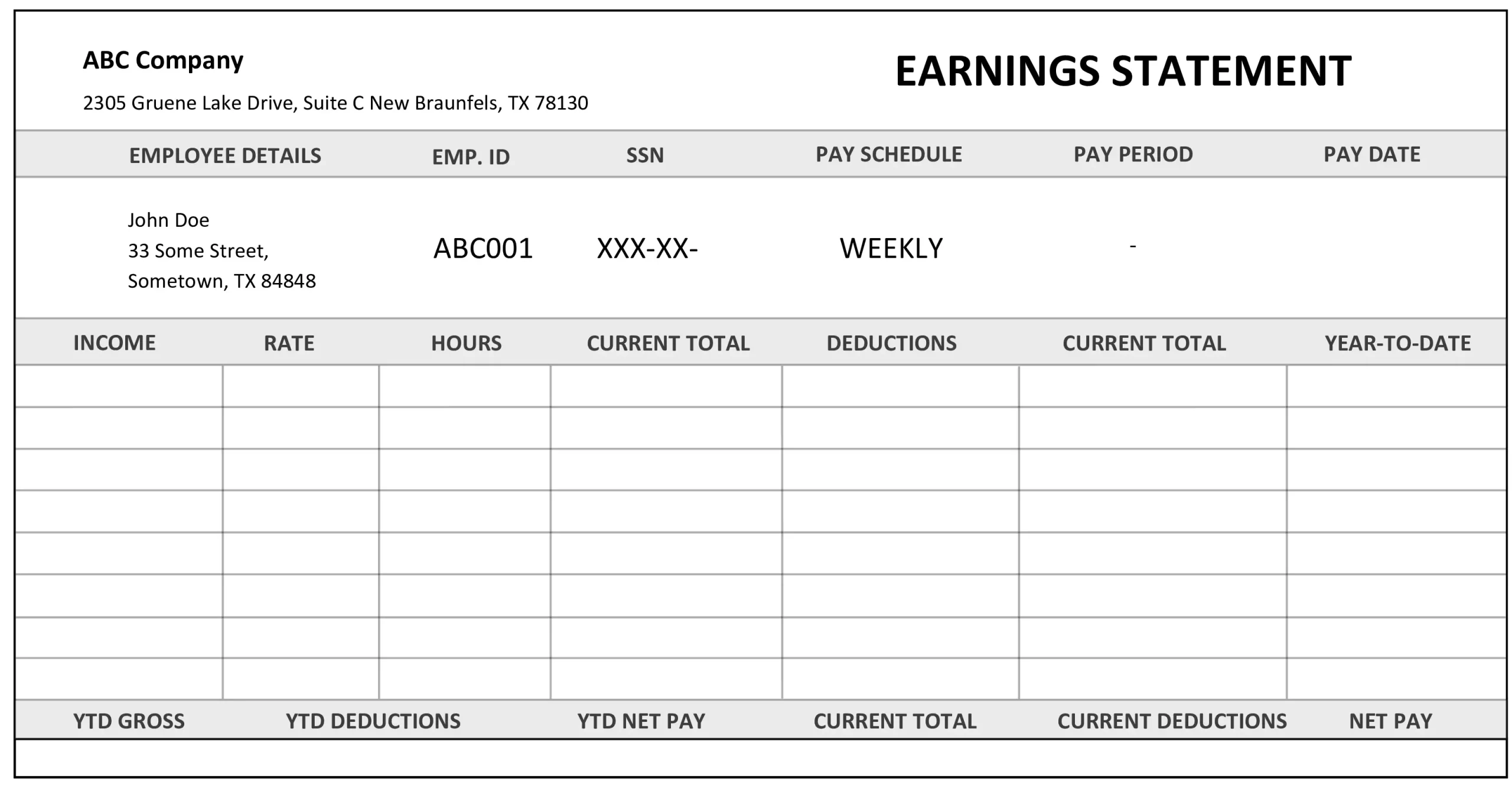

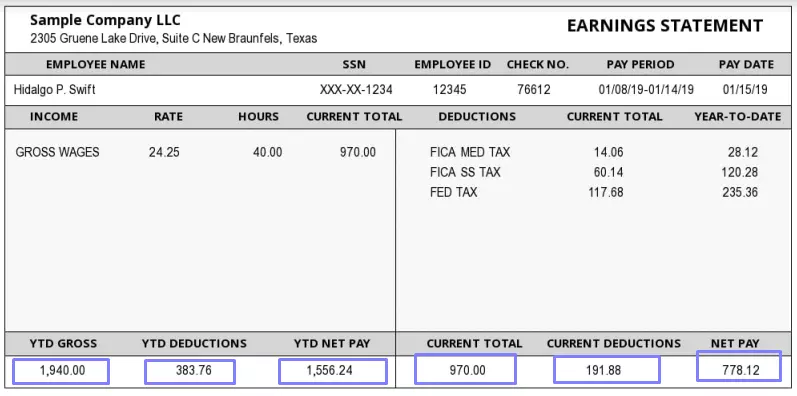

An Independent Contractor Pay Stub Template is a customizable document used by individuals or companies to provide a detailed payment summary to independent contractors. It records the financial transaction between the hiring entity and the contractor for a specific period or project. Elements included in an Independent Contractor Pay Stub Template are:

- Contractor information. Name, address, and tax identification number.

- Payment details. Work description, pay rate, and total hours or quantity of work completed.

- Adjustments. Any pre-agreed deductions or additions like equipment costs or bonuses.

- Net pay. The actual amount paid to the contractor after any adjustments.

Unlike traditional employee pay stubs, these templates are adapted to reflect the unique nature of contract work, where typical payroll taxes and benefits deductions are not applicable. This pay stub helps contractors maintain accurate financial records for tax and billing purposes and provides hiring entities with documents to support their accounting records.

Other Financial Forms

There are more fillable financial forms accessible here. Down below, we selected a number of the more popular PDFs included in this category. Moreover, keep in mind that you are able to upload, fill out, and edit any PDF document at FormsPal.

How to Fill out the Independent Contractor Pay Stub Template

Every time your work is done, and you receive a wage, you had better create a pay stub to reflect all the details about the money received. The template is relatively transparent, contains only one sheet, and probably will not take much of your time. You can see the guide about the form below.

Find the Relevant Template

It is a good idea to have a sample that you can use to make your own document or even a template you can fill out. Try our user-friendly form-building software that can generate the Independent Contractor Pay Stub Template, among other documents. You will have all the fields you should complete right in front of you.

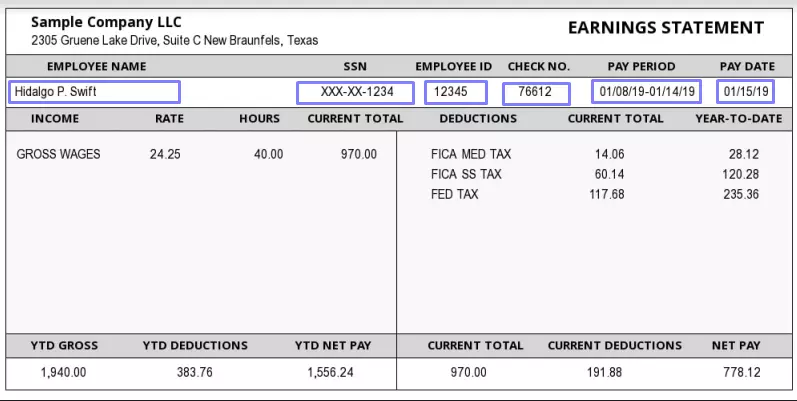

Identify the Client

In the very beginning, you should write the client’s name and address on the left, regardless of the client’s type (an individual or organization).

Enter Your Personal Details

You have to insert your name, social security number (SSN), employee ID (if any), the number of the paycheck you have received (if there was a paycheck), pay period, and pay date.

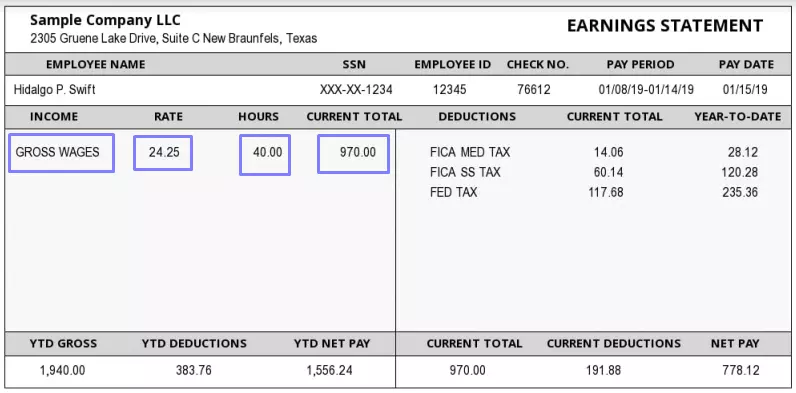

Define Your Wage

After inserting your details, proceed to the following block, where you will see a chart. In the left column, you should describe your gross wages. Typically for all pay stubs, it is possible to write your rate per hour and the number of working hours you have had. Then, you should multiply those numbers and get the “current total.” It is current because after this step is completed, you will define various deductions.

Sometimes you get a fixed wage that is not linked with the number of hours you have spent working. In this case, you can write the total wage without hours.

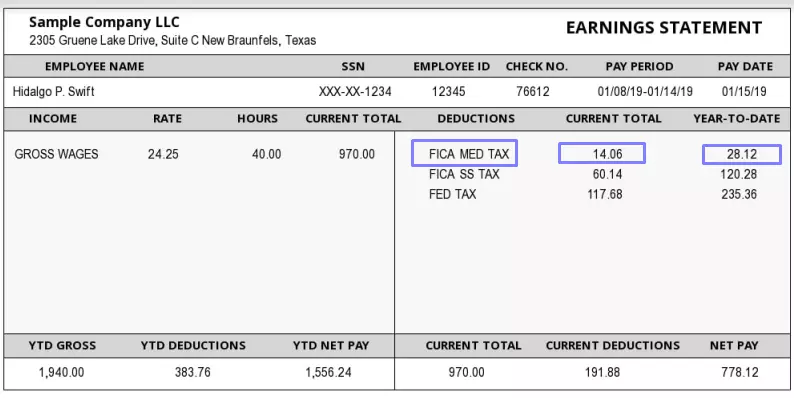

Describe the Deductions

A part of your wage will be cut because of taxes you have to pay. If you are a self-employed person for a while, you probably know how to count your deductions. If not, we recommend getting a consultation from a tax professional who will help understand the exact amount. You have to insert the current total and “year-to-date” total.

Determine the Net Amount You Get

Under the chart, you can see a line with six numbers where you will count the net sum you get from the client. On the left, write all “year-to-date” amounts: gross pay, deductions, and net sum. On the right, insert the same info but only for the considered period.

Because a pay stub is a document given to an employee, you have to store your pay stubs in your archives (because you, in a way, are an “employee,” too). There are at least two reasons to create and keep all such forms:

- You can apply for a mortgage or a credit easier than without pay stubs

Banks and financial institutions that give credit to citizens are always hesitant about people who have low income or have no income. Highly likely, individuals in such a situation will not get any tiny little credit, let alone a mortgage or any other significant amount of money. If you have a set of pay stubs demonstrating stable revenues and regular money transfers, your request for a loan will probably be approved.

- You have the written evidence of your earnings

If your client tries to cheat with their own taxes or has any problem with its accounting, you, as a contractor, will not face any consequences because you have a pay stub. You can show it as proof of money given to you from a certain entity or person if needed.