contractors should note that the other party may require them to provide insurance coverage. If the client requires this, it is important to specify this in the contract.

- Project Timeline and Deadlines

Always include the length of your working relationship in the independent contractor agreement. If the parties are unsure of the exact length of the job, then a general timeline should be included. Concrete deadlines and what needs to be delivered at these deadlines should be outlined. Also, discuss what constitutes a successful meeting for the deadline, deliverables, or milestones. This has the added benefit of creating a sense of transparency between the contractor and the client because both parties know what will be delivered during each process.

- Termination Conditions

The termination conditions should outline the rights of both parties involved. This section is to protect the independent contractor and the client from a worst-case scenario. Some reasons to end the contract may include things such as nonpayment or breach of any of the rules outlined in the contract.

- Non-Disclosure Terms, Confidentiality, and Non-Compete Clauses

Non-disclosure and non-compete clauses or a separate confidentiality agreement are designed to prevent employees, contractors, or anyone involved in the project from taking insider knowledge or trade secrets from the company to a competing business. This is a tricky idea to agree on as an independent contractor because their very nature involves working on a client-to-client basis, and changing clients after completing jobs is very common. Some of these clients are bound to be competitors of each other.

If the client insists on including a non-compete clause, the contractor should explain why this would prohibit them from working with other clients in the same field. The best-case scenario is to negotiate a middle ground. The parties can specify the amount of time required to pass before working with a client in the same field. These terms should be realistic, not something like ten years.

Creating a well-established and organized contract is an excellent opportunity to start the contractor-client relationship off to a positive start. A clear contract helps everyone be on the same page by giving both parties a clear idea of what is expected. When everyone involved works in sync, the work can progress smoothly and confidently.

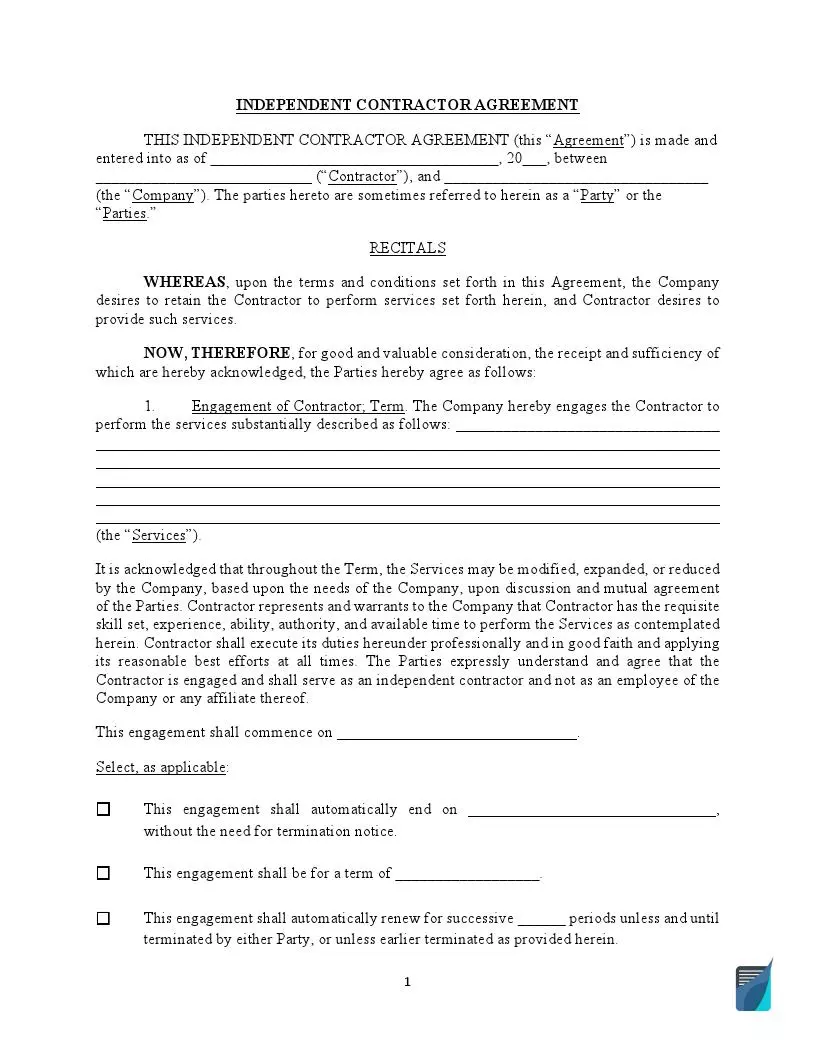

Filling Out an Independent Contractor Agreement

As we have mentioned, there is no particular form that contractors and their clients should follow. We recommend sticking to the following structure of our free independent contractor agreement if you want to avoid time-consuming research or paying lawyers to create the contract.

Step 1 – Identify the names of the parties

Indicate the parties who participate in creating the independent contractor agreement.

Step 2 – Specify the goal of the agreement

Next, specify what the agreement is created for. You can write that the client employs the contractor, and the contractor agrees to the employment.

Step 3 – Indicate the start date

The independent contractor agreement should state the date when the project starts. It should also mention how many days the written notice needs to be sent if one of the parties wants to terminate the agreement.

Step 4 – Describe the nature of the services

Further, the agreement should describe the client’s services from the contractor. The more details are included in this section, the clearer the scope and nature of work will be for both parties.

Step 5 – Specify the compensation

How the contractor will be compensated should be set out here, including the compensation structure (flat fee, hourly rate, etc.), its amount, and payment method.

Step 6 – Indicate the reimbursement

The agreement should include the clauses that will determine whether or not the contractor will be compensated for certain expenses incurred.

Step 7 – Add a non-solicitation clause

The employer might decide to include the clause in the agreement that will require the contractor to not solicit the employer’s employees or clients during the agreement period.

Step 8 – Describe the unplanned situations

The agreement might also state what the parties should do in the event of an unplanned situation happening to either of them. The agreement typically terminates in such cases, but the parties might agree to other consequences.

Step 9 – Classify the contractor

It is prudent to state that the contract worker is not a partner or an employee in the agreement.

Step 10 – Mention legal notices

This clause should tell what form of notices the parties might send to each other. The provision should also include the address of the counterparts. For instance, it might state that the contractor cannot assign or otherwise transfer their obligations under the agreement without the prior written consent of the employer.

Step 11 – Specify the governing law

The independent contractor agreement should end by specifying the state’s laws that will govern it.

Step 12 – Sign the agreement

Finally, both parties should review the entire agreement and sign the independent contractor contract to make it valid and enforceable.

Who Should Use an Independent Contractor Agreement?

An independent contractor is a person who is in an independent trade, business, or profession and provides services based on their expertise. It can be any professional who is offering their services to the general public. Most often, those people are:

- Doctors

- Dentists

- Veterinarians

- Lawyers

- Accountants

- Contractors involved in carpentry, roofing, stonework, ironwork, HVAC, plumbing, landscaping, etc.

Independent Contractor vs. Employee

There are many differences between hiring an employee and an independent contractor. The significant differences can be broken down into five separate sections.

Employment Laws

There is a crucial difference between an employee and an independent contractor regarding employment laws. Employees are officially hired by the company and offered protection by several state and federal labor laws. In contrast, an independent contractor is not covered by these same laws. An independent contractor is covered from what is explicitly stated in their contract, and that is all.

Hiring Practices

Employees and independent contractors differ in the ways they are hired as well.

The process for hiring an employee can be generally outlined by the following. Potential employees complete an application that gets sent to Human Resources for review. At some point, an interview is conducted, and if everything is satisfactory for the employer, the applicant receives a job offer. If the applicant accepts the position, there is an entire onboarding process that involves things like having the employee fill out paperwork regarding their date of birth, marital status, citizenship status, and many other tax-related topics.

On the other hand, the hiring practice for an independent contractor is vastly different. The potential contractor typically interacts with one person or department that wants a particular service or job completed. This contractor generally will complete a work proposal and present it to the business. If the business decides to go with this contractor, then an employment contract is entered upon by both the contractor and client. This contract should contain information regarding the time of employment, service arrangement, pay rate, description of the project, expectations, etc.

Tax Documents

The tax documents for an employee versus an independent contractor are also quite different.

Similar to the employment laws, a traditional employee is covered by a number of federal and state employment and labor laws. This protects not only the worker but also the business. When hired, the employee is expected to fill out the information that provides their name, address, social security number, tax filing status, and any number of tax exceptions on a W-4. The employer also submits all the pertinent tax information, including all money paid to the worker during the tax year on their W-2. It’s also the employer’s responsibility to report this information to any other agency that requires it.

There is some overlap between an employee and an independent contractor for tax documents. A contractor also provides their name, address, tax identification number, and possibly a certificate about backup withholding on a W-9. If the contractor makes more than six hundred dollars in a calendar year, it must be reported on the 1099 Form. Besides the differences in tax forms between an employee and an independent contractor, one main difference is that a contractor can be paid for in a total amount or one lump sum. They could also be paid hourly, daily, weekly, or on a specific date or when the job is completed, but these are typically specified in the contract itself.

Value of Work

Employees are paid at an hourly rate or salary. An independent contractor is paid based on the stipulations in their independent contractor agreement.

Pay Period

An employee’s pay period must remain the same throughout employment unless formally changed. Pay periods can vary from company to company, but generally, they are from one week to one month. Federal and state laws require that an employee be paid on the regular pay date or earlier if their paycheck is not negotiable on the expected payment date, which can occur on holiday.

Unfortunately, independent contractors are not offered such protections. Generally, Accounts Payable (if applicable) pays a contractor after receiving their invoice. The terms of the independent contractor agreement dictate when payments are made, such as upon completion, by each specific task, or in periodic amounts. Contractors are not paid by traditional payroll staff in most businesses.

How to Hire an Independent Contractor

When considering hiring an independent contractor, you should keep these steps in your mind.

Step 1. Classify a person as an independent contractor

First and foremost, you need to make sure you will employ an independent contractor. It is crucial to make sure that in the eyes of the Internal Revenue Service (IRS), a worker is self-employed and is not considered an employee. If you don’t take this step seriously, you might face fines and penalties from the IRS, that by default treats all workers as employees.

So, before turning to a person for their service, make sure that:

- You are going to hire a contractor for a temporary project.

- The contractor can choose the location and date of performing the work.

- The contractor will be using their own materials to perform the project.

Step 2. Request the W-9 Form

Another thing is to ask an independent contractor to complete Form W-9—Request for Taxpayer Identification Number and Certification. It is the form commonly used by the IRS. It helps businesses working with independent contractors fill out the 1099-NEC, Nonemployee Compensation form, and report the payments made to these contractors at the end of the year.

The W-9 form should include the following information about an independent contractor:

- Full name as shown on federal income tax return

- Tax classification (in this case, it will most likely be “Individual/Sole Proprietor”)

- Mailing address

- Taxpayer identification number (TIN)

- Backup withholding (in case the IRS requests a business to withhold income taxes from money paid to a contractor)

An independent contractor should fill out the form and return it to the other party. Once filled out, the form should be kept in the employer’s records. There is no need to send it to the IRS.

Step 3. Write and sign the independent contractor agreement.

The next step for a client and an independent contractor is to create an independent contractor agreement. The document will act as a legal shield if something goes wrong between the parties and make the nature of their cooperation clear to them. The lawyer might be addressed before creating the document to provide legal advice. Still, you can easily use our free independent contractor agreement template to get an idea of what to include in this legal contract.

Step 4. File IRS Form 1099

If you plan to get involved in a project with an independent contractor, there might be some tax documents that you need to know about. One of them is Form 1099-NEC. It is meant to show the IRS how much a freelancer earns from working for a company.

The form is used in the following cases:

- If a business pays an independent contractor at least $600 during the current year

- If a business did not use a credit card or third-party payment platforms when making transactions with an independent contractor

- If an independent contractor is not running an S corp or C corp (indicated in the W-9 form in the respective field)

Both parties should have Form 1099-NEC attached to an independent contractor agreement in place. A business should send Copy A of the Form to the IRS when an independent contractor should get Copy B by the end of January of the following year.

Frequently Asked Questions

What are the employer's IRS obligations when hiring independent contractors?

According to the IRS, employers working with independent contractors have at least two tax obligations.

The first obligation of the employer who uses the services of an independent contractor is to get the Form W-9. It does not have to be filed with an IRS, but it is crucial to keep it as a personal record if any questions arise from the IRS.

Another obligation of an employer is to file Form 1099-NEC. It is used to report payments made to non-employees for their services.

What if I misclassify an employee as an independent contractor?

Suppose you classify an employee as an independent contractor, and you have no reasonable grounds for doing so. In that case, you may be held liable for employment taxes for that worker (tax withholdings or health benefits).

Do I have to pay taxes if I work as an independent contractor?

The IRS requires independent contractors to:

- Report self-employment income and deductions on Schedule C (to report any income that you earn).

- Pay self-employment taxes (equivalent to the Medicare and Social Security taxes) on Schedule SE.

- Pay quarterly estimated taxes (both federal and state).

Receive Form 1099-MISC (detail how much you are paid throughout the year).