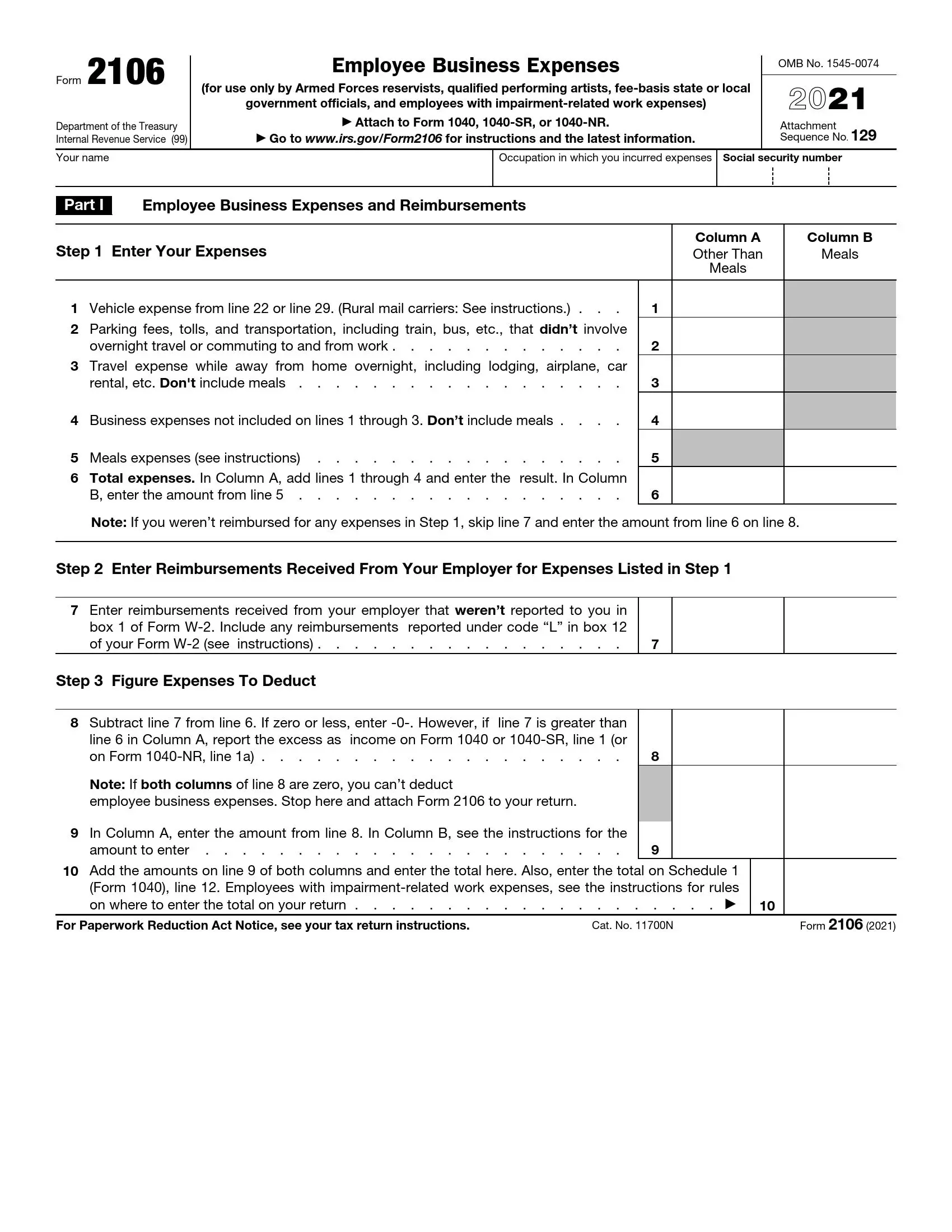

Form 2106, titled “Employee Business Expenses,” is used by employees to calculate and deduct ordinary and necessary expenses incurred related to their jobs. This form is particularly relevant for individuals whose employers do not reimburse these expenses. Eligible expenses might include travel, transportation, meals, entertainment, and other work-related expenses.

As of the tax reform law, most employees can no longer claim miscellaneous itemized deductions, including unreimbursed business expenses. However, certain categories of employees, such as armed forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses, are still eligible to use Form 2106 to claim deductions for unreimbursed business expenses. This form helps these taxpayers calculate the allowable expenses that can be deducted on Schedule A (Form 1040) under miscellaneous deductions.

Other IRS Forms for Individuals

Some IRS forms are devised only for certain categories of employees, and IRS Form 2106 is one of them. Learn what other forms are commonly used by employees.

Instructions For This Application

Before you fill out the form, read the instructions carefully, enter the correct data. For providing false information, you lose the opportunity to submit a document.

1. Information About Your Expenses

The first part deals with questions about your employee business expenses. If you have not yet received the payment, fill in only the first and the third sections. So, in this section, specify the costs for transport, travel, and parking. The fourth line is the costs of business gifts, souvenirs, and education. Carefully enter the amounts in the right columns. Enter the number from the fifth row in the second column.

2. Compensation Received

The information in the second section directly relates to the refunds you have already received for your expenses. Carefully fill out the refund application with your employer that was not specified on another form. These are the amounts indicated under the code ” L ” and received for business expenses. Do not forget that you must document your costs during the work period. It is necessary for maintaining accounting records. Use a special amount calculation sheet.

3. Calculation Of Expenses

Now it is necessary to make mathematical calculations for reimbursement for expenses. Typically, you may only deduct 50 percent of your business expenses. The eighth point is calculated as follows. You need to subtract the amount of the seventh line from the sixth line. If you get a zero or a negative number, enter zero. If you get a positive number, enter this difference. Remember, if both columns of the eighth row are zero, you can’t deduct your employees ‘ business expenses. Leave the other lines blank.

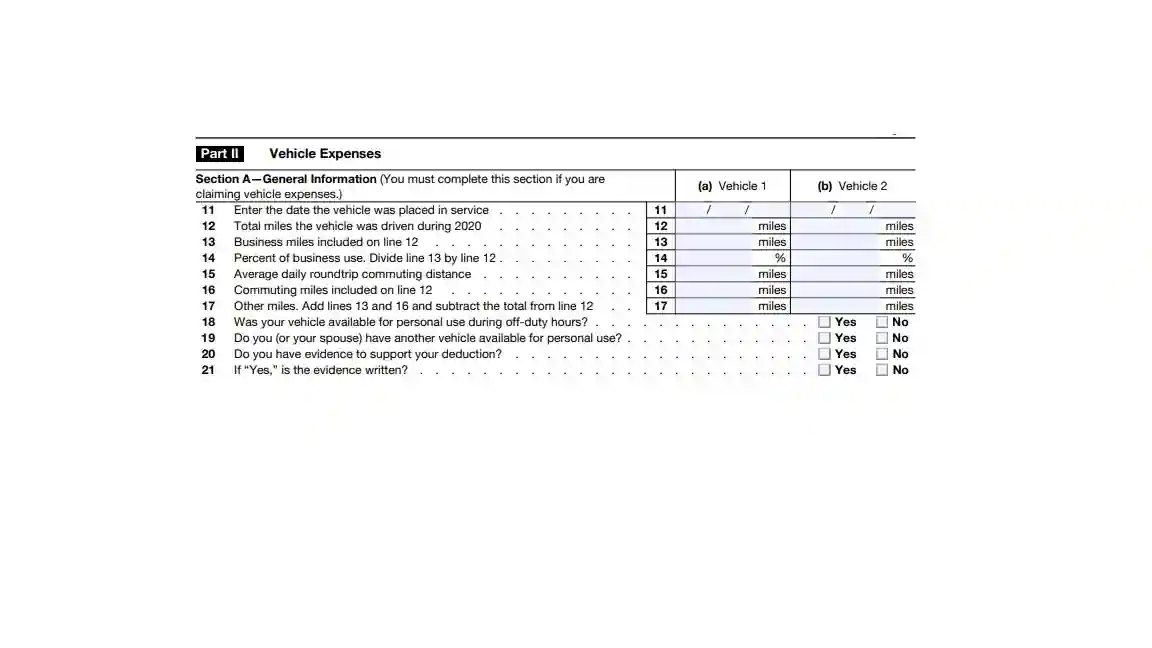

4. Commercial Property

Now let’s move on to one of the significant sections of this application. If you have used commercial vehicles for several years, use the A, C, and D columns to fill in the detailed information. If you have used more than two cars, attach another Form 2106.

Enter information about the date of the first use of a commercial car, the total number of miles traveled, and the transition from a personal to a business car. By the way, if you first drove your car and then a commercial one, the date of the first operation is different. It is the date of the first use of the machine for business. Answer the following questions honestly:

- Could you use a commercial car outside of business hours?

- Do you have another vehicle for personal use?

- May you document the above?

5. Miles And Actual Costs

In this part, you may calculate the standard mileage rate by multiplying the data on the 13th line by 57.5 cents. If you will use this calculation method, do it in the first year of operation of the car.

You should also include the actual cost of the car in the application. In particular, it is the cost of gasoline, tires, repairs, and other goods. According to American regulations, you do not need to include state taxes on personal property or interest expenses that you have paid. This section also includes rental issues. Follow the rules of the instructions!

6. Depreciation Of Transport

The entire cost of a vehicle purchased by an enterprise is never immediately debited. It is deducted gradually over the useful life. It is necessary to calculate the depreciation of the car in the framework and tax accounting. Car depreciation is the write-off of the cost of a vehicle in parts. It is the amount that you may deduct for reimbursement. It is necessary to write off the amounts of costs. It does create negative indicators in a short period. Specify the depreciation of vehicles and calculate the numbers. The date of the deduction depends on the time of commissioning of the car.