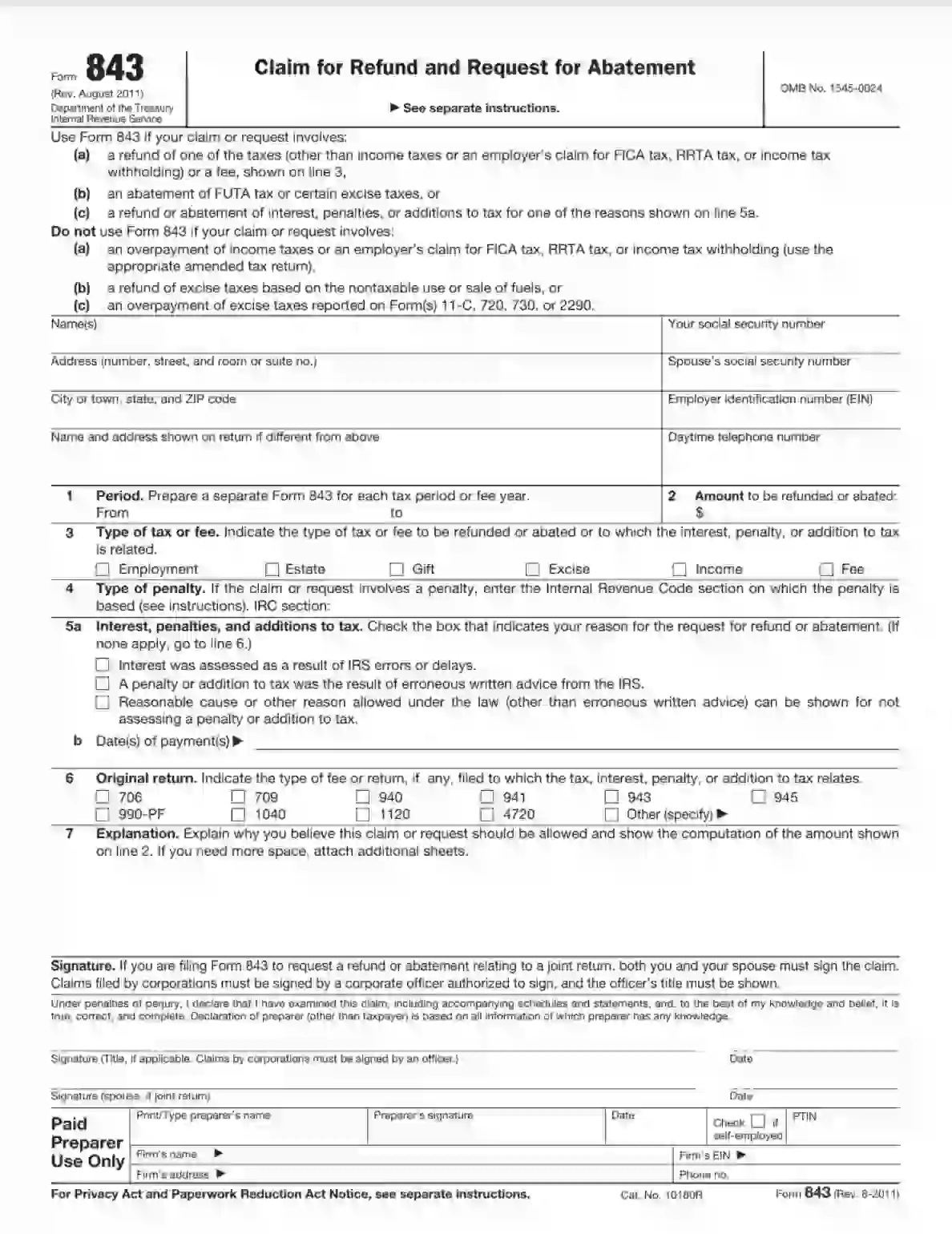

IRS Form 843, titled “Claim for Refund and Request for Abatement,” is a tax form taxpayers use to request a refund or abatement of certain types of taxes, penalties, interest, or other amounts paid to the Internal Revenue Service (IRS). This form is typically utilized when taxpayers believe they have overpaid their taxes or have been assessed penalties or interest that they believe should be waived due to reasonable cause.

The purpose of Form 843 is to provide taxpayers with a formal avenue to request relief from certain tax-related liabilities. By completing this form and providing supporting documentation, taxpayers can seek refunds or reductions in their tax liabilities. This form covers various situations where taxpayers may be entitled to relief, including errors made by the IRS, statutory limitations, or extraordinary circumstances beyond the taxpayer’s control. Form 843 allows taxpayers to address issues of fairness and equity in the tax system and ensures they have recourse to seek relief from undue financial burdens imposed by the IRS.

How to Fill Out the Form

When completing forms issued by the Service, you always have two options: either fill them out by yourself or hire someone who will do it for you. Using the second option saves you time but requires paying a wage to the document preparer. However, this option ensures that you will submit the correct form, which will most likely be accepted by the public authority right away. So, if possible, we advise you to get professional help.

If you want to deal with the form on your own, do not worry: it is quite adequate, and you will need to fill out only one page. The Service also provides helpful guidelines to each form, and the 843 Form has its guide as well, so you can use an informative manual not only from us but from the institution directly. Open it and have it at hand when you start to fill out the template.

The last thing you should do before filling out is to get the form’s right version. The Service updates certain forms on its site; we, in turn, also provide you with the current templates. You can use our smart form-building software to get the required form in a blink of an eye, IRS Form 843 included.

Try it, download the file, and see our quick guide below. Note that if the form is made on behalf of an organization, an officer should complete and sign it.

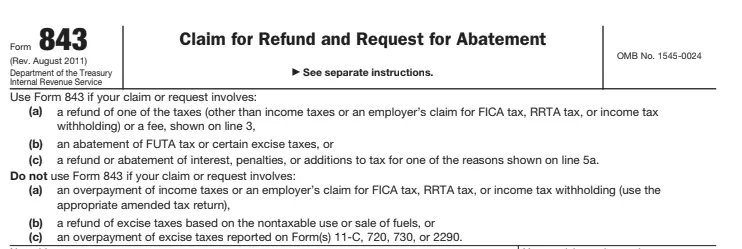

Read the Initial Statement

The Service wants you to define if this form fits your needs before you complete it. So, under the heading, you will find a set of statements you should read to understand whether you should continue or not.

There are three reasons why you must use this template and three reasons why you must not. Read them all and either stop working on the form or proceed to the completion.

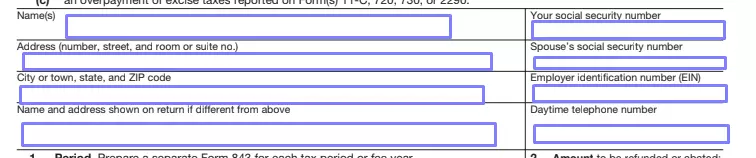

Identify Yourself

To accept your claim, the Service should understand who is sending it. You must provide your full name, social security number (SSN), address, the spouse’s SSN (if you have a spouse), EIN (employer identification number), and a phone number at which you are available during working hours.

If your name and address here differ from those, you have indicated in your tax return, write the details you used before in the designated line.

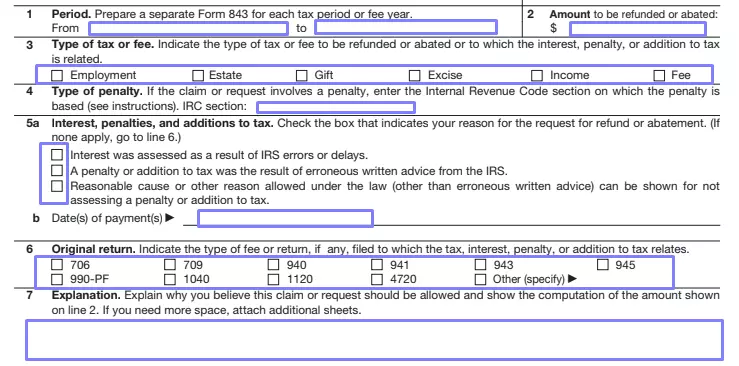

Describe Your Claim

You have to provide details about the amount you want to get back. Write the period during which you have probably overpaid. Indicate the sum in US dollars you are asking for a refund for. Pick the tax type from the suggested options (estate, employment, income, fee, excise, or gift).

If your claim presumes you had been subject to any penalties, use the IRS Code to define sections where your penalties are described. Check the Service’s instructions additionally. Enter the relevant section.

Choose the reason why this document will be filed. If all reasons are irrelevant, you can skip this section and proceed to the next one. If you see a suitable reason, mark it and add the date (or dates) of payment (or payments).

In the next section, select the fee or return type (you will see ten options and will be able to include “other” types, too). Then, give a thorough explanation proving that you can have this refund and provide calculations showing that you should get the stated sum (not less, not more). You can attach an additional sheet if there is a lack of space to describe all things fully.

Sign and Date the Document

Leave your signature (and title, if applicable) at the bottom of the form. Write the current date nearby. If you and your spouse submit the form together, your spouse must add their signature under yours and write the date as well (near their signature).

If you have hired a specialist who prepares the form for you, they will also sign the form below, adding their name, signature, date, tax number, and various details about the entity where they work (if any).