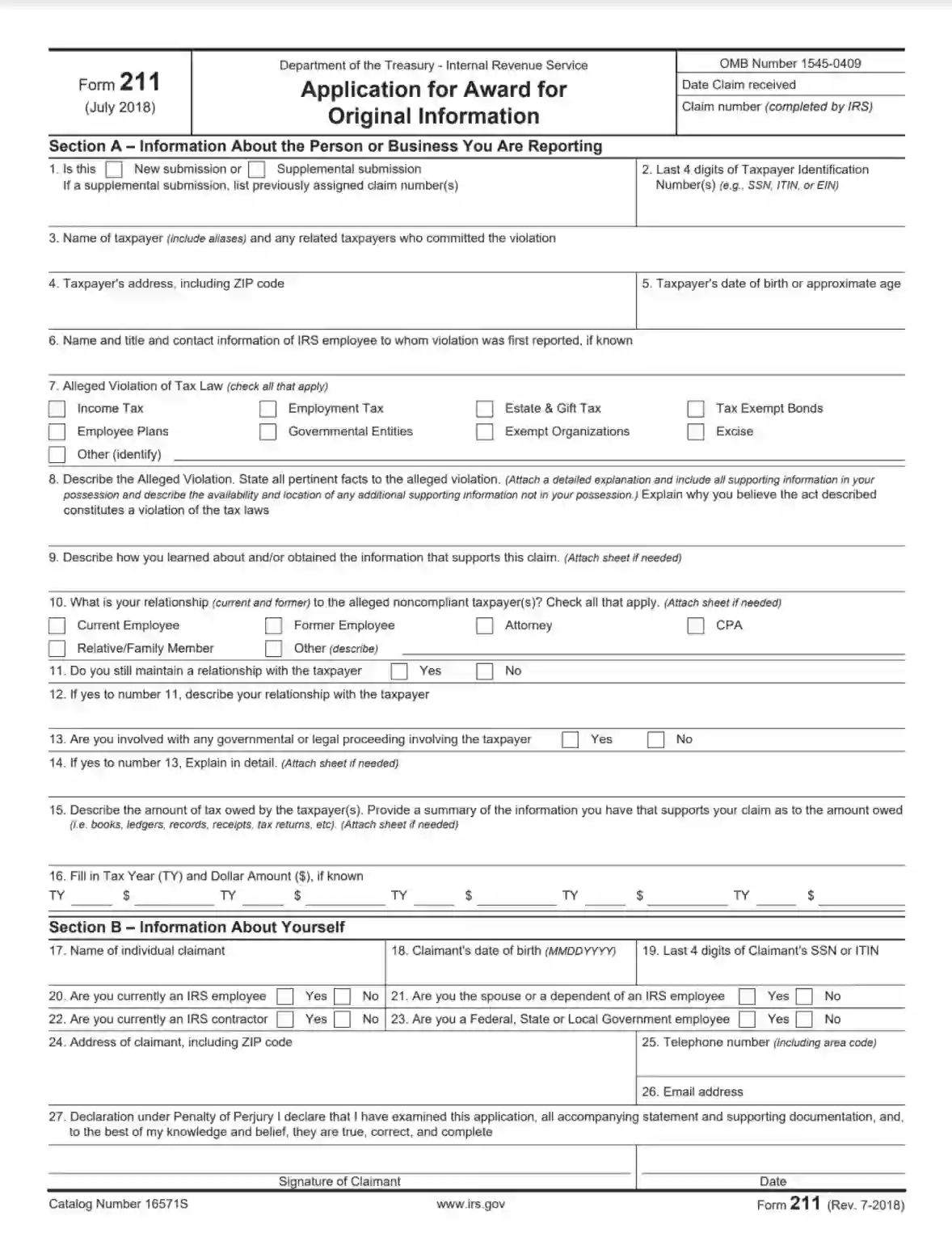

Form 211 is a document used by individuals who want to report tax fraud or significant tax underpayments to the Internal Revenue Service (IRS) and claim a reward for providing this information. The form allows whistleblowers to provide detailed information about the person or entity they believe is failing to comply with tax laws, including descriptions of the violation and any documentation that supports their claims. This structured approach helps the IRS collect essential data to initiate tax evasion or fraud investigations.

The purpose of Form 211, titled “Application for Reward for Original Information,” is to encourage individuals to come forward with information that can assist the IRS in identifying and addressing tax noncompliance. The IRS may offer monetary rewards to whistleblowers whose information leads to the collection of unpaid taxes, penalties, and interest. Using Form 211, whistleblowers can formally submit their tips in a way that may potentially lead to a financial reward if their information successfully resolves a tax case.

Other IRS Forms for Individuals

On our website, you can find various IRS forms that are used by individual taxpayers.

How to Fill Out and File IRS Form 211

Application for Award for Original Info 211 Form covers one page. You are welcome to browse for the valid document on the IRS portal. To save time and effort, we encourage you to use our advanced template-building online tools and generate an up-to-date PDF file. Enter the inherent info instantly and be ready to file the form within minimum time.

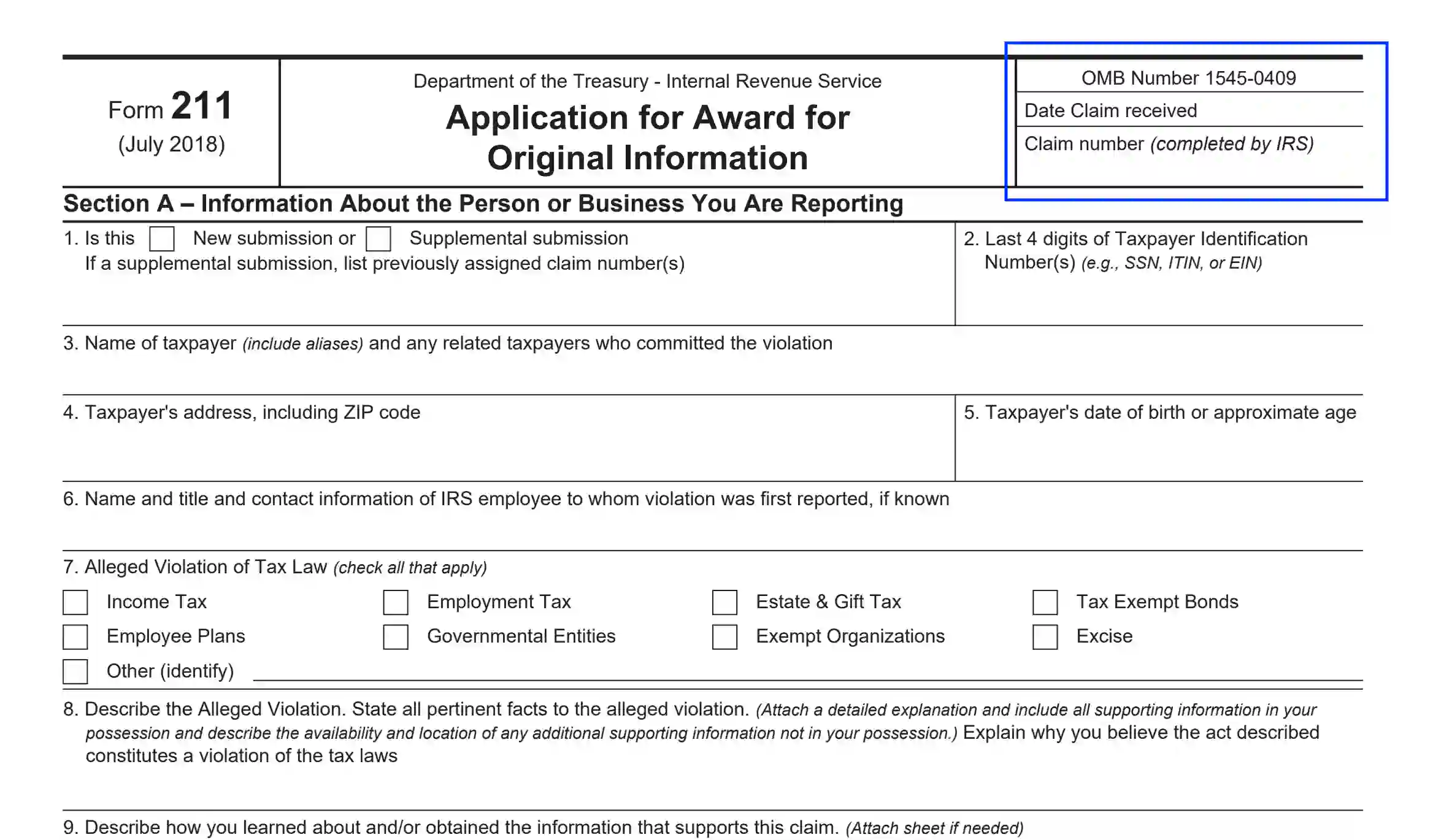

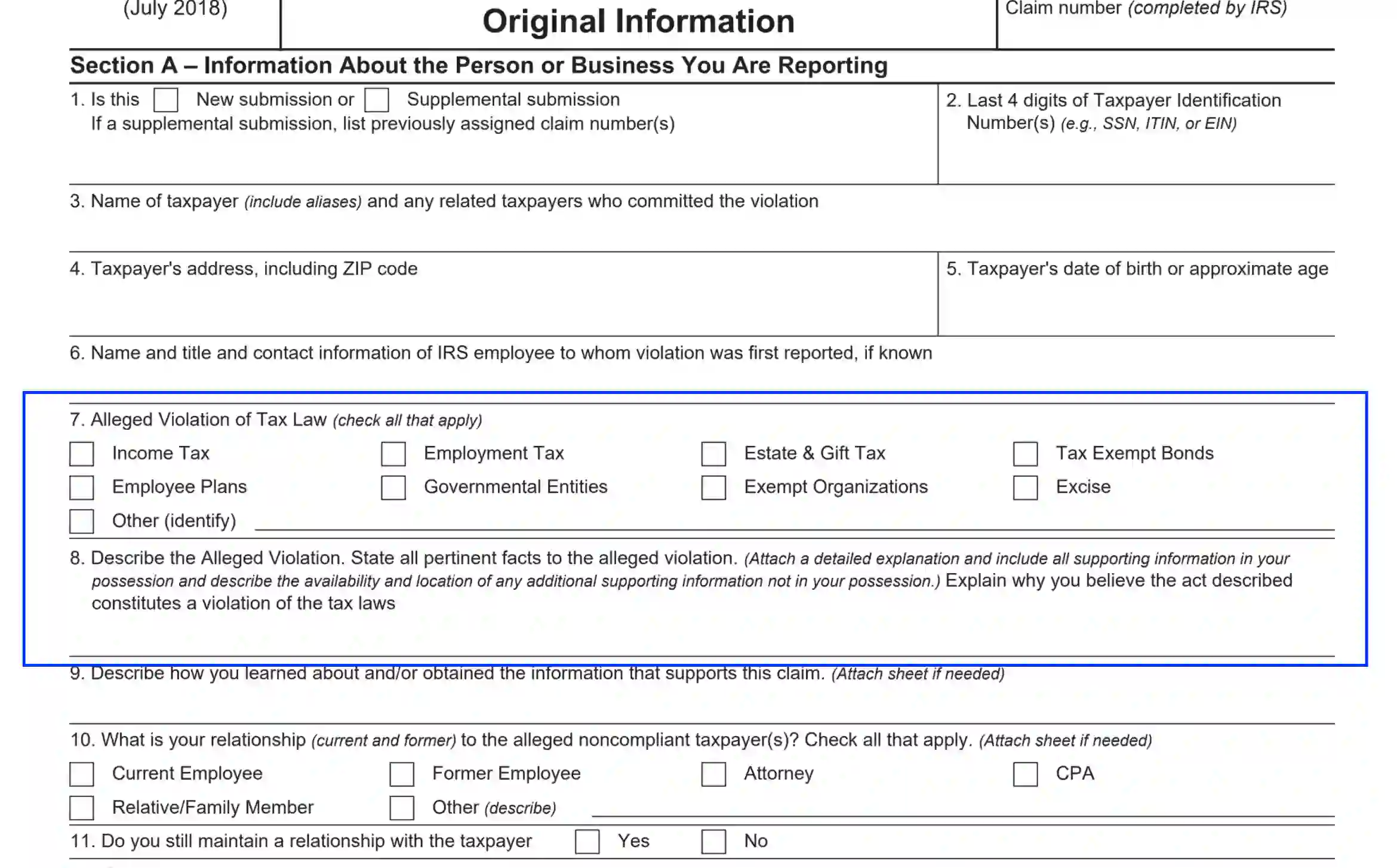

Before you begin completing the document, ensure to leave the upper right section blank. This part is executed by the IRS representatives.

The form consists of two parts. Section “A” covers info regarding the non-compliant individual about whom the preparer provides the report. Section “B” is dedicated to the preparer’s personal data. Follow our illustrated guidelines to submit the required details.

Specify If This Is the First Submission

In Unit 1, the preparer should define if the report regarding the business or individual is created for the first time. If positive, check the corresponding box and proceed to the next statement. If there are previous submissions, enter the claim numbers assigned by the revenue service.

Indicate the Entity’s (Individual’s) Tax Identification

In Unit 2, the preparer needs to specify the taxpayer’s data. For individuals, enter the SSN. Entities and proprietorships require TINs or EINs. You need to enter only the last four characters of the tax ID number.

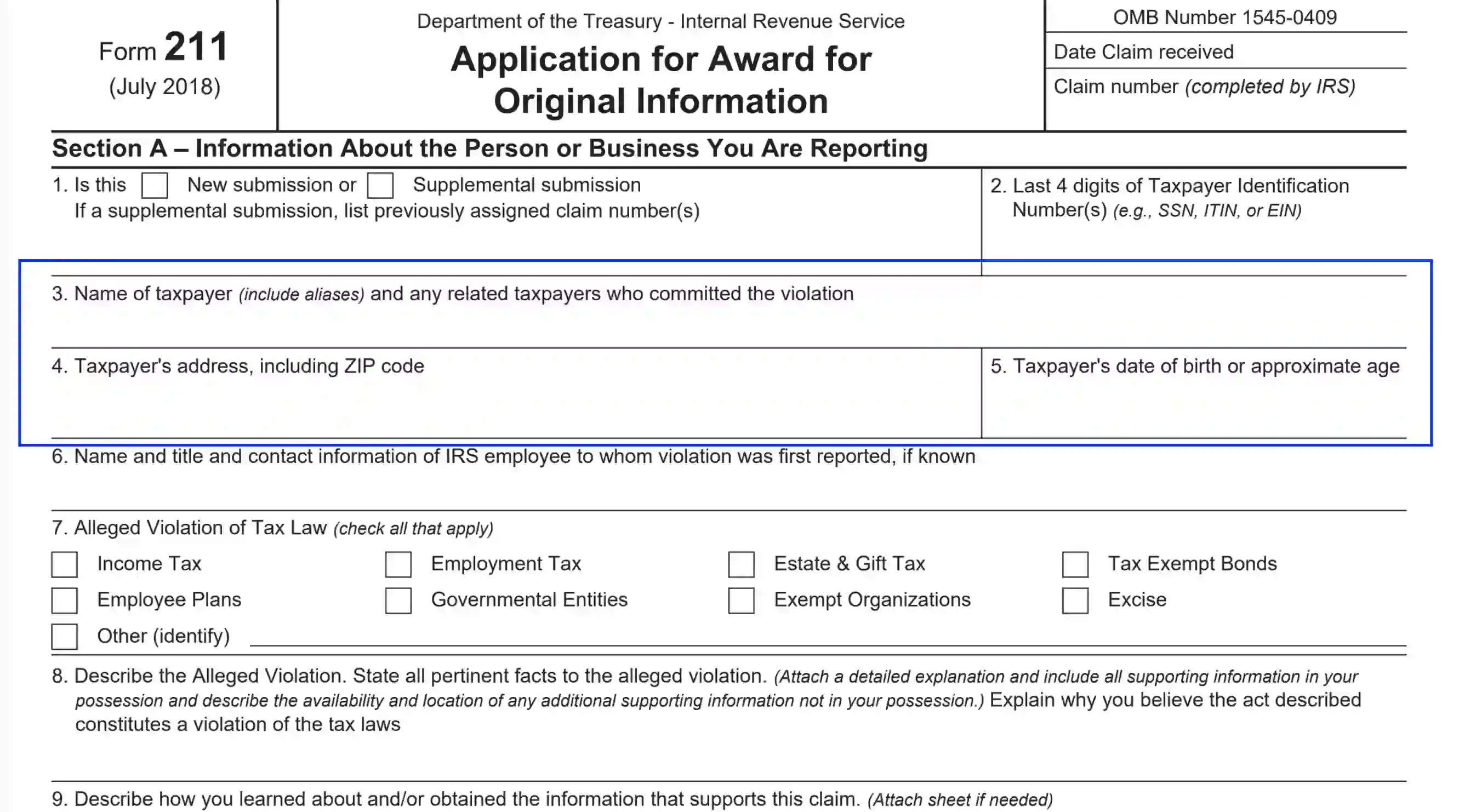

Complete the Taxpayer’s Personal Data

In Units 3 through 5, the whistleblower should identify the taxpayer. Make sure to enter the below-listed info:

- Taxpayer’s name

Include the legal name and any aliases. Also, add individuals who relate to the breach committed.

- Living address, including unit and apartment number, street, city, state, and ZIP details

- Taxpayer’s birthdate

If you, as the preparer, are not sure about the trespasser’s date of birth, enter their estimated age.

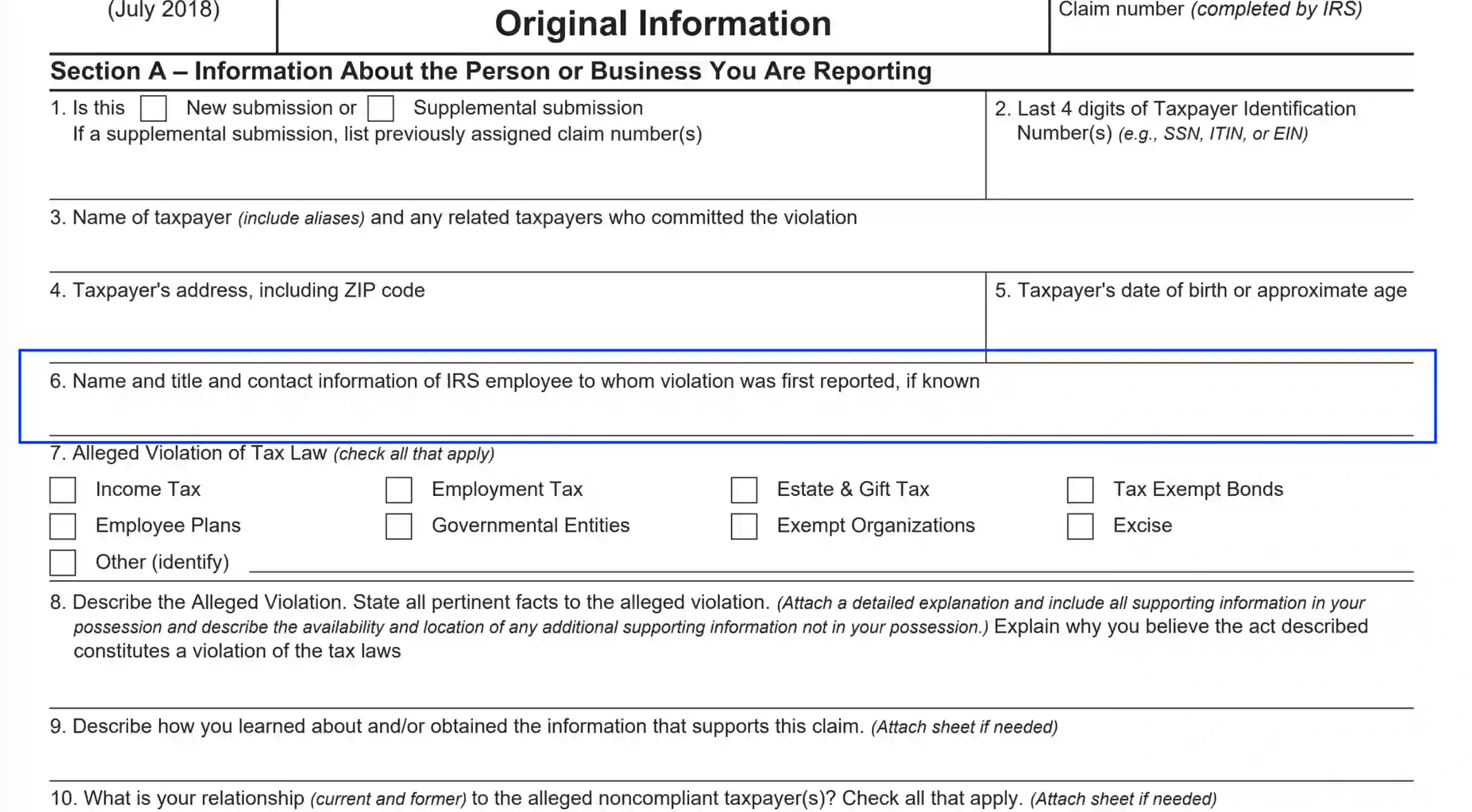

Clarify the IRS Representative Info

In Unit 6, you should enter the IRS representative’s name and contact info (if known) to whom you have reported the tax trespassing originally. Besides, you need to enter the employee’s title.

Describe the Tax Violation

Units 7 and 8 contain info about the tax violation committed by the individual or business identified in Unit 3. The section covers several types of tax law violations. Choose the correct one. If none is applicable, select the “Other” box and provide inherent details.

Next up, you are encouraged to provide extra details and describe your assumptions of the act of violation. Use section 8 to fulfill the task.

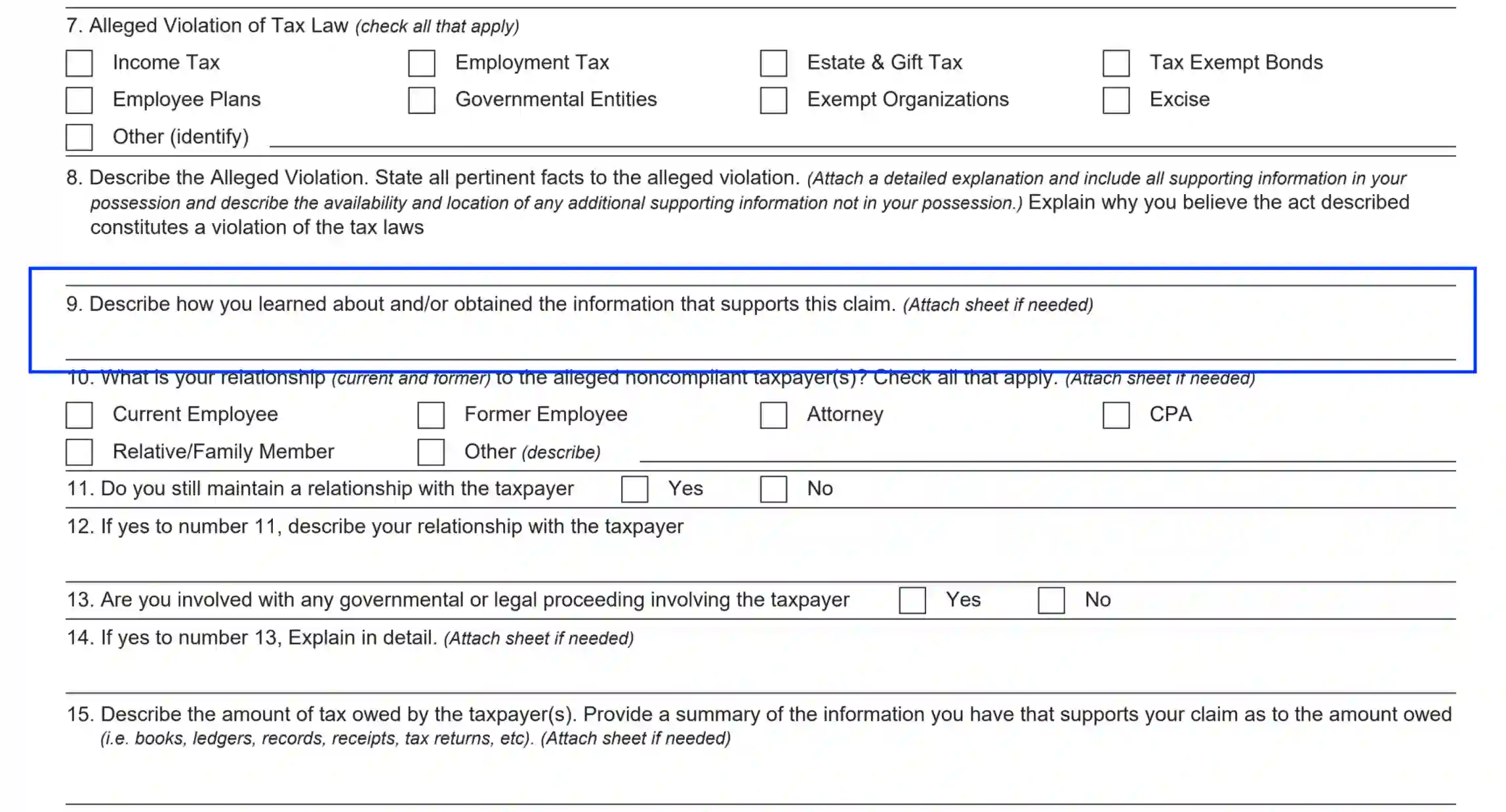

Explain the Info Source

In Unit 9, the preparer is supposed to clarify how they have learned about the tax law breach. You are empowered to use additional sheets if needed and file the attachments together with Form 211.

Specify the Preparer’s Relationship with the Taxpayer

In Units 10 through 12, the preparer should clarify their relation to the taxpayer identified in Unit 3. Describe the character of your business communication and if it continues.

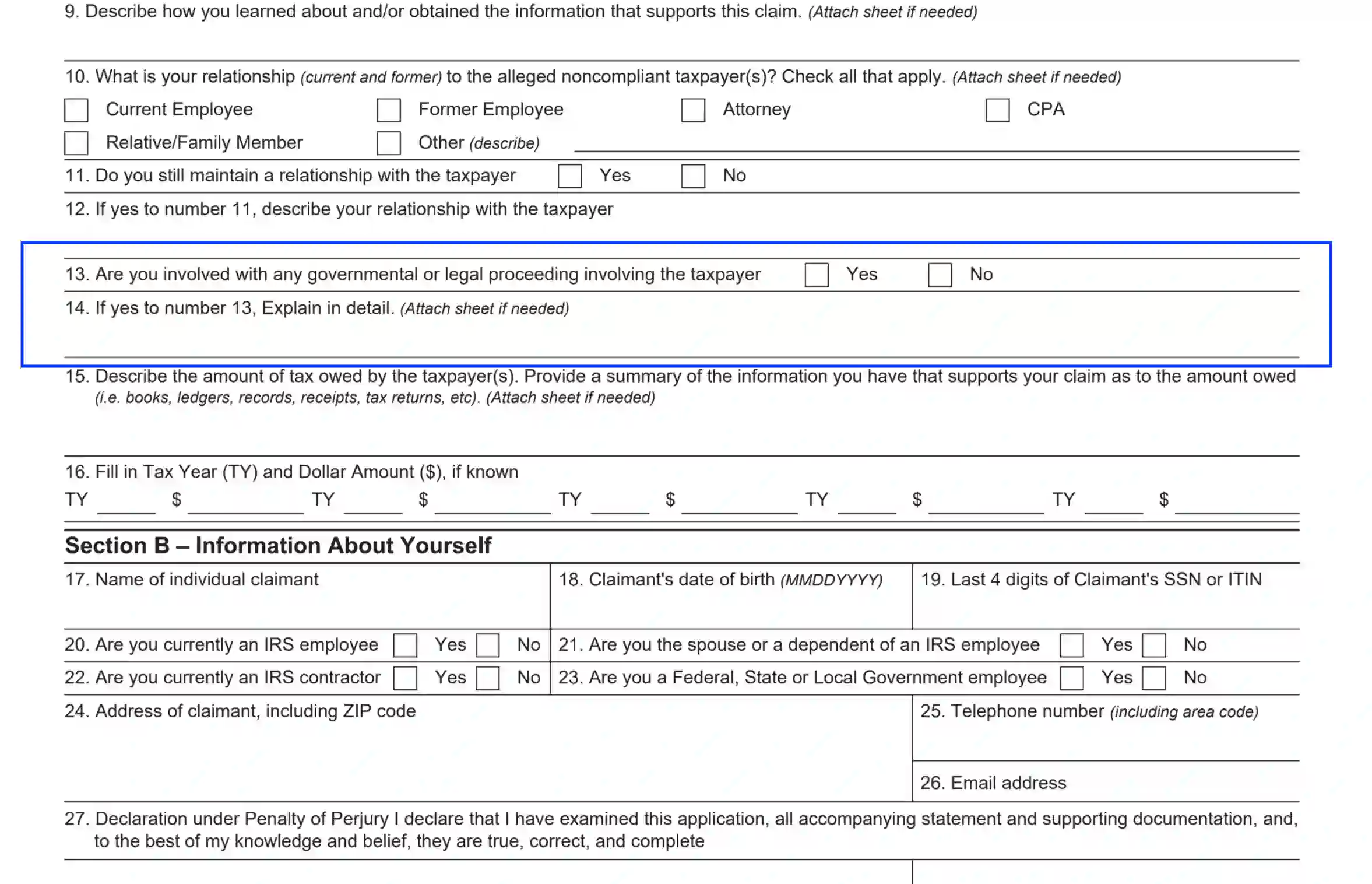

Submit If There Is a Current Proceeding

In Units 13-14, the preparer needs to clarify if the preparer and the taxpayer are involved in any legal proceedings jointly. If you select “Yes,” please, provide details in Unit 14 or attach an extra sheet with a detailed explanation.

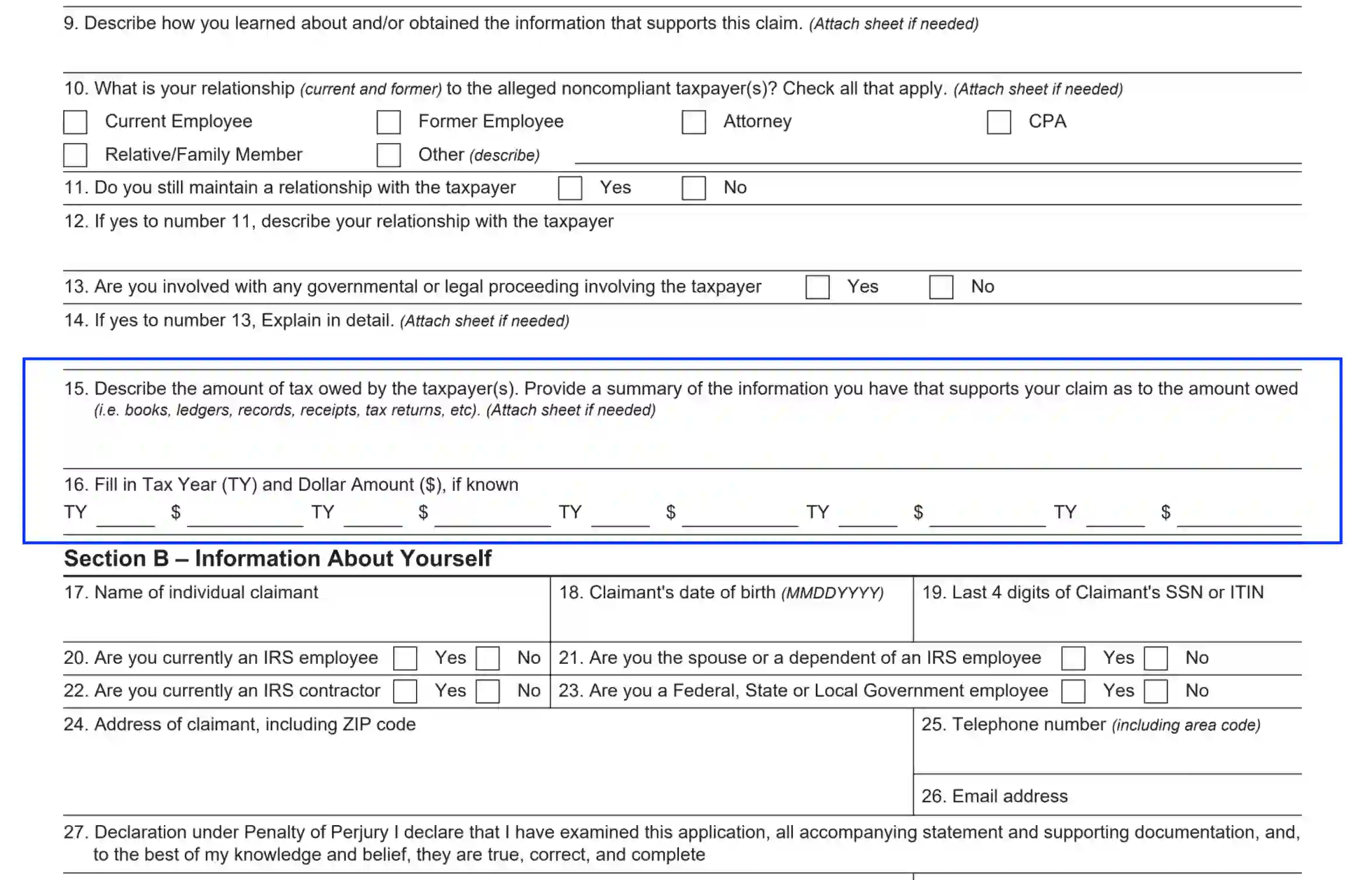

Submit the Tax Amount Owed and Tax Period

In Unit 15, you are encouraged to provide details regarding the tax amounts owed by the trespasser. Here, you should submit proof, including ledgers, books, or other official documentation. If extra space is required, use attachments to describe the aspects.

In Unit 16, provide specific amounts per each tax period at issue.

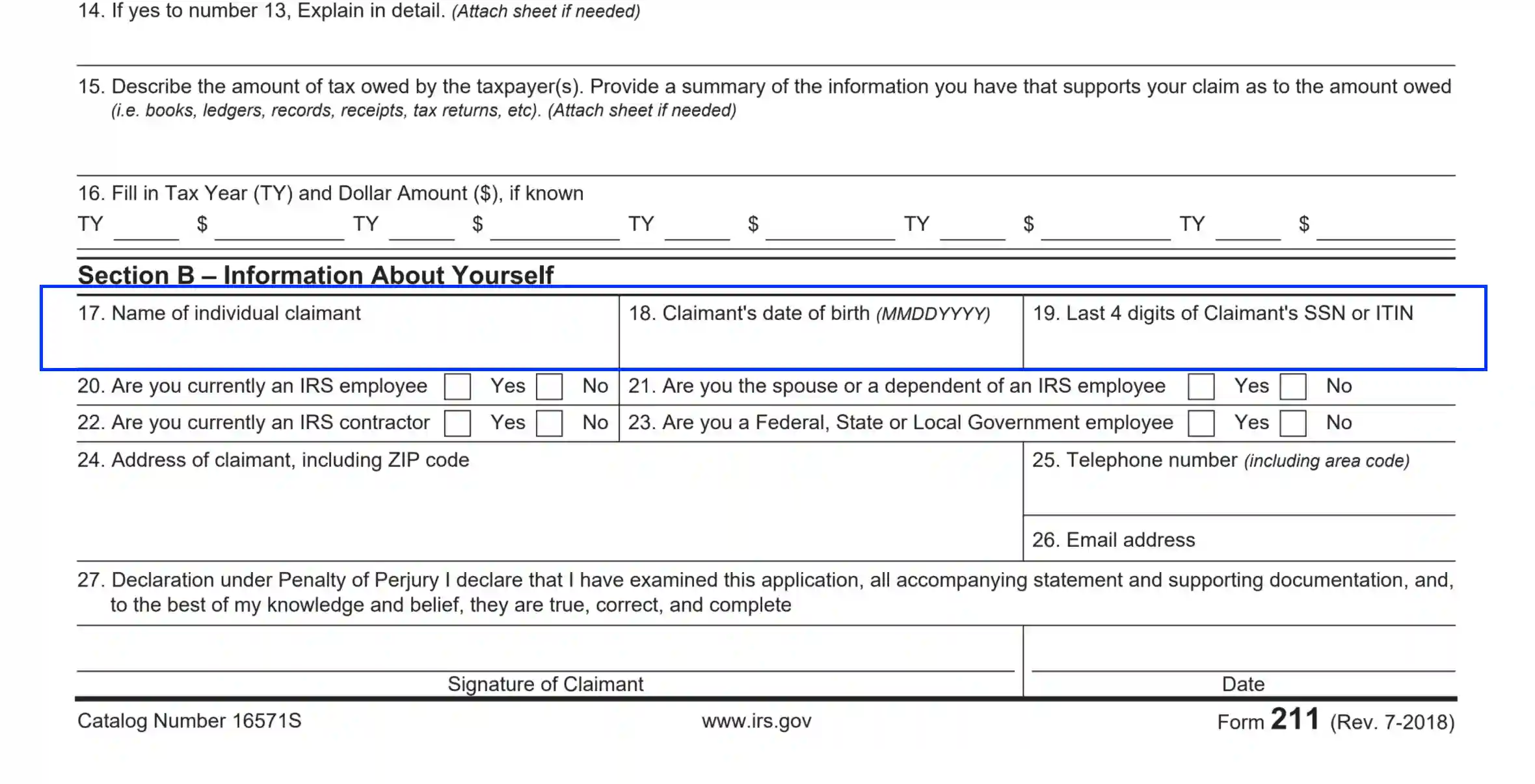

Introduce the Preparer

Use Units 17 through 19 to submit details about the claimant. Disclose info as follows:

- Legal name

- Birthdate in a month-day-year format

- Preparer’s SSN or TIN — enter only the last four characters of the tax identification.

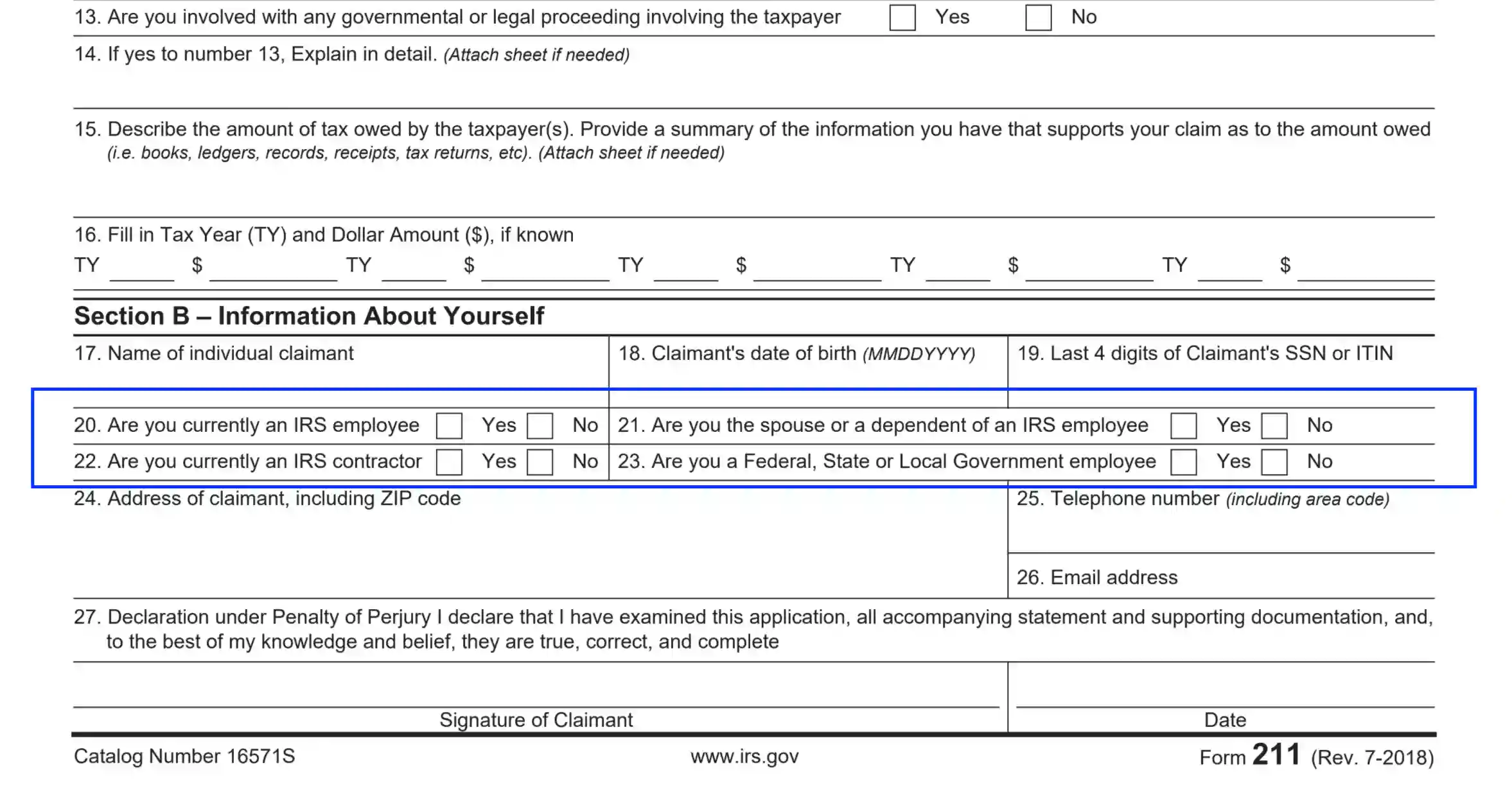

Specify If the Claimant is IRS-Related

In Units 20 through 23, the claimant should disclose any professional relation to IRS. Select and checkbox the appropriate variant.

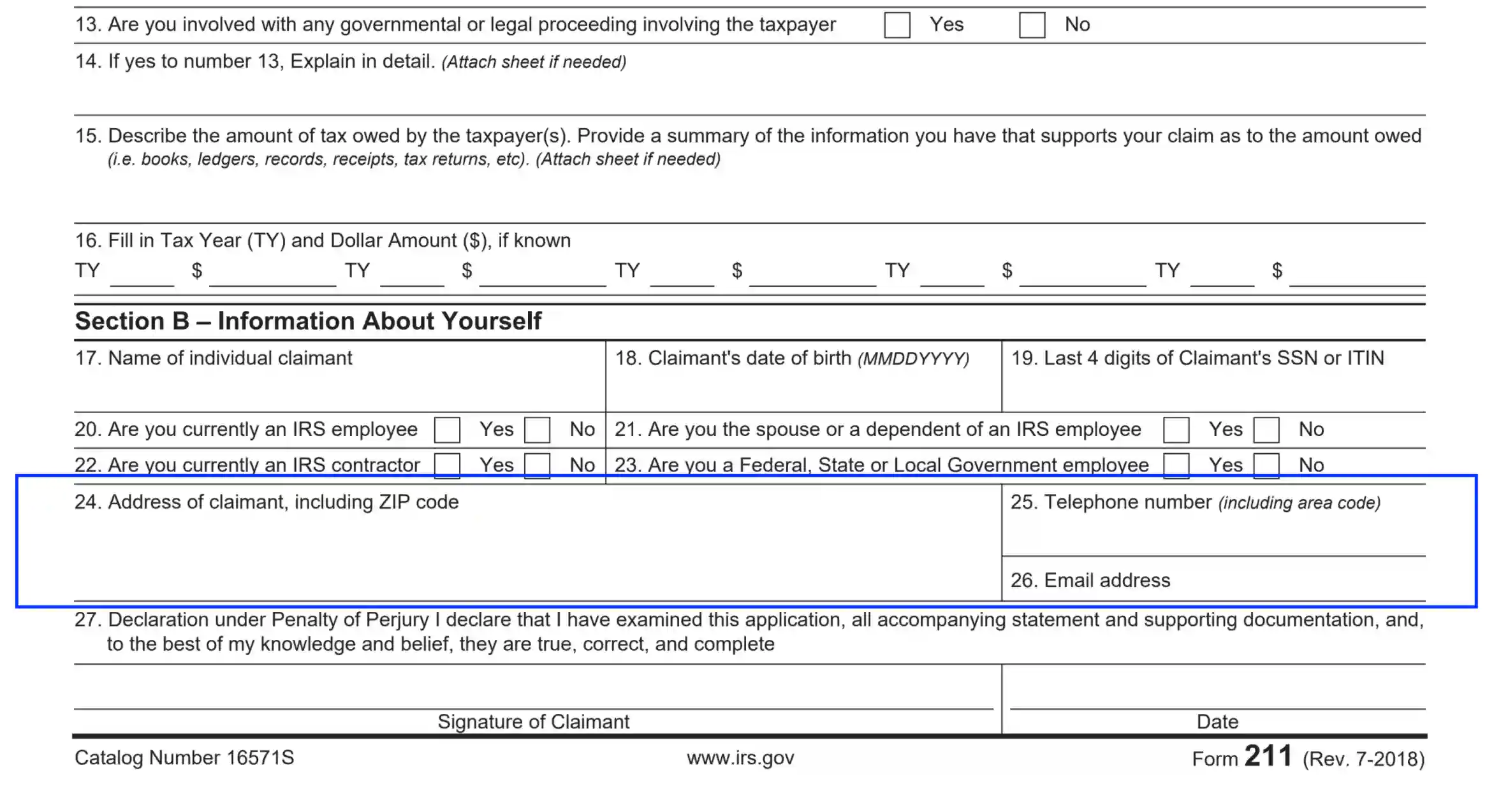

Submit the Preparer’s Address

Use Units 24-26 to disclose the claimant’s contact data. Enter the info as follows:

- Living address, including the state and ZIP code

- Phone number, including the area code details

Authorize the Form

Conclude the form by appending your signature and current calendar date. Read attentively the data disclosed and sign if everything is correct and true. Remember that any knowingly false statement will not only damage your reputation but involve penalties for perjury.

File the Paperwork

Compile Form 211 and all attachments (if any) and send the application for the award set to the address indicated on the second page of the respected claim form.