IRS Form W-9, titled “Request for Taxpayer Identification Number and Certification,” is used in the United States to provide a taxpayer identification number (TIN) to the entity or person that will pay the individual or other entity, ensuring the correct reporting of income and expenses to the IRS. It’s commonly used by freelancers, contractors, and vendors to provide their Social Security Number (SSN) or Employer Identification Number (EIN) to the entities they receive payment from.

The primary purpose of Form W-9 is to enable payers to accurately issue Form 1099s, which report various types of income other than wages, salaries, and tips to the IRS. The form helps prevent backup withholding from payments, which may occur if taxpayers don’t provide their TIN to the payer. Completing a W-9 form is essential for the payer and the recipient to ensure compliance with IRS information reporting requirements and accurate filing of annual income tax returns.

Other IRS Forms for Individuals

Learn more about other IRS forms that you might need for employment or other income-generating purposes.

Filling Out a W-9 Form

W-9 contains an acknowledgment that specialists share valid tax ID and their tax class, whether they are exempt from backup withholding or should take tax return responsibility.

W-9 can be challenging to fill out because not all sections may fit your particular case. We suggest you try out our software to generate a PDF and fill out the required information instantly. Follow this comprehensive guide to understand better how to fill out form W-9.

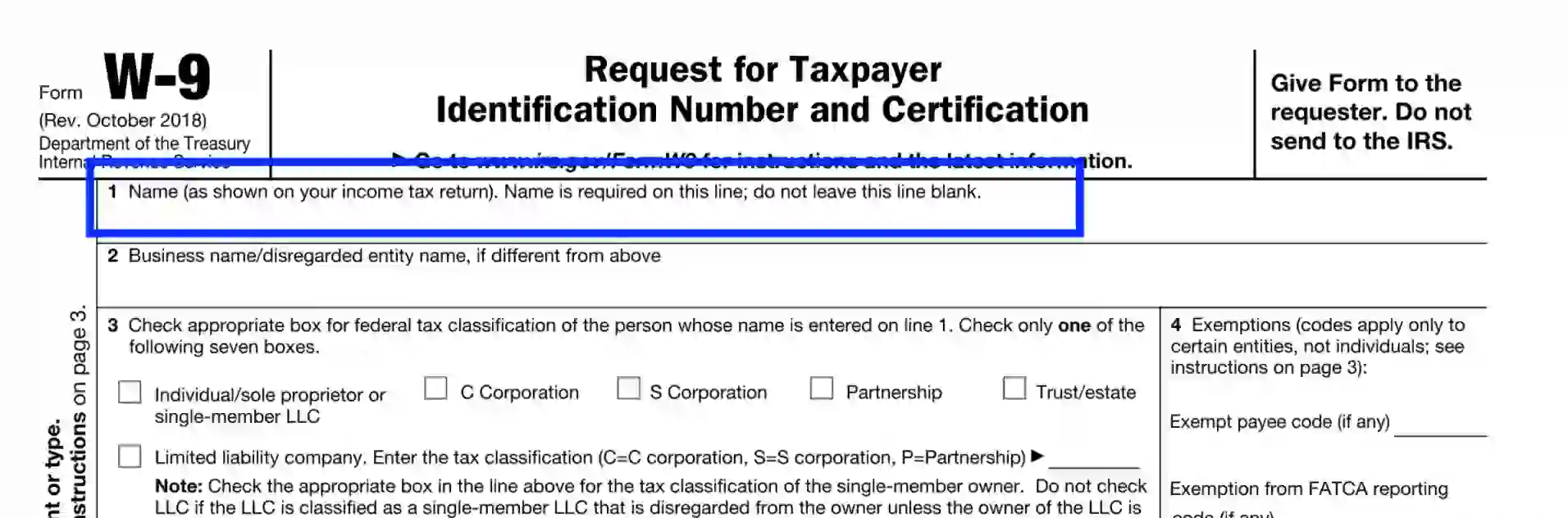

1. Indicate the Taxpayer’s Identity Details

The individual should provide the full legal name the same way it is spelled on their income tax return. It is compulsory to fill out this section whether you are an independent contractor or running a proprietorship.

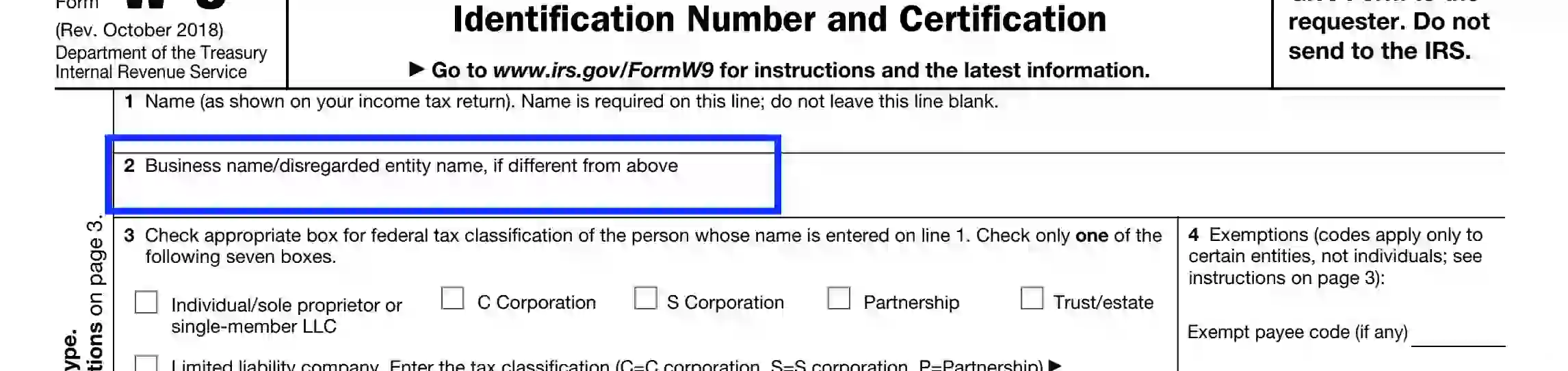

2. Indicate the Taxpayer’s Business Title

This section is optional if your legal name (spelled in section one) is the same as the business name. However, should the spelling or the concept differ, define it in the suitable section. Suppose your name is Anna Baker. You should fill this information in the first section. Your business name is Anna Baker — leave the field blank. However, if your business name is, for example, Anna Baker and Friends Inc. — it is mandatory to fill out this section.

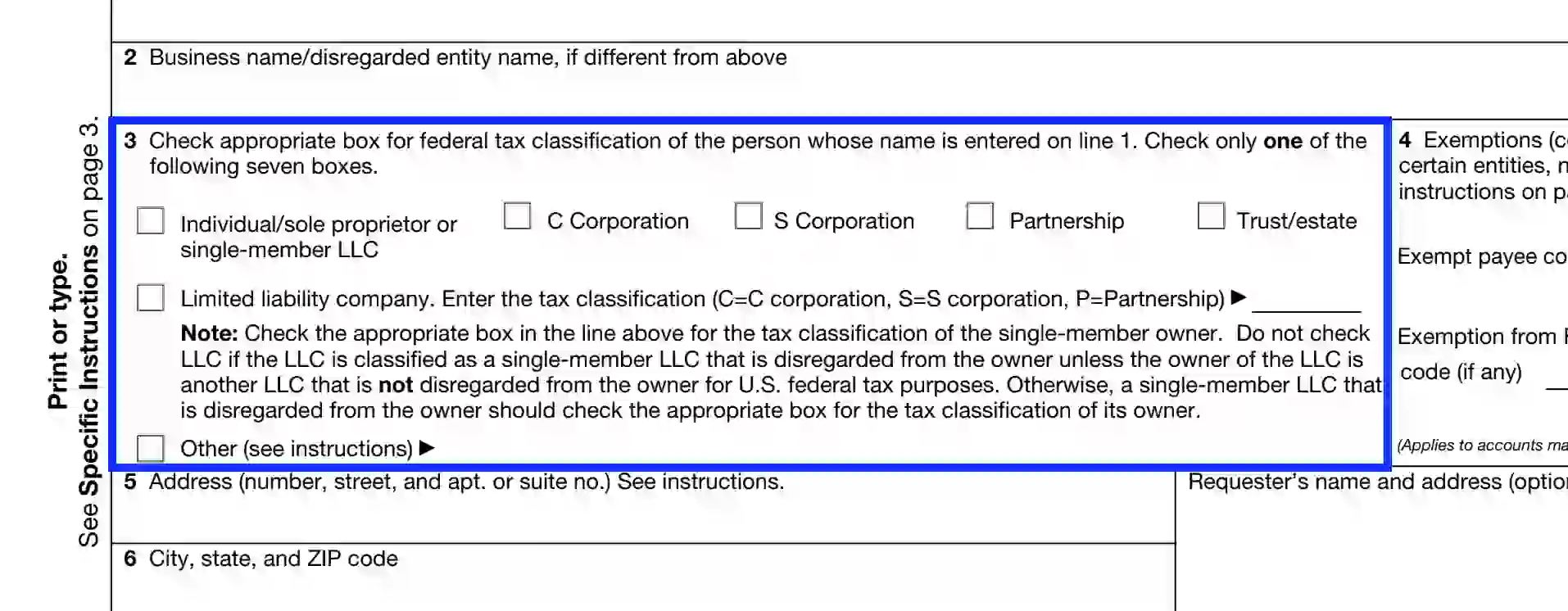

3. Specify the Tax Status

Follow the guidance of section three and submit your status regarding IRS classification. Select one option and check the appropriate field.

Single-member LLCs should select the first box. “Limited Liability Company” slot is appropriate for corporation and partnership statuses.

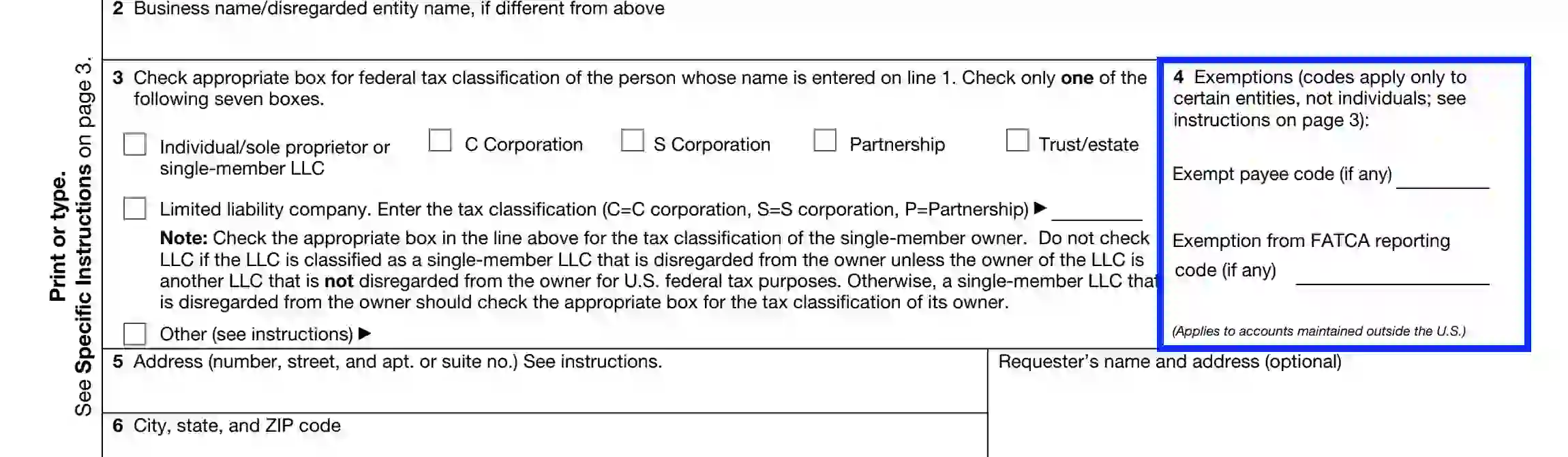

4. Complete the Exemptions Section

The Exemptions section is applied only to some types of entities. Being a sole proprietorship or an independent contractor, please, leave these areas blank. This field offers two choices. If you are exempt from backup withholding, enter a valid code in the first box. If you have a legal benefit not to proclaim the Foreign Account Tax Compliance Act, mark the second box.

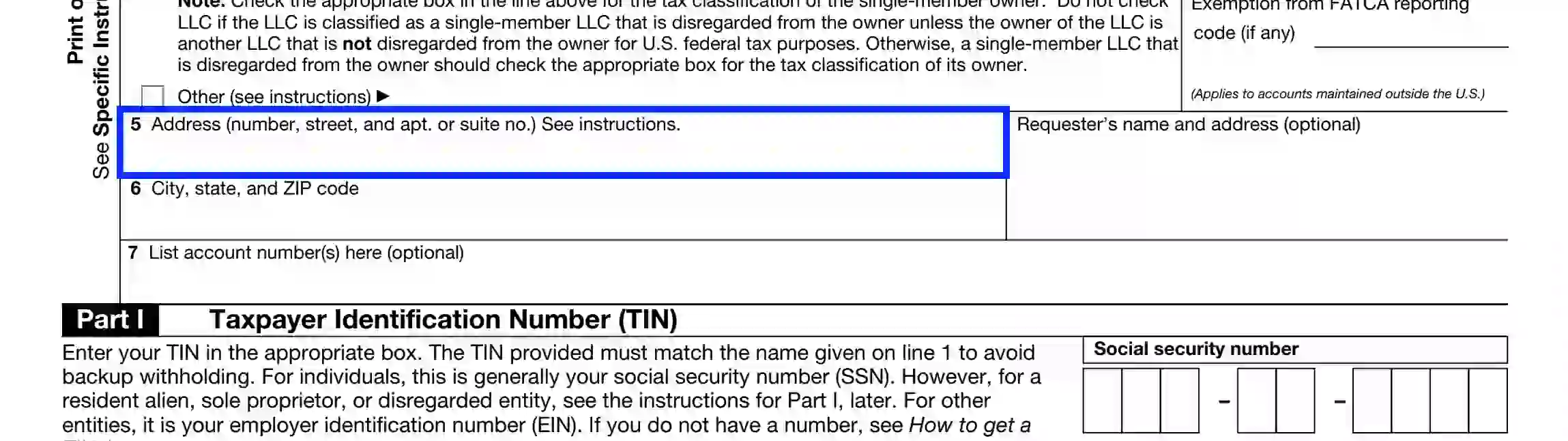

5. Define Your Home Address

The petitioner should provide their physical address, including the street and apartment number. This information is needed to serve notifications and important mail delivery from the employer.

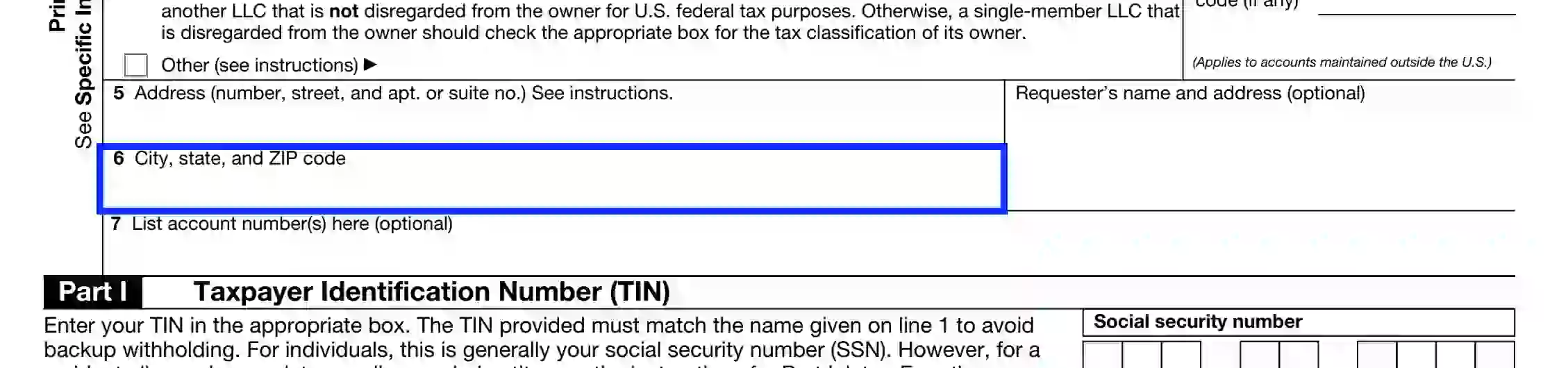

6. Write Down the Domiciliary Data

Enter the information regarding the city, your state of residence, and your ZIP code.

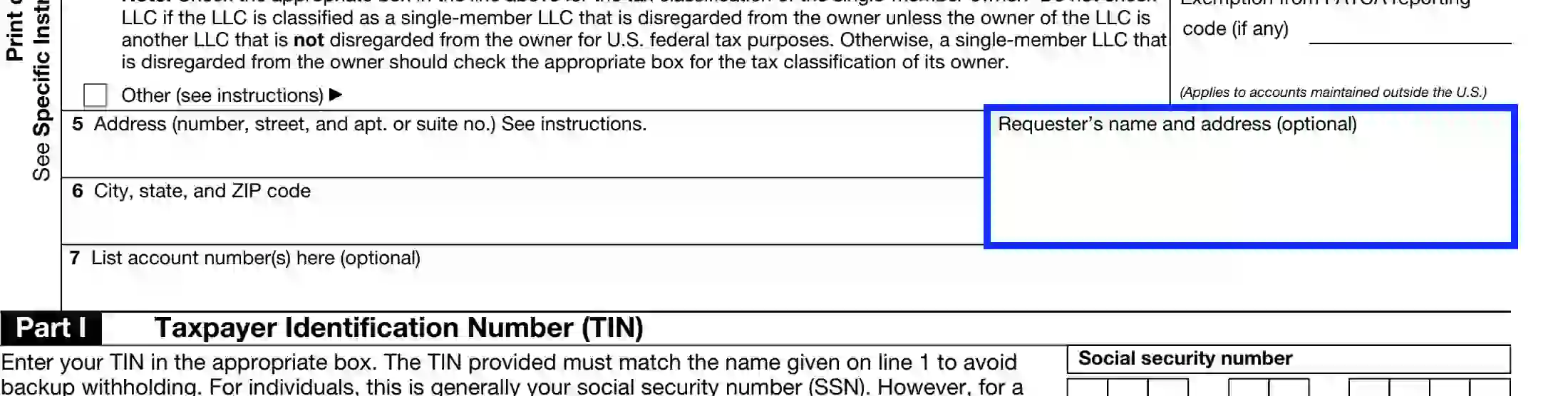

7. Specify the Requester’s Address

There is a slot requiring the requester’s (employer’s) address and legal name opposite the taxpayer’s residency information. The section is optional and can be left blank.

8. Enter Extra Account

If applicable, provide any extra account number at the employer’s request. If you don’t have any, skip this optional section.

The second and third segments are as follows:

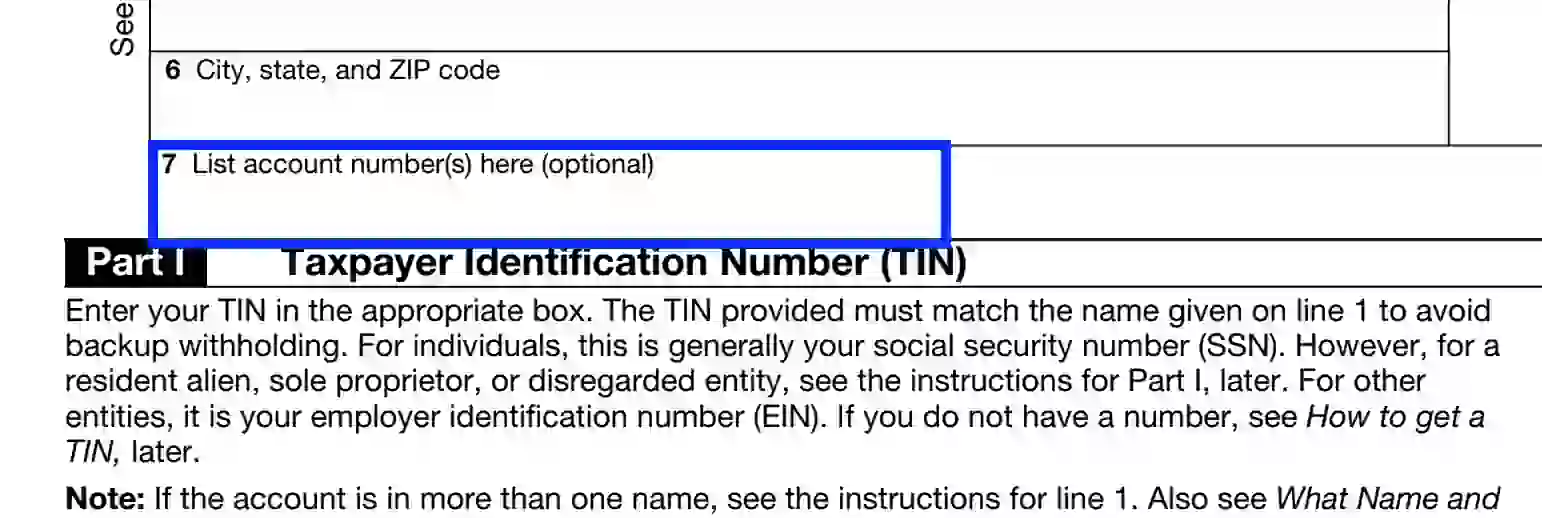

“Part One” — Defining the TIN

The section is dedicated to the taxpayer ID and provides two options: for individuals, single-member LLC versus entities and business corporations.

- Individuals should enter their Social Security Number.

- Corporations and partnerships need to select and enter the Employer Identification Number.

- A sole proprietor can opt for any option provided in this section.

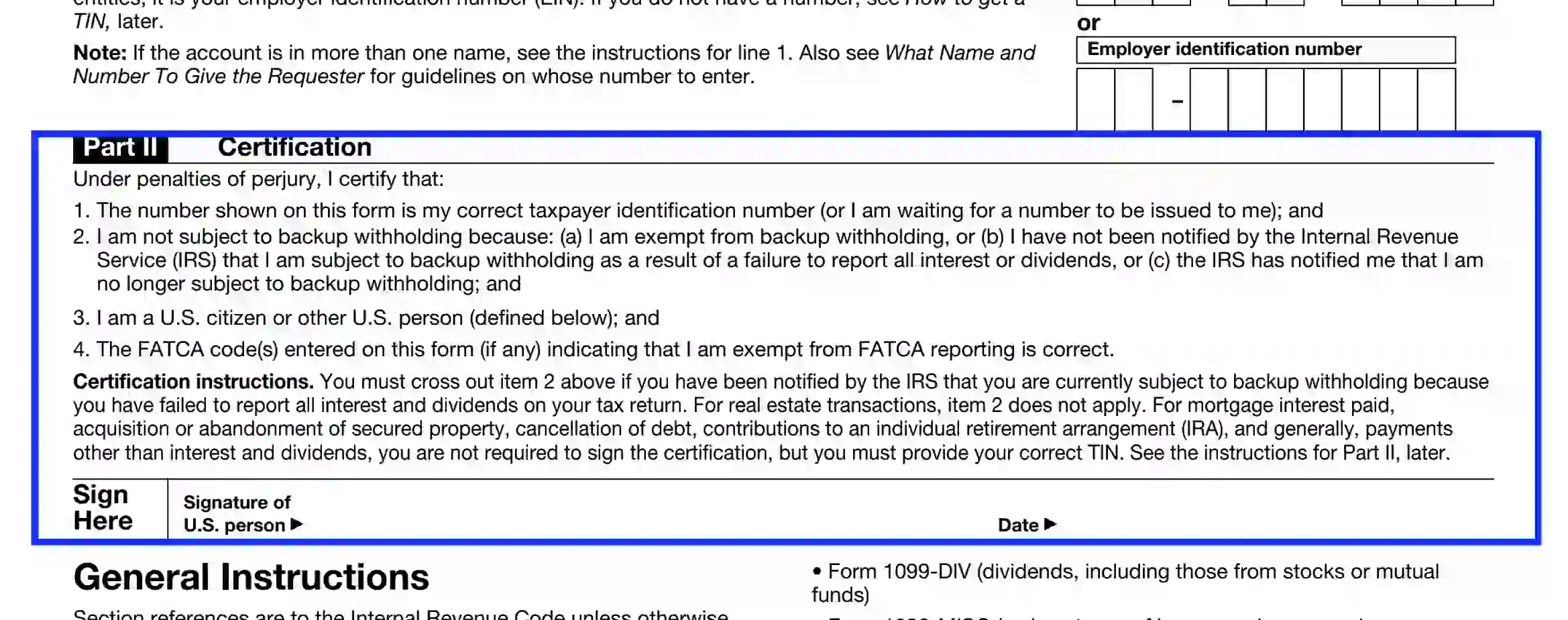

“Part Two” — Certification

This part authenticates all the aforementioned information and proves your consent to the data submitted. Therefore, you should review the document again with scrutiny and append your signature if everything is correct. Note that you completely agree with every statement provided in the Certification Part.

Suppression of evidence and malicious falsehood can lead to prosecution and penalties, including fines and imprisonment. Form W-9 allows you to cross out the second statement if you are subject to backup withholding and have been notified about this fact.

Complete the W-9 IRS Form by placing the current calendar date and report the document to the requester. Remember that you don’t need to serve this paperwork to the IRS office.