IRS Form 8655 is a document used by taxpayers to authorize a reporting agent to perform certain functions related to federal tax obligations on their behalf. This form allows a designated agent to file returns, make deposits, and receive copies of tax-related notices or correspondence from the IRS. Businesses often use Form 8655 to authorize payroll service providers to handle their employment tax duties, ensuring that these tasks are managed efficiently and accurately.

The main purpose of Form 8655 is to formalize the relationship between a taxpayer and a reporting agent, clearly defining the agent’s authorized actions and responsibilities. This authorization helps streamline tax administration for small businesses that may not have the resources to manage all aspects of tax compliance internally. By completing this form, businesses can delegate routine but critical tax functions to experts, reducing the risk of errors and ensuring compliance with tax laws.

Other IRS Forms for Business

Along with IRS forms devised to report financial information to the IRS, there are forms to facilitate payment of taxes for businesses. You can find out more information about similar forms on our website.

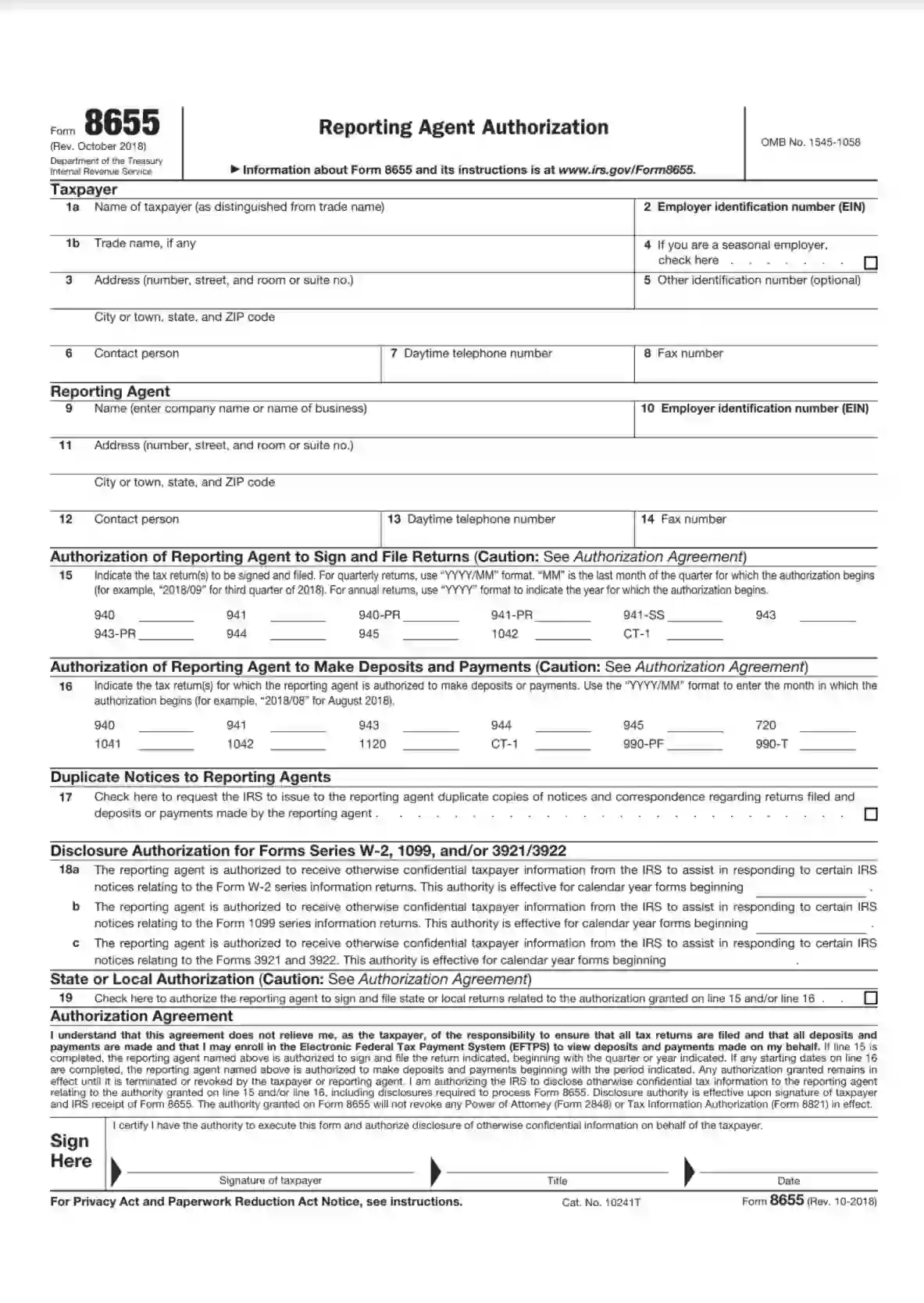

How to Fill Out the Template

You, as the organization owner or a shareholder, can most probably complete the template by yourself. It is not that hard, and you must fill out just one page and provide basic details that are not rocket science.

You will see a list of the forms and actions your agent will be able to submit and accomplish on behalf of the entity you represent. If any of the things you note in the document seem odd or unfamiliar to you, consult your accountant or a tax specialist to avoid undesired consequences in the future.

You must ensure that your template is accurate and actual before you fill it out. To get the proper version, either visit the Service’s website or make use of our advanced form-building software that regularly provides clients with not only IRS Form 8655 but also plenty of other legal forms widely used in the United States.

When the form has arrived, use our manual below that explains in detail how to create your own paper correctly and deliver it to the public authorities.

Check the Instructions Provided in the Form

This form offers you the Service’s guide — you can read it on the second and third pages. Before you start writing details in the document, read these guidelines carefully to complete the form in conformity with the rules.

Enter Your Organization’s Info

You should describe your entity in the form’s initial block, so the Service understands who is assigning an agent.

Enter the business’s name and trade name (if there is any), EIN (employer identification number), full address, a responsible person who can be contacted regarding the matter, their phone number, and fax number. In line 4, mark the box if you are a seasonal employer.

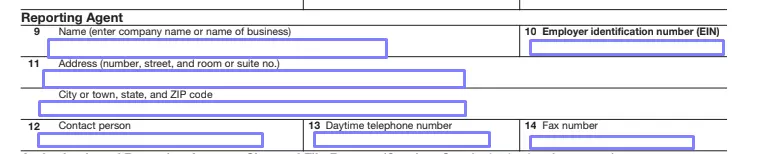

Appoint the Reported Agent

The second block is for assigning the reporting agent and providing its details to the Service. Write its name, EIN, address, person to contact, phone and fax numbers.

Authorize Your Agent

You have to give authorization for several types of actions: signing and sending forms for your organization and making deposits and payments on its behalf.

In Section 15, you will determine records your agent can sign and submit. You will have 11 different forms to choose from and empty lines near them where you should put the period from which your permission is effective (year and month).

In Section 16, you will state for which forms your agent can make deposits and payments. You will be given 12 options and blank lines for dates again. Pick those you consider relevant for your case.

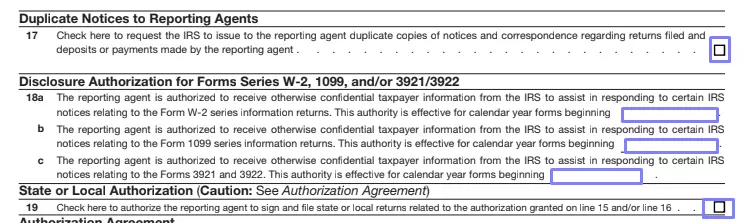

Then, check the box in the following section if you want the Service to provide your agent with copies of certain papers. Answer the questions regarding your agent’s permit to deal with confidential info and forms 3921, 3922, W-2, and 1099. Finally, read the statement in line 19 and the Authorization Agreement and mark the box if it is applicable to your situation.

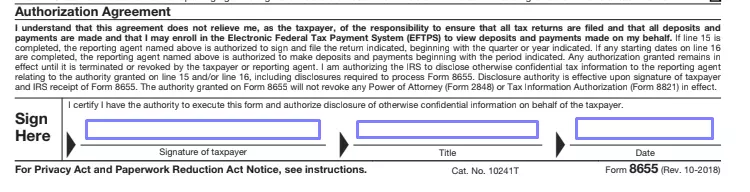

Sign the Document

Signing this form is mandatory — this way, you confirm everything you have stated in the document. Leave your signature in the line on the left, the title in the middle, and the current date on the right.