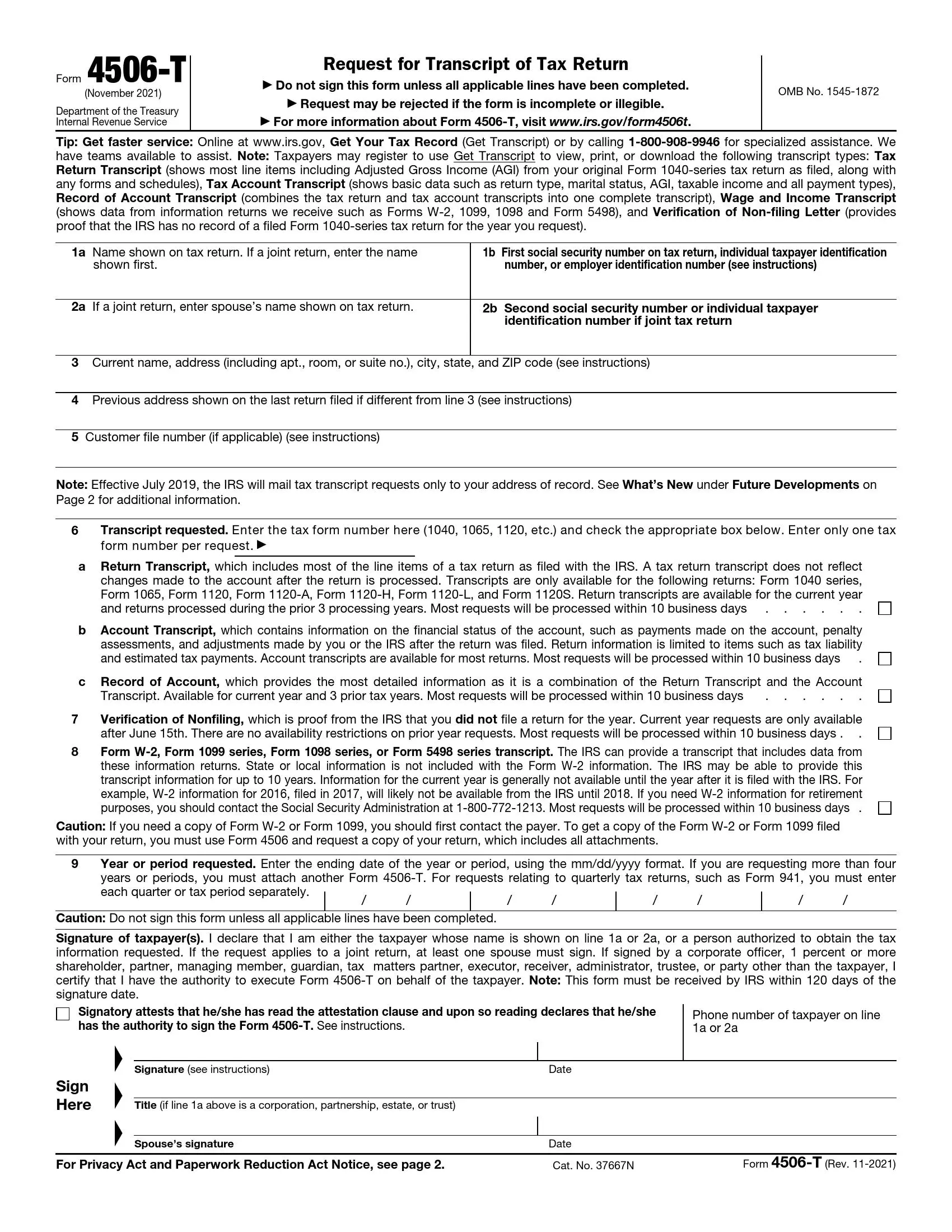

Form 4506-T, titled “Request for Transcript of Tax Return,” is a tax form taxpayers use to request transcripts or summaries of previously filed tax returns and other tax-related documents from the Internal Revenue Service (IRS). This form is commonly used for various purposes, including obtaining tax return transcripts for mortgage applications, student loan applications, and income verification for financial transactions. Form 4506-T provides the IRS with the necessary information to process the taxpayer’s request and release the requested documents.

The purpose of Form 4506-T is to facilitate the retrieval of tax-related documents by taxpayers and authorized third parties, such as lenders or tax professionals. By completing and submitting this form to the IRS, taxpayers can request transcripts of their tax returns, wage and income information, and other tax documents needed for various purposes. This form streamlines the process of obtaining tax information, ensuring taxpayers can access the documents they need to fulfill their financial obligations or verify their income accurately.

Other IRS Forms for Corporations

A taxpayer can make various requests to the IRS, and the Form 4506-T is one of them. Check for other IRS forms that you might need for getting a loan, mortgage, or any other purposes.

How to Fill Out IRS Form 4506-T?

You should complete all the boxes for this form to be accepted. We will describe the filling process step by step. However, if you still have any problems, you can apply the self-help device on the governmental IRS website. You may use our form-building software tools to get the necessary form and fill it out online.

Please note that the automated self-help system is available only for individual taxpayers. To get a copy version of your tax return, call the number given in the form.

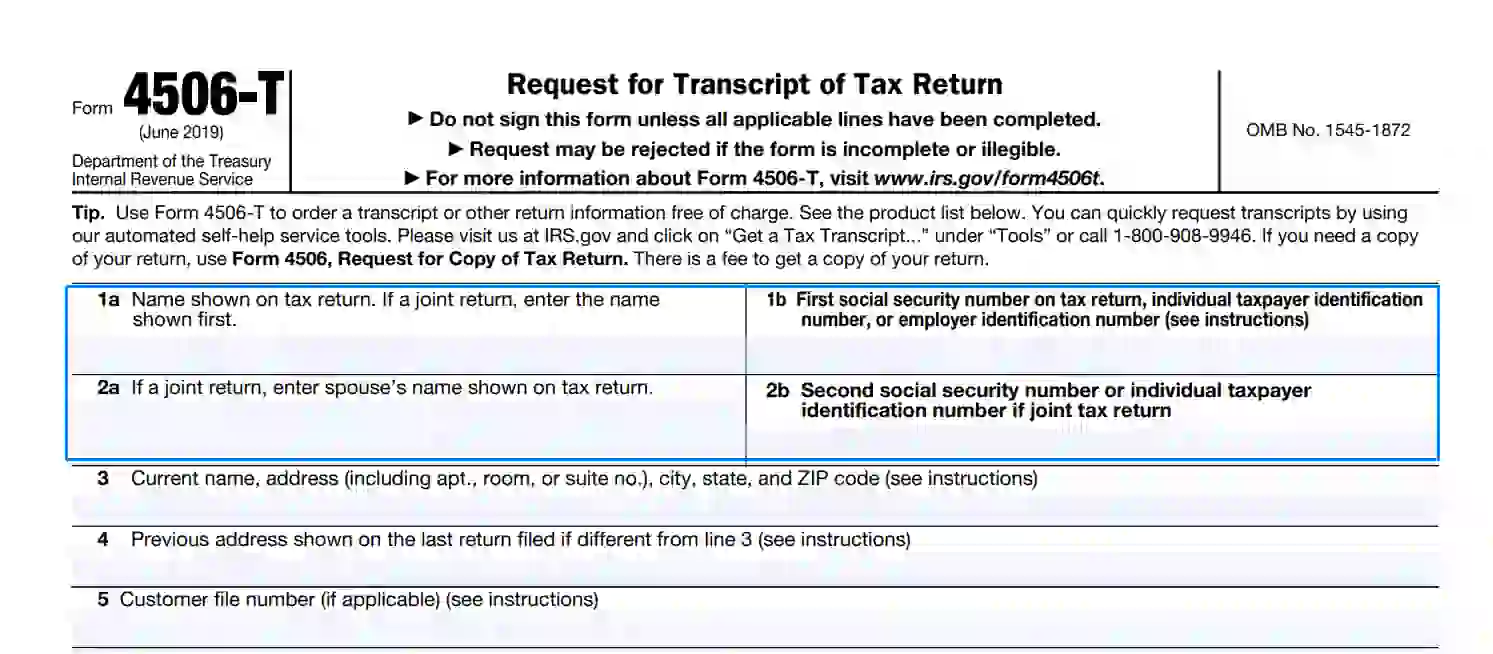

- Introduce Yourself

Fill in your name and Social Security Number (SSN) as stated in the tax return into Boxes 1a and 1b. If you use this form for a joint tax return request, enter your spouse’s name and SSN into boxes 2a and 2b.

Enter EIN (employer identification number) in Box 1b if you are applying for business tax returns specification.

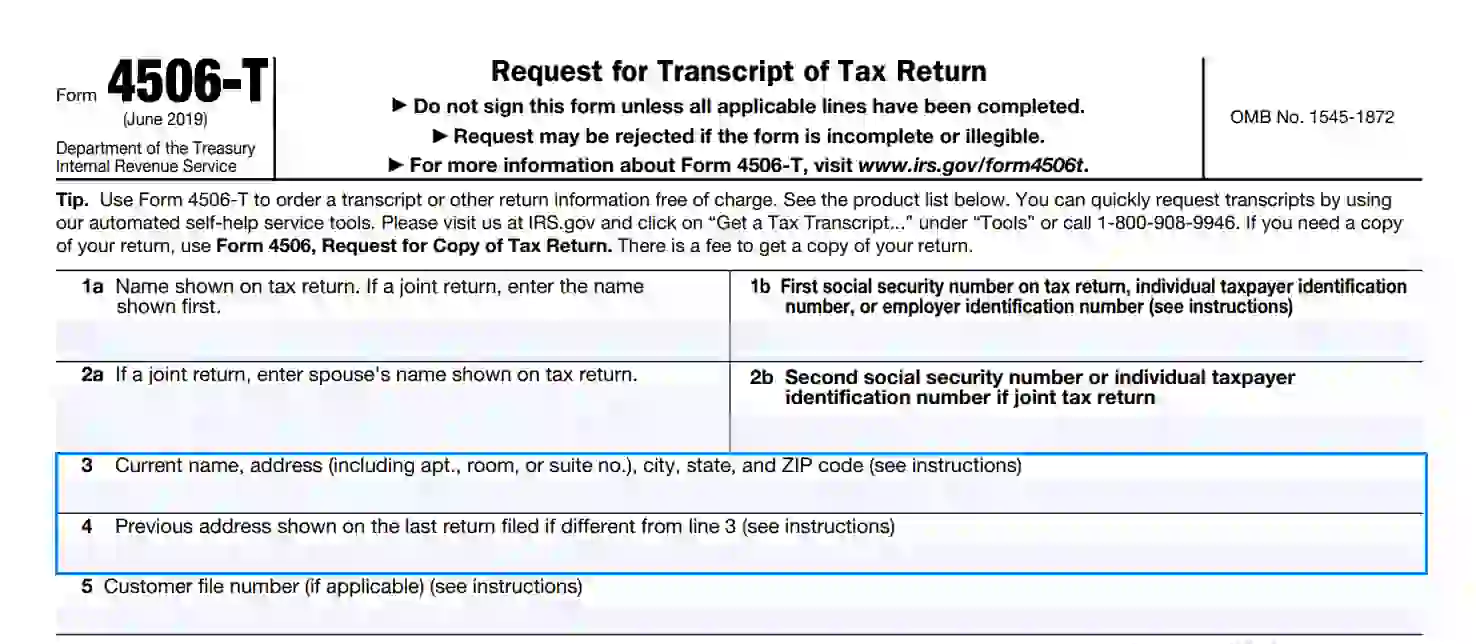

- Provide Relevant Contact Info

Write your address in Box 3 with all the details listed in the description, including the information about your post box if you use it.

Use Box 4 in situations when your current address (in Box 3) does not match the address you stated in the last return form. Specify your previous address in this section. Additionally, fill out and send Form 8822 for personal return or 8822-B Form for business return if you have not done it since changing the address.

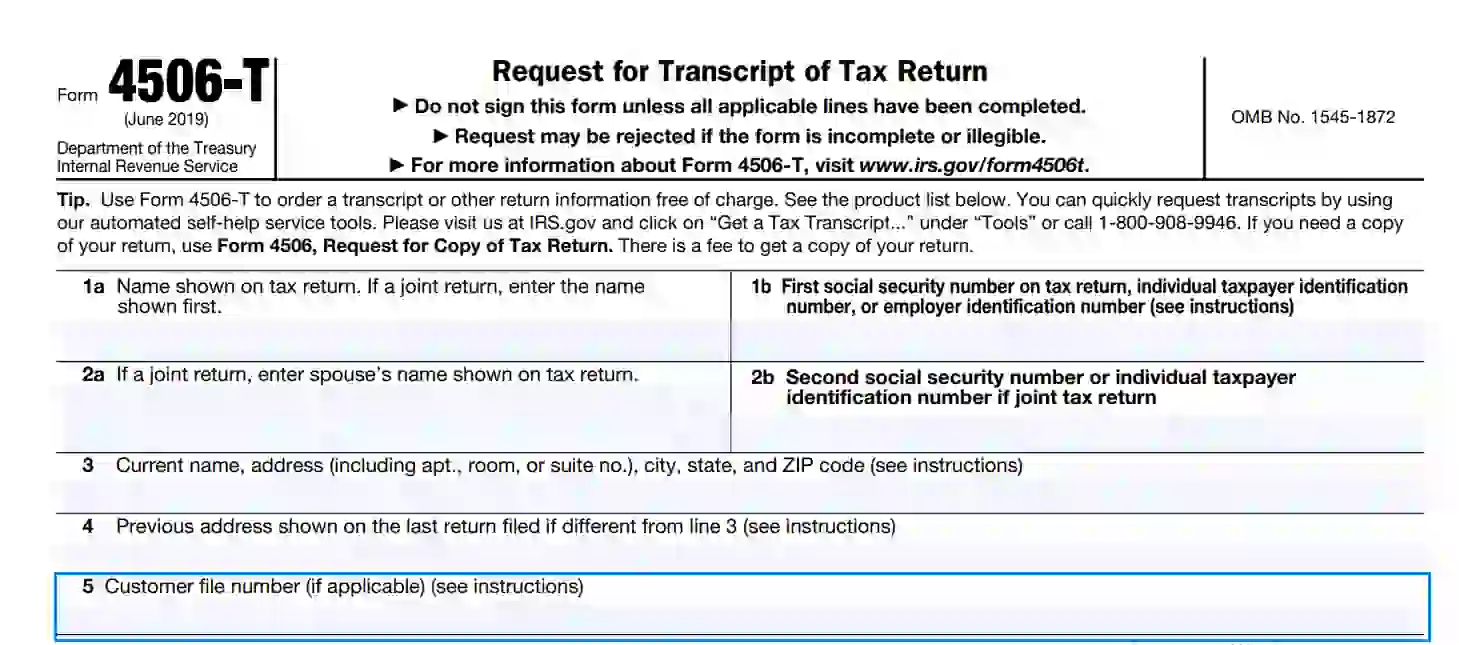

- Enter Unique Customer’s Number

Enter the assigned unique file number in Box 5. This field is optional. Remember that this number should not contain SSN.

- Choose an Appropriate Tax Return Option

Box 6 requires entering your tax transcript. You can choose from 1120, 1065, 1041, and other tax forms according to a return’s purpose. You may use the 1040 series for individual requests. For business purposes, please enter the business tax return you have for the year.

Then, you need to choose the transcript type you need (6a or 6b or 6c) based on the kind of information you are requesting.

- Verification of Nonfilling

Check Box 7 if you want to get official proof of the tax return absence for the current financial year.

- Options of the Request

Check Box 8 if you want to get the transcript of the returns in W-2, 1099, 1098, and 5498 forms. Please note that the requested information will be available only a year after filing. For example, the transcript for 2019 will be accessible only in 2021.

Pay special attention to the “Caution” field. The copies of the Forms W-2 and 1099 can be attached only after approval from a taxpayer.

- Enter the Period of Requested Tax Return

Fill in the dates of the needed years’ endings in line 9 in the designated format. You can put here no more than four years. If you want the request for more than four years, add one more Form 4506-T. To get the quarterly return, fill in the ending dates of every quarter you need.

- Sign and date the Form

Check all requirements before signing the form. Put your signature in the line “Sign Here”. If the request is joint, the spouse should put a signature in the box “Spouse’s signature”. Fill in the firm’s name if the return is for a business. Enter the current date near your signature. Do not forget to mail the form not later than 120 days after signing.