IRS Form W-4 is a tax document employees use to indicate their employers’ federal income tax withholding preferences. When starting a new job or when their personal or financial situation changes, employees must complete Form W-4 to ensure that the correct amount of federal income tax is withheld from their paychecks. The form allows employees to specify their filing status, number of withholding allowances, and any additional amount they want to be withheld from each paycheck. Key information provided on Form W-4 includes:

- The employee’s personal information, such as name, address, and Social Security number (SSN),

- The employee’s filing status (single, married filing jointly, married filing separately, or head of household),

- The number of withholding allowances claimed by the employee,

- Any additional amount the employee wants withheld from each paycheck.

By completing Form W-4, employees ensure that their employers withhold the appropriate amount of federal income tax from their paychecks based on their circumstances. This form helps employees manage their tax liabilities and ensures they neither overpay nor underpay their taxes throughout the year.

Filling Out the 2022 W-4 Form

The IRS regularly issues updated templates. Go through the 2020 W-4 template as slowly and carefully as possible to avoid making mistakes in the new form. The employer should check that you are provided with a correct template because altering the template will lead to its refusal.

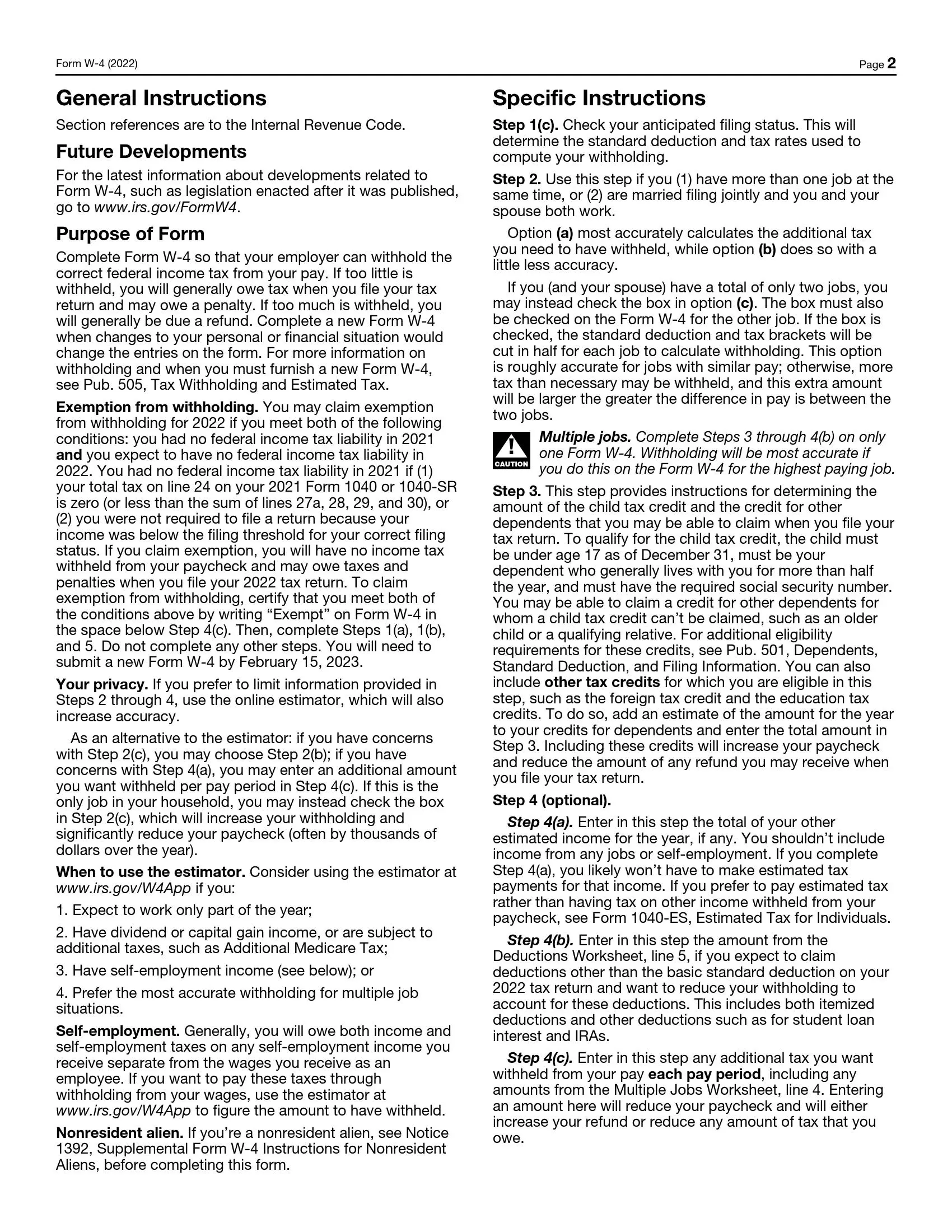

Step 1. Personal Information

As one may expect, firstly you are supposed to specify your details. That is how many forms start, so this part should be fairly self-explanatory. Note that in addition to your full name, including the middle name, and contact address, you will also have to include your social security number.

Remember that you have to include your full contact address with the ZIP code when providing your address. Note that your name should match your name on your social security card. If they do not match, you are advised to contact the Social Security Administration (SSA). The required contact details are provided for you.

The last paragraph is incorporated to identify your status. The first response is either for single individuals or for those who are married filing separately. You could also be married filing jointly. Finally, you could be a widower or widow. Read carefully the definition of being the head of household and check only if that legal definition applies.

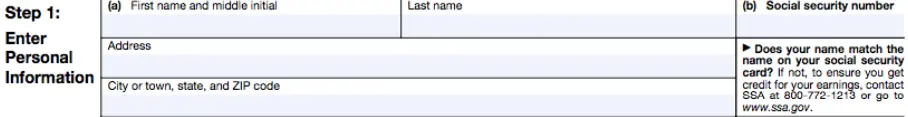

Step 2. Multiple Jobs or Spouse Works

Fill out these boxes if these concern your current circumstances. This would be so in the following cases:

- if you hold several jobs at the same time,

- if you are married filing jointly with a spouse who also works

Individuals who have two jobs that they hold in total should check the appropriate box, as shown below under letter “c.” If not, either use the tax estimator through the link provided to you or use the multiple jobs worksheet in the appendix.

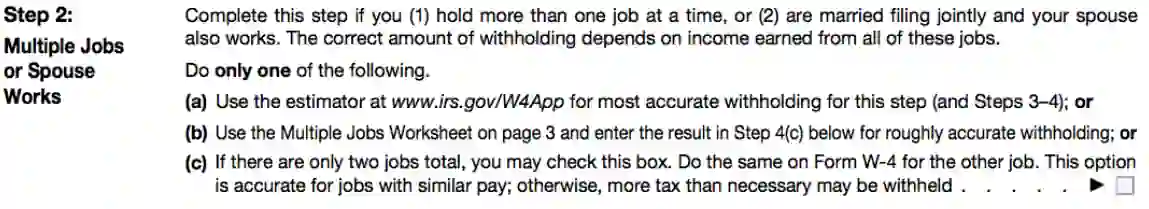

Step 3. Claim Dependents

If you have dependents, you should calculate the money amounts as suggested in the form, depending on how many dependents you have and whether these are your children. Remember to include the total in the last box.

If you apply for the child tax credit, you should know that the child should be under the age of 17 by the end of the year and live with you for more than six months. They should also have a valid social security number. There could be other dependents who are not underage children, too, such as qualifying relatives.

Step 4. Other Adjustments (Optional)

This step would not apply to everyone, so only go through it if you know that you need to. It will be in case you want tax withholding for some other income not related to jobs, or if you claim deductions of a specific, non-standard nature, or if you want to add some extra tax withholding. Otherwise, feel free to skip this section entirely.

If you are demanding withholding exemption, simply put “Exempt” in this section.

Step 5. Provide Your Signature

Make sure that all the information you have stated above is correct. This is extremely important because by providing your signature, you confirm that all you have specified is correct and true, to the best of your knowledge.

In addition to your signature, you will need to state the date when you filled it out.

When the employer receives the form from you, they will need to complete it by filling a special ’employers only’ box at the end of it. This will notify the IRS of when you started your work and will allow them to identify your employer with their name, address, and identification number.

The appendix incorporates the general and specific instructions for you to read through and follow, as well as the multiple jobs worksheet. If you have chosen the corresponding variant of response during Step 2, then you should use this spreadsheet.