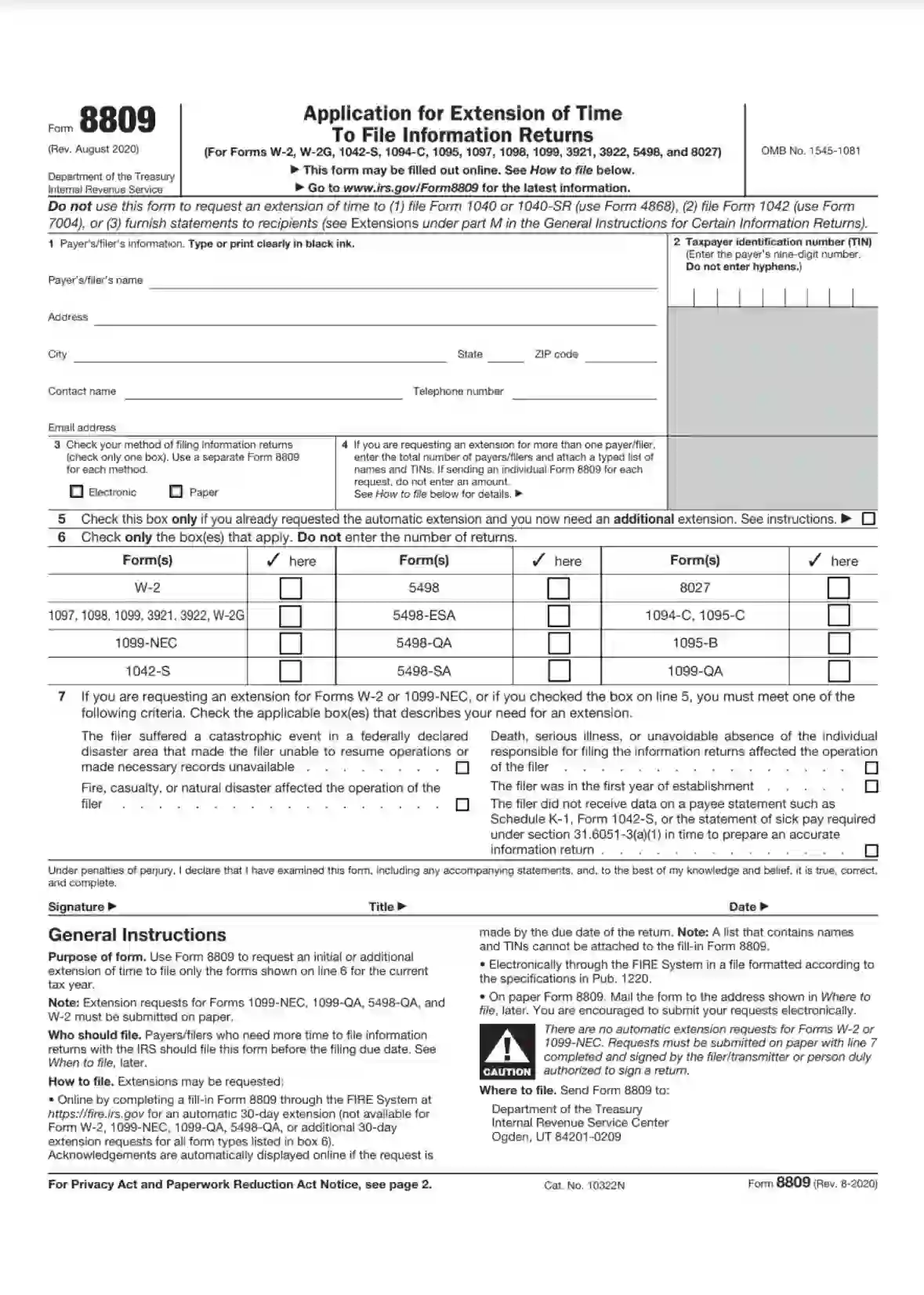

IRS Form 8809, titled “Application for Extension of Time to File Information Returns,” is a tax form businesses and other entities use to request an extension of time to file certain information returns with the Internal Revenue Service (IRS). Information returns include forms such as W-2, 1099, 1098, and others used to report payments made to individuals and entities during the tax year.

The main purpose of Form 8809 is to provide taxpayers with additional time to compile and submit their information returns to the IRS. Businesses and entities can request an automatic 30-day extension to file their information returns by completing and submitting this form. This extension can be helpful for organizations that need more time to gather the necessary information or resolve any issues that may arise during the preparation process.

How to Fill Out IRS Form 8809

The filers are welcome to use our advanced template-building software to generate and fill in the required PDF form online. Also, you can visit the IRS site and download the needed document. Follow the guide below to learn the specifics of how to complete and file the referenced application.

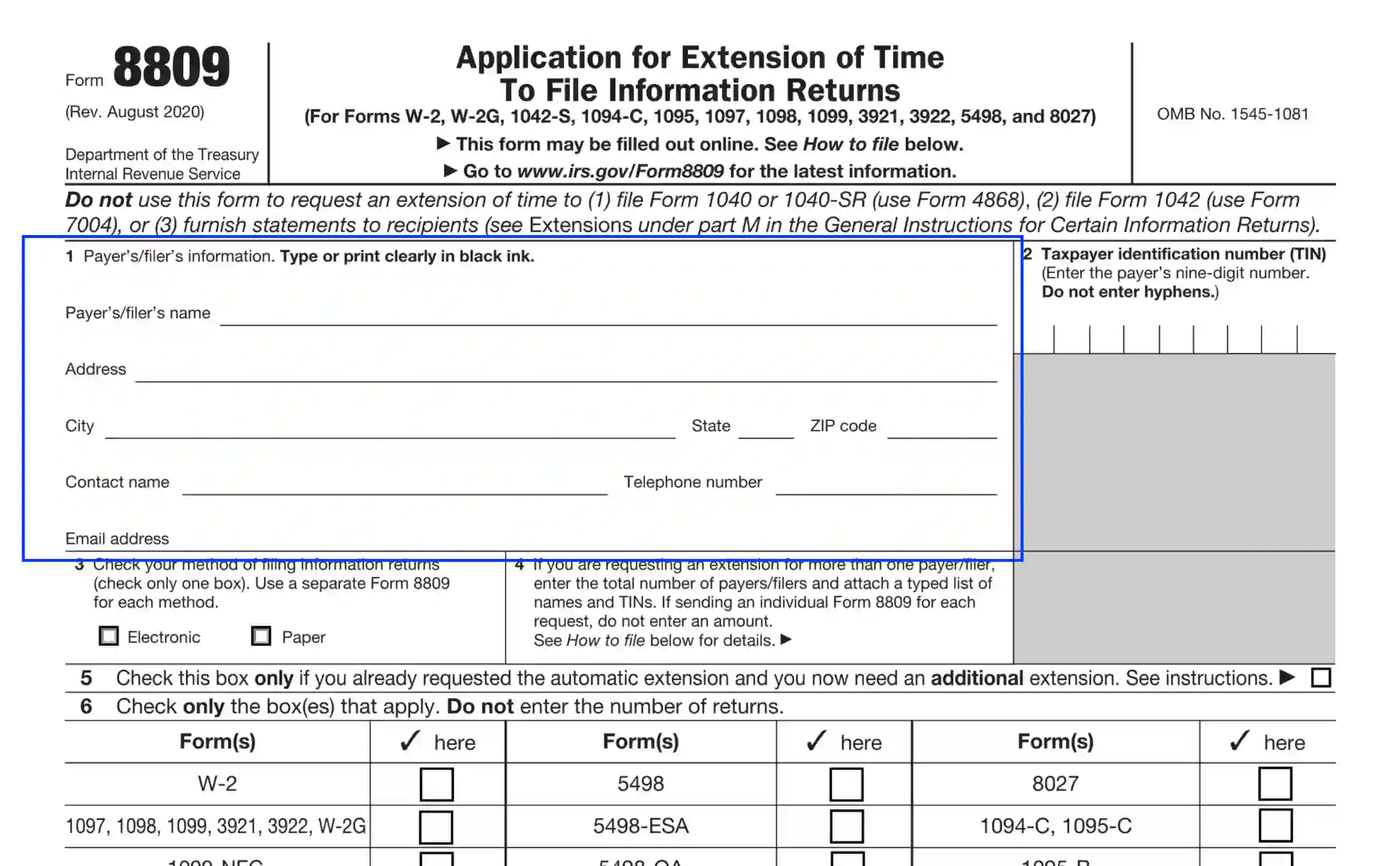

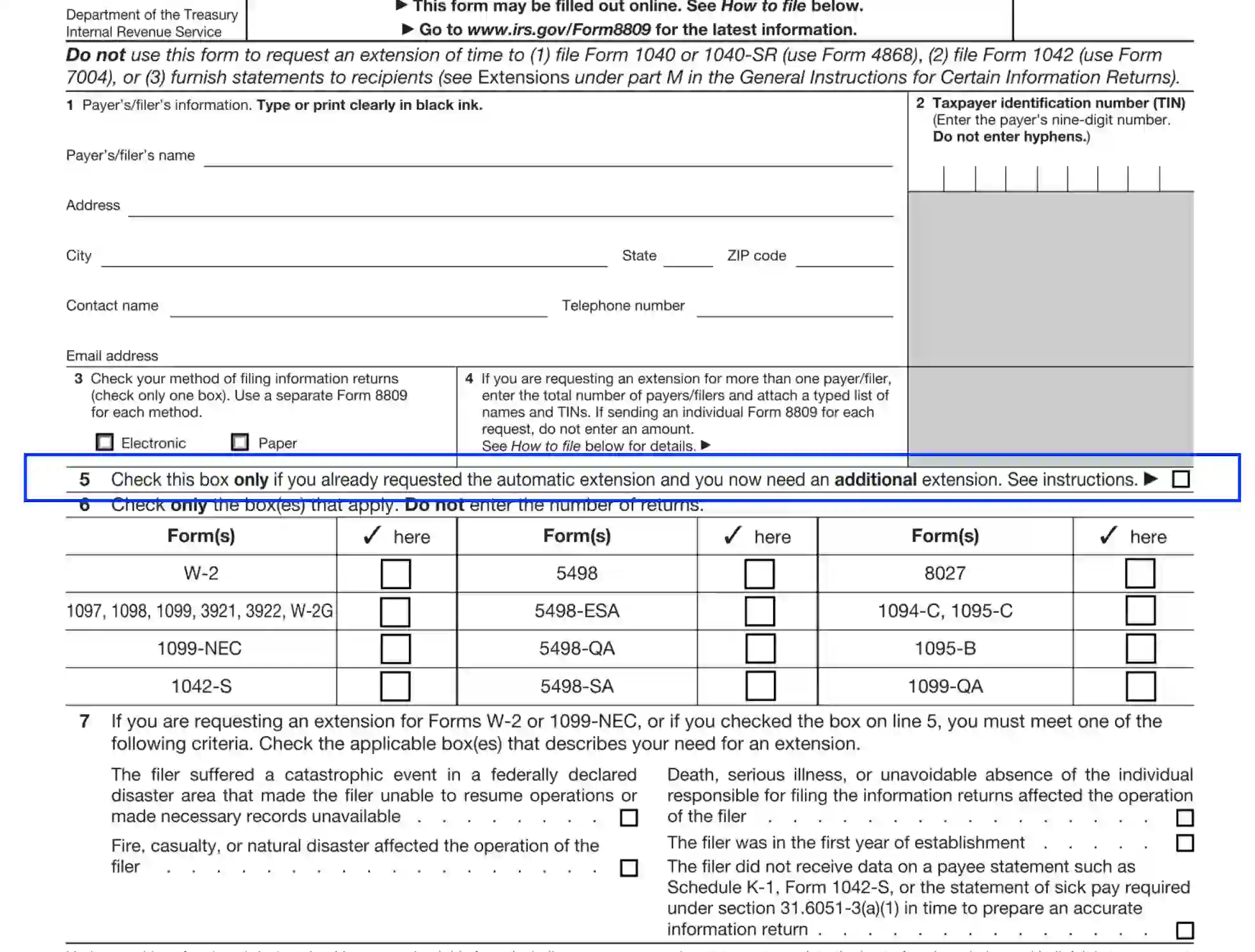

Identify the Preparer

In Unit 1, the preparer should introduce themselves and disclose the ID info as follows:

- Payer’s (or the authorized preparer’s) legal name

- Apartment (unit) number and street, city, state (region), and ZIP code details. It is recommended to use the mailing address for the correspondence.

- Contact name — enter the recipient’s full name if the template is filled out by an invited preparer.

- Payer’s contact phone number

- Email address

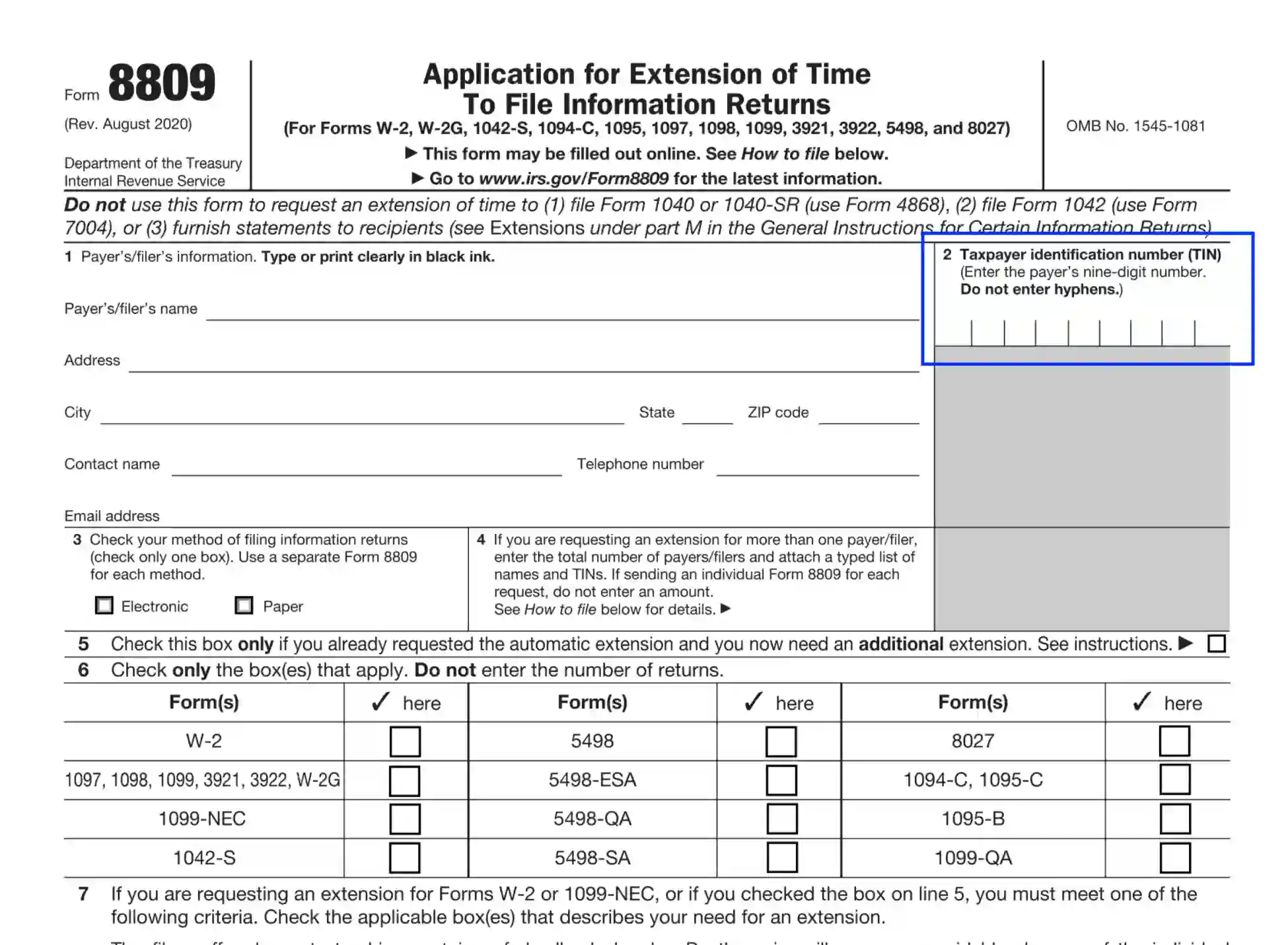

Disclose the Tax Identification

In Unit 2, the preparer needs to enter the taxpayer ID number. Use the nine characters of TIN avoiding the hyphens. It is vital to submit the name as indicated when applying for the EIN and TIN. If the taxpayer has changed the name, the adjustments must be declared at the IRS. If all the necessary actions are executed, disclose the current personal data for the taxpayer ID number.

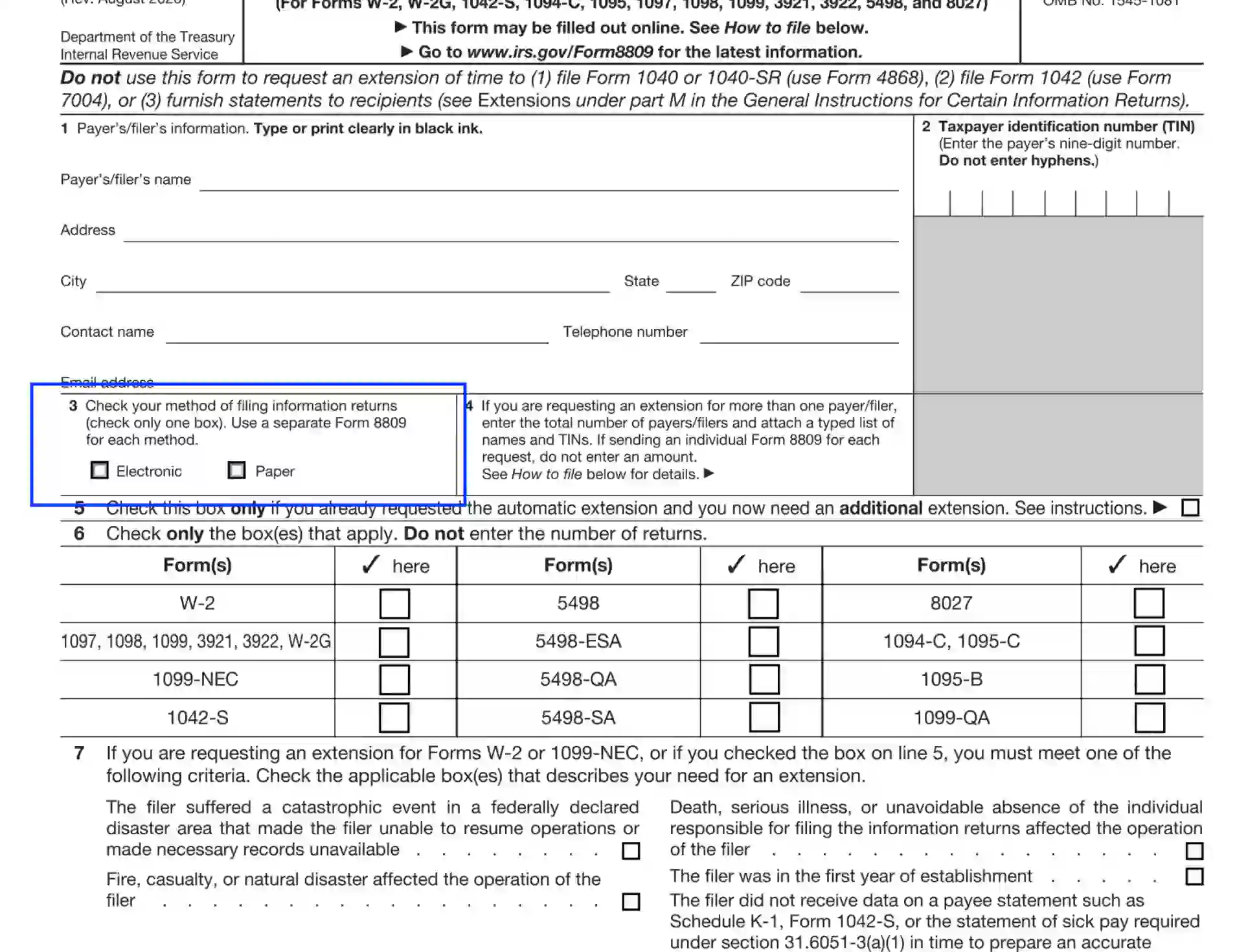

Specify the Preferred Method to Submit the Data

In Unit 3, the preparer should indicate how they prefer to report the form. It is allowed to submit the data online or use the traditional way and send the paper exemplar. You are empowered to check only one alternative.

Determine the Number of Taxpayers

If you are an invited preparer and apply for an extension for several payers, you need to specify the exact number and attach a full list of individuals to file with the referenced form. Enter each person’s legal name and TIN details. However, if you decide to prepare each extension request separately, do not enter the number of payers in Unit 4.

Claim the Extra Extension Requests (If Applicable)

In Unit 5, the preparer should specify if the taxpayer has already been granted a 30-day default extension. In this case, the claimant needs to check the box if they decide to request extra time to complete and serve the necessary return forms. The application must be mandatorily executed and filed on paper. Also, if the preparer ticks off the section, they must fill out Unit 7.

Still, if the 8809 form appears to be the initial Extension of Time request, do not tick off Unit 5 and proceed to complete further data.

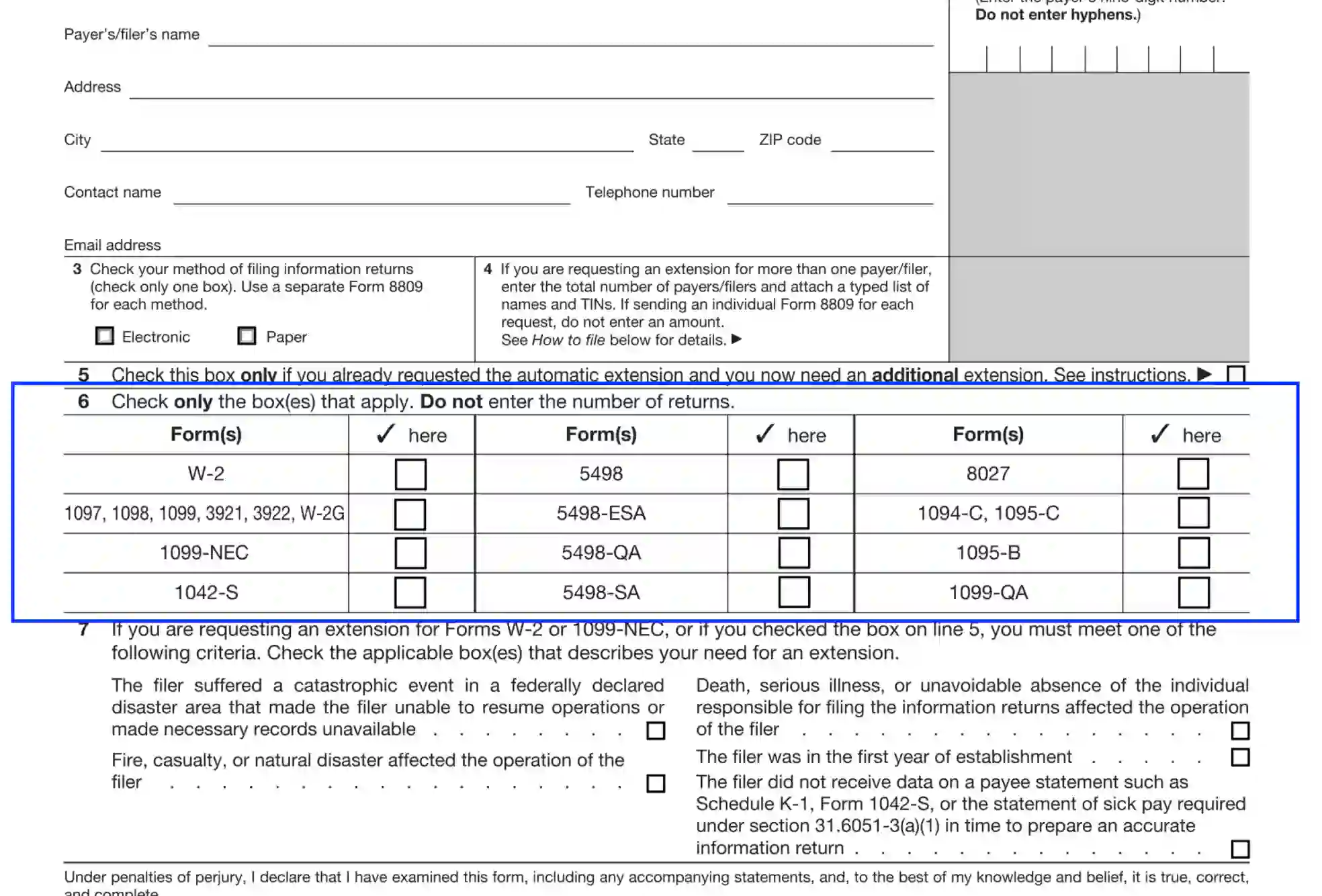

List the Return Form You Are Claiming the Extension of Time Request

In Unit 6, the claimant should clarify and select the return forms for which they are applying for the time extension. Here, you are expected to check the corresponding box. Do not point out the number of forms selected.

It is vital to understand that each type of tax return should be delivered to the IRS by the due date. Also, each form has its deadline. Therefore, make sure to comply with the requirement and apply for an extension of time prior to the earliest deadline if you list several return forms in Unit 6. Otherwise, the taxpayer will be banned from getting the time extension privilege.

One of the solutions to avoid such an unfavorable situation is to file application form 8809 separately for each return disclosure. Below is the table of the due date for various forms listed.

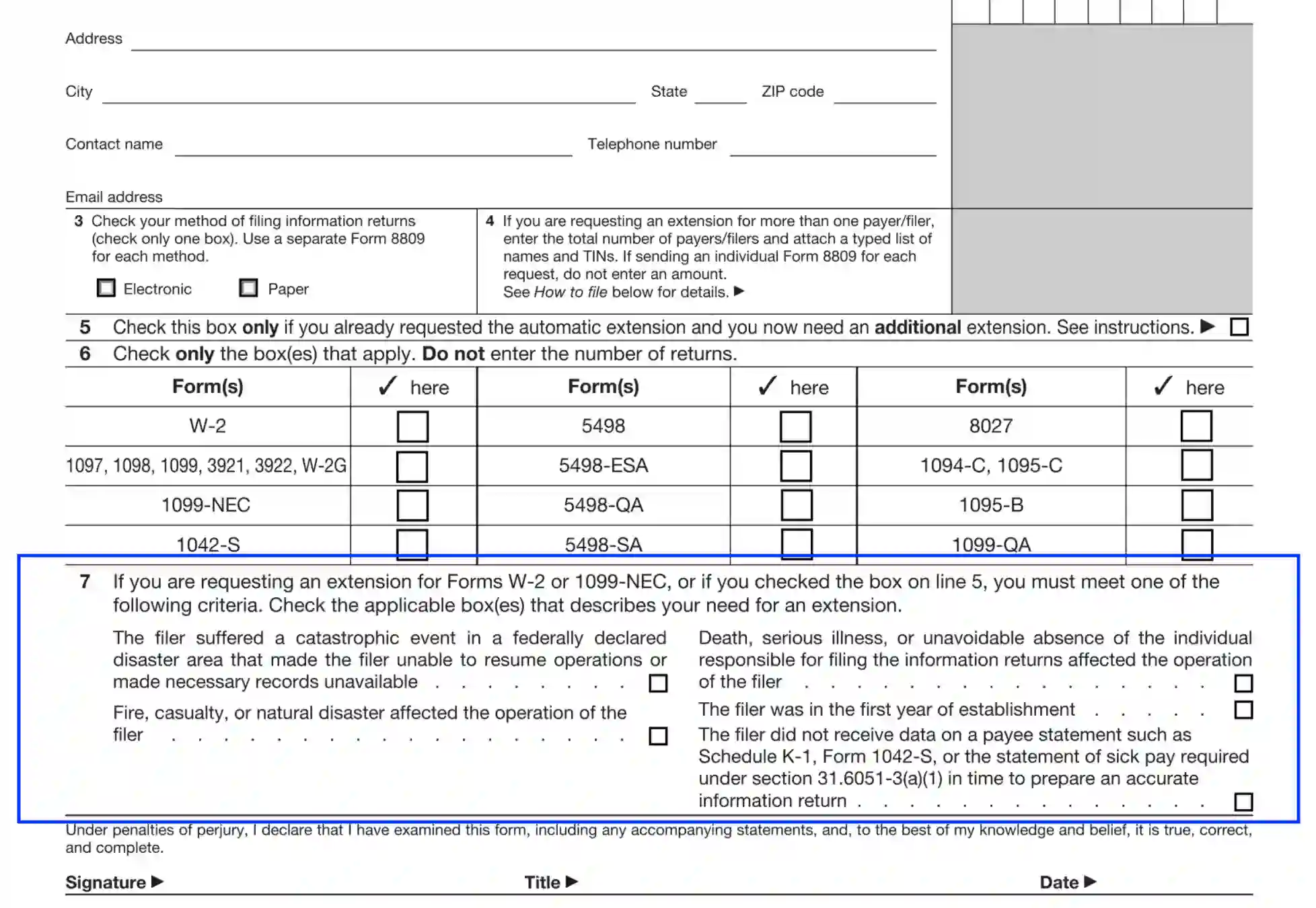

Clarify the Reasons for the Time Extension Benefit

In Unit 7, the preparer should disclose the reasons that make them eligible to apply for the time extension privilege. Also, this section must be completed if the claimant checks the Unit 5 box.

You are empowered to tick off all applicable alternatives that relate to your situation:

- Catastrophic situations within the federal territories prevented the taxpayer from submitting the needed report disclosures on time.

- Natural disasters or emergencies delayed the process of reporting the taxes.

- Death or unpredictable serious health problems

- The payee failed to submit the needed tax info, which prevented the preparer from completing the tax returns on time.

- The first year of establishment aspects

Authorize and File the Application

After all required data are clarified, the claimant (or the invited authorized preparer) should append the signature, specify the title, and place the current calendar date.

The completed application should be delivered to the Department of the Treasury, IRS Center in Ogden, Utah 84201-0209. Make sure to comply with the deadline requirements and serve the paperwork before the due date.

Some forms allow online service. You are empowered to use the licensed IRS FIRE system to submit authorized forms. However, the preparer must be aware of the fact that they can only apply on behalf of each taxpayer separately, as the attachments with names and TIN data requested by Unit 4 of the Application 8809 cannot be filed online.