Form 13614-C is a document the IRS uses to streamline the tax preparation process for individuals participating in the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. These programs aid individuals who qualify based on income, age, disability, or limited English proficiency by offering free tax preparation services. The form acts as an intake and interview sheet, ensuring that all relevant personal and financial information is collected for accurate tax return preparation.

The purpose of Form 13614-C is to assist volunteers in capturing comprehensive details about a taxpayer’s income, deductions, credits, and any applicable expenses that could affect their tax filings. By thoroughly reviewing this form during the tax preparation session, volunteers can better understand the taxpayer’s situation and identify any specific tax benefits or obligations. This process ensures taxpayers receive all the deductions and credits to which they are entitled.

Other IRS Forms for Individuals

Here are some other IRS forms that are commonly filled out by our users.

How to Fill Out the Form

You, as a taxpayer, must fill out the template on your own. Reply honestly on each question: the information you outline will probably be checked by public authorities. If anything you state there is not correct or accurate, and governmental institutions discover it, you will be in trouble.

The template should be given to you by a VITA or TCE volunteer. However, if it did not happen for some reason, you can find the form using other sources. The most obvious is the Service site, where you can get the template in various languages: not only English but also Spanish, Korean, Chinese, Russian, and others.

Another way to get the proper template is by downloading it from our site, using our easy-to-use form-building software that has already satisfied plenty of users. We recommend checking it out and obtaining the IRS Form 13614-C here.

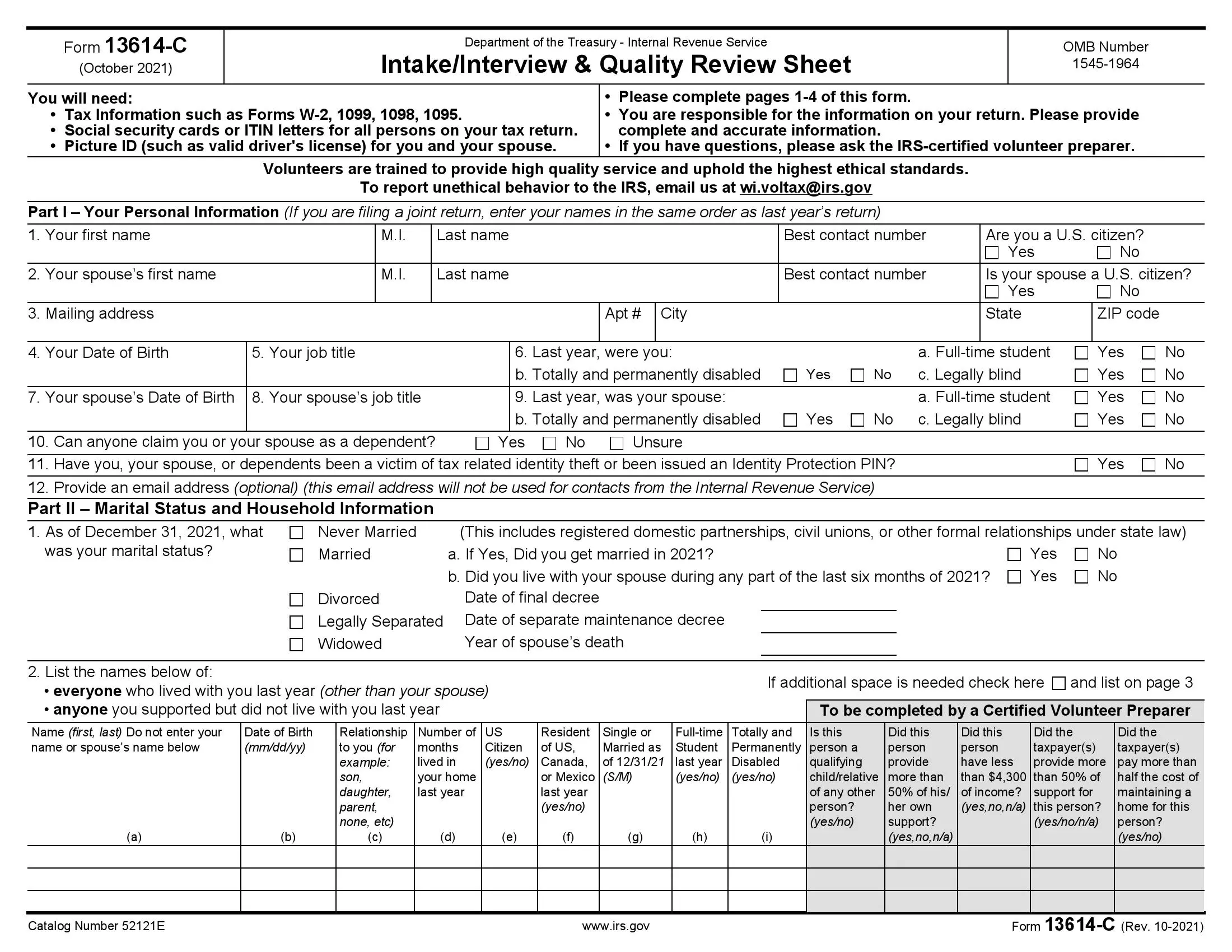

Read the Notices Carefully

This form starts with a couple of notices that each signatory must read before proceeding to the completion. From the text, you can find out which forms and documents you will need to complete this template, what pages you need to complete, and who to contact if you have concerns.

Additionally, you will see an email address you can use to leave claims if the volunteer who helps you with the form behaves unethically in relation to you.

Proceed to the First Part

When you have read the notices and everything is clear, scroll down to the first part, where you should add your and your spouse’s personal details.

In the suitable lines, enter your name, middle initial (if any), surname, and valid telephone number so the Service can reach you. Answer if you are a citizen of the United States. Below, add the same data for your spouse. Then, write your mailing address.

Specify your birth date and job title. Do the same for your spouse. Answer if you or your spouse were permanently and totally disabled, legally blind (your eye doctor can diagnose it if you have problems with your vision), or a full-time student.

Reply if anyone might claim you or your spouse a dependent: besides “yes” or “no,” you can mark “unsure” here. If you or your spouse have suffered from identity theft or are protected from it with certain instruments, answer the next question affirmatively.

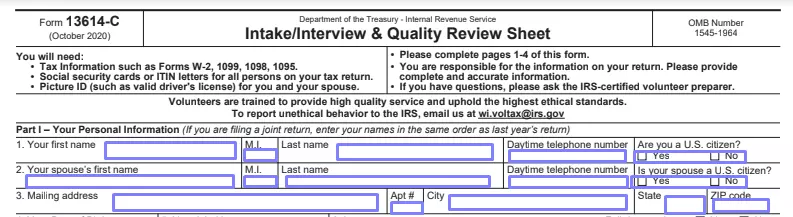

Describe Your Marital Status

The form’s second block is about your marital status and household details.

You should define your marital status by checking one of five boxes (married, widowed, divorced, never married, legally separated).

If you are married, answer if you married last year or not and lived with your spouse for a certain amount of time last year. If you are widowed, write the year when your spouse passed away. “Divorced” and “Legally Separated” statuses require adding the court’s decree date.

Then, you should list all people (excluding your spouse, if you have one) who lived with you last year and those who were supported by you financially but did not live with you.

In the chart, you can indicate four people. If you need more space, you can mark a special box on the right and add people on the form’s third page. For each person, write their name, birth date, relationship to you, the quantity of months they lived with you, whether they are a US citizen or resident of Canada or Mexico or not, whether they are single or married, a full-time student, or a disabled person.

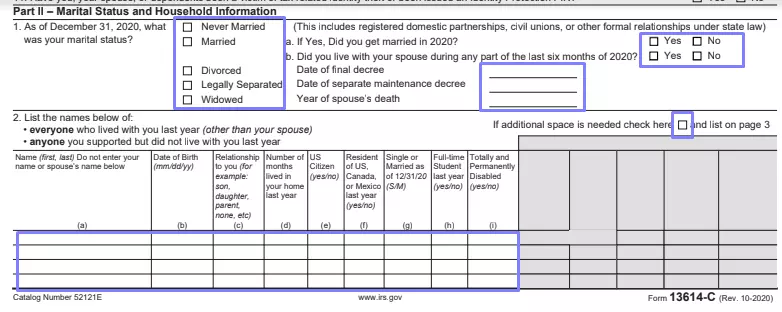

Answer a Set of Questions

The second page is fully dedicated to questions about your and your spouse’s income, costs, and other financial matters. There are three options you can reply with: “yes,” “no,” or “unsure.”

In the “Income” section, you will be asked if during the last year you or your spouse received wages, or salaries, interest, taxes refund, a scholarship, tip income, self-employment income, prizes or awards, and so on. You should respond to each question truthfully. In some questions, you will see the name of the forms you have prepared before: get answers from there.

In the “Expenses” section, you need to state whether you or your spouse paid alimony, retirement accounts contributions, insurance, student loan, taxes, mortgage interest, any supplies tied to your self-employment, and other items. Reply to each point, honestly.

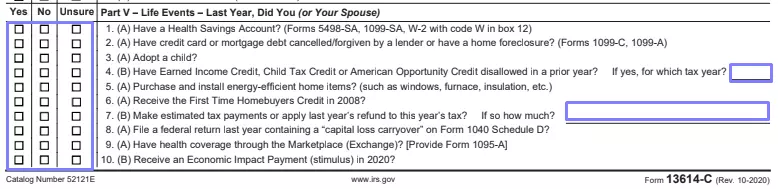

The third part is more general and is not only about money. Here, you will answer if you adopted a child, had any debt forgiven or canceled, bought energy-efficient home items and installed them, and so on. Answer all questions step by step, providing truthful information.

Include Additional Information

The following page requires you to insert additional info into the document. Add your email address (this is optional) and specify if you or your spouse want to give 3 US dollars to the Presidential Election Campaign Fund.

Choose the preferable refund method and payment method (if these questions apply to you). If the area where you live was declared a disaster area, mark the relevant box. Do the same to identify if you or your spouse have received any mail from the US Internal Revenue Service in the past year.

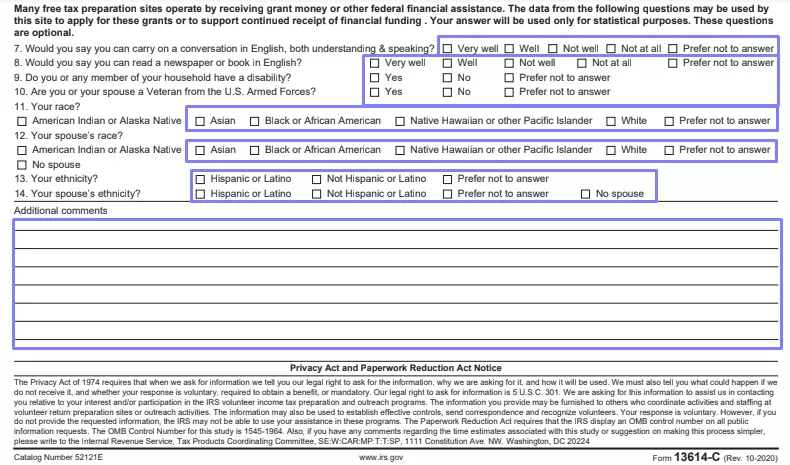

Below, you will see a set of optional questions: the government uses them for statistics, and you can omit them if you do not want to participate. If you decide to answer, you should determine your English level (if you can speak, listen and understand, read a book or newspaper).

Then, state if you or any of your co-livers is a disabled person. Reply if you or your spouse are veterans of the American Army. Define your and your spouse’s race and ethnicity by picking the relevant options.

If you are ready to answer a part of these questions, you can reply “Prefer not to answer” in those you deny.

Under the questions, you can leave additional comments in the blank lines (if you have any comments).

Express Your Consent to Process Your Data

The template’s last page is a separate form, 15080 (EN-SP). You need to fill it out to express your consent to the data processing. Read the federal disclosure and terms. Then, write your name and surname and sign the form. Your spouse mentioned in the form above should do the same here.