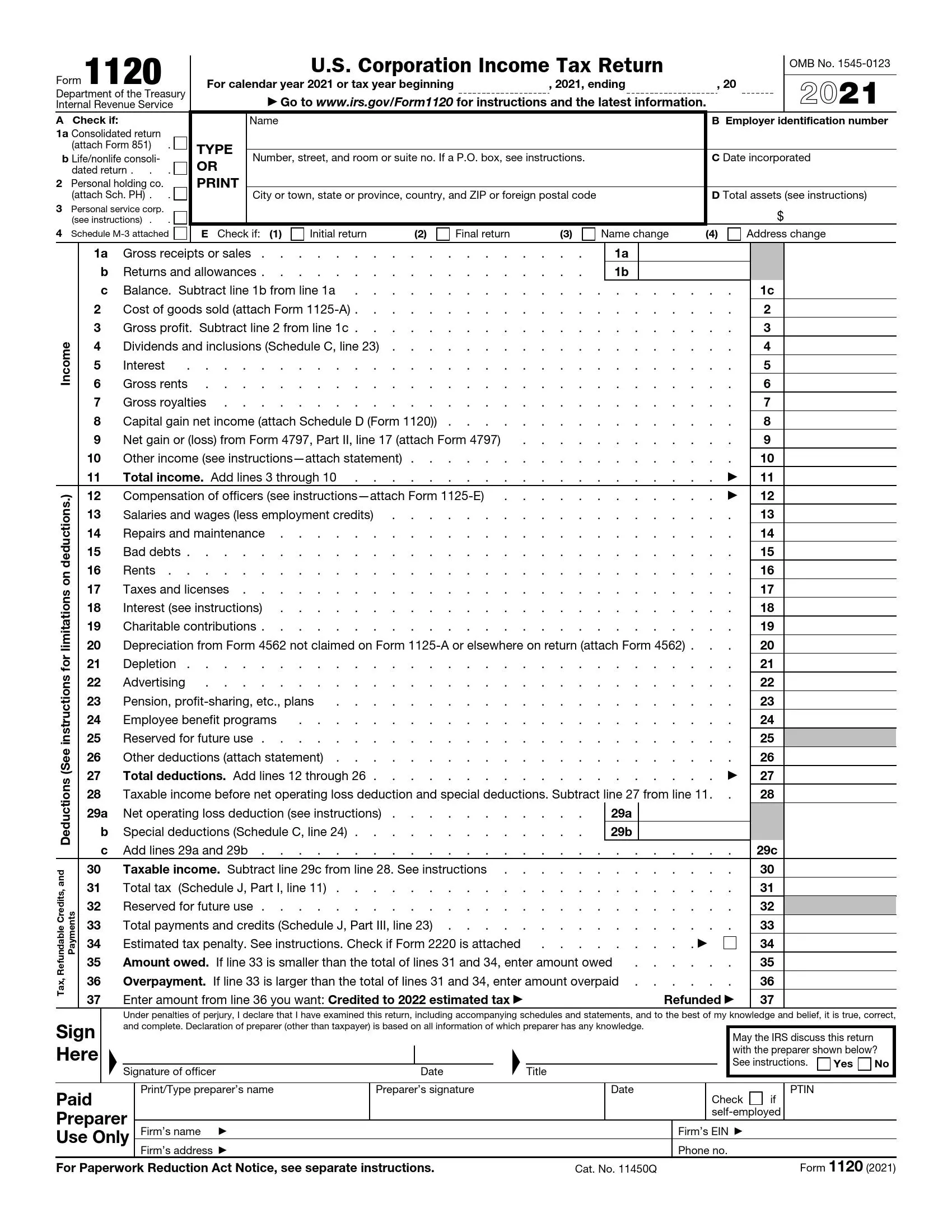

Form 1120 is a tax document corporations use to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). The form is essential for the IRS to assess a corporation’s tax liability under the applicable tax laws. It provides a comprehensive overview of the corporation’s financial activities throughout the tax year, including gross and taxable income, ensuring that corporations pay the correct amount of income tax.

This form is crucial for maintaining the transparency and accountability of corporate financial activities. It allows corporations to detail their operating profits, net losses, and other financial parameters critical for accurate tax assessment. By filing Form 1120, corporations fulfill their legal obligations and contribute to their standing as compliant entities. This form also helps stakeholders understand the corporation’s financial health, affecting decisions on investment and business strategy.

Other IRS Forms for Corporations

Requirements of the Internal Revenue Service for different types of businesses vary. Find out more IRS forms devised specifically for corporations.

How to Fill Out the 1120 Form

You can get the form template from the official IRS website: they do provide interactive forms now. The 1120 Form can be filed electronically; we encourage you to use our latest software tools and developments to create, customize, and fill out the form online. You may then submit it to the address indicated in the form not later than the 15th day of the 3rd month after your corporation’s taxation accounting year is over. But ensure that you check the renewed location data.

You can always use legal or tax adviser assistance to help you manage your income taxes and tax returns. But in the meantime, you can also use our detailed guidelines and recommendations below to fill out the form without professional help.

We would also advise you to read the continued instructions that the IRS has issued with the new version of the form to get familiar with the novelties, terms, and definitions. It is a 30-page document containing exhaustive info on all the form’s contents.

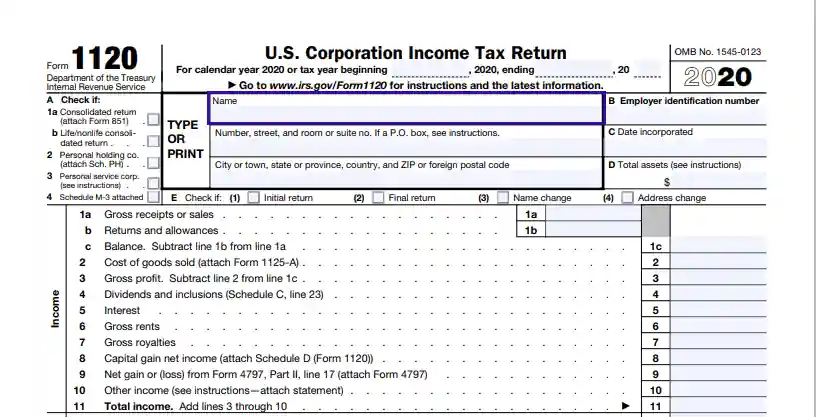

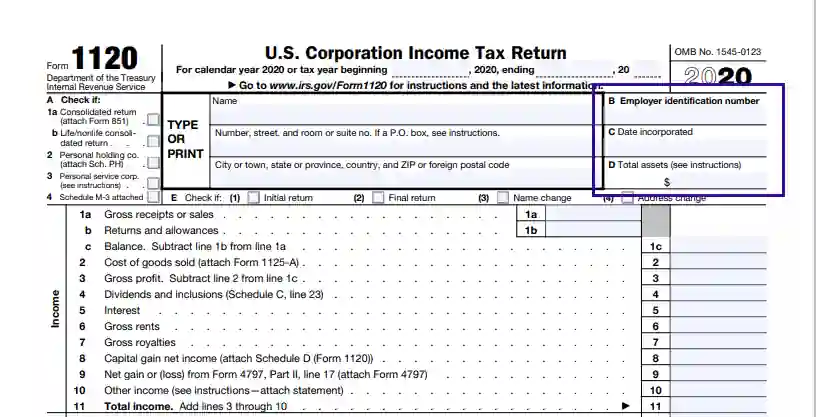

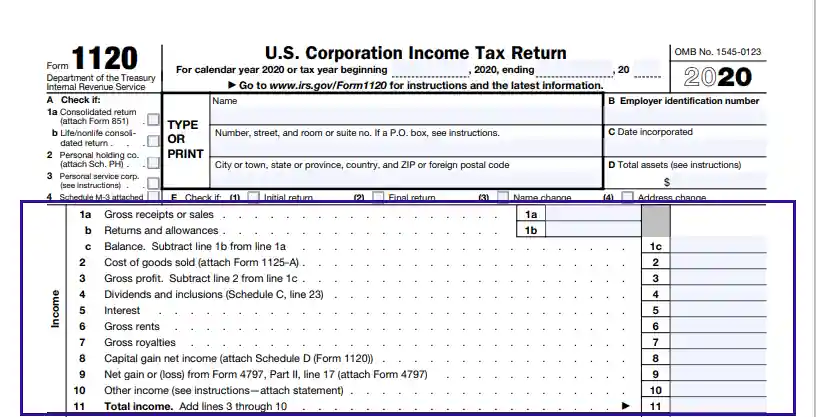

- Insert the Company’s Name

At the very top of the Form, insert the company’s legal and registered name.

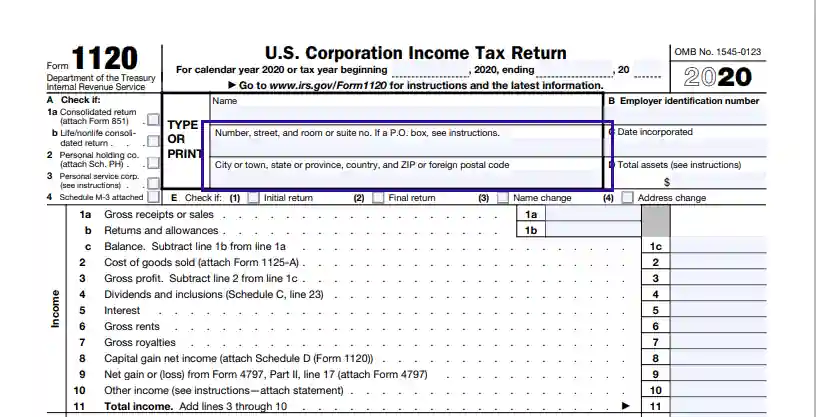

- Provide the Company’s Legal Address

In the next section, you shall put the company’s address, including street, building, room or suite number, city/town, state, and ZIP code.

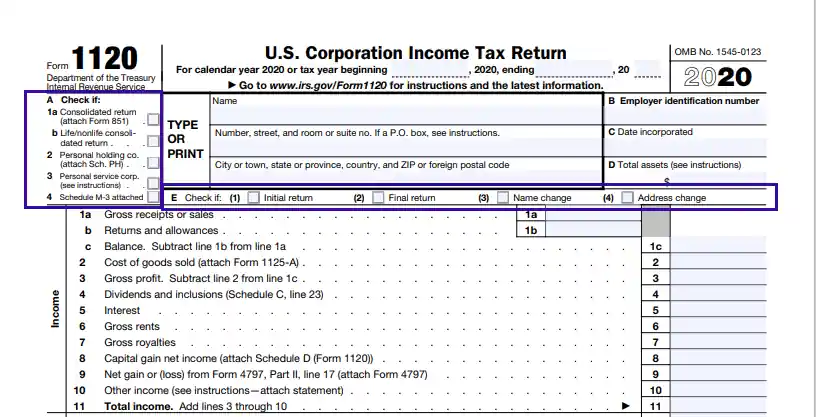

- Checkbox the Type of Tax Return

In the top left corner of the form, there is a list of suggested options for the tax return types. Choose the one you are willing to submit and tick the corresponding box.

- Enter the EIN and Assets Description

In this section, you need to enter the Employer’s Identification Number, the company’s incorporation date, and describe the total amount of the assets pertaining to the subject company.

- Insert the Total Income Calculations

Below, you will find a list of entries that will constitute your company’s total income amount that had occurred during the financial period under review. You will need all the corporate income details you can get and provide legal proof of their source and existence. These include interest rate income from dividends, investments, rent, royalties, and other capital-related profits. Only the company’s responsible financial officer gets to fill out and calculate the gross income amount that goes in the section.

- Provide Total Deduction Specifications

In this section, the financial officer must calculate the total amount of the company’s deductions that may include: salaries, compensations, interests, taxes, sick leave (as of 2021), and other expenses that might be relevant.

- Enter the Taxable Income Amount

Based on all the information designated in the previous sections, the financial officer calculates the total taxable amount in US dollars, as well as the amount owed and the amount currently overpaid (if applicable).

- Put Date, Signature, and Title

Once finished, the responsible officer shall put a signature, current date, and their respective title.

The preparer also defines if the IRS can contact them to discuss the matters concerning the information designated in the form. The preparer shall tick their answer in the box right next to the title.

- Insert the Preacher’s Data

The company’s responsible financial officer proceeds to fill out their personal data. The officer needs to enter the name, physical address, and contact number of the firm that the officer works for.

- Fill in the Schedules and Supplements

In the conclusion of the form, there are several supplements (Schedules) that one must also fill out and submit to the IRS office. Some schedules are required for submission, and some are kept for the company’s financial records. You will find a list of all supplements with a brief explanation below:

- The Cost of goods sold supplement;

- Schedule C

This one is dedicated to the dividend income and the so-called special deductions. Mind that this particular Schedule C differs from that of individual proprietors.

- Compensation amounts paid by the company to its officers;

- Schedule J

This supplement is a more detailed paper providing info on tax computation, including credits and other relevant taxes paid by the company;

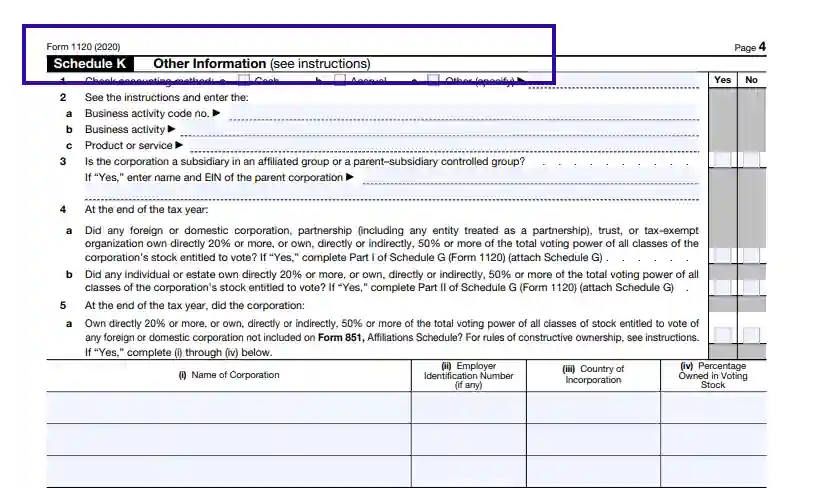

- Schedule K

With this one, you can provide other essential info about your accounting methods, business type, stock ownership, and submit your NAICS classification number.

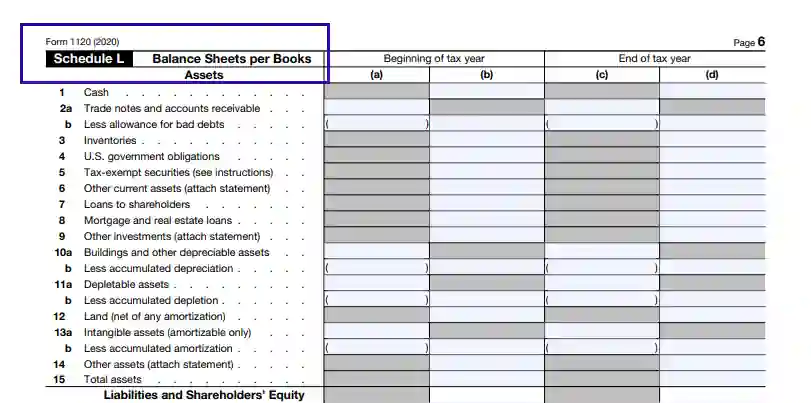

- Schedule L

This one is a balance sheet that the responsible financial officer fills out based on the books at the beginning and the end of the current financial year.

- Schedule M-1

Once you have filled the previous sections out and calculated all the necessary amounts, you may proceed to fill out this Schedule to record reconciliation of income gains or losses per book with the designated income per return.

- Schedule M-2

Finally, you can now provide a comprehensive analysis of all unappropriated retained earnings per the current financial yearbooks.