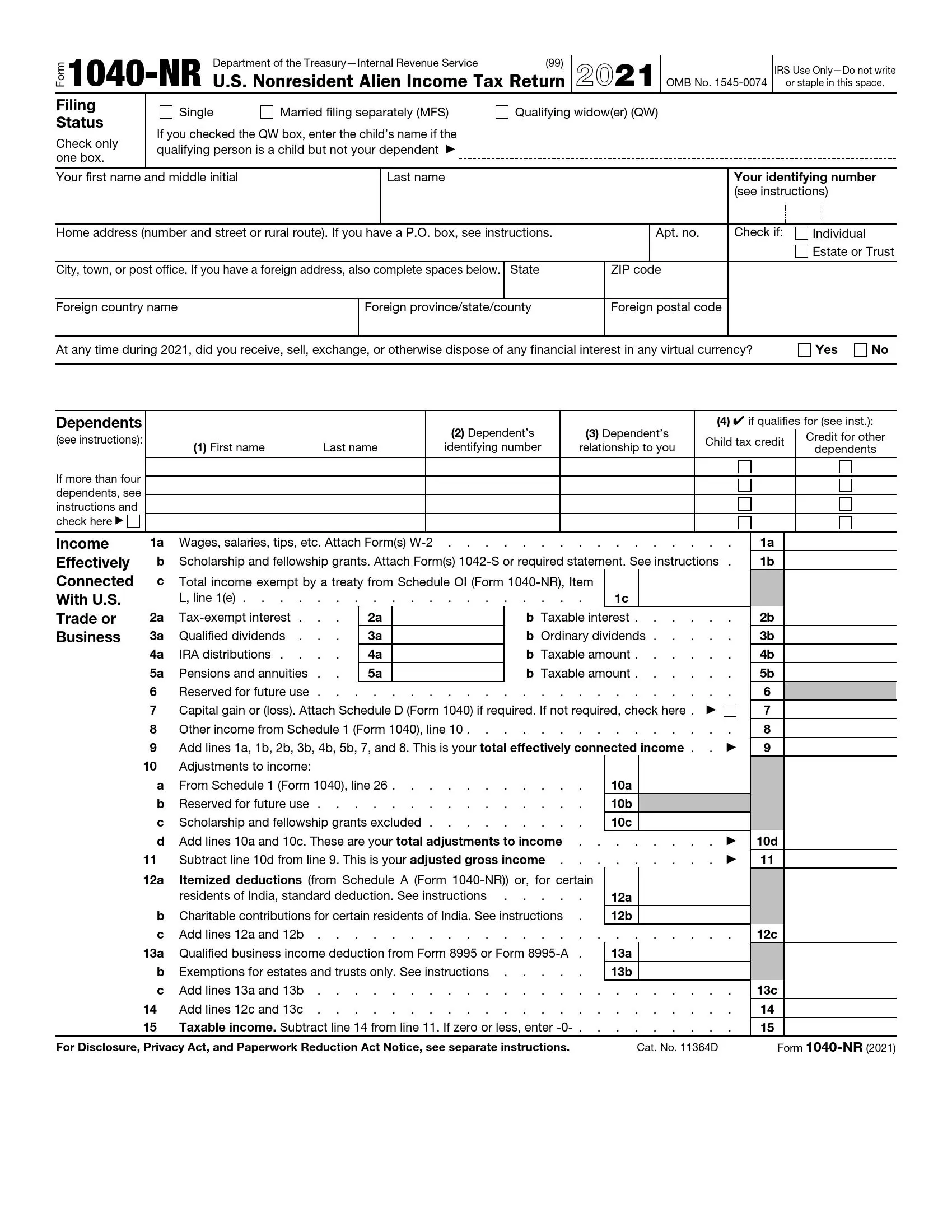

IRS Form 1040-NR is a tax document used by nonresident aliens of the United States to file their income tax returns. It is similar to Form 1040, used by U.S. citizens and residents, but is specifically designed for individuals who don’t meet the tax residency requirements. The form is used to report types of income subject to U.S. tax, allowing nonresidents to calculate the correct tax based on their U.S.-sourced income.

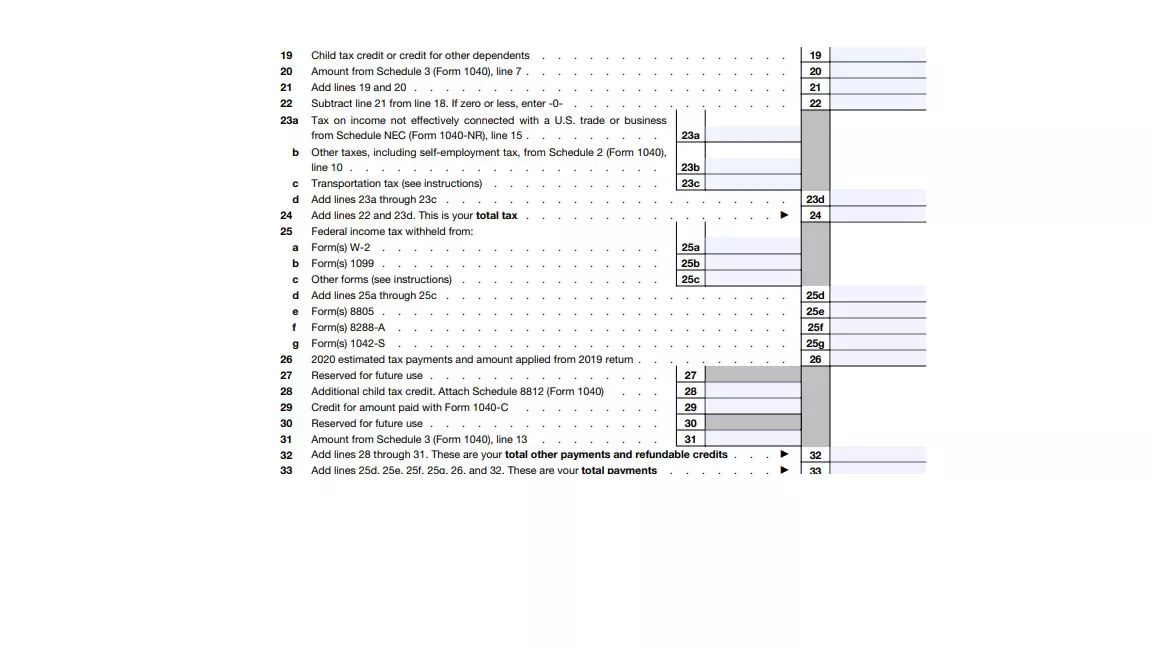

The form includes provisions for various types of income, deductions, and credits pertinent to nonresident filers. Key sections on the form include:

- Income effectively connected with a U.S. trade or business,

- Non-effectively connected income, subject to a flat rate of 30% or lower treaty rate,

- Deductions that are allowed to nonresidents,

- And credits for taxes paid to foreign governments.

Form 1040-NR ensures compliance with U.S. tax laws while acknowledging the unique situations of nonresident aliens, providing a structured way to account for earnings and tax obligations within the United States.

Other IRS Forms for Individuals

Apart from the income tax return form, there might be other IRS forms you need to file. Check what IRS forms are common to file by our users.

Instructions For This Application

Any instruction is a universal assistant in filling out tax documents. Step-by-step analysis of complete tax returns saves you time and your nerves, and, to some extent, even money. Therefore, do not neglect the opportunities, and you need to use the plan for filling out the application. If necessary, check out our form-building software to simplify the procedure.

In 2020, there were some changes regarding this document. Firstly, the line numbering has changed. However, some items now belong to other sections. Secondly, now you need to use the instructions for filling out related applications.

1. Basic Information

Any application, first of all, includes information about you. Enter your first and last name, address, and corresponding country in the lines. Write down your mailbox, phone numbers, and any contact details. Enter a foreign address if you have one. The form also assumes the introduction of an identification number. By the way, an incorrect identification number or its absence leads to an increase in the tax. So make sure to get it in advance. If you intend to change your address after submitting your application, inform the Tax Service by completing an additional document. The same goes for changing the name.

2. Your Position

At the beginning of the application, you select the appropriate status (single, married, qualifying). As a general rule, sometimes you need to enter your social security number. If you haven’t received it yet, apply to the relevant institutions.

How may you determine your status? You may choose a single position if you meet the following conditions. For instance, you have never been married or have a divorce document. It is a mandatory requirement since this is how you confirm your position.

The second type of status applies to married couples. Even if you live separately, but the marriage is not officially dissolved, you choose this item. The third option applies to those who have a deceased spouse.

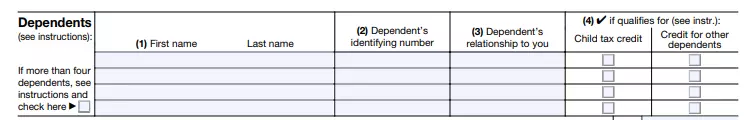

3. Long-term Security

The income tax return for unregistered foreigners provides an opportunity to resolve issues related to dependents. You may even get a credit registered on a child. However, this only applies to Americans, Mexicans, and Canadians. These are conditions that require attention. Enter the first and last names of the dependents related to you. Select the appropriate loan options.

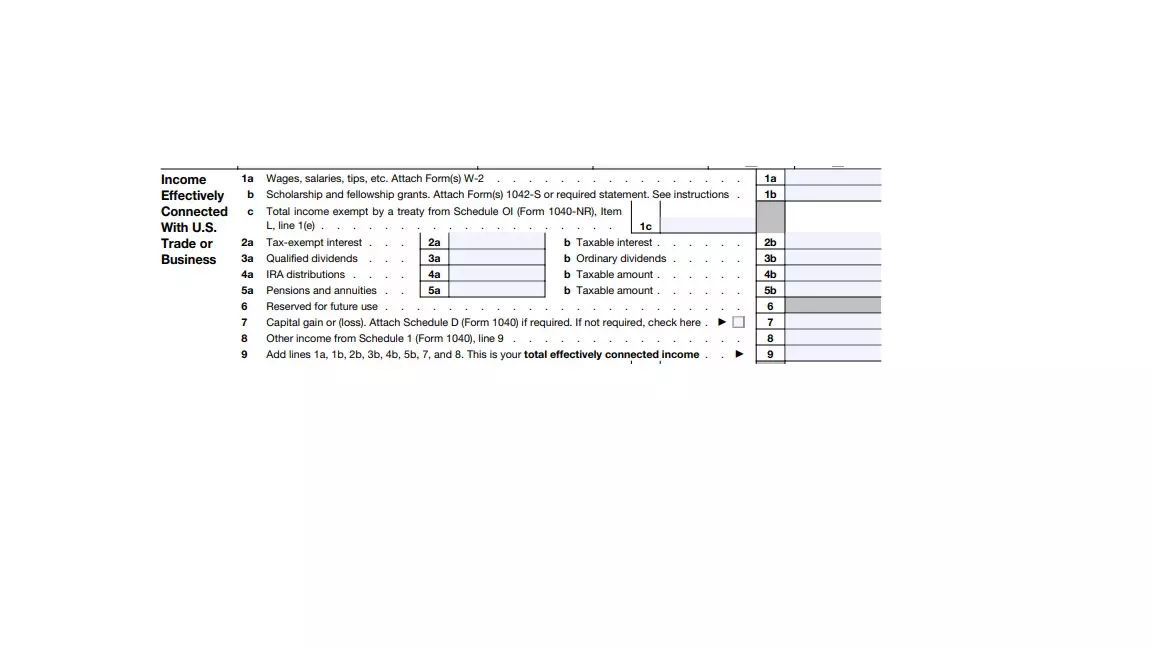

4. Taxable Income

What else does this application include? Firstly, fill in the details of your business and trade if you do it in the United States. Your income should be directly related to this activity. Otherwise, the profits of organizations in other countries are not taken into account in taxes. Carefully fill out the lines about salary, scholarship, tips, and profits.

If your income is not taxed in the United States, skip this point and do not enter the data. Sometimes the income of entrepreneurs comes from the United States and other countries. In this context, distribute the correctly received amounts. Please note that mathematical errors lead to incorrect actions.

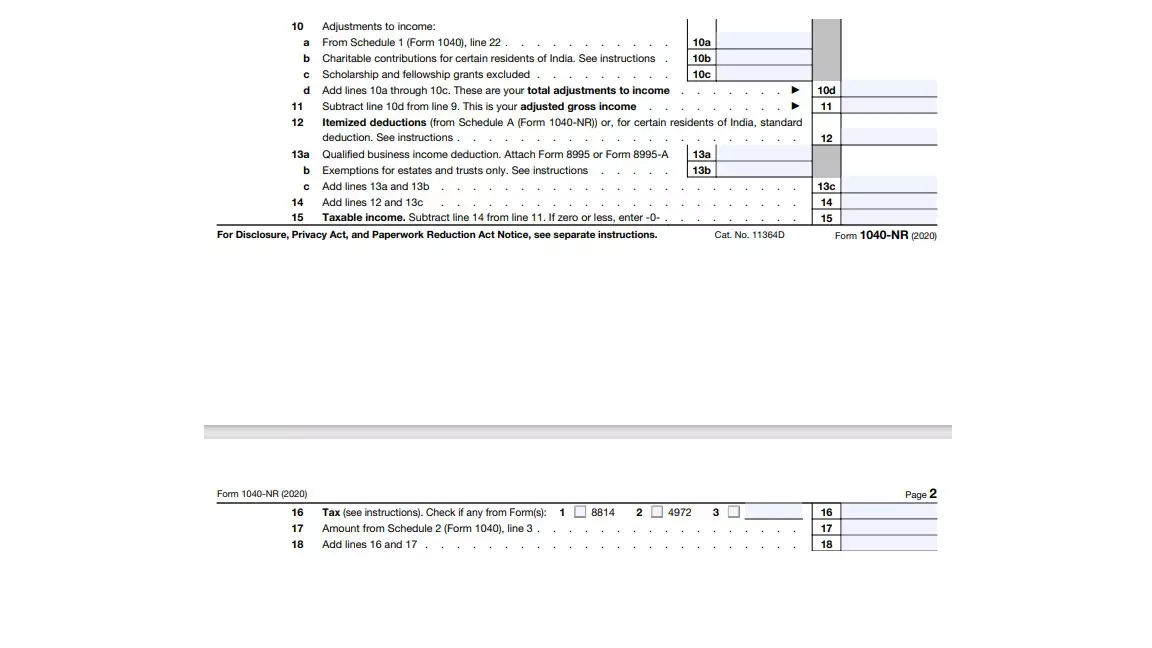

5. Profit

Now let’s talk about profit adjustments. It is a significant point, as it affects the compensation or retention of amounts. As a student or co-student of a business enterprise, you are automatically eligible for benefits. At the same time, you submit the necessary documents, confirm that you have this right, and receive benefits. Write down the detailed deductions and then the income.

6. Additional Benefits

The authorities allow you to get a tax credit for children and other dependents in some circumstances. Complete this section to the end, providing all reliable information about payments. We remind you that false data will never provide you with more opportunities. On the contrary, you will lose some benefits, pay fines, or even interest. The more honest you are with the Service, the better for you.

7. Refund And Some Issues

US law also provides for the return of amounts within the framework of taxation. You receive a notification of compensation from the authorities in advance and fill out the necessary documents. Also, if you are in debt, the Service may write off the amount.

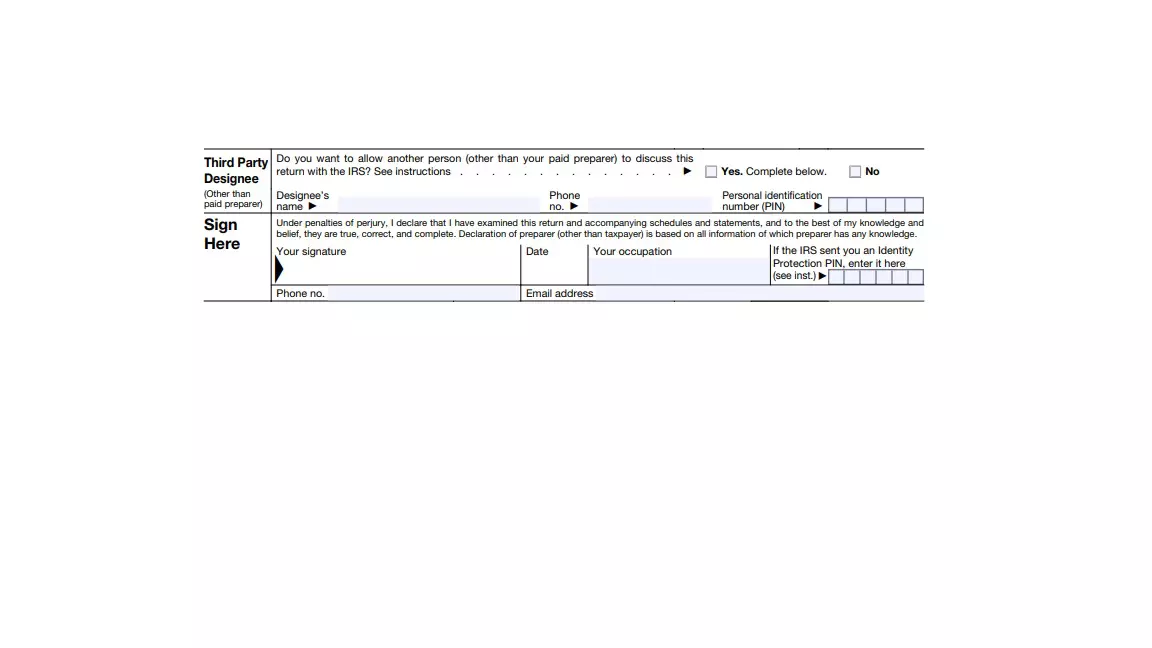

If there is a third designated person, complete this section. After filling out the form, check the correctness of the information several times and sign it. Without your signature, the Service has the right not to accept the application.

The use of a paid compiler is not a prerequisite for the application. But if you used this help, this person should fill in the information in this section.

Thus, take into account all the mentioned recommendations to avoid miscalculations and misunderstandings. Submit all the documents in time. The government agencies accept your application. Otherwise, you might have to deal with a fine.