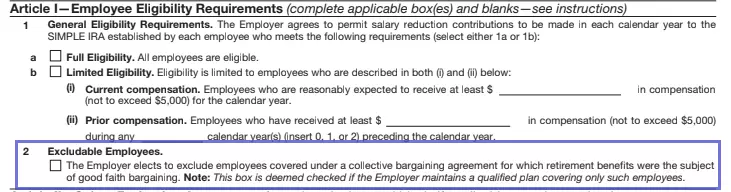

IRS Form 5304-SIMPLE is a document employers use to establish a Savings Incentive Match Plan for Employees (SIMPLE) IRA plan for their employees. This form allows employers to establish a retirement savings plan that provides a simplified method for employers and employees to make retirement contributions. With IRS Form 5304-SIMPLE, eligible employees can choose to make salary reduction contributions to their SIMPLE IRAs, and employers are generally required to make either matching or nonelective contributions.

In essence, IRS Form 5304-SIMPLE is the basic paperwork for setting up a retirement savings plan that benefits employers and employees. It streamlines the process of establishing a SIMPLE IRA plan, designed to encourage small businesses to offer retirement benefits to their employees. By completing this form, employers can provide an easy way for their employees to save for retirement.

Other IRS Forms for Business

Here are some other business forms that small employers might need to use to report financial information to the IRS.

How to Fill Out the Form

The IRS recommends using the help of a legal assistant due to the fact that the paper is relatively complicated to complete properly. However, if you are sure that you will be able to successfully fill it out yourself, you may choose to use our form-building software and create a personalized IRS Form 5304-SIMPLE online.

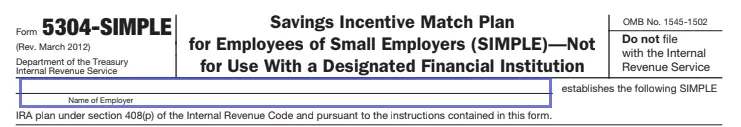

Provide the Name of the Company

You will have to input the name of your organization on the very first line.

Choose the Eligibility Requirements

Choose the type of eligibility, depending on whether all of your employees can legally participate in the plan or not.

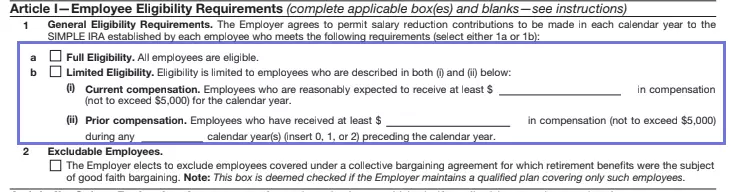

Indicate Whether There Are Excludable Employees

Check the box if relevant.

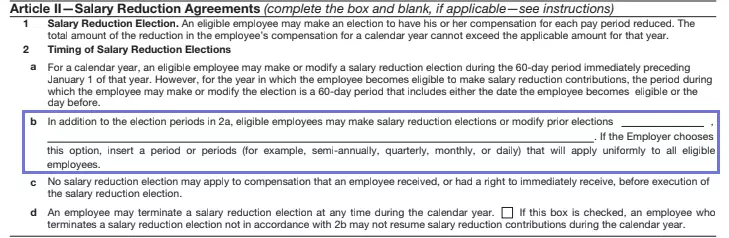

Extend the Period for Modifying the Contributions

Normally, the employee has the right to make or modify a salary reduction election not later than 60 days after the first day of the calendar year (or after becoming eligible). However, you may alter this period and indicate the one you consider appropriate.

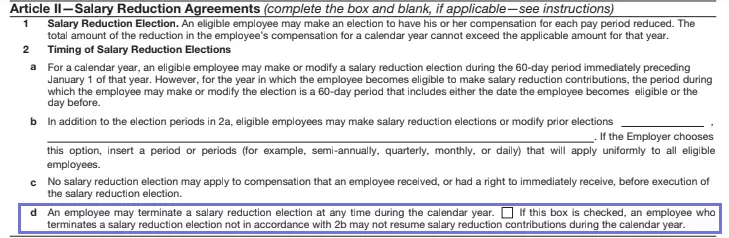

Prohibit the Employee to Terminate a Salary Reduction Election at any Time

If you check the box, you will not permit those employees who have terminated a salary reduction election at the time other than indicated above to continue to receive contributions during the year. Leave it blank in case you consider this acceptable.

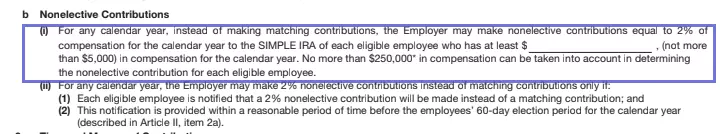

Indicate Contributions Amount

According to the law, when you stick to a SIMPLE IRA plan, you have to contribute certain amounts of money to an organization chosen by the person who works for you. This amount has to be not more than 3% of the employee’s compensation but cannot be less than 1%. Normally, the sum is $5,000 or less (insert the exact amount of contribution on line 2b(i)).

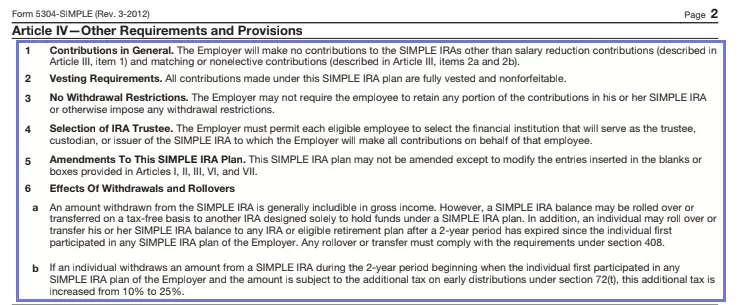

Look Into Additional Provisions

This part of the document consists of some more details you should study before signing the form.

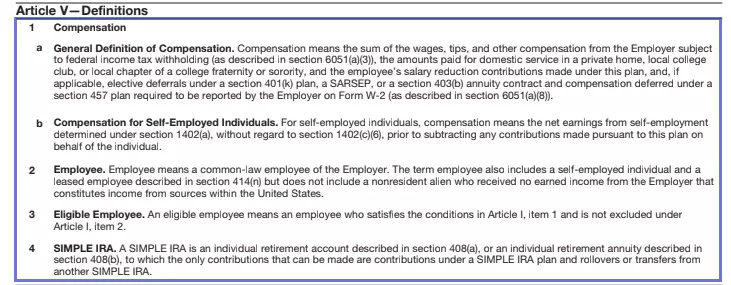

Study the Definitions

Make sure you understand the terms shown in Section 5, including the following:

- The money you pay your staff members as a work provider, which is subject to federal income tax.

- Compensation for Self-Employed Individuals. The net income an individual entrepreneur receives from their self-employment.

- The person is residing on the territory of the US and legally working for you as a work provider.

- SIMPLE IRA. An individual account is created for keeping the contributions.

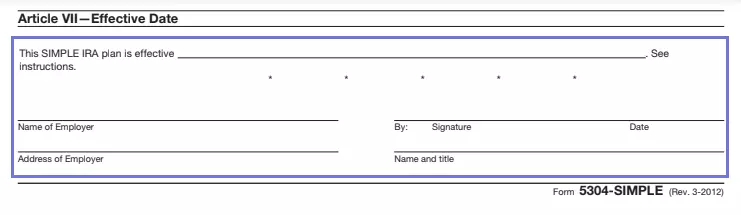

Date the Paper

The provisions of this document will gain validity on the date you select to insert herein. Write your name, residential address, title, and append the signature.

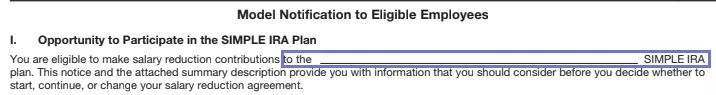

Enter the Company Name

The third page of this form begins by identifying the entity, which is about to set up the plan.

Specify the Year

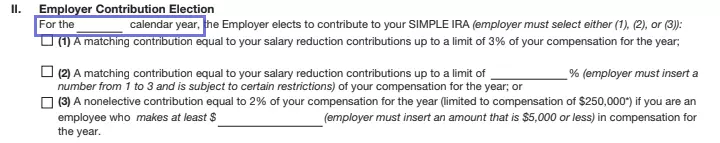

Then, write down the appropriate year. If you fill the form out not for the first time, enter the first day and month of the calendar year. In other cases, insert a date between January and October.

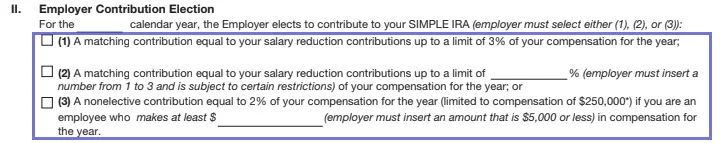

Choose the Contribution Election

Choose among three options and check the corresponding box. You will also need to indicate the percentage of a matching contribution if you check the second type or a certain amount of annual contribution the staff member is supposed to receive.

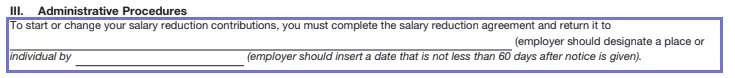

Inform Employees about a Written Agreement

Complete the line with a name of a company or its representative who is responsible for getting the notice back from the employee. Do not forget to enter the due date for this paper to be delivered (which cannot be less than 60 days).

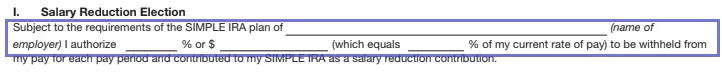

Agree Upon Salary Reduction

This part of the paper should be completed by the employee. First, indicate the entity name and the type of retirement contribution you consider appropriate.

Specify the Date Your Plan Will Start to Work

The salary reductions will start once all the paperwork is ready. However, you have an opportunity to indicate a particular date, which, however, should not be before the agreement is signed and considered effective.

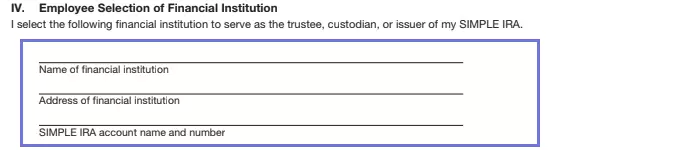

Designate a Financial Institution

Provide the name of an organization that will deal with your contributions. Insert the address and the data concerning your account as well. This institution is responsible for providing the employer with summary descriptions every year.

Append the Signature

By signing and dating the paper, you confirm to have agreed upon the conditions. This document will terminate any agreement that has been made prior to the current one. You possess the right to stop participating in the plan under the requirements shown in this form.

The IRS takes care of how simple it is for the individuals living on the territory of the US to complete tax forms. They estimate preparing this one rather time-consuming — a person might spend more than three hours recordkeeping, more than two and a half hours studying relevant laws, and 47 minutes filling inapplicable data. In case you are ready to suggest how to improve and simplify the paper, contact the Tax Products Coordinating Committee.

Remember that this form does not have to be filed. Consult a legal professional and keep it for your records instead.