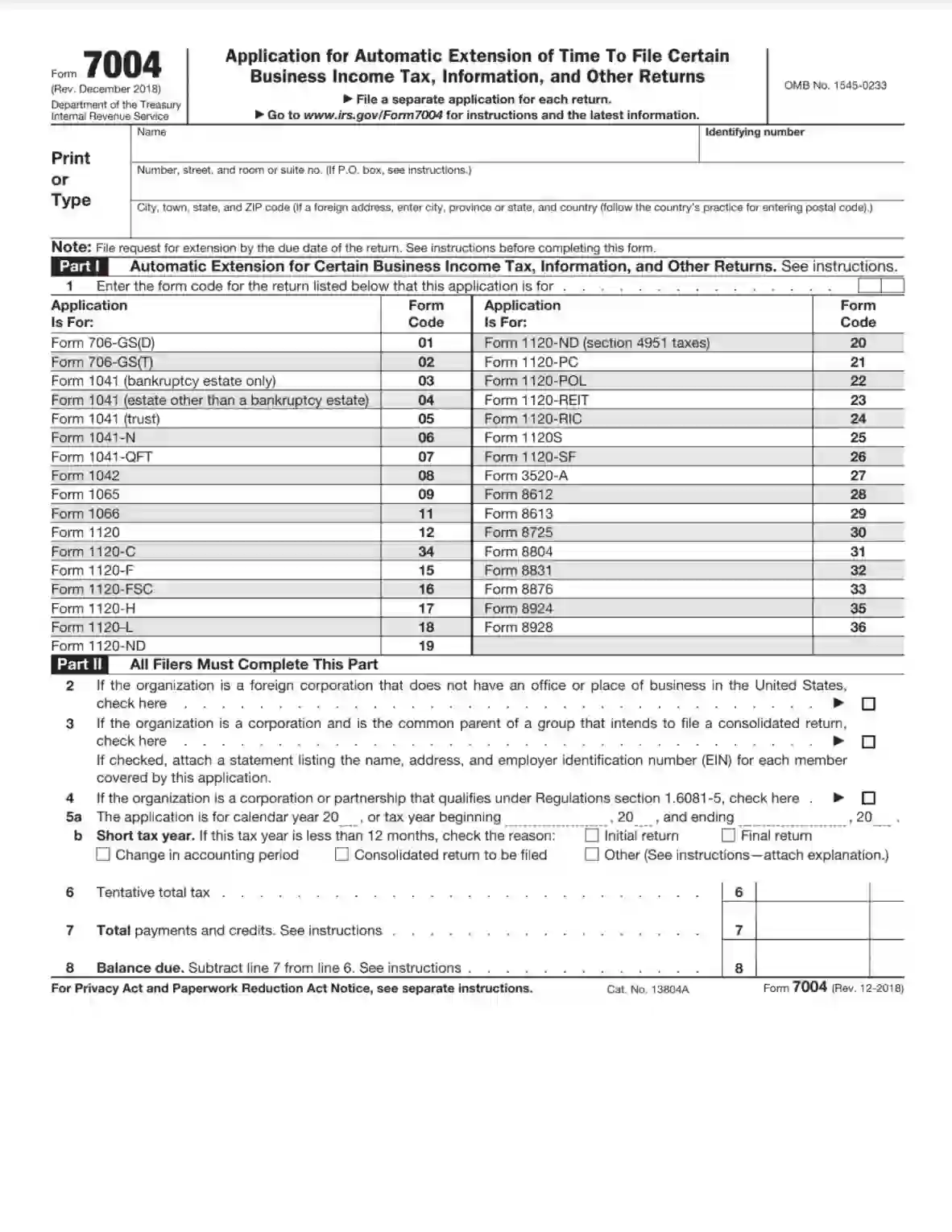

IRS Form 7004 is a United States tax form used by businesses and certain other entities to request an automatic extension of time to file their federal tax returns. It does not extend the time to pay taxes due, only the time to file the necessary forms. Entities typically using Form 7004 include partnerships, multi-member LLCs, corporations, and S corporations. This form must be filed by the original due date of the entity’s tax return.

The purpose of Form 7004 is to provide relief to entities that cannot complete their tax returns by the standard deadline. By filing Form 7004, an entity can receive an extension of up to six months to file its return, depending on the entity type and tax return. This additional time allows for better accuracy and completeness of the tax return, helping entities avoid penalties for late filing. However, taxpayers need to estimate and pay any owed taxes by the original due date to avoid potential penalties for late payments.

Other IRS Forms for Business

Apart from the form of extension of time to report income taxes, your business might need to file some other forms with the Internal Revenue Service. Check some related IRS forms here.

How to Fill Out Form 7004

The filler has two options for how to complete the form. They can print out the paper and enter the data by hand or use our online form constructor. Anyway, it will be useful for everyone to read the following tips for a better understanding of the structure of the document. Despite the fact that this Form is quite short in comparison with other forms of IRS, some points need to be commented on. So that you do not miss some lines of the form, we have highlighted several steps in filling the document out:

Input identification data

Fill in the document header area. This field includes the filler name, full address, and your company’s tax identification number (in the upper-left corner).

Indicate Tax Return Code

In the first line after the header, enter the code of the tax return, the deadline for which you intend to extend. The table below this row provides the matching of tax return forms and codes. For example, if you are requesting Form 8612 prolongation (calculation and payment of excise tax on undistributed income in an investment trust), enter code 28.

Since the form has only one field for the form code, a new Form 7440 must be used for each new renewal application.

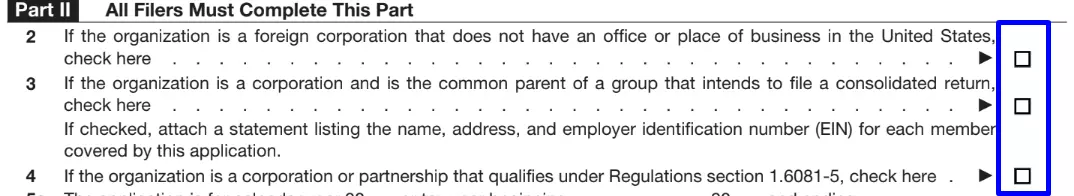

Provide company Status

We now turn to Part II of the document, and lines 2-4 are aimed at identifying the status of your business. Read these sections carefully and check the box carefully.

Fill out Tax Year terms

Enter the start and end date of the tax year. Specify whether this tax year is short for your company (item 5b).

Fill out tax and payments

Terms 6 to 8 relate to the estimated amount of tax, payments, and loans.

In item 6, enter the total tax number that is expected to be paid for the current tax year. It is needed to make preliminary calculations and evaluate the future activities of the company before filling in this line.

In item 7, point out the total payments and refundable credits. Finally, in line 8, enter the balance due.

This is a brief overview of filling out IRS Form 7440. For more information, please refer to the official instructions developed by the IRS specialists. The IRS accepts both scans and forms filled out electronically through the online deed constructor.