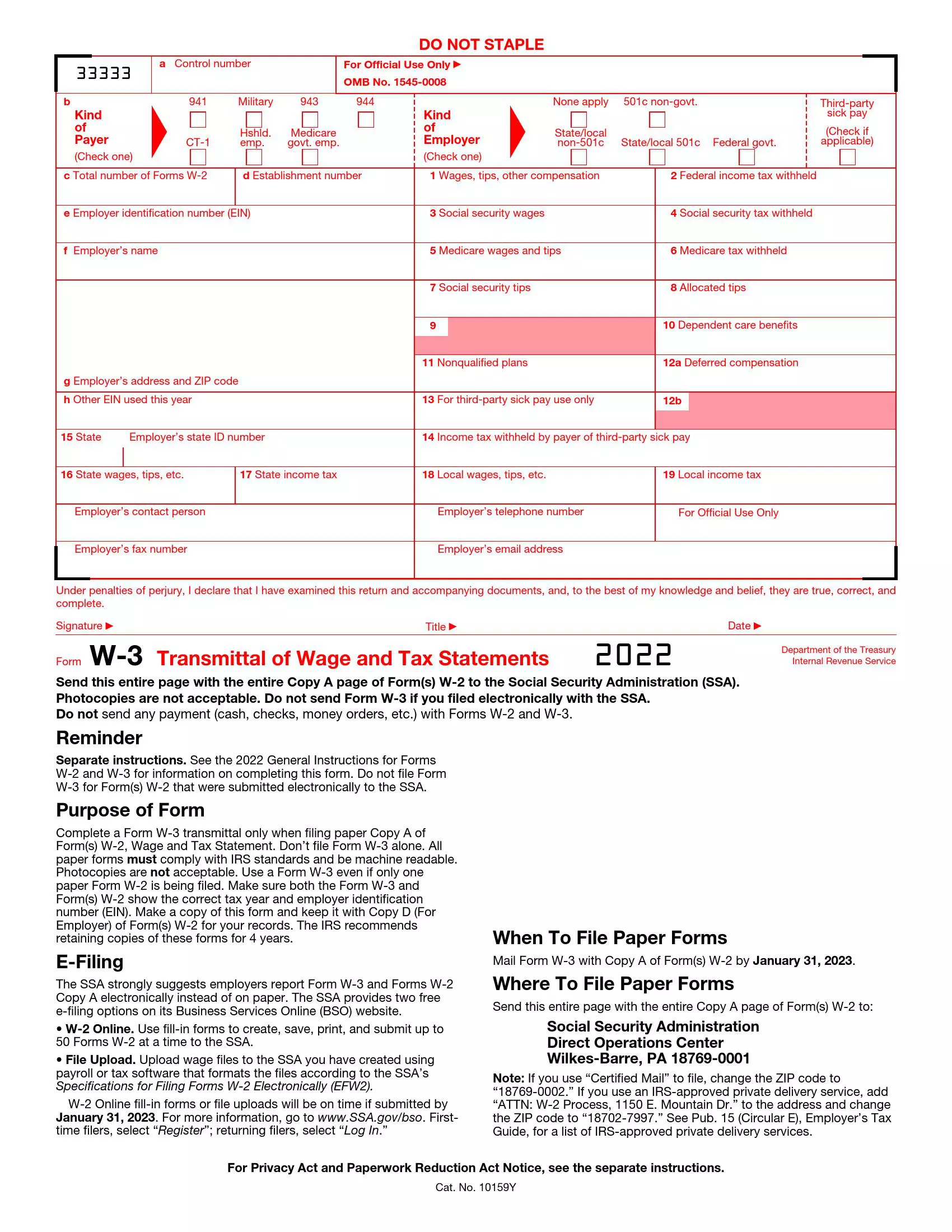

IRS Form W-3 is a transmittal form that reports employee wages and tax information to the Social Security Administration (SSA). Employers typically file it along with Form W-2, which reports wages, tips, and other compensation paid to employees during the tax year. Form W-3 summarizes the total wages, tips, and other compensation reported on all accompanying Form W-2 and provides essential information to the SSA for tax administration purposes. Information provided on the Form W-3 includes:

- The employer’s name, address, and Employer Identification Number (EIN),

- The total number of Forms W-2 being transmitted,

- The total wages, tips, and other compensation reported on all Forms W-2,

- The total amount of federal income tax withheld from employees’ wages.

By completing Form W-3, employers ensure that the SSA receives accurate and complete wage and tax information for their employees. This form helps facilitate the processing of individual tax returns and ensures that employees receive proper credit for the wages and taxes withheld from their paychecks.

Other IRS Forms for Self-employed

As an employer, you have to file plenty of financial information about your employees, including employee payments and withheld taxes. Learn more about other important IRS forms for businesses.

How to Fill Out Form W-3 Transmittal of Wage and Tax Statements

Filling out the form correctly will help you avoid inaccuracies in the reports and provide trustworthy information about workers’ income and taxes. We advise you to carefully read the guidelines for drafting W-3 forms to avoid mistakes.

You can fill out Form W-3 yourself or use our form-building software to get the best results and avoid potential mistakes. If any of the wording is not clear or makes you doubt, seek professional advice.

Below you will find a detailed step-by-step guide on how to draw up a W-3 form. Each step will be described and explained in detail.

1) Enter Control Number

Entering the control number is an optional step when filling out the form but can be subsequently used by the company.

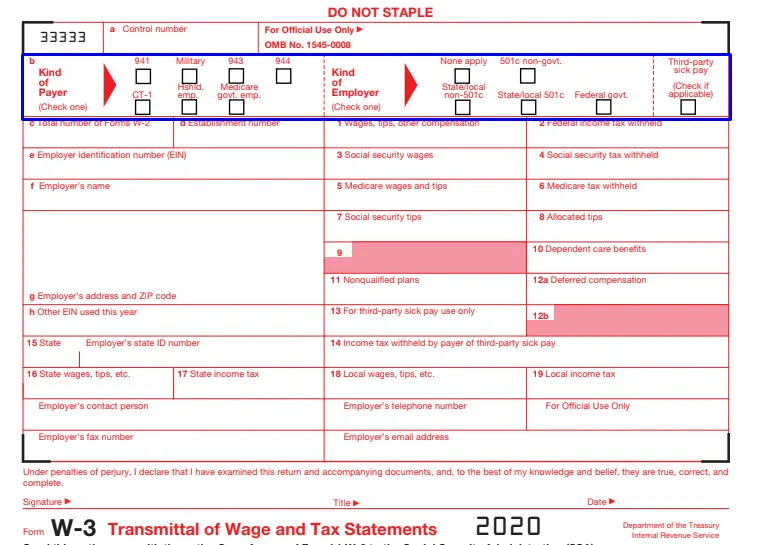

2) Kind of Employer and Kind of Payer

When choosing a kind of employer, the employer is most often labeled “non-applique.” There are also options for nonprofits and federal government employers. When choosing the kind of payer, they most often choose option 941. This is the quarterly reporting option that many companies use. In the column Kind of Payer, you can also select the option for home employers and others.

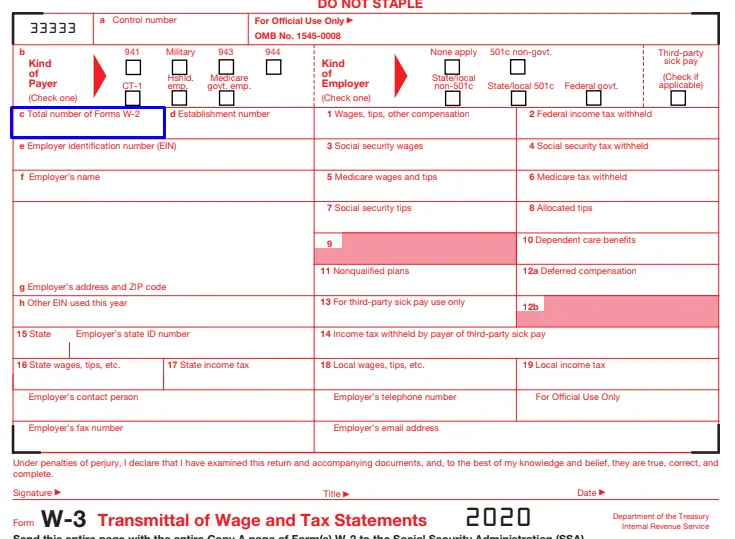

3) Specify the Number of Forms W-2

In this field, you need to enter the total number of W-2 forms

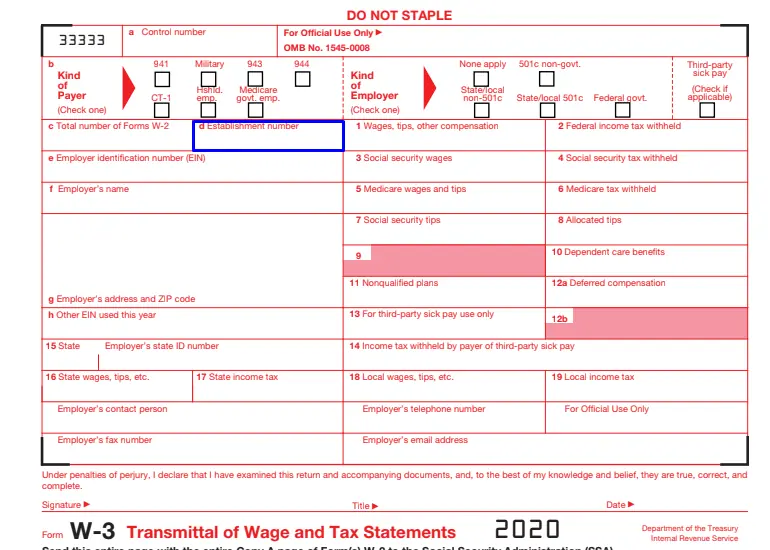

4) Enter the Company Number

Providing a business number helps employers determine which department of their company worker whose income tax is recorded on the formwork.

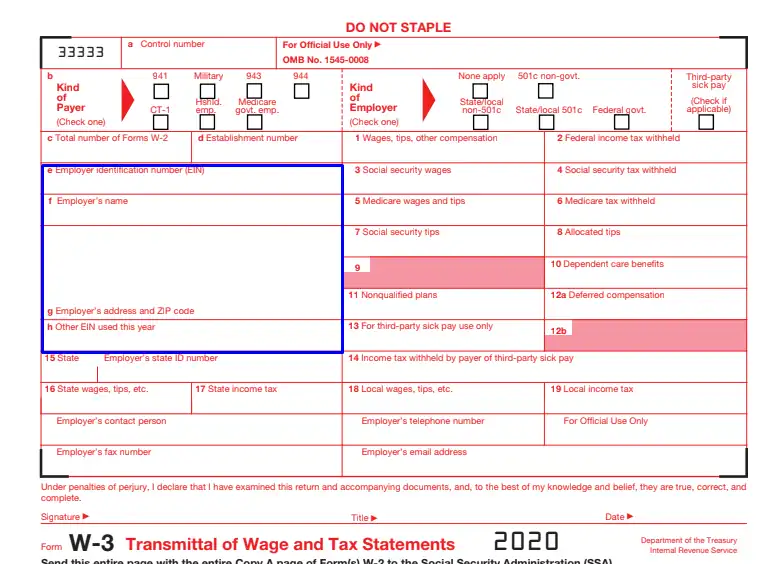

5) Fill in Employee Information

In sections E-H, you need to specify information about the worker. These fields must include the employee number, full legal name, residential address, and zip code. Also, at this step, you need to indicate if any other employee number was used for this year. If used, write it down.

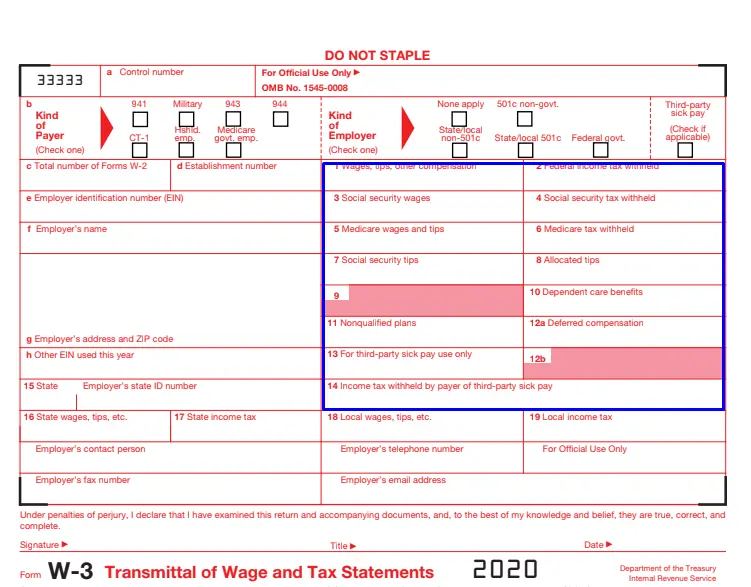

6) Complete Parts 1-14

In parts 1-14, you need to indicate the wages and taxes, tips, bonuses, and other payments for the worker on the report. The sum of salaries and payments of all forms of W-2 should be equal to the total amount specified in Form W-3. You need to file social security tax withheld, income tax withheld, and other withheld taxes in the same parts of the form.

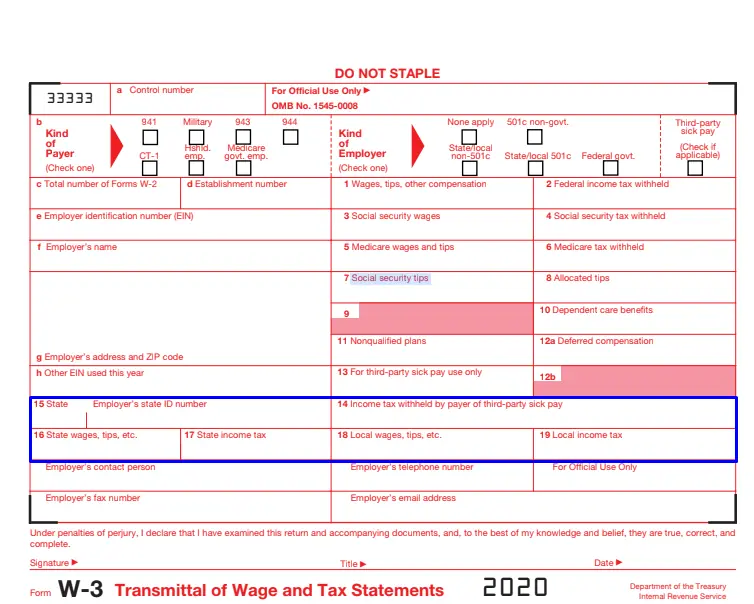

7) Complete Parts 15-19

In part 15, you need to indicate the state and state ID of the worker. In the next sections, you will need to fill in information about state earnings and handouts, as well as state income taxes. Next to it, you need to write down local earnings and rewards, as well as local taxes.

8) Enter Contact Info

You need to write the company’s contact information. First, specify your company’s main contact. After that, you need to enter the phone number. In the remaining two parts, write your fax number and contact email.

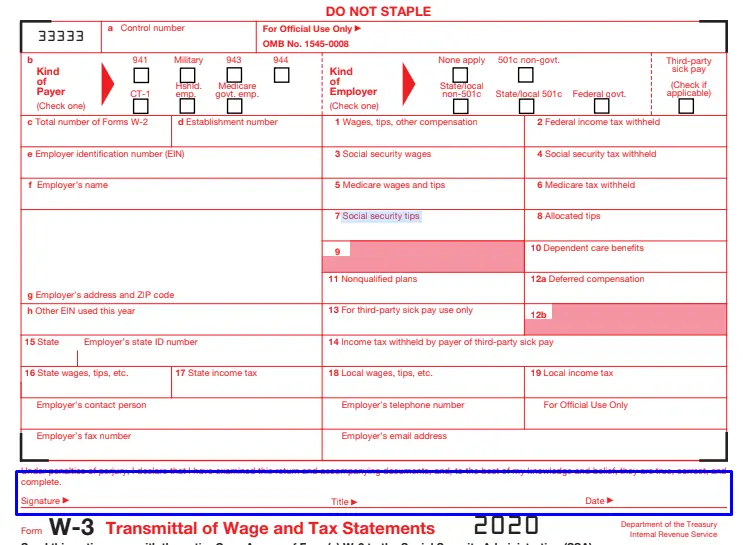

9) Sign and Send

The compiler of the form must sign his or her name, thereby confirming that they consider the information provided in the form to be genuine and true. After that, the contact person of the company must submit the title. The final step in filling out the form is to date the creation of the form. You need to specify the day, month, and year you create the document. Then collect all the forms (W-2 and W-3) and send them to the Social Security Administration.