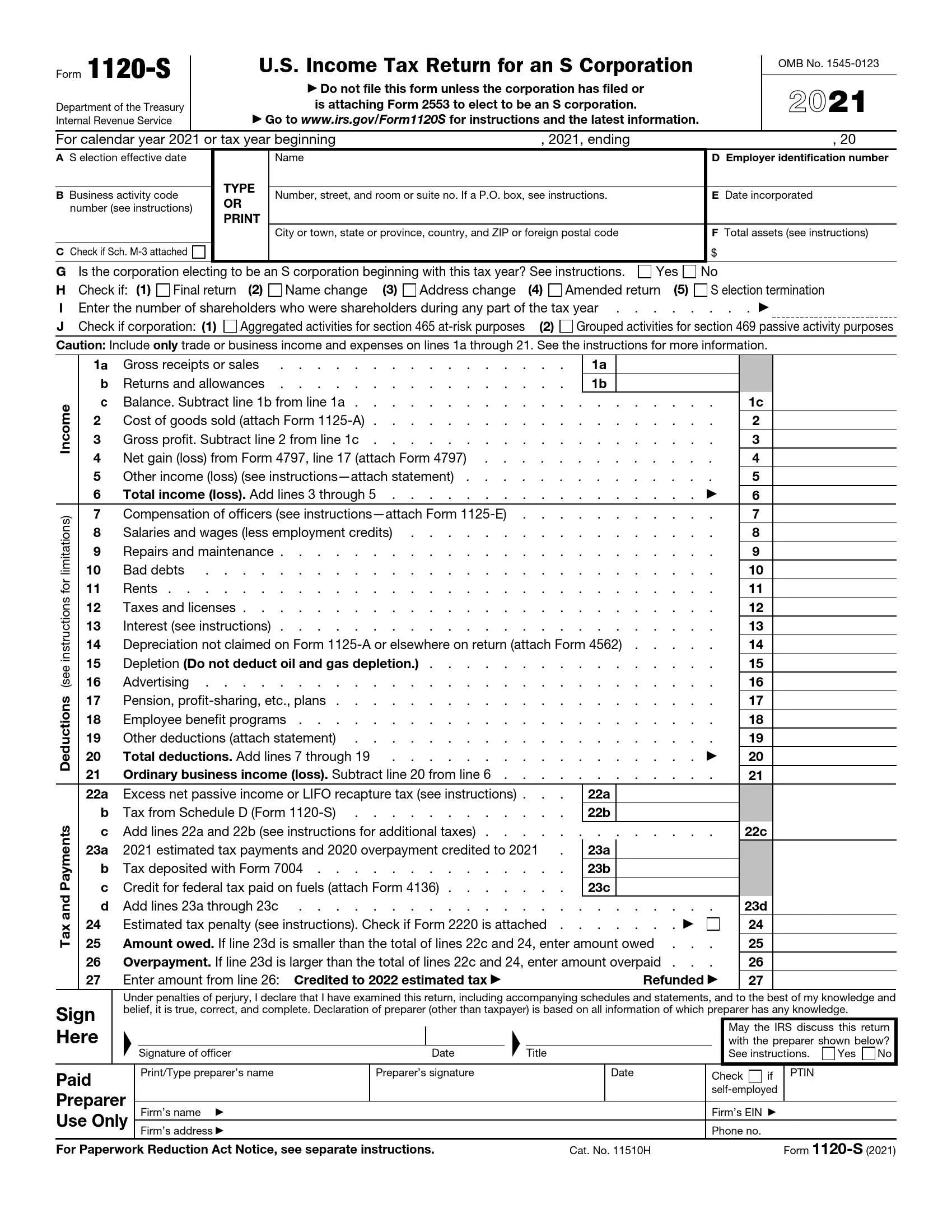

Form 1120-S is a tax document S corporations use to report their income, losses, deductions, and credits to the Internal Revenue Service (IRS). This form serves as the S corporation’s annual tax return and is crucial for the IRS to ensure that the income passed through to shareholders is reported correctly. It details the corporation’s financial activities throughout the year, including total income, taxable income, and profits distributed to shareholders, which are taxed at their individual tax rates.

This form is essential for S corporations because it aligns with the pass-through taxation structure, where the corporation pays no federal income tax. Instead, the corporation’s income or losses are passed through to its shareholders and taxed at individual rates. By using Form 1120-S, S corporations ensure compliance with IRS rules and provide clear, transparent financial information to shareholders for their personal tax filings

Other IRS Forms for Corporations

There are some other forms corporations should use to report financial information to the IRS. You can learn more about them on our pages with other IRS forms.

How to Create the Form

Typically, documents that refer to taxes seem complicated for the majority of citizens. We hope that you consider our instructions clear and helpful, even though such records (that are submitted on behalf of various organizations) are usually created by accountants you hire for your business.

If your business currently cannot afford such a professional or you do not hire them for other reasons, use our guidelines on the template completion below. However, in case you have any doubts, even one tiny doubt, we still recommend asking tax specialists for help or hiring one just for this task because of the document’s complex structure.

You must prepare several documents your company has already issued to file this form. These documents reflect the company’s results: for instance, income statements, balance sheets, and so on. You will also need the shareholders’ names, a list of business transactions, and other details.

Prior to starting the completion process, you have to find the current template IRS will accept. You can make use of our straightforward form-building software designed specifically for people who seek various legal templates. Another option is to visit the official IRS website and try getting the form there; however, since you are here, there is no need to switch between tabs, and you can generate your own template.

After you have downloaded the file we have offered, you can start filling the IRS Form 1120-S out. Remember that if any form element mentioned below is unclear or you need more details about some points, you can always consult the Service’s official website along with tax professionals.

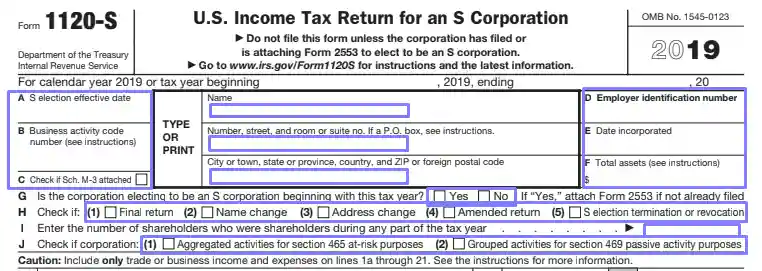

- Insert the Period

Initially, you must insert the period of the entity’s activity covered by this template.

- Describe the Entity

Then, introduce the entity by inserting its name, address, business code, EIN (or employer identification number), foundation date, and total assets expressed in US dollars. Then, answer the listed questions and mark suitable options that relate to your entity.

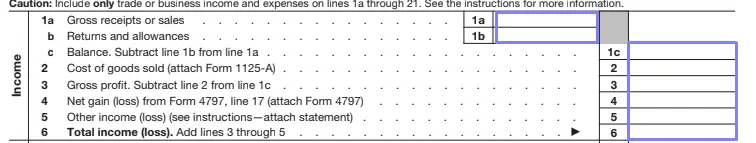

- Proceed to the Income Description

The first massive part to complete is linked to your business’s income in a certain period. In the designated lines, insert the gross receipts or sales, net gain or loss, and other required details.

- Enter Deductions

Each business has its costs and expenses: from workers’ salaries to advertising. You will have 15 lines with different cost types to fill out, including the above-mentioned salaries and advertising, rent, repairs, beneficial programs for workers, and other costs. Get the numbers from previously made documents and insert them in relevant lines.

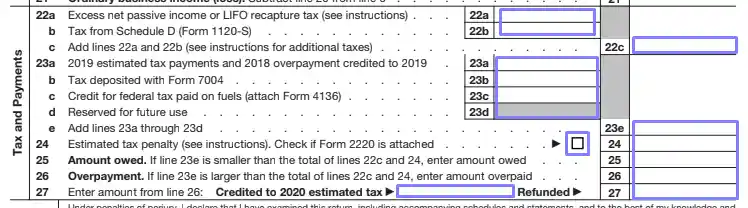

- Proceed to the “Tax and Payments” Section

Here, you have to add some taxes and payments you have already made or plan to make, estimated tax payments for the year, and other information. Some data you enter here comes from other forms you have created before (4136, 2220, and other templates). Use them to provide correct details.

- Sign the Main Page

It is the end of the form’s first page. If you create this record on your own, sign the form, add your title in the entity and the date when you sign this paper. If your form is completed by a specialist who gets paid for it, they must sign the form, write their name and the name of the company they work for (if applicable), its address, EIN, and phone number. If they are self-employed, they should mark the relevant box.

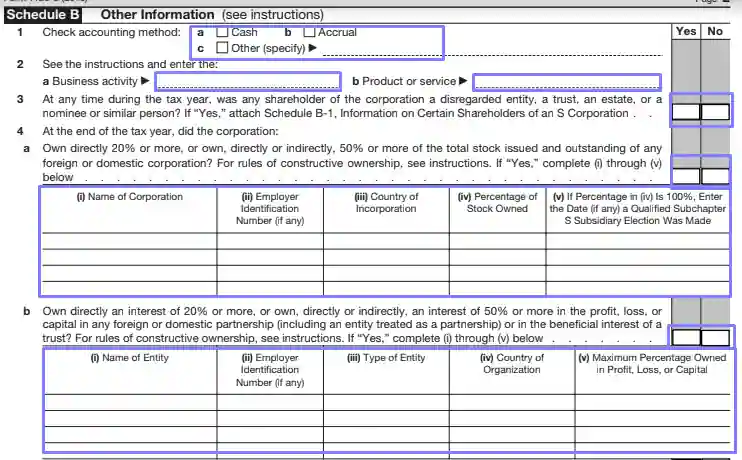

- Complete the Form’s “Schedule B”

The form has several Schedules that also must be filled out. You can add the details applicable to your entity: not all blank fields may be relevant for your business.

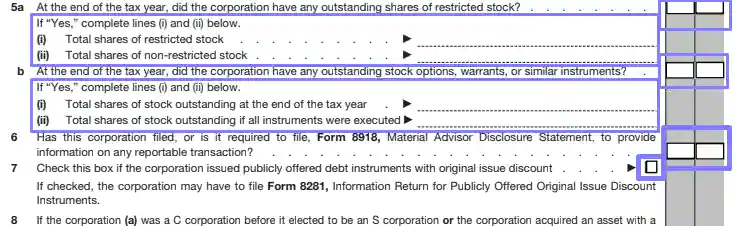

Choose the accounting method your entity uses, insert the business activity and product or service (as defined by the Business Code). Then, answer all the listed questions about the entity’s ownership, shares, stock options, warrants, and publicly offered debt instruments. Reply if the corporation has filed or will file Form 8918.

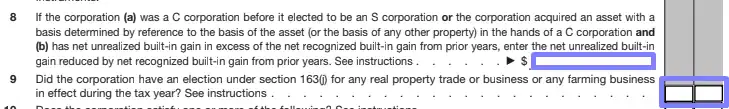

The two following questions require an answer if your S Corporation ever used to be a C corporation and if the entity has net unrealized built-in gain in US dollars that exceeds previous years’ similar rates. If both answers are positive, write the gain’s sum. Then, respond if the company had the election mentioned in the US Code, section 163(j).

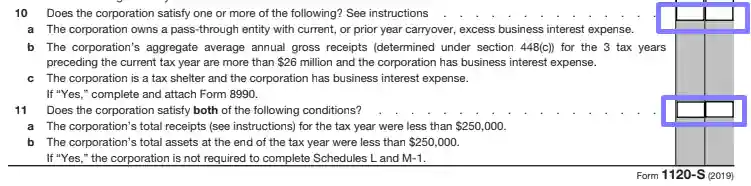

The two following questions will reveal if you need to attach additional forms: 8990 and Schedules M-1 or L. Read the statements and choose that applicable one for your entity. In Question 10 of the form, if none of the statements apply, you will not have to provide Form 8990; if at least one answer applies, the document is required.

In Question 11, if you choose both conditions (and they describe your company), you will be free from the completion and attachment of Schedules M-1 and L of this form.

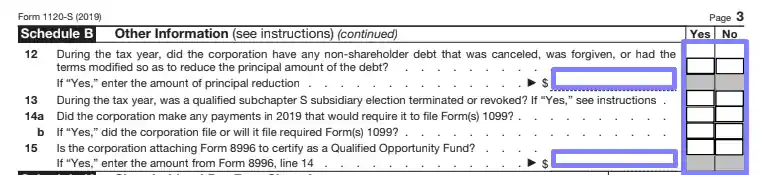

In the next question, you will have to determine if there ever was indebtedness canceled, forgiven, or modified non-shareholder. If the principal sum of such debt was decreased, you must enter the reduced amount.

Then, answer about subsidiaries’ election, payments regulated by Form 1099, and your plans to submit this record. If you also plan to attach Form 8996, enter the sum you have previously stated in that document.

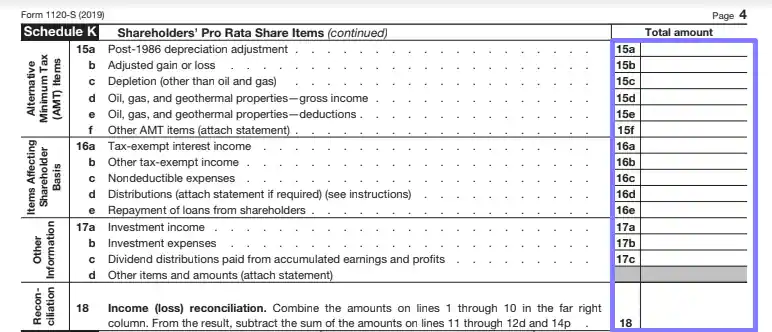

- Scroll to Schedule K

Here, you will need to add the shareholders’ proportionally shared items: income, deductions, foreign transactions, credits, and other items. Each line denotes what numbers you need to insert.

- Fill Out Schedules L and M-1 (If Needed) and Schedule M-2

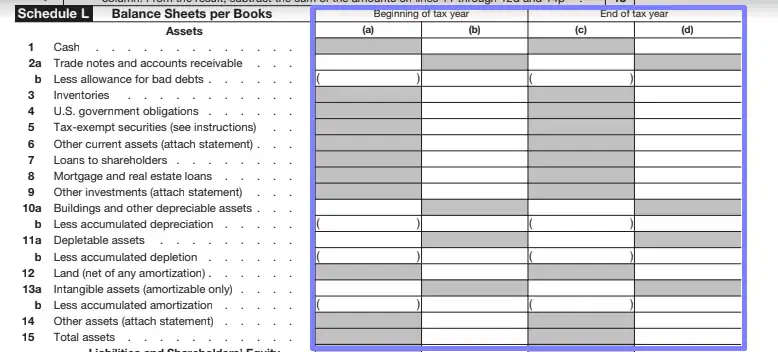

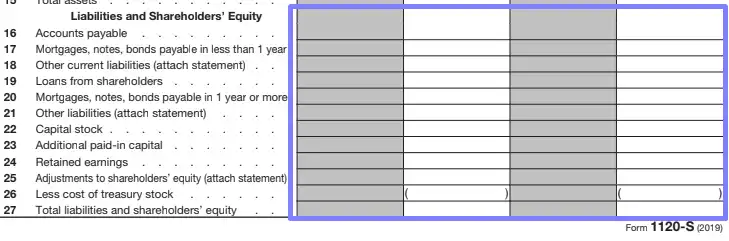

If your company conforms to both Question 11 (Schedule B) statements, you do not have to complete these attachments. If not, start with Schedule L, where you must fill out the chart to demonstrate your entity’s balance sheets per accountants’ books. You have to start with assets and then proceed to all the liabilities and equity of shareowners.

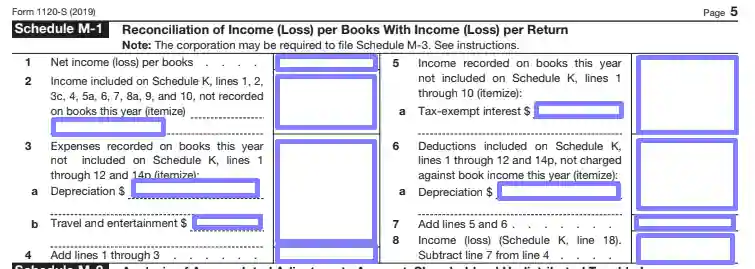

By Schedule M-1, you will reconcile your business’ income (or loss) per accountants’ books with the same rate per return. You have to fill out the chart with various sums (some of them are already included in Schedule K). Please note that signatories must complete Schedule M-3 instead if their entities’ assets exceed 10,000,000 US dollars at the end of the considered period.

Schedule M-2 is dedicated to the accumulated adjustments account used by S-corporations, your entity’s accumulated profit, shareholders’ undistributed taxable income that was taxed before, and other adjustments account. For all these items, you have to fill out specific rates (balance at the start of your tax year, additions, reductions, distributions, and other items). Some of these rates should be taken from previous Schedules and the form itself (the template will indicate which rates).

As you can see, the form’s content and structure are rather difficult. We still suggest you hire a specialist who will create this record for you. This measure will save you time and effort.

Whether you decide to create the form on your own or with professional help, you will have to send it to the public authorities once it is ready. Below, you will find out some details about the filing procedure.

How to Submit the Form

You should submit the form to the IRS, and you can send it either by regular mail or digitally. Moreover, in some cases, you should file the document online: it depends on the assets your entity has. If they are worth 10,000,000 US dollars or more, you must use the “e-file” system designed by IRS to deliver your record. There is a way to waive digital submission: consult the Service’s closest office to find out the details.

If you file your papers by mail, the Service’s website will help you with the list of offices where you should send the documents (the address depends on the state where you file).

Besides the form itself, you are also required to submit all other relevant forms you had filled out before and used to provide the info to an existing template. Do not forget to gather them all and attach them to the form you plan to file.

Deadline to File

The deadline for such documents’ filing depends on the considered period. If you take a calendar year into account, you should send the form no later than March 15 (regardless of the year). If you follow your own tax year, the last day is the 15 of your year’s third month.