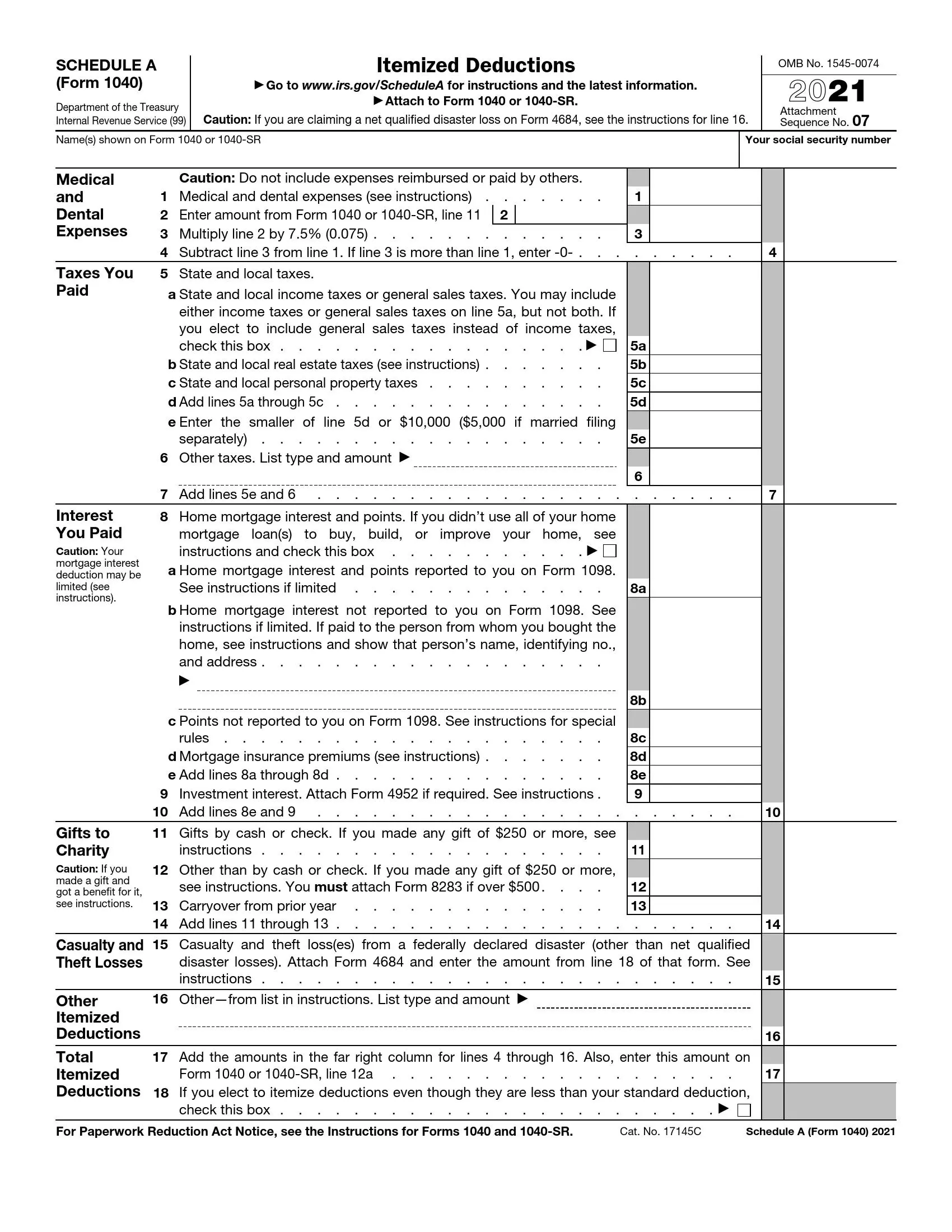

IRS Schedule A for Form 1040 or 1040-SR is used to itemize deductions, allowing taxpayers to deduct certain eligible expenses from their taxable income instead of taking the standard deduction. This form benefits taxpayers with significant deductions that exceed the standard deduction amount provided by the IRS.

Schedule A includes various categories of deductions, such as medical and dental expenses that exceed a certain percentage of adjusted gross income (AGI), state and local taxes paid, real estate taxes, personal property taxes, mortgage interest, mortgage insurance premiums, and gifts to charity. It also includes less common deductions, such as casualty and theft losses from federally declared disasters and other miscellaneous deductions. Filing Schedule A requires detailed record-keeping as taxpayers must provide information and sometimes documentation for each itemized deduction they claim.

Other IRS Forms for Self-employed

Schedules should be prepped and attached to IRS forms only in specific circumstances. Read more about other schedules to make sure you are using the right one.

Filling Out the Schedule

Some taxpayers in the US prefer to hire an expert (or an agency) that will help them deal with their returns. However, many people decide to save some money and prepare the required forms on their own. We have made a set of instructions for those who pick the second option.

Even though the template is short and there is not much to fill out, you still may face confusion and a lack of understanding. If this occurs, we strongly recommend you to talk to those who deal with taxes professionally or to read the Service’s guidelines (they are provided for every template issued by the Service).

You cannot create any legal document without having a correct template. Downloading the file from the Service’s official website is possible; however, we encourage you to try our professional form-building software that can deliver any template you are searching for. Schedule A (IRS Form 1040 and 1040-SR) is on the list of available templates, too.

So, your filling-out process starts with getting the proper template. After you have found one, see our guide below with details to include step by step.

Write Your Name and SSN

By now, you must have filled out your tax return (1040 or 1040-SR). Prepare it because you will need some data from it. Enter your name and SSN (or social security number) as written in your return.

Determine Your Medical Costs

In the initial block, you will add the medical and dental costs you had during the considered year. If somebody else paid for some procedures, do not insert these costs here. The full list of expenses you can and cannot add is written on the Service’s website.

Check if your procedures fit the list of allowed ones. Also, the instructions contain the chart where you can see the maximum amount of deduction (it depends on your age) and other limitations. You have to do the math as well: the form gives a hint on how to count numbers for some lines.

Add Deductible Taxes

The second block lets you include some taxes you have already covered and get some deductions from them. If you have paid something, add the numbers for local and state tax, real estate tax, and other required figures.

If some taxes you have covered are not on the list, there is a line for miscellaneous taxes and their sum. Then, add one rate to another to get the total amount as written in the template and enter the result in the designated line.

Describe the Paid Interest

If throughout the year, there were particular interest payments made by you, you can ask for a deduction, too. To insert some numbers, you might need the forms 1098 and 4952 and information from there.

Overall, you can add the investment interest, home mortgage interest rates, and mortgage points here under certain conditions. Double-check the Service’s guidelines to understand what you can re-count: there are also some restrictions you need to know about.

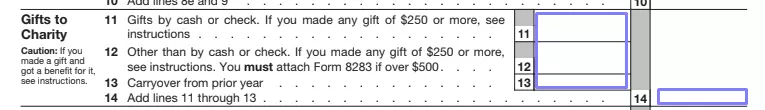

Insert Charity Gifts

This block is applicable for you if you have made any gifts of a certain value for the purposes of the charity. Choose the relevant line to fill out: it depends on the payment method. If your gift was more expensive than 250 US dollars, see the Service’s guidelines for clarification.

In case the charity gifts’ value exceeded 500 US dollars during the year, you must provide one more form (8283). If there is a carryover from the past year, write the sum in the relevant line. Then, add the sums from all lines of this block and write the result in the “total” line.

Define Casualty and Theft Losses

If during the year there was any disaster that was federally declared and related to you, you may add the sum in this section. You should use another form, 4684, and enter the numbers from this template (line 18).

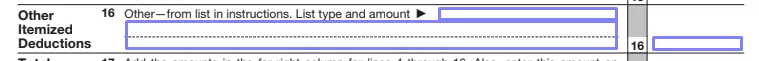

Include Miscellaneous Deductions

If you have something more to add, there is a “miscellaneous” section. There, you can describe anything that does not fit other form’s blocks. You must write the types and sums in this section.

Get the Total Result

You should sum the numbers from all previous lines and add the result here. Also, it must be copied to a certain field of your tax return (line 9).

Your deductions with this form might be less profitable for you than standard deductions. If you still wish to count them in accordance with this Schedule, mark the box below the total sum.