Form 433-B is a financial statement businesses use to provide detailed information about their financial condition to the Internal Revenue Service (IRS). This form, titled “Collection Information Statement for Businesses,” is typically used when a business owes back taxes or wants to establish a payment plan with the IRS. It requires businesses to disclose their assets, liabilities, income, expenses, and other financial information to assess their ability to pay outstanding tax debts.

Form 433-B assists the IRS in evaluating a company’s financial situation and determining an appropriate course of action for tax collection. By completing this form, businesses provide transparency into their financial affairs, enabling the IRS to make informed decisions about installment agreements, offers in compromise, or other payment arrangements. Form 433-B is crucial in facilitating communication and cooperation between businesses and the IRS to resolve tax issues and ensure compliance with tax laws.

Other IRS Forms for Business

Businesses face various financial situations, and depending on the financial condition, they need to file different IRS forms. Check what other IRS forms your business might need in your specific situation.

How to Complete the Form

Typically, an entity has an accountant or an invited specialist who deals with taxes on the entity’s behalf, regardless of its size. So, if there is a need to submit the form, ask one of your employees to prepare it.

If you run a business alone, consider employing a tax specialist who can assist you with the form creation or even make the document for you. Even though you will pay them for their work, you will save your time and nerves. In this case, you will surely avoid problems caused by mistakes you could have made while filling the template out.

If you cannot afford to hire anyone right now or are forced to create the record by yourself due to other reasons, make use of our comprehensive guidelines that tell how to finish the task step by step. Besides the guidelines, we also offer advanced form-building software that you can use to download the proper template. It is much quicker and easier than wasting time looking for IRS Form 433-B on other webpages.

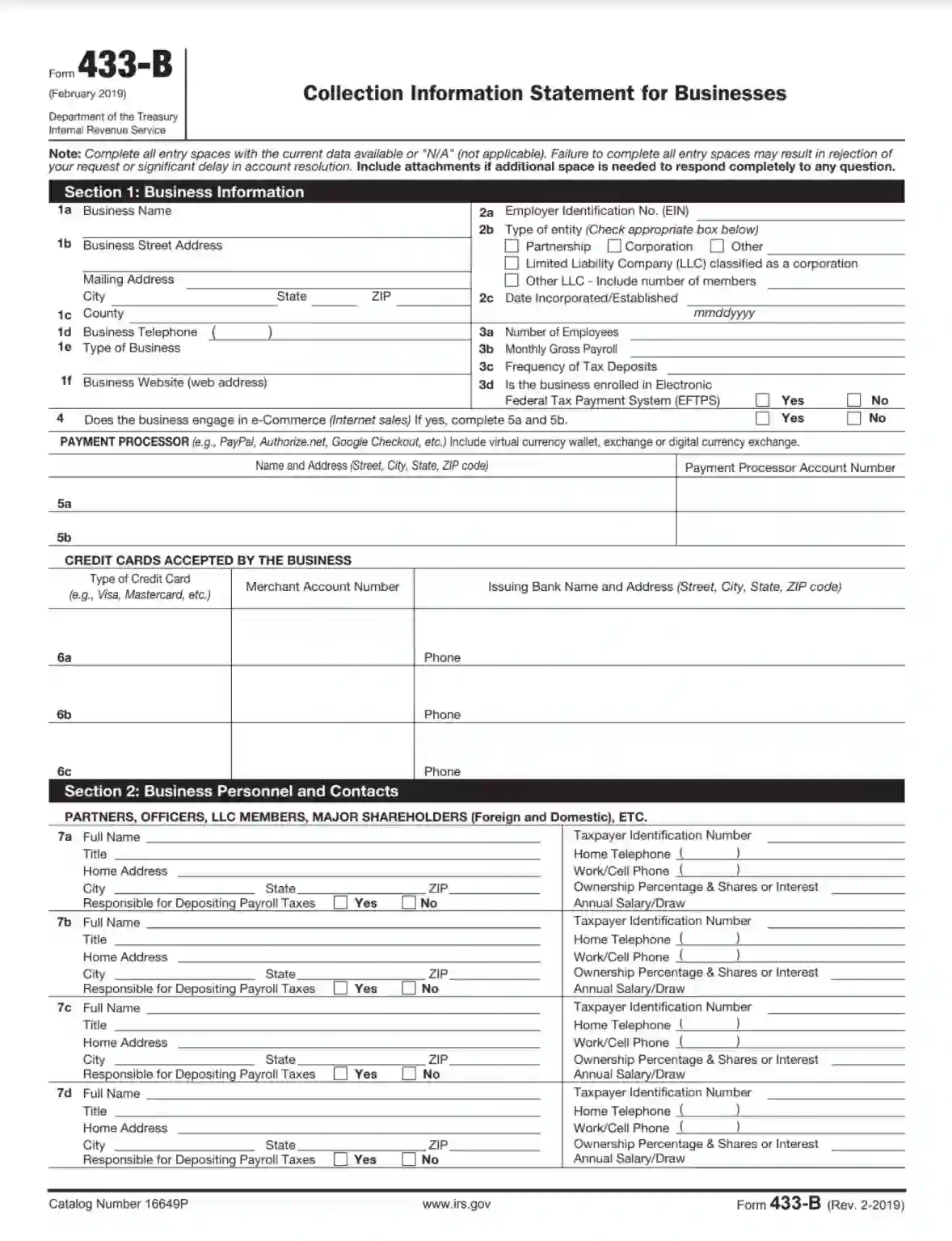

Provide Business Info

You must add your business’s details in the form’s first section. This includes the entity’s name, street and mailing address, phone number, business type, and website. Complete the required fields on the left and move to the right-hand side where you will insert more data.

On the right, enter your entity’s employer identification number (EIN) and choose the entity type from the listed options. Write the date when the entity was founded. Indicate the number of workers and gross salary per month (for everybody in total). Then, answer two questions regarding taxes.

If the entity takes part in e-commerce processes, you should state this fact by checking the “yes” box in line 4 and complete the chart below. In this chart, you will indicate your payment processors (their names, addresses, and account numbers).

If clients can pay using their credit cards to buy things from your entity, you should outline which cards you accept. For each, write its type, merchant account number, and name, phone, and address of the bank that issues those cards.

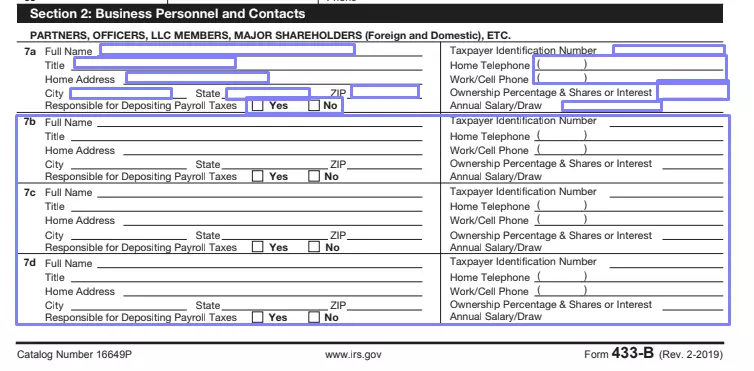

Introduce Your Personnel

You have to include data about specific personnel of your entity in the second section. Among these personnel are top managers, major shareowners, partners, and other similar categories.

For every person who you describe, enter their full name, title, and address. Answer if depositing payroll taxes is among their duties. Place their tax ID number, phone numbers (home and work or mobile) on the right along with their share in percent and salary per year.

Fill Out “Other Information” Section

Your following step will be to provide additional financial details about your business. You will see a set of questions where you should answer either “yes” or “no.” If responding affirmatively, you must add an explanation for each question.

Reply if the entity uses the reporting agent’s or payroll service provider’s services. If no, move to the next question. If yes, indicate their name, address, and the dates when services are effective.

Define if your entity takes part in any lawsuit. If yes, choose its side (either a defendant or a plaintiff), write the amount in US dollars, and provide other required details on the lawsuit (a subject of it, case number, location, and other items).

If your entity has ever filed bankruptcy, describe the circumstances in the next part (petition number, where you have filed, and all the needed dates).

If your business’s concerned parties (members, shareowners, workers) have uncovered debts, they should pay to the entity, indicate the name, address, date when the money was borrowed, present balance, sum to pay, and due date.

In case any of the entity’s assets were passed to someone else but for a smaller value than should be, list such assets and describe the conditions (the transfer date and the value, who received them).

Respond about businesses related to your entity below.

If you expect that your entity’s income will become bigger or smaller than before, share your concerns, including the expected sums.

Lastly, indicate if the entity is on the list of the Federal Government Contractors.

Reveal Details about the Entity’s Assets and Debts

The next part is for revealing information about the assets and debts that belong to the entity. Begin with cash: insert its amount (real cash, not the one in the bank); tell if there is a safe in any of the entity’s premises. If yes, explain what do you have inside that safe.

Below, describe all bank accounts that your business possesses. Add every single account, including mobile and online accounts. State their types, the bank’s or another financial institution’s name and address, account numbers, and current balances (here, write the date for each).

Then, indicate the total sum of cash you store in all financial institutions and accounts.

Describe all accounts receivable in the chart below. For everyone who owes you something, write the name of an entity and a person to contact, address, phone number, status, date when you expect to be paid, contract number (or invoice number, or any other proving document’s number), and the owed sum.

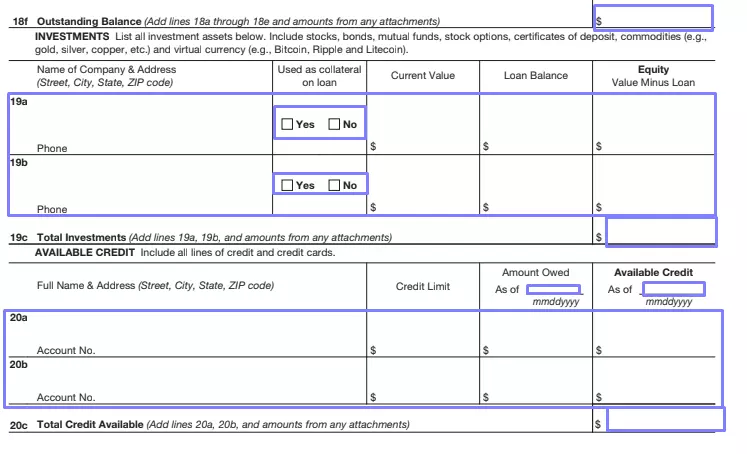

Give details about your outstanding balance, total investments, and available credits. Follow the chart’s requirements to provide data for each item.

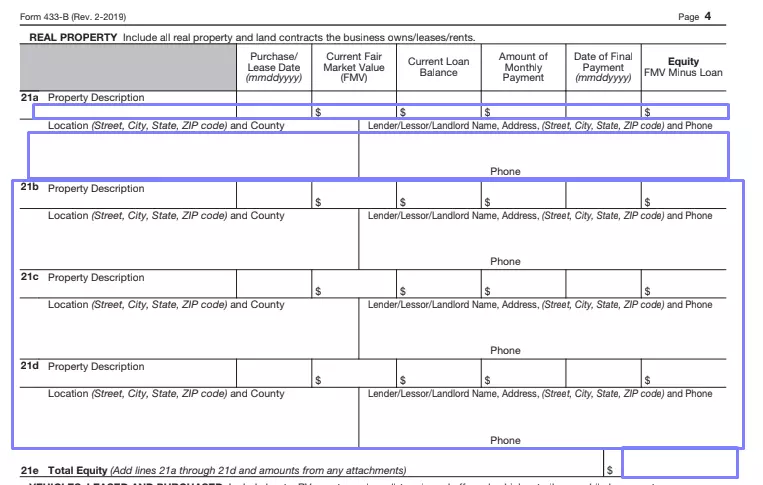

Tell about the real property your entity owns, leases, or rents. Add its description, location, current fair market value, how much you pay for it per month, and other demanded info. For each leased or rented, indicate the lessor’s name, phone, and address. Sum all amounts in US dollars and indicate total equity in the section’s last line.

After describing real estate, do the same for vehicles your entity uses (both bought and leased). Add financial details, lessor’s details (if applicable), the production year, make, and mode for every possessed or leased vehicle. Add total equity in the end.

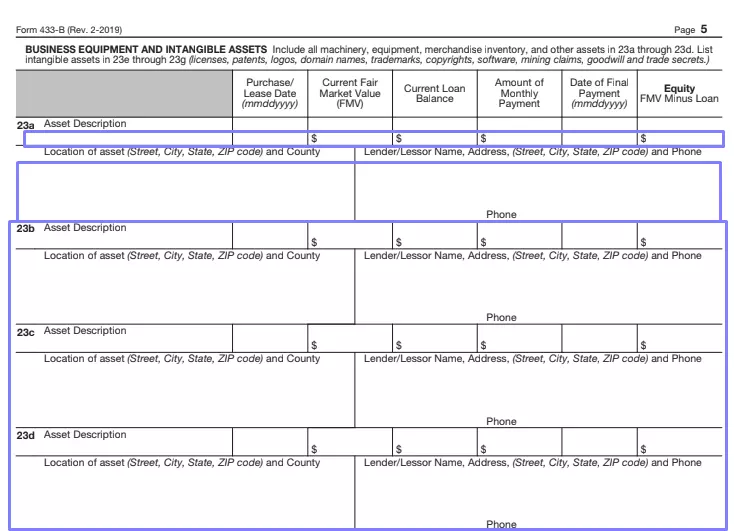

Move to the section where you will demonstrate equipment and intangible assets that your business owns and rents. Write all needed details (description, location, the date when it was leased or bought, current value, lender’s info, and so on). Remember to count total equity.

Finally, add info about your entity’s liabilities. Write about everything that has not been mentioned in the form before in accordance with the template’s demands.

Include the Monthly Income and Expenses Statement for Your Entity

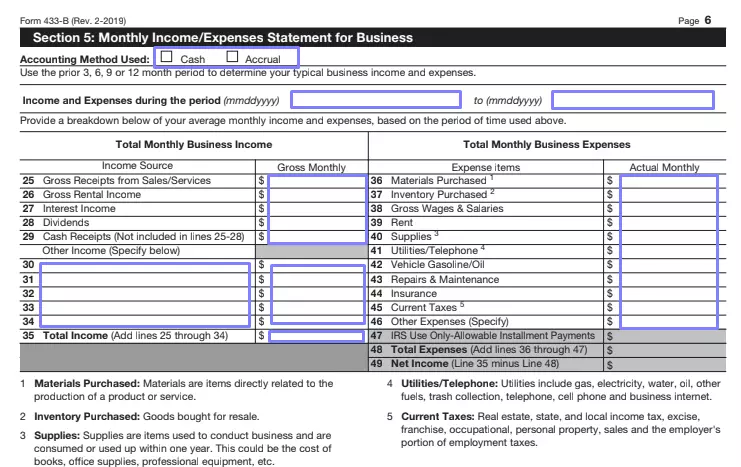

The last section requires you to add an income and expenses statement per month (averagely). Choose the used accounting method and period. List all numbers related to your entity’s income on the left and to its expenses on the right. You will have various lines serving as hints on what you should include (receipts, dividends, rent, insurance, supplies, and other points).

Sign the Document

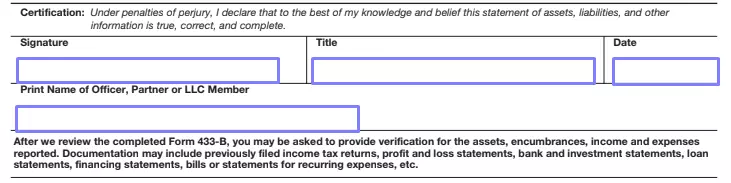

The last thing you should do is verify all data you added by signing the form. Besides signing, add the current date, your title, and full name.

After you have finished working on the form, you have to submit it to the Service the way it requires. There is no deadline for such documents; the Service considers each such case individually and stays in contact with a person or entity that has problems and debts, so you will receive all the needed notifications and submission information relevant for you.