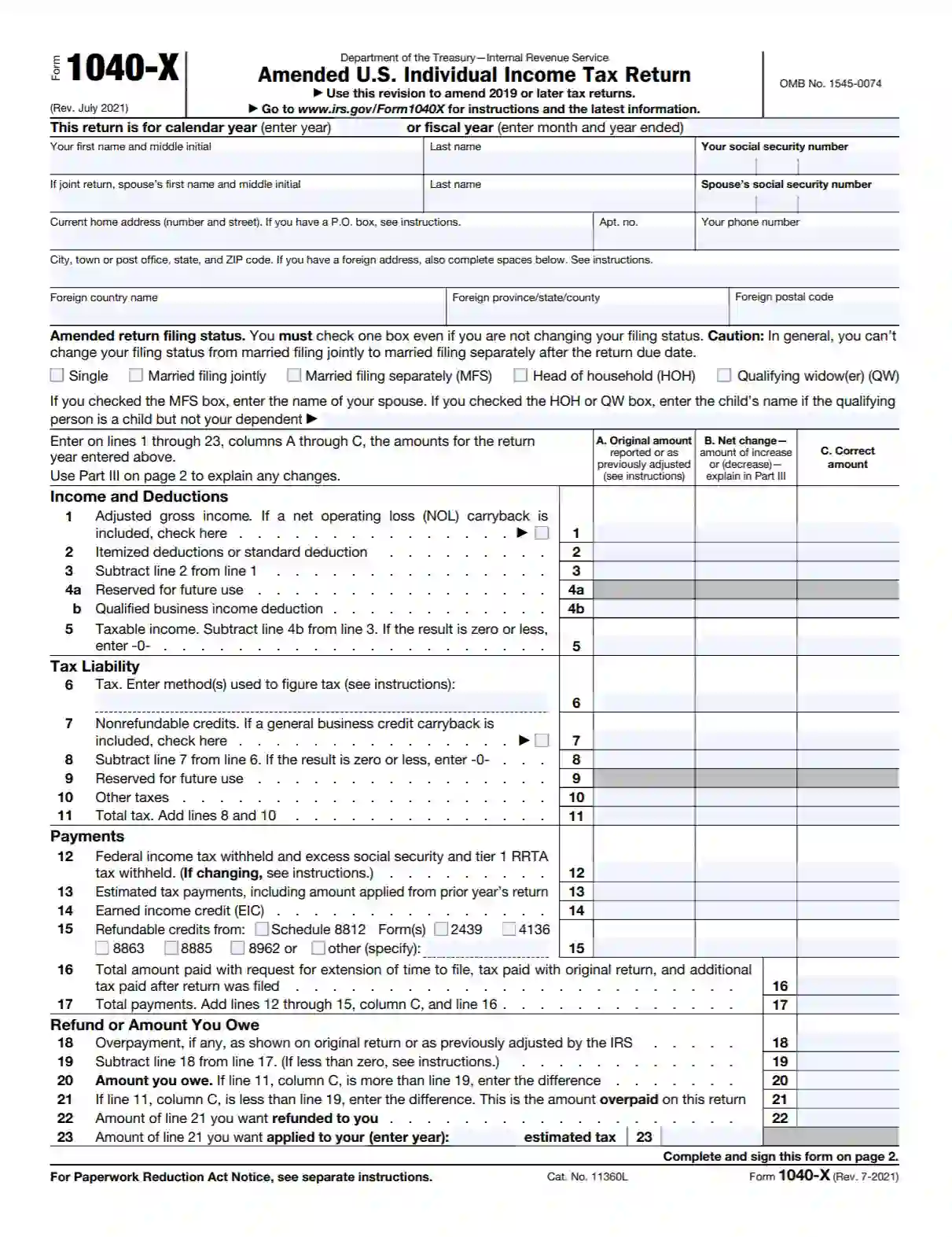

Form 1040-X, titled “Amended U.S. Individual Income Tax Return,” is a tax form individuals use to correct previously filed Form 1040, 1040-A, 1040-SR, or 1040-EZ. This form allows taxpayers to adjust income, deductions, and credits after filing the original tax return. It is necessary when taxpayers must correct errors or have overlooked deductions or credits in their initial submission. The form includes sections explaining the changes made, which helps the IRS understand the reasons for the amendments.

The primary purpose of Form 1040-X is to ensure taxpayers can correct discrepancies in their tax records, ensuring compliance with tax laws and accuracy in tax liability or refund calculations. This form is crucial for maintaining accurate and up-to-date tax information with the IRS, allowing for adjustments to previously reported income that could affect tax calculations and payments. It also provides a way for taxpayers to claim refunds they are entitled to, which were not claimed on the original tax return. Using this form, taxpayers can manage their tax responsibilities responsibly by rectifying errors or missed opportunities efficiently

Other IRS Forms for Individuals

In our database, we have hundreds of IRS forms for different types of taxpayers and life events. Check what other forms you might need.

How Should I Fill the Document Out?

You may choose to complete Form 1040-X in writing or type it out with a multifunctional automatic system. Use our form-building software to access a personalized template.

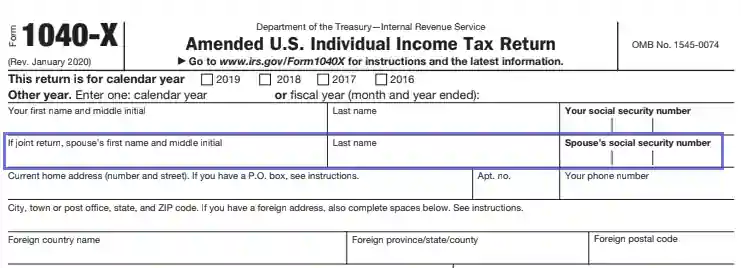

Specify the Year

The form begins by indicating the tax period. It is highly advisable that you look into the information about each tax year (especially 2017-2019) because, depending on the period, you will complete or leave certain fields in this paper blank.

Input the Name and SSN

Provide your last name, first name, and middle initial. Then, insert the nine-digit SSN.

Fill In Your Spouse’s Data

In case you are changing a separate tax report into a joint return (JR), write down your husband or wife’s complete name and SSN.

If you are modifying a JR, insert your name second if it has been entered second in the original paper.

Provide Your Current Address

This field is completed if your residential address does not match with the one you have input in an original return (OR).

Indicate Foreign Address

If applicable, type the foreign country name, the region, and the postal code.

Select the Filing Status

Even if your status has not changed since you created an OR, you must check one box herein.

Request a Full-Year Health Coverage

Leave this field blank if you are completing the document for 2019 or subsequent years.

Indicate Your Income and Deductions

Leave this section blank unless you wish to establish that something has changed. Remember that column A has to contain the original amount reported. Column B is dedicated to certain corrections you are willing to make. Column C shows the calculations you have made with the previously mentioned numbers. The lines in this part contain info about:

- Adjusted gross income;

- Itemized deduction or standard deduction;

- Exemptions (amended for years before 2018 only);

- The qualified business income deduction (before 2018 only);

- Taxable income.

Complete Tax Liability

Fill out the lines in this section applying the same methods you used to while completing an OR.

Enter the Payments

Provide all necessary information and compute the total payments on line 17.

Input Data About the Overpayment or Amount You Owe

This section is completed to figure out the tax amount you must pay or the extra monetary funds you have delivered to the IRS. If you find yourself in a situation where you cannot transmit the requested sum, contact the IRS staff to work out a special plan.

Change the Exemptions and Dependents Info

Complete the fillable lines if applicable. Make sure to list all dependents, notwithstanding whether you have already claimed them in your OR or are adding new ones.

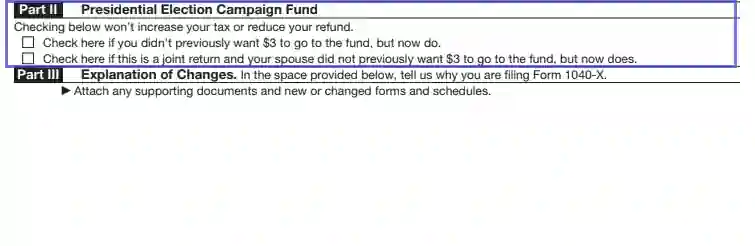

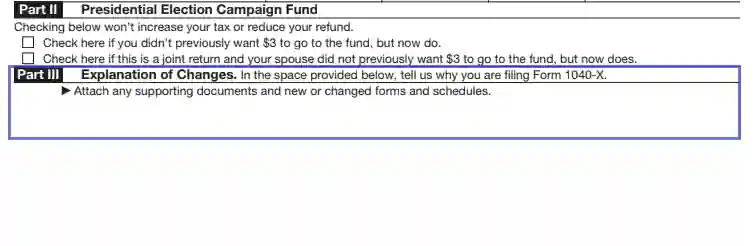

Donate to the Presidential Election Campaign Fund

This part is additional and does not affect the way your report will be processed or the sum of money you will receive (or provide for the IRS). If you chose not to support the fund in your previous return, you might voluntarily donate $3.

Declare the Purpose of Completing This Form

The paper will not be processed unless you state a clear reason why you are making amendments. Indicate it herein and attach relatable documentation.

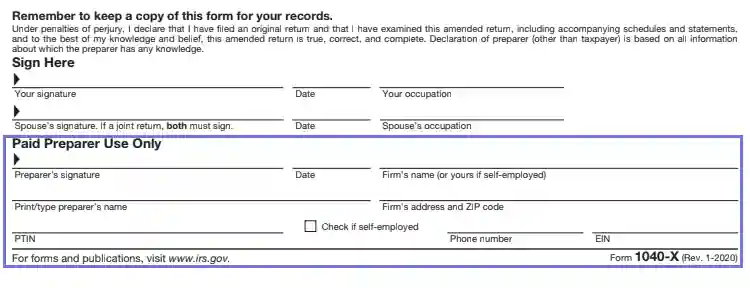

Append Your Signature

Sign the form, date it, and provide information about your occupation. If you are filing a JR, your husband or wife should complete these lines as well.

Complete Paid Preparer’s Info

Completing tax-related documentation is never simple, and, logically, a lot of US citizens opt for seeking professional assistance. If you have chosen to hire a specialist who will fill the form out for you, they must print their name, sign, date the paper, provide details about the company they work for, and enter their PTIN. If a preparer is self-employed, check the corresponding box, and input their EIN, along with the phone number. If you are not paying this specialist, they should not append the signature.