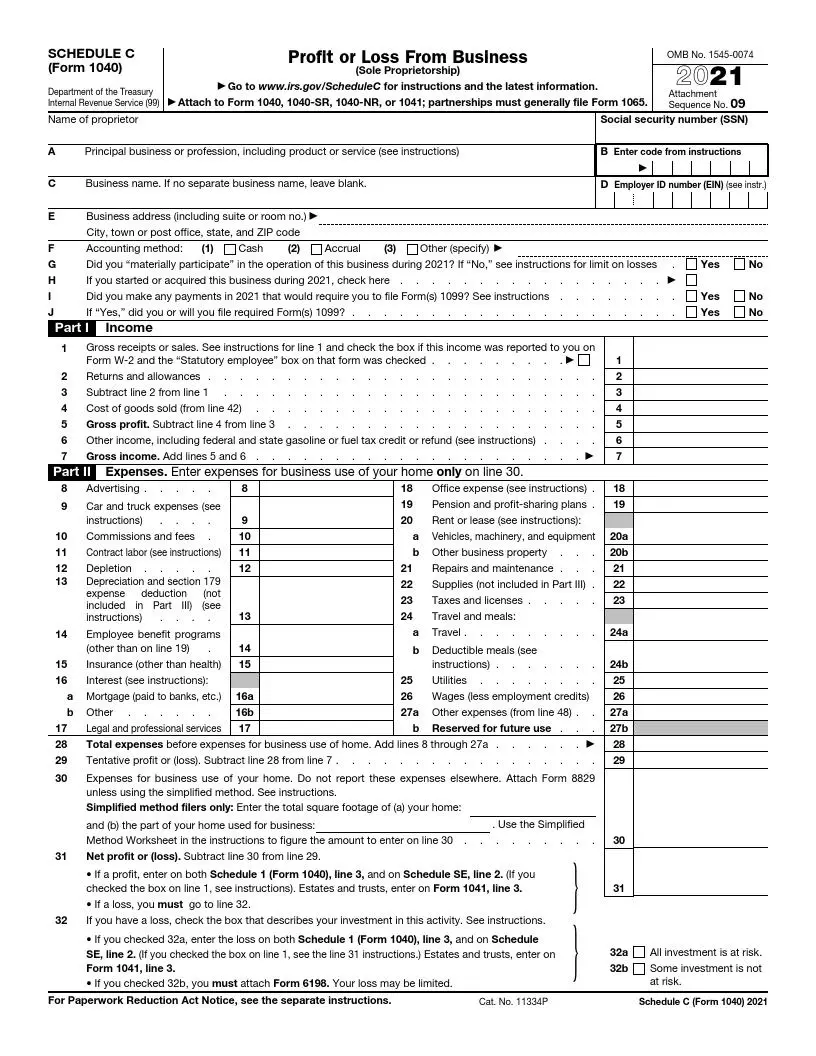

IRS Schedule C (Form 1040) is a tax form used by sole proprietors and single-member LLCs to report the income, expenses, and overall profit or loss from a business they operated or a profession they practiced as a self-employed individual. This form is an essential component of the owner’s personal tax return and is crucial in calculating the taxable income from business activities.

The form requires detailed information about the business, such as income earned, cost of goods sold, and various expenses (advertising, travel, meals, office expenses, etc.) that can be deducted from gross income. Schedule C also addresses aspects like the home office deduction and allows entrepreneurs to deduct the portion of their home used regularly and exclusively for business activities. This form is also integral in assessing how much Social Security and Medicare tax the self-employed individual owes.

Other IRS Forms for Self-employed

Schedules are used in addition to individula’s tax return, but you need to choose a proper one which will depend on your specific financial situation. Find out more about other schedules and IRS forms.

How Do I Fill Out a 1040 Schedule C 2021 Correctly?

Once there appears a necessity to file Schedule C Forms (one for each business you run), you need to prepare for completing them in advance by gathering the required documentation.

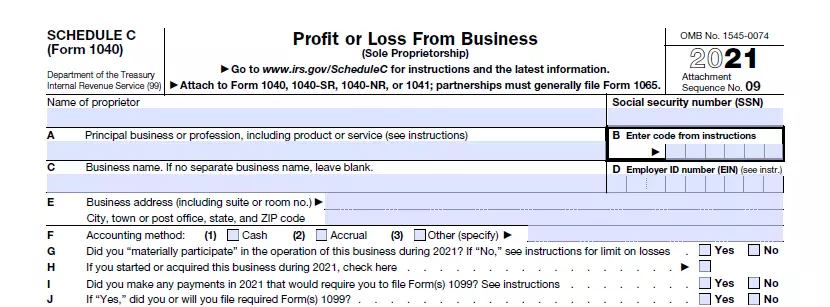

Submit Basic Information

Begin with completing your full name and providing a Social Security Number. Enter the type of business you own or describe the service you provide as a sole proprietor and an activation code from instructions.

If your business is registered as single-member LLC, input the business name (leave the line blank in case you do not have one). Submit the tax ID number (EIN) if you have it. Business address, including city, state, and zip code, should be inserted herein as well.

Specify the accounting method. Indicate whether you have materially participated in the operation of this business within the current year or not. If you gained ownership of this business during the current year, check the corresponding box.

Your intention to create a Form 1099— in case you need it— has to be stated at the end of the introductory part. The taxpayer should file this document if a sum of money that equals or exceeds 600 US dollars has been delivered to the subcontractors within a period of one calendar year.

Provide Detailed Information About Your Income

In this part of the paper, fill in your gross receipts for the year first. If there are any returns or allowances that diminish your income, indicate those and calculate your net receipts in line 3. Then you are asked to estimate the cost of sold goods, subtract line 4 from line 3 and write down the gross profit. The information about other income you have earned must be counted and included in line 6. Finally, it would help if you inputted the gross income.

Capture the Business Expenses

You are supposed to categorize all the expenses you have had within this year. Describe this information in detail on lines 8 to 26. 27a is referred to the other expenses if there are any. 27b should be completed if some expenses are reserved for future use. On line 28, you will enter the total number of all expenses you happened to have this year. Tentative and net profit (or loss) has to be estimated along with the expenses for business use of your home if you have them. Additional forms might have to be attached according to the type of expenses you are describing.

Calculate the Cost of Products Sold

If applicable, share the information about your income earned by trading products (through direct delivery to the customers or using subcontractors) in this part.

Select the method of valuing closing inventory and any changes in using the method on lines 33 and 34. Line 35 should be completed with the information about the inventory at the beginning of the tax year. If it is different from last year’s closing inventory, provide explanations. Lines 36 to 39 contain data about the other costs.

Add lines 35 to 39 and enter the result on line 40. The information about the cost of all goods will be the number you will get after subtracting inventory at the end of the year from line 40.

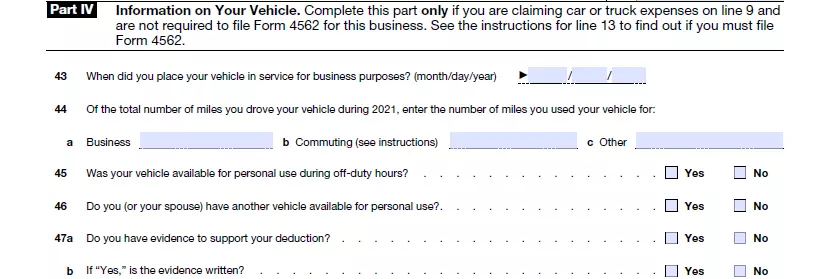

Fill Out the Information on Your Vehicle

This part should be completed only if you are claiming car or truck expenses in line 9. Report the date when you placed your vehicle in service for business purposes (month, date, year) and the total mileage of driving for business and commuting. Keep in mind that you will be asked to provide proof of the numbers you are entering.

If you or your spouse possesses another motor vehicle, select the corresponding option.

List Other Expenses Additionally

All expenses that did not fit into the categories in Part II have to be described herein. Make sure to fill in the information only about business but not personal expenses, even if they are deductible. If you are unsure whether the expense is deductible, ask for professional help before submitting the report.