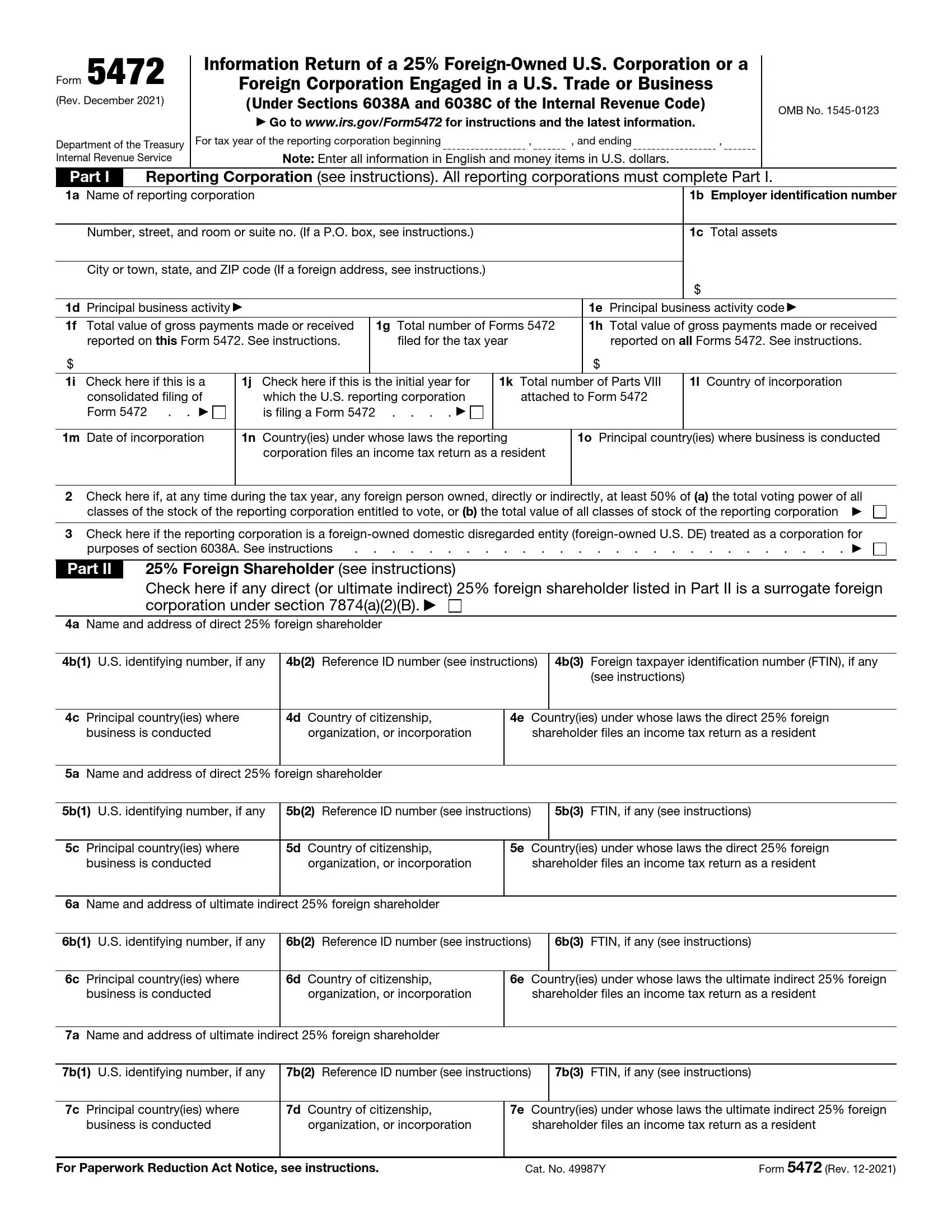

IRS Form 5472 is a tax document used by certain U.S. corporations that engage in transactions with foreign owners or related parties. Specifically, it is required for 25% of foreign-owned U.S. corporations or foreign corporations engaged in U.S. trade or business.

The purpose of Form 5472 is to provide detailed information about transactions between the reporting corporation and its foreign or domestic related parties. These transactions include sales, rents, royalties, commissions, and loans. The form helps ensure compliance with U.S. tax laws and assists the IRS in enforcing transfer pricing laws and preventing tax evasion.

Other IRS Forms for Corporations

Apart from the form to report information return, there are some other IRS forms every corporation should be familiar with.

How to Fill Out the Form

You are kindly advised to use our form-building software to get yourself the most recent customized document.

The form is relatively complex. Study several terms mentioned in the paper:

- 25% foreign-owned. If there is one 25% foreign shareholder or more during a period of one tax year, the organization is considered 25% foreign-owned.

- 25% foreign shareholder. That is an individual or an entity who either has at least 25% of the total voting power of all classes of stock or the total value of all classes of stock of the entity.

- Reportable transaction (RT). If any type of transaction is listed in Part IV of this document and monetary consideration was the sole consideration for it, it is viewed as reportable.

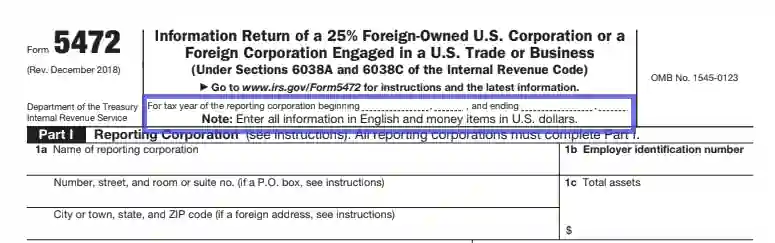

Part I

- Indicate the Tax Year

Input the beginning and the end of the tax year of the RC at the top of the paper.

- Essential Entity Data

Line 1a has to be filled out with the RC’s address. Provide employer ID on line 1b and the company’s total assets on line 1c. Your principal business activity, along with the PBA code, will be input on lines 1d and 1e.

- Total Numbers

Line 1f represents a total value of gross payments made on this line unless the RT is with a U.S.-RP. You should file a separate form per each related party (RP) you have had an RT with, so enter the total number of Forms 5472 filed for the tax year on line 1g. Then, insert a total value of gross payments delivered or accepted this tax year.

- Provide Info About the Business-Related Countries

To begin with, check the corresponding boxes if it is a combined reporting or (and) it is the first time for your company to send this report. Then, write down the name of the country of incorporation in line 1k. The country (ies) that legally control filing an income tax return by the RC should be indicated on line 1l. Name the key country (ies) where the business is carried out on line 1m (make sure not to write “worldwide”). Two more lines have to be filled out underneath the previously specified information by the RCs under certain circumstances (look into the details on the official website).

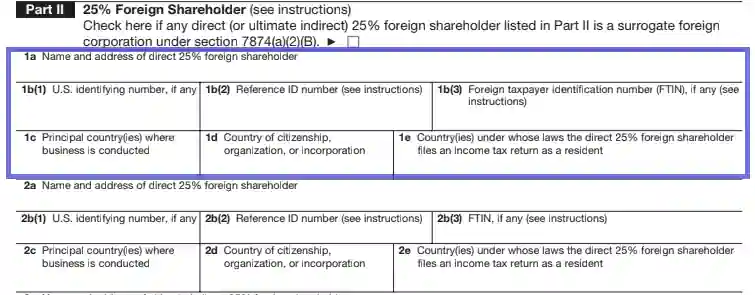

Part II

You have to provide evidence of your being a 25% foreign shareholder to continue completing Part II by checking the corresponding box. Next, input the names and the full addresses of each partner on lines a, their US ID numbers (if applicable) on lines b(1), reference ID numbers (if required) on lines b(2), and FTINs, if any, on lines b(3). Lines c have to be filled out with the name(s) of the principal country(ies) where the business is run. Indicate the country of citizenship, entity, or corporation on lines d. Complete lines e with information about each country regulating filing an income tax return of the part-owner where they officially reside.

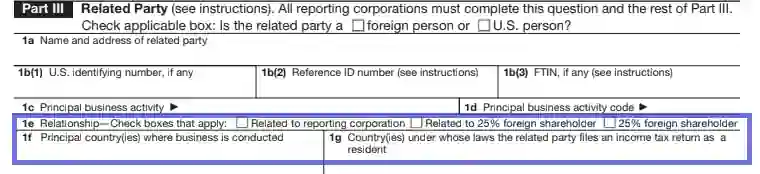

Part III

All RCs obligatorily complete Part III, even if the RP has been identified in Part II as a 25% foreign shareholder.

- Name the Related Party

Check whether the RP is a foreign person or a US resident and name them on line 1a. You have to provide their address herein as well.

- Enter ID Numbers

Input the US ID number on line 1b(1), if applicable. If the RP is a foreign person, their reference ID number has to be submitted on line 1b(2) in case no US ID number was provided in the previous field. Line 1b(3) must be filled out with an FTIN.

- Business Activity

Describe the RP’s main business activity and insert its PBA code afterward.

- Country (ies) Regulating Related Party’s Business Issues

Line 1e contains information about RP’s relationship with your business. Check the boxes that apply: related to RC, related to a 25% foreign shareholder, or is a 25% foreign shareholder. Write down the country(ies) where the business of the RP is being administered on line 1f. Name the country(ies) that are legally responsible for the RP’s income tax return.

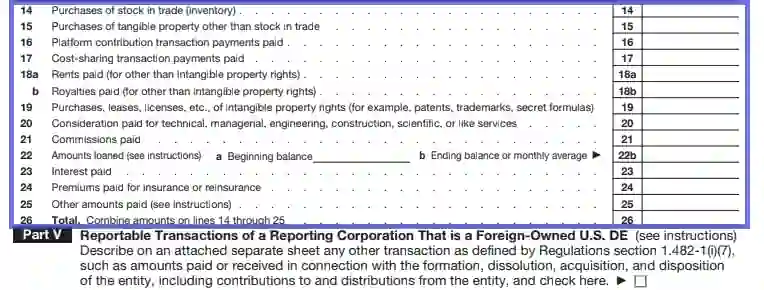

Part IV

Part IV must be filled out for the monetary issues with a foreign RP only. Generally, this part is divided into two smaller ones:

The first 13 lines are dedicated to the monetary funds you have got during the tax year.

Lines 14-26 are required to be completed with the data about the amounts you have paid.

Part V

Filers should check the box herein if they are a foreign-owned DE that had other sale and purchase issues not indicated in Part IV. Details about these transactions should be provided additionally.

Part VI

Part VI is not filled out for money-related issues with a US RP. For other RPs you are doing business with, describe nonmonetary and less-than-full consideration RT that occurred within a current tax year and attach it as a separate sheet.

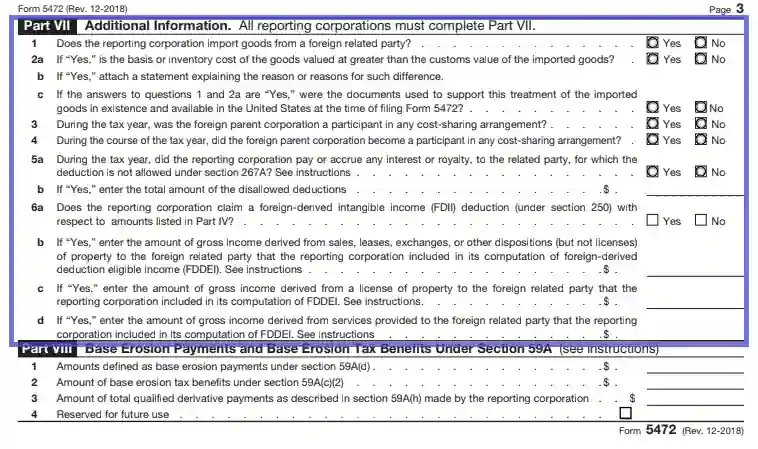

Part VII

Part VII is filled out by all RCs and contains additional information. Check corresponding boxes on lines 1-6a. Lines 6b-6d must be completed if you answered “Yes” to the question on line 6a.

Part VIII

Describe base erosion payments and tax benefits in this part.

The RC needs to input the base erosion payments on line 1. Those amounts that are considered BE tax benefits are represented on line 2. Filers submit the total qualified derivative expenses in US dollars on line 3. If any amounts are reserved for future use, indicate that in line 4.