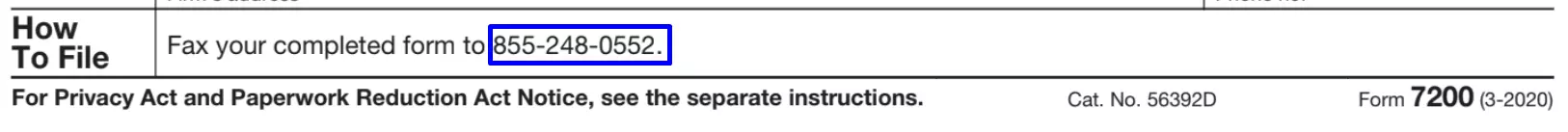

IRS Form 7200 is a tax document used by eligible employers to request an advance payment of the tax credits for qualified sick and family leave wages and the employee retention credit. It was introduced as part of the COVID-19 relief measures to provide financial assistance to businesses affected by the pandemic. The form allows employers to request an advance payment of tax credits they expect to claim on their quarterly employment tax returns. It provides much-needed cash flow to help cover the costs of providing paid leave to employees or retaining employees during periods of economic uncertainty. Information provided on Form 7200 includes:

- The employer’s name, address, and Employer Identification Number (EIN),

- Details about the tax credits for which the advance payment is being requested,

- The anticipated amount of the tax credits,

Certification that the employer is eligible to claim the tax credits under the relevant provisions of the Internal Revenue Code.

By completing Form 7200, eligible employers can request advance payments of tax credits to help offset the costs of providing paid leave to employees affected by COVID-19 or retaining employees during challenging economic conditions.

Other IRS Forms for Business

Along with the Form 7200, there are some other IRS forms small businesses need to properly file with the IRS. Check whether you are aware of all the forms you need to prepare.

How to Fill Out Form 7200

The structure of the form includes three parts, namely the header field, Part I, and Part II. Let us analyze all the parts and elements steadily to understand the purpose of each item of the Form.

The Form can be completed in several steps:

Fill out the Header Field

In the top area of the document, fill in your personal data (the name and address of the filler) and indicate the employer ID.

Also, specify whether the third-party payer is involved. This may be an agent or another intermediary organization. Information about this must be provided on the last line in the Form header.

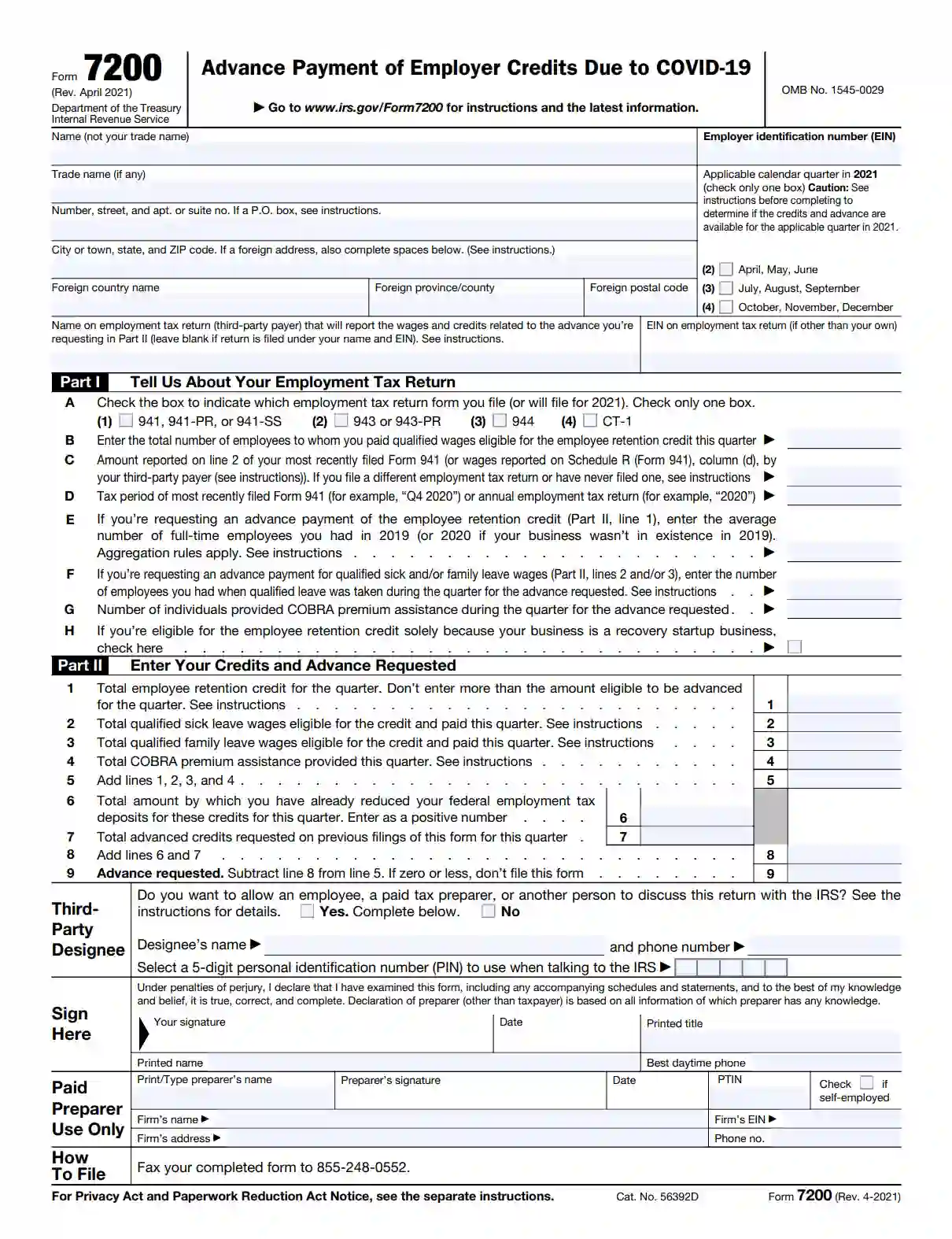

Fill out Part I

This section discloses information about the company. Be prepared to provide the date of the type of employment tax return, the amount, and the number of employees of your business.

In this part, you must check the boxes or specify a number. You can do this on a printed form or use our online constructor to create IRS forms.

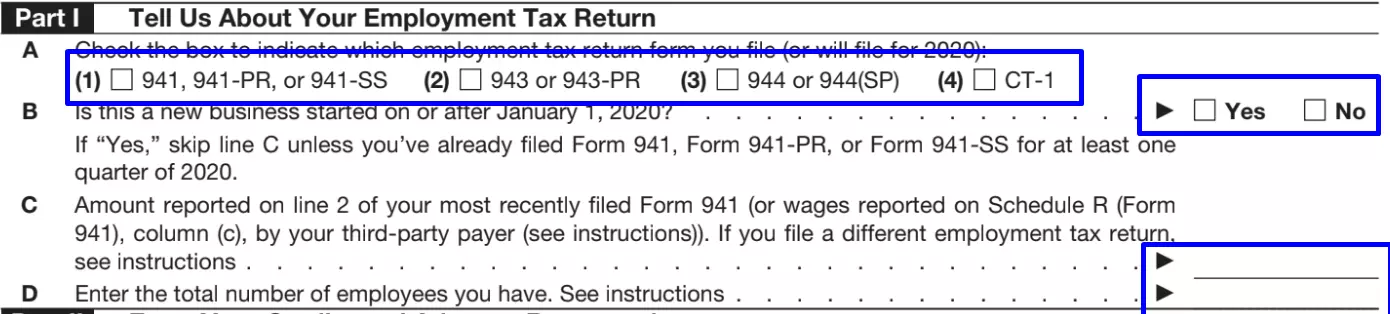

Fill out Part II

This part of the Form contains the details of the data. Filling it in requires preparation, namely, studying the previous date and making some calculations of the amounts.

Please pay attention to all the lines highlighted in the screenshot area. More information to fill in is provided by the official instructions to the form so that the filler can refer to the explanations of the IRS specialists.

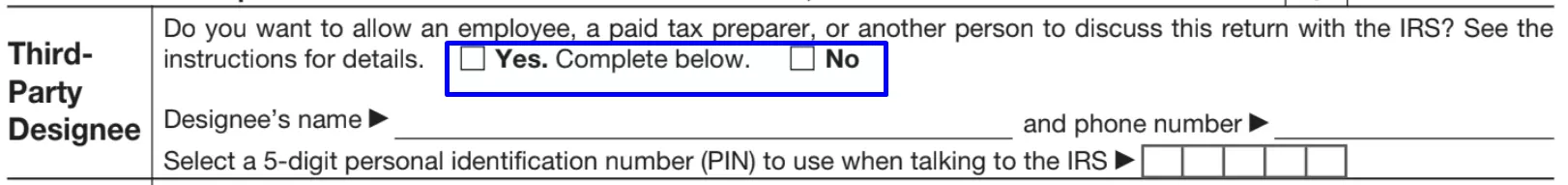

Involve third parties.

In this section, select “yes” if you need a consultation with an IRS specialist and you want to discuss a refund by phone. Select “no” if you do not need it.

If you select “yes,” fill in the remaining lines of the section.

Sign and certify

The last section is intended for signing and certification. Please put your signature and date at the top (highlighted in the screenshot) and leave the bottom part blank.

The lower part is filled in by the taxpayer’s agent or paid preparer. The paid preparer signs the document and provides the appropriate date on their lines. Then they provide a copy of Form 7200 to the filler who submits it to the IRS.

Fille the paperwork

After certification by the agent, send a copy of the Form by fax to the number indicated at the bottom of the document.