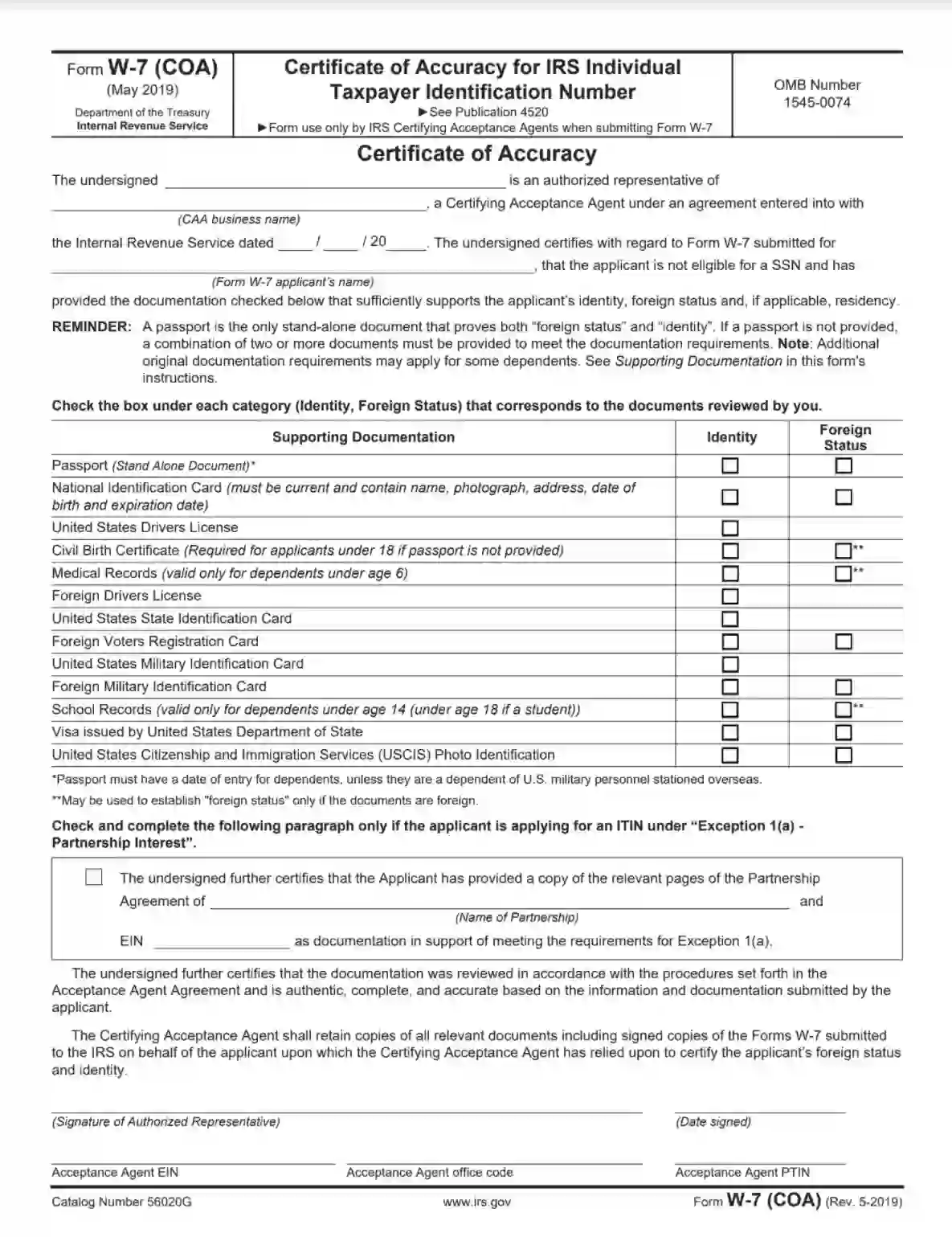

IRS Form W-7 (COA), also known as “Certificate of Accuracy for IRS Individual Taxpayer Identification Number,” is a specific document that accompanies Form W-7 when applying for an Individual Taxpayer Identification Number (ITIN). This form is used primarily by Acceptance Agents (AAs) and Certifying Acceptance Agents (CAAs) who assist applicants in obtaining ITINs. The W-7 (COA) confirms that the Acceptance Agent has reviewed the necessary identification documents and attests to their authenticity and accuracy.

Acceptance Agents facilitate the ITIN application by ensuring that all required paperwork is complete and accurate. They verify the applicant’s identity and foreign status, thereby negating the need for the applicant to send original documentation to the IRS. The COA form helps streamline the ITIN application process, providing a layer of trust and validation that the information provided to the IRS is correct.

Other IRS Forms for Individuals

Depending on the complexity of your finances, you might need to file several IRS forms along with the standard tax return form for individual taxpayers. Check what IRS forms are often used by our users.

How to Fill out Form W-7 (COA)

Depending on the quantity of time you want to spend on paperwork, you can choose one of the further options of filling out Form W-7 (COA): you can utilize our form-building software with a PDF editor or use our illustrated step-by-step guidelines for extra assistance).

No matter what option you choose, you can be sure no mistakes will be made if you’re following the guidelines drafted neatly by our skilled experts below.

Get Acknowledged with the Guidelines

You are not obliged to, but we highly recommend you to get acknowledged with the general and specific guidelines, referring to Form W-7 (COA) completion. It is always easier not to make mistakes at all than fix them, especially if these are mistakes in legal papers. Even the slightest mistake can lead to a situation when the supervising body declines your application, and you need to file it once more, wasting your precious time (and money, sometimes).

Moreover, you can find some useful tips and definitions for various terms mentioned in the form template here. There is no need to google them if they’re right at your hand.

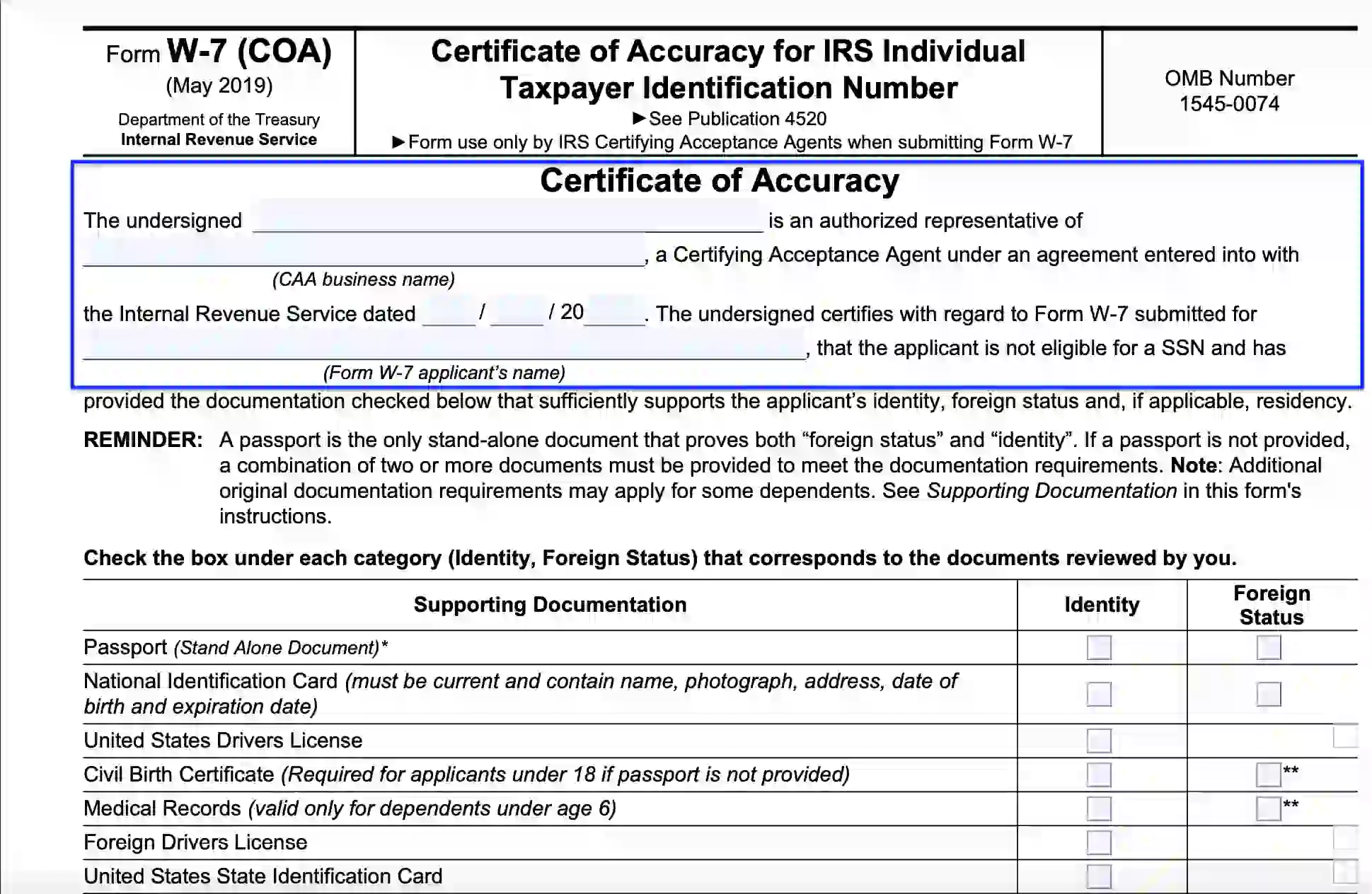

Type in the Introductory Data

Type in the name of the official verified representative. Enter the business name of the CAA organization the official verified representative is advocating for. Ensure to provide its full and correct legal name.

Also, register the signing date of the form, or Certificate of Accuracy, in other words.

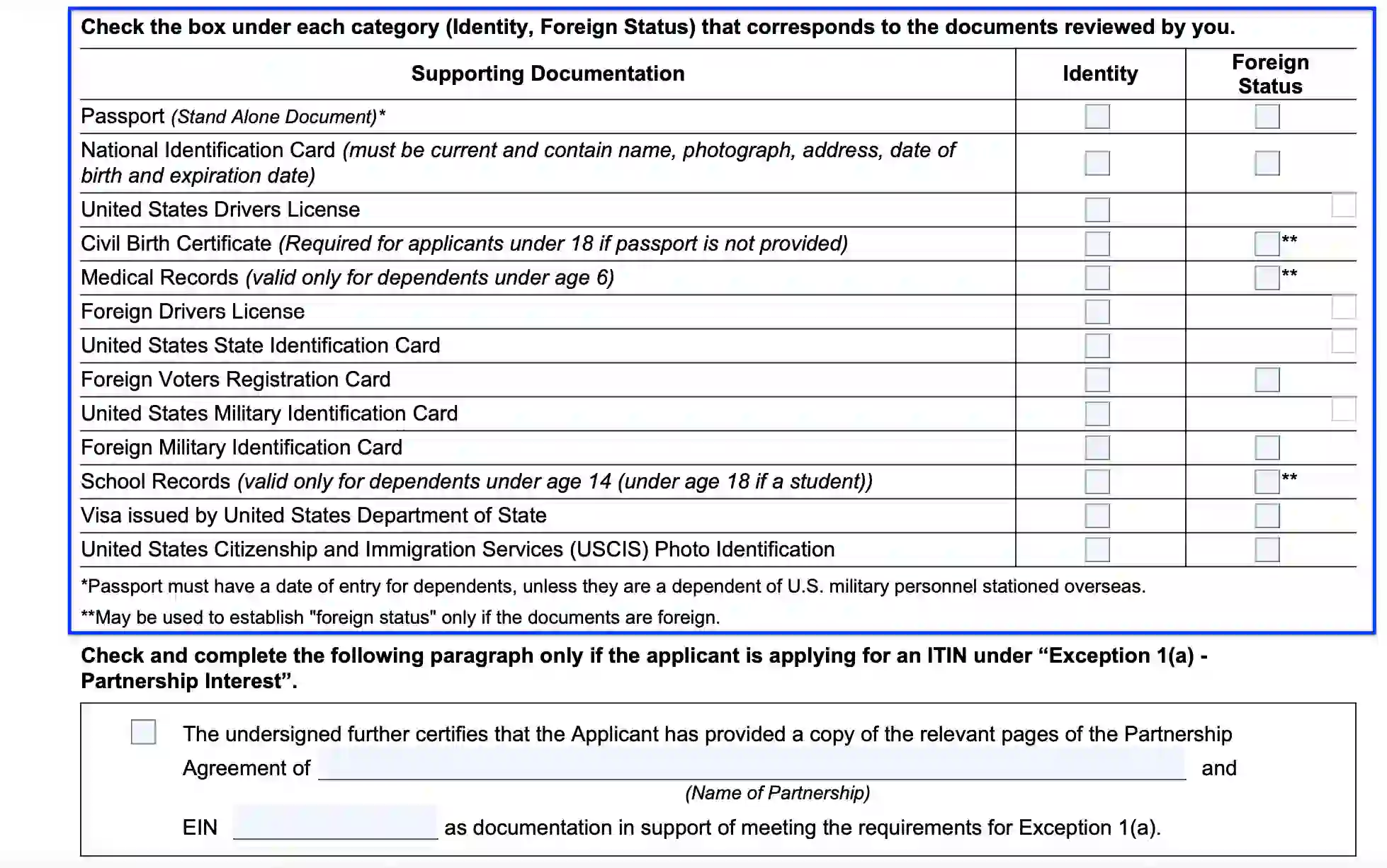

Define the Supporting Documentation Statuses

In this part of the form template, the ITIN applicant has to define the statuses of all the supporting documents presented in the list. The ITIN applicant must check the corresponding boxes and report whether the application refers to acquiring an “identity” number or a “foreign status.” Check the possibility of defining documentation as “foreign status” as sometimes it is only possible if the paper is foreign.

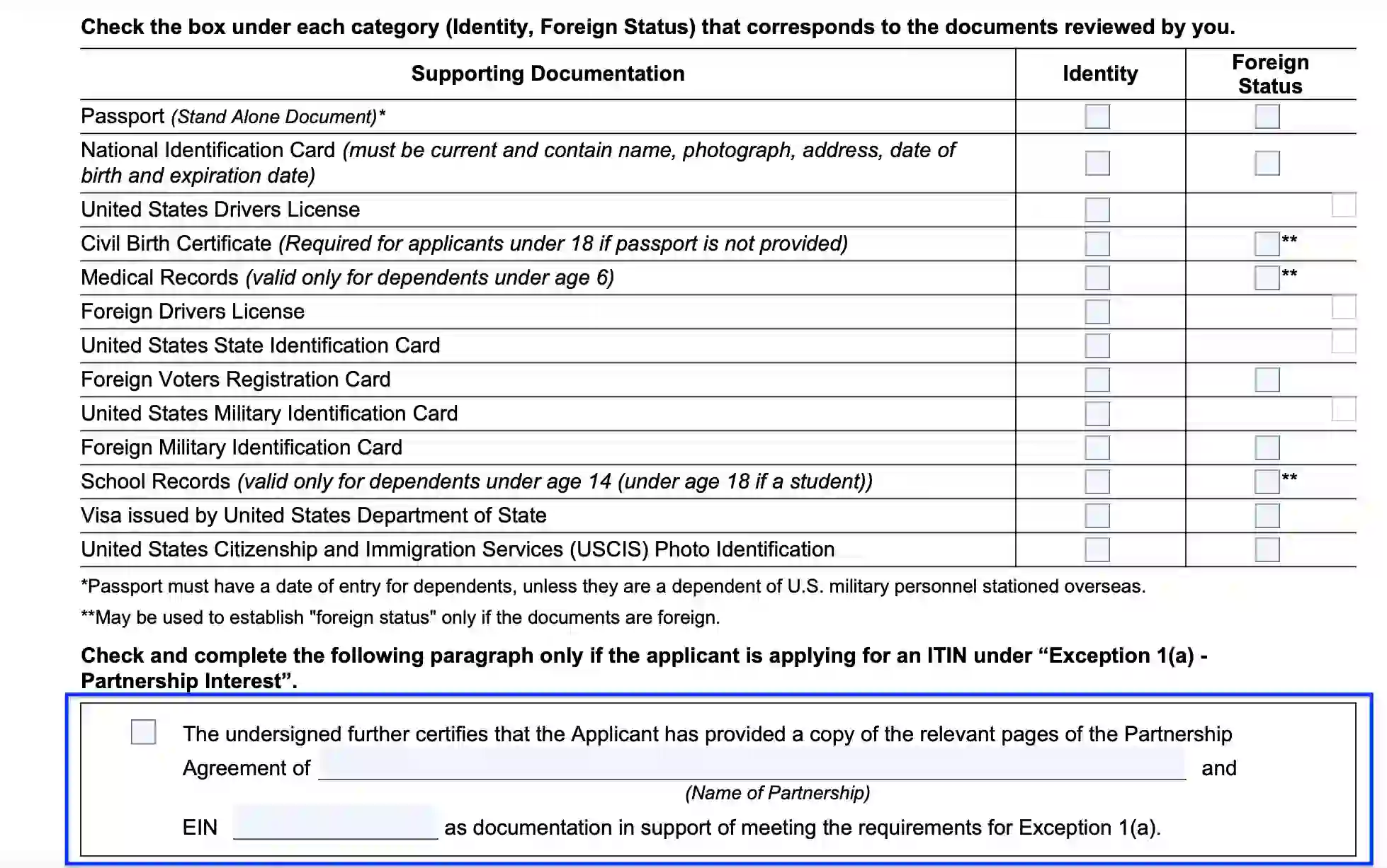

If there’s room for a specific condition or situation meeting the “Exception” criteria, please enter the name of the partnership and the Employer Identification Number (EIN).

Ensure the Signing of Form W-7 (COA)

The official verified representative of the CAA must sign the finished form and enter the signing date. Also, the CAA’s representative has to type the Acceptance Agent Office code, Acceptance Agent EIN, and Acceptance Agent PTIN.

Deliver the Legal Papers to the Supervising Body

After all the necessary documents are collected and all signatures are presented in the finished form, an ITIN applicant must deliver them to the supervising body, which is the Internal Revenue Service.

Check attentively whether all the necessary documents are on your hands before sending them to the IRS.