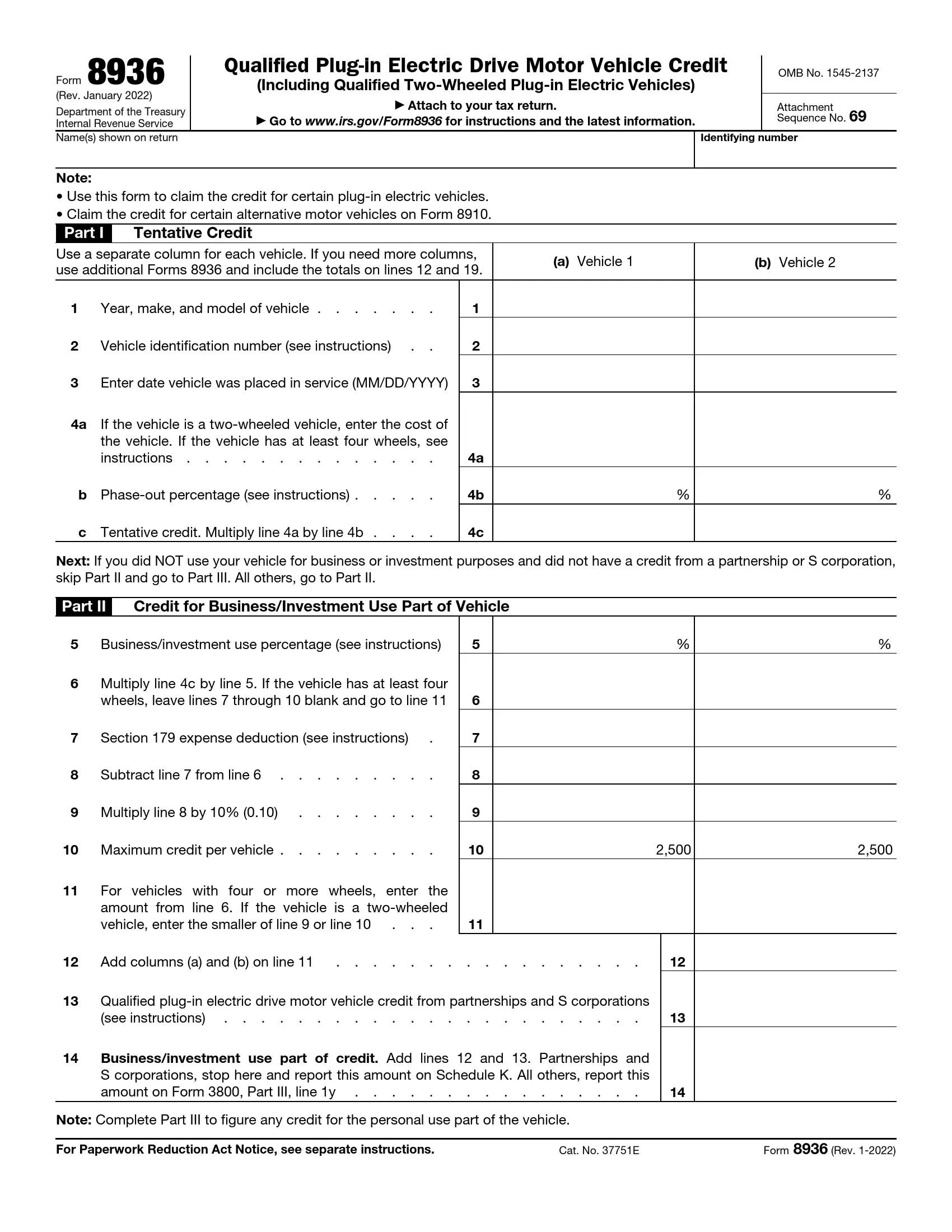

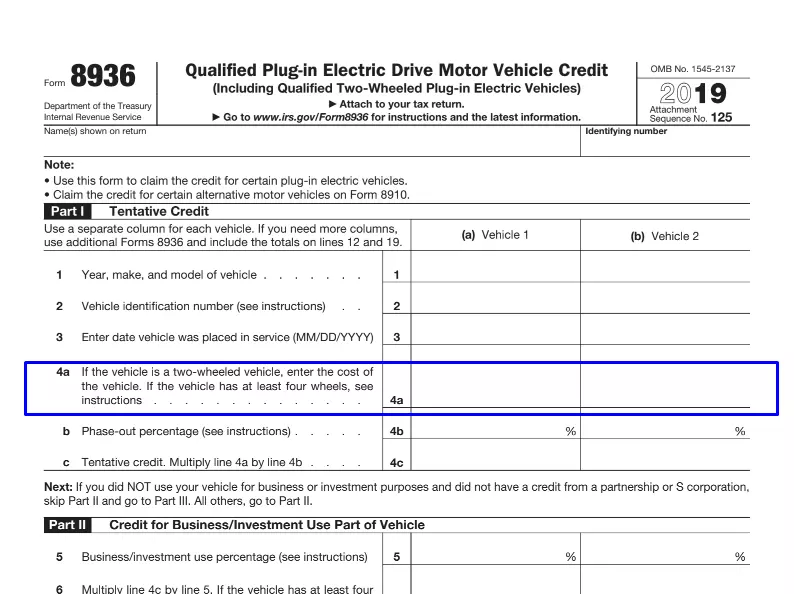

IRS Form 8936, titled “Qualified Plug-in Electric Drive Motor Vehicle Credit,” is a form taxpayers use to claim a tax credit for purchasing a qualified electric motor vehicle. This credit is part of an incentive program to encourage the adoption of environmentally friendly vehicles. It applies to vehicles equipped with a battery that powers the propulsion system and has a capacity of at least four-kilowatt hours. The form requires the following details to calculate the credit:

- Vehicle identification number (VIN),

- Date the vehicle was placed in service,

- Make, model, and year of the vehicle.

Taxpayers must also specify whether the vehicle is for business or personal use, as this affects the credit calculation. Form 8936 helps determine the credit amount, which can significantly reduce the taxpayer’s owed federal income tax, depending on the battery capacity and other qualifications of the electric vehicle.

Other IRS Forms for Corporations

There is a big number of official documents developed for US citizens by the IRS. Make sure to learn other forms you might need to file with the Service.

How to Fill out Form 3800

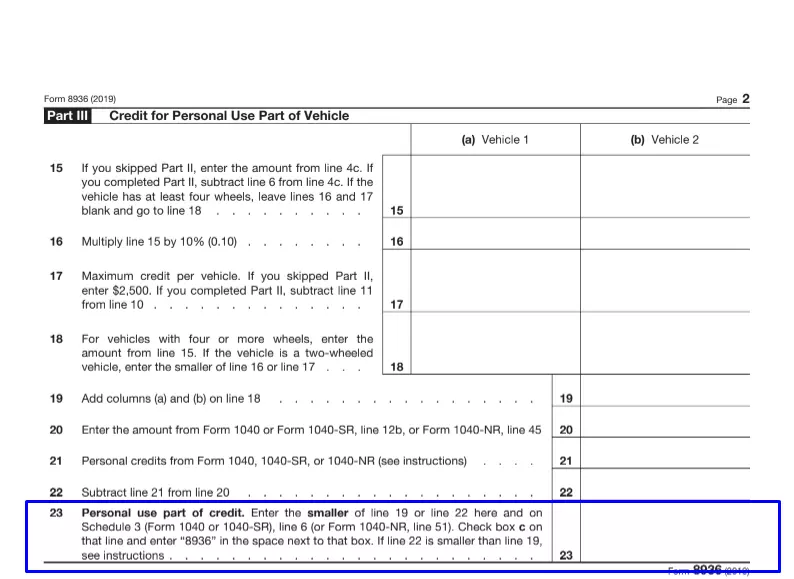

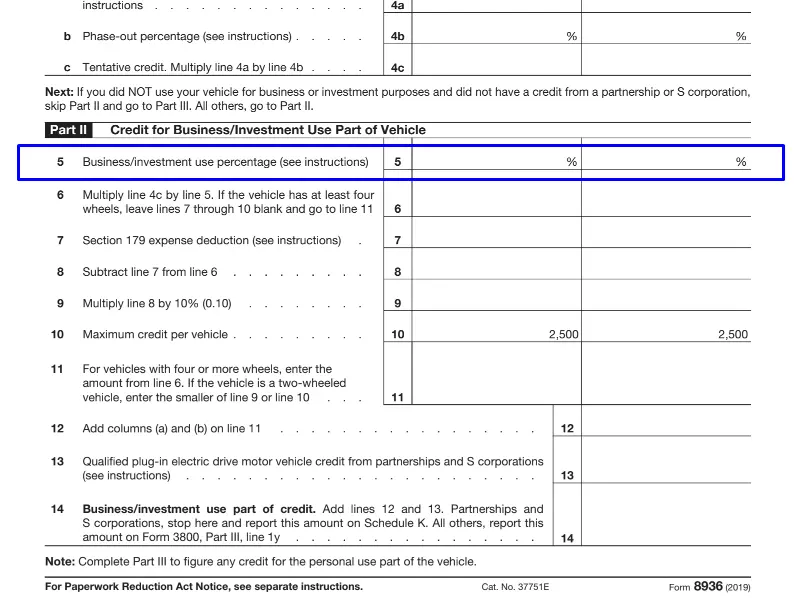

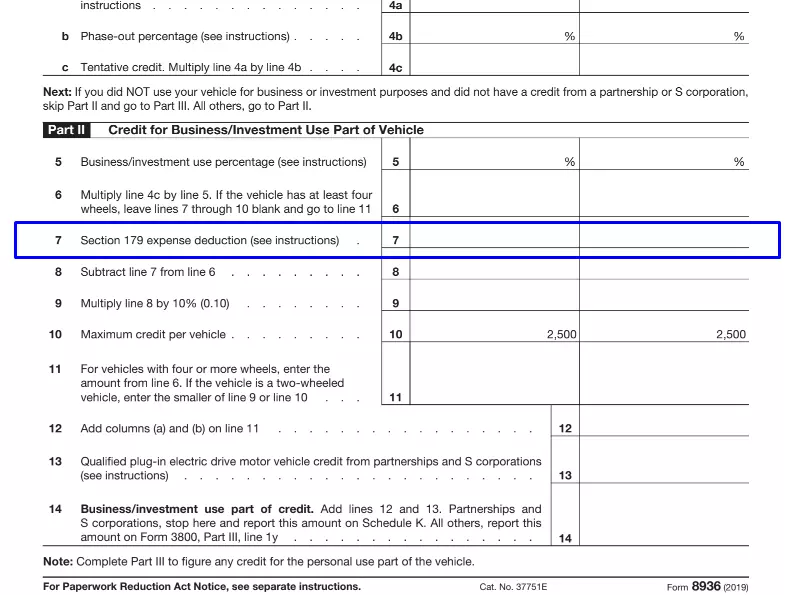

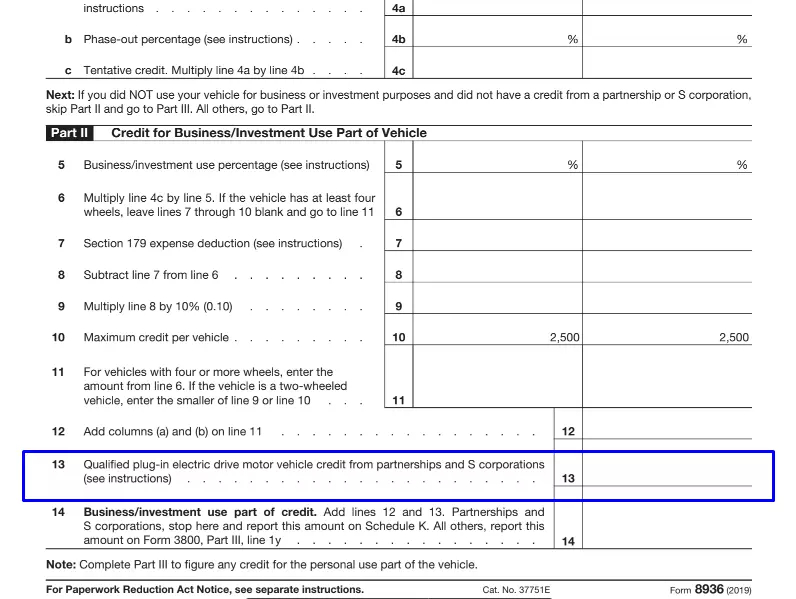

The form contains three parts according to three types of credits. Not all taxpayers are obliged to fill out all sections of the documents. After the first part, pay attention to the line, which says that you must not continue filling out the form if you do not use the car for entrepreneurship or your credit sources exclude S-corporations and partnerships.

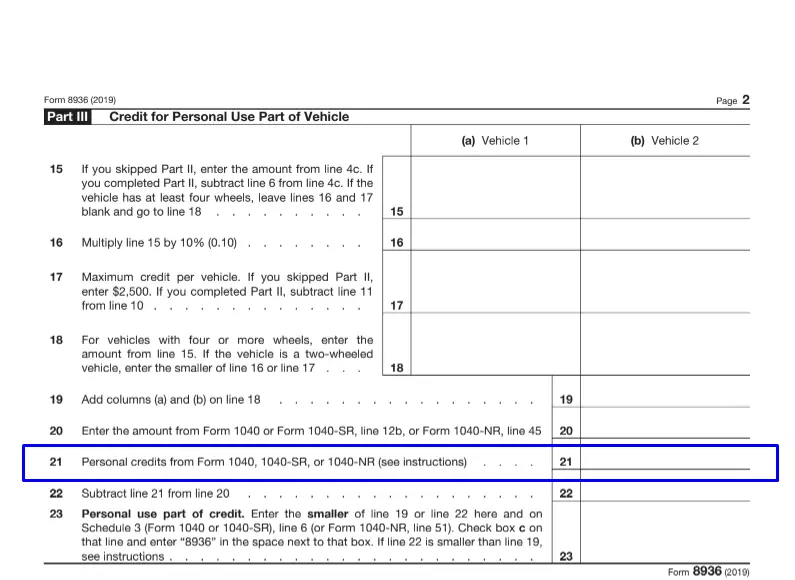

After the second section, it is stated that the third part is compiled for reporting the private use of an electric vehicle. Read the instructions carefully and follow them not to fill out the information that does not refer to your particular case.

Complete the First Part

You should write down the vehicle’s identification number in the second line. To find it, go through the related documents (such as proof of insurance or registration). Look for the number which contains 17 signs (both letters and numbers).

The information that you fill out on the fourth line (section a) depends on the type of vehicle. If it is a two-wheeled one, simply write down its price as in the first line. If it is a four-wheel one, fill out the credit allowable for the year, as well as the model and make of the vehicle.

In line 4b (phase-out percentage), you should write down 100% in all cases except for the vehicles produced by General Motors or Tesla. Pay attention to the fact that the credit is no longer provided for the transport from these companies, which were purchased after March 31, 2020, for General Motors and December 31, 2019, for Tesla.

Therefore, if you provide information on a General Motors car, enter 25% if it was bought during the period from September 30, 2019, to April 1, 2020. Write down 0% if you purchased a vehicle after March 31, 2020. If you are an owner of Tesla, fill out the line with 25% for vehicles bought during the period from June 30, 2019, to January 1, 2020. Enter 0% if you made a purchase after December 31, 2019.

Move on to the Second Part (If Needed)

On the fifth line, write down the percentage of investment or entrepreneurship usage. 100% should be written if you use your car or a motorcycle exclusively for these purposes or if you sell them. If you use personal transport both for earning money and your private life you have to do some calculations.

Divide the car mileage number (only when the reason for using a car was entrepreneurship) by the overall mileage (how many miles a vehicle is driven in general). If the main cause for using a car has changed during the year, figure out the percentages for particular months. Then divide this sum by twelve.

On the seventh line, write down a section 179 expense deduction that you have claimed for your personal electric two- or four-wheel transport (see form 4562, the first part).

Fill out the credit source data in line 19. Remember that they should include S-corporations and partnerships. They report the sum on this line only, while others also have to write down a separate credit in the document’s parts above and on this line. Those who have not been figuring out credit on previous lines can write down the information in the third part of form 3800 (look for line 1y).

Fill out the Third Part of the Form

On line 21, a taxpayer must write down the general amount of credits from forms 1040, 5695, and 8910;

After completing all required lines in the form, pay attention to the fact that the personal part of the credit sum which has not been used is lost. In addition, a taxpayer cannot carry it back or forward it to the other tax years.