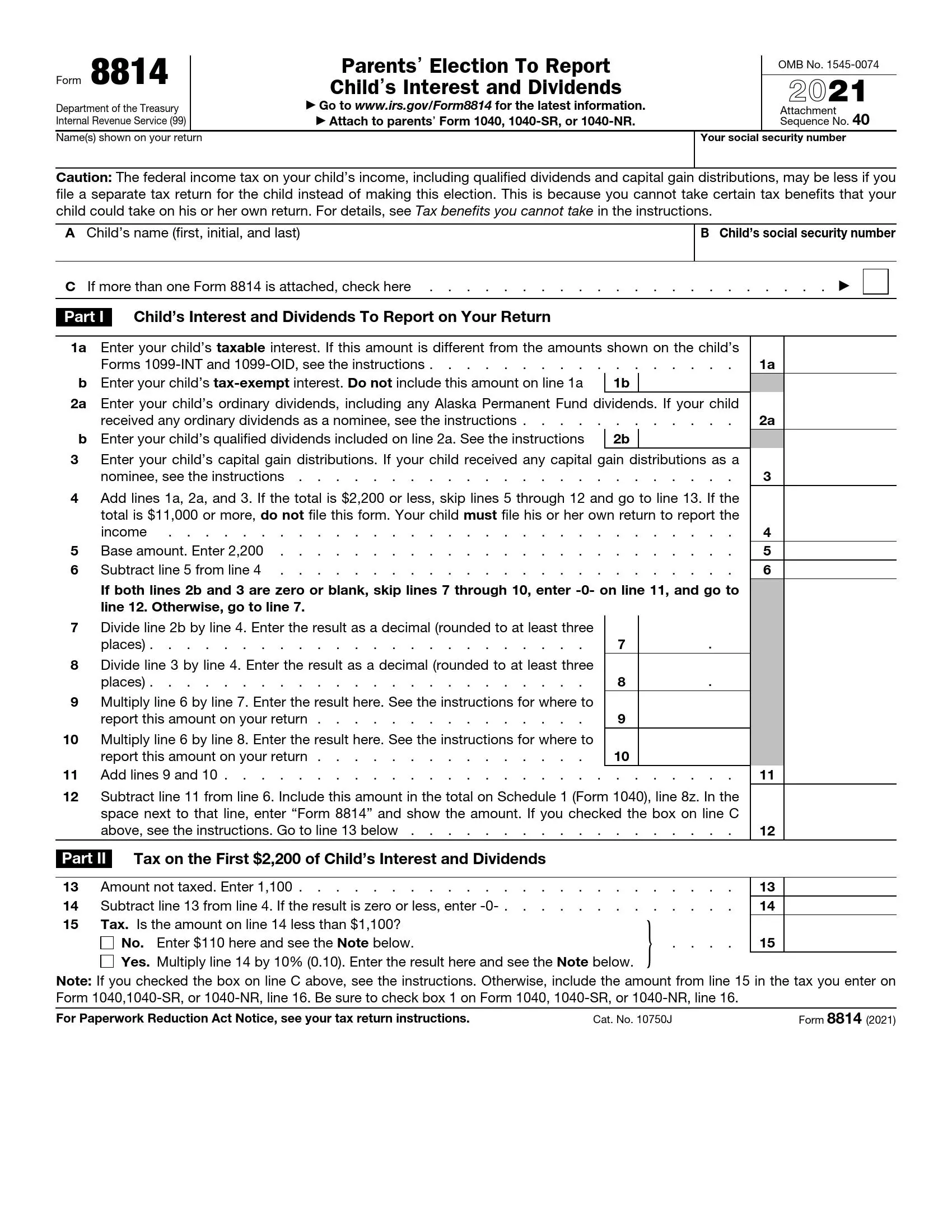

Form 8814 is a form parents use to report their child’s investment income on their tax returns rather than filing a separate return for the child. This form is applicable when a child’s income includes interest and dividends, and the total is less than a certain amount specified by the IRS for the tax year. Using Form 8814 simplifies the filing process and can be beneficial in cases where the child’s income is not substantial.

The purpose of Form 8814 is to allow parents to include their child’s investment income on their tax return if it meets the criteria, including being under 19 or 24 if a full-time student and having income only from interest and dividends. This option can be more convenient and potentially reduce tax preparation costs. However, it might result in a higher tax rate on this income, as it is added to the parent’s income and taxed at their rate. Parents should evaluate whether this form is advantageous based on their tax situation.

How To Fill Out IRS Form 8814

As a parent, you should fill out IRS Form 8814 and attach it to your tax return on proper dates. If you have more than one child and want to report the income of two or more children, you should fill out separate papers for each child.

Here we will describe the step-by-step procedure of filling out IRS Form 8814. If you have any misunderstandings about some lines, you can use our software that will fill in everything for you.

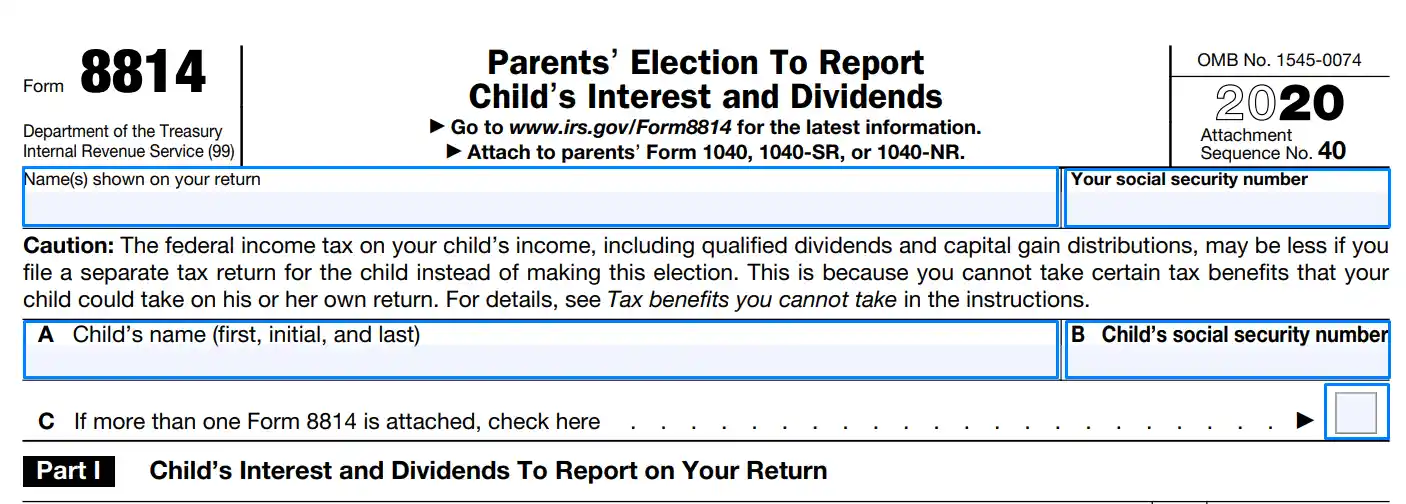

Introduce yourself and your child

You need to enter your full name and social security number on the top of the form. If you have joint returns, you should write in the name of both parents but identify SSN only for one parent. It should be the SSN of the person whose SSN is the first in the tax return. Repeat the same actions for your child. If you are going to complete more than one Form 8814, put the checkmark in the box near field C.

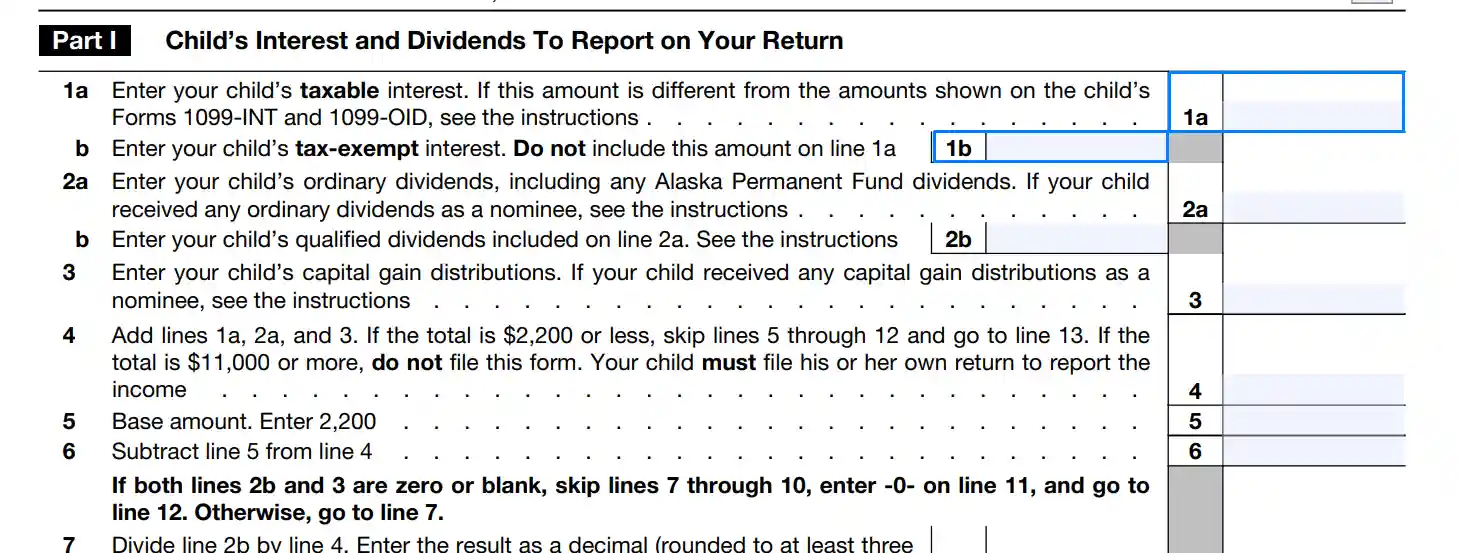

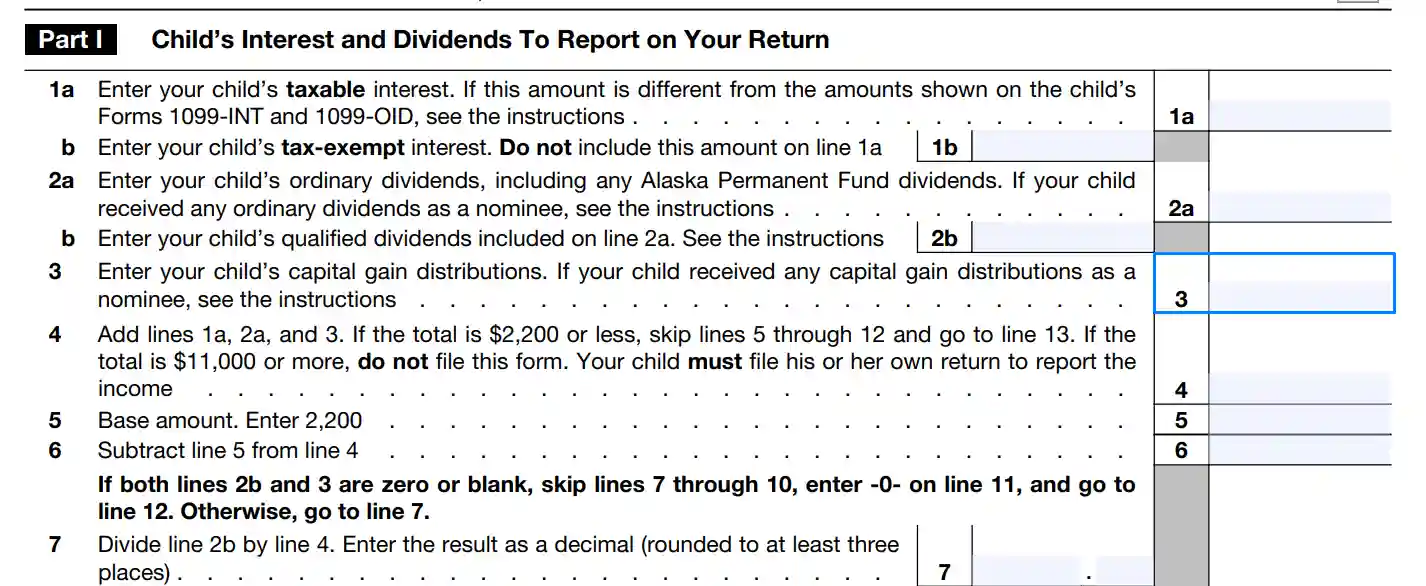

Describe child’s interest

Use lines 1a and 1b to clarify the amount your child earned from interests. Do not include nontaxable income in line 1a — enter it in line 1b.

If a child earned something as a nominee, you should write “ND” in line 1a near to the amount of income.

If the income consists of acquired interests, ABP (amortizable bond premium” or OID (original issue discount), highlight it on the dotted lines in 1a.

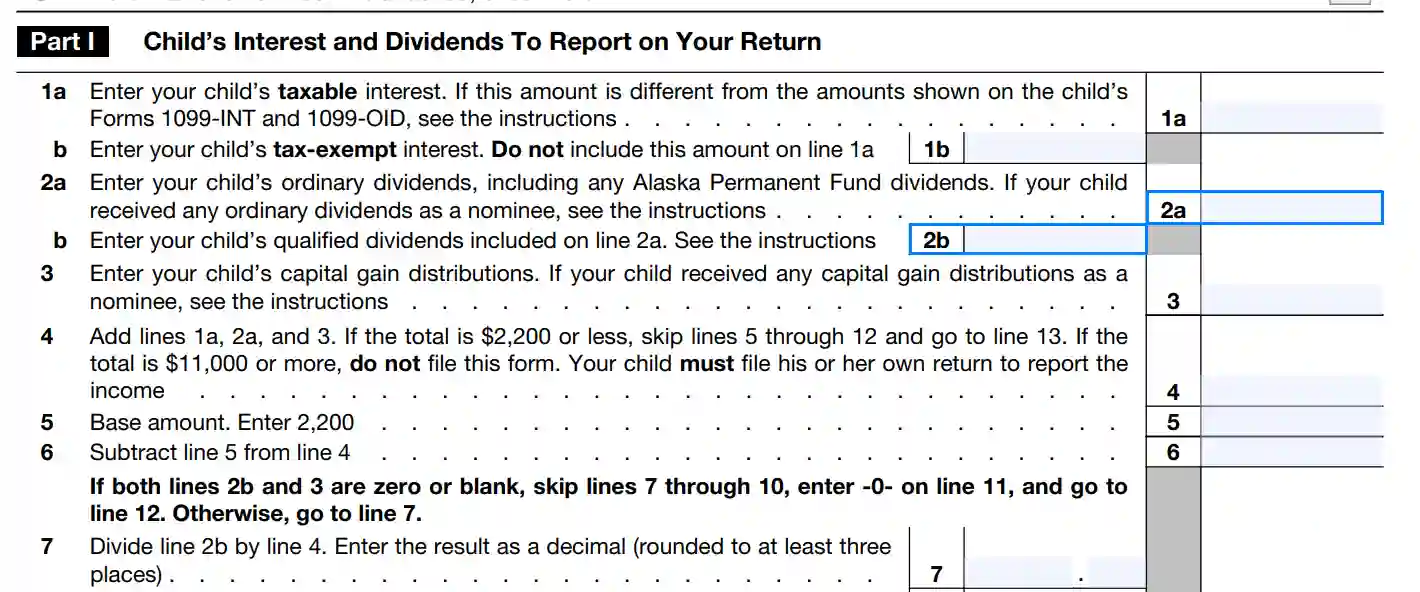

Provide data about dividends

Include the amount your child earned from dividends in line 2a. If dividends were received as a nominee distribution, write “ND” in line 2a.

Also, fill line 2b with the amount your child got from qualified dividends.

Enter the capital gain distribution

Put the amount your child received from capital gain distribution in line 3. In the case with a nominee distribution, follow the similar to previous boxes procedure.

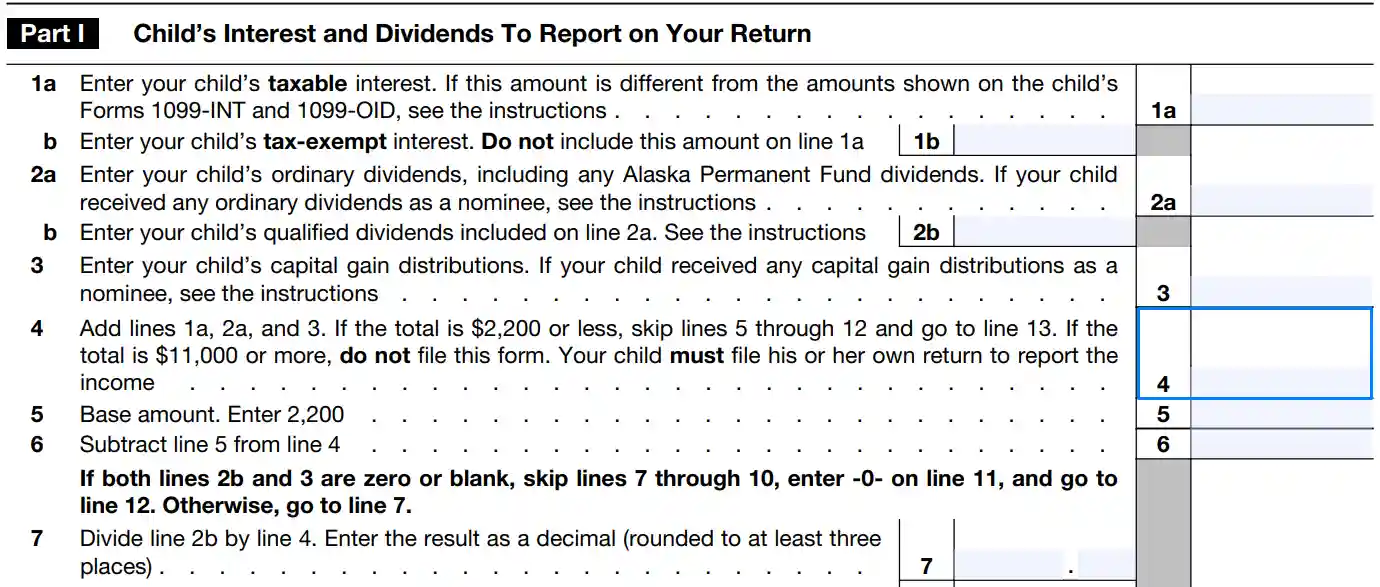

Summarize income

Calculate the sum of values in lines 1a, 2a, and 3 and fill it in line 4. Make sure the number is not greater than $11,000 because if it is the case, children should have their tax return. Also, pay attention to the amount because if it is equal to or less than $2,200, you can move further to line 13, skipping lines 5-12.

Make several computations

Firstly, you need to clarify whether you need to complete lines 5-12 or not based on the explanation above.

Secondly, you should write in 2,200 in line 5 — it is a base amount.

Then, you need to subtract the value in line 5 from line 4 and put the result in line 6.

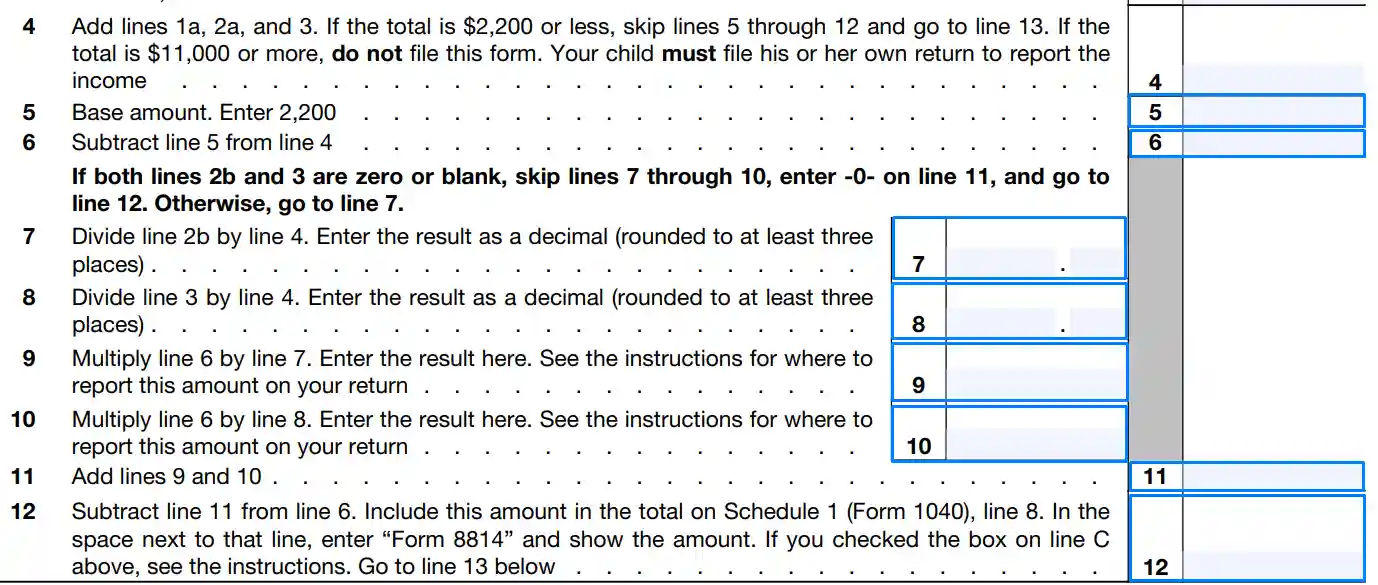

After that, you should complete lines 7-10 only if you have empty boxes in lines 2b and 3.

If you need to fill out these lines, you should follow these steps:

- Divide value in line 2b by line 4 and put the rounded to three digits result in line 7.

- Divide the number in line 3 by line 4 and enter rounded to three digits result in line 8.

- Multiply results of lines 6 and 7 and enter the number in line 9.

- Multiply numbers in lines 6 and 8 and put the result in line 10.

If you have completed lines 7-10 you should put the sum of lines 9 and 10 in line 11. If not, you should enter zero here.

To fill out the final line in this part you must subtract the value of line 11 from the value of line 6 and enter the result in line 12. When you are filing several forms 8814, you need to enter numbers from the 12th line of every paper in Form 1040.

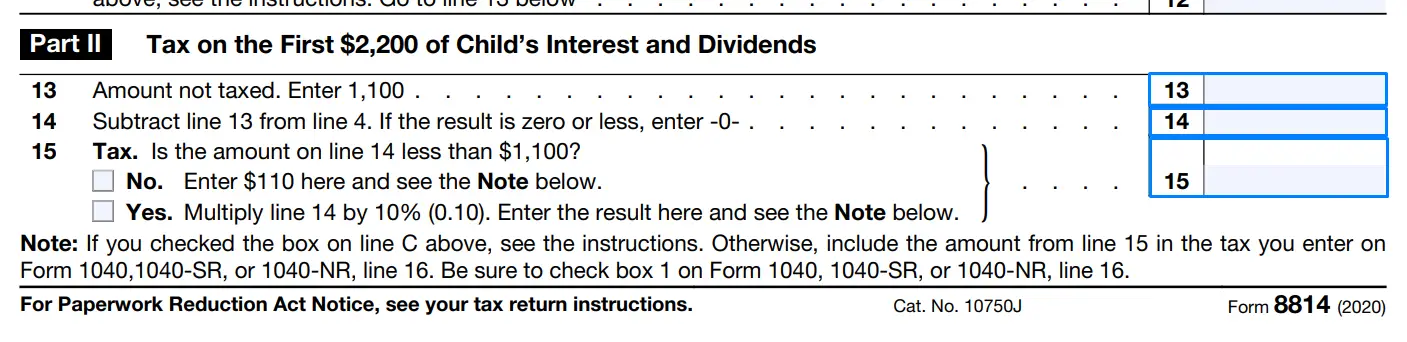

Identify taxation amount for the first $2,200 of child’s income

Put value 1,100 in line 13 — it is an untaxable part of income.

After that, subtract the value in line 13 from the value in line 4 and enter it in line 14. If it is equal to zero or negative, put zero here.

If the result in line 14 is less than $1,100, you should put 110 in line 15. It means that the final taxation amount for this part will be equal to $110.

If line 14 is greater than $1,100, you should multiple it by 0.10 and put the result in line 15.

Read the note below carefully, and do not forget to fill the final amount in your Form 1040, line 16. If you complete forms for more than one child, you should summarize amounts in line 15 from all forms and put the sum in line 16 of Form 1040.

When you have finished filling out this form, you should check the correctness of all the given information, copy some values into your tax return, and attach file Form 8814 with your main tax return.