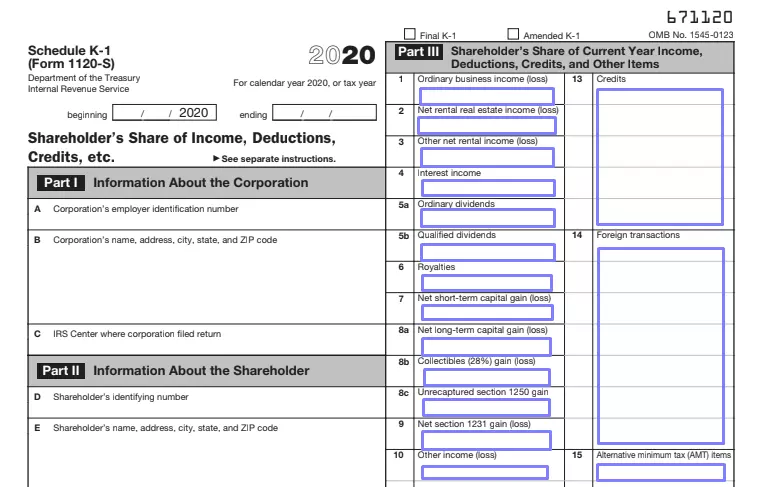

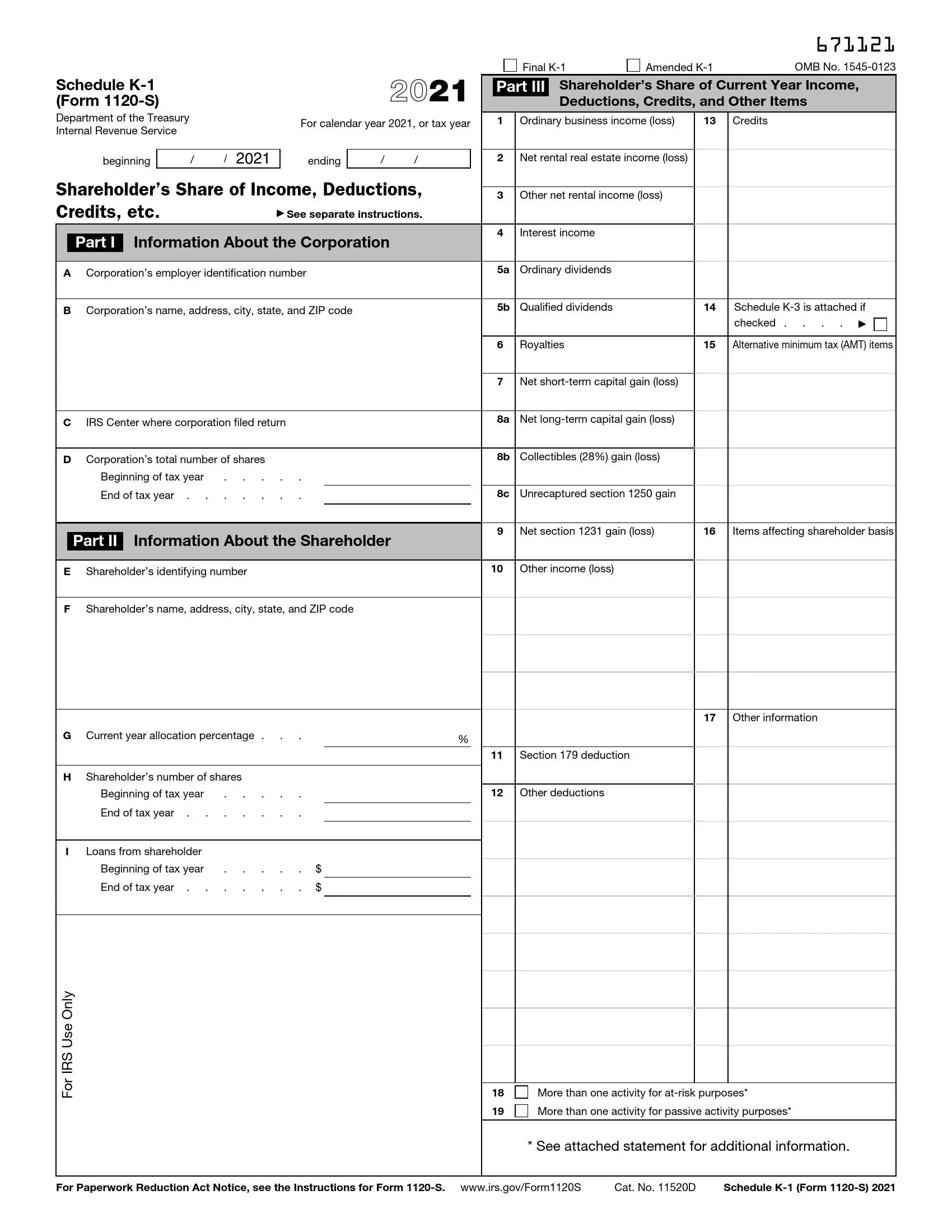

IRS Schedule K-1 (Form 1120-S) is a document used to report each shareholder’s share of income, deductions, credits, and other items from an S corporation. This form is an essential part of the S corporation’s tax filing. It provides necessary information for shareholders to correctly report their share of the corporation’s income or loss on their individual tax returns. Each shareholder’s Schedule K-1 includes this information:

- The shareholder’s percentage of stock ownership for the year,

- Their share of the corporation’s income or loss,

- Distributions received from the corporation,

- Tax credits and deductions that the shareholder is entitled to claim.

The purpose of Schedule K-1 is to ensure that the income from the S corporation is reported once at the shareholder level, maintaining the S corporation’s flow-through nature. This helps avoid double taxation and allows shareholders to account for their respective shares of the corporation’s financial activities in their personal tax calculations.

Other IRS Forms for Corporations

The Schedule is devised to report vital information to the US Internal Revenue Service. Check what other essential details the IRS expects from corporations.

Filling Out the Form

Even though Schedule K-1 is dedicated to shareowners (each one personally), they shall not complete the template: the corporation does it for each person (or entity). Shareowners then either keep the paper in their personal archives or add information from the paper to their tax returns.

Because the form creation is an entity’s responsibility, there is normally an accountant who makes and submits both Form 1120-S and all the needed schedules. If for some reason, you cannot ask an accountant to create the papers, you can either try to do it by yourself or hire someone who deals with such forms professionally on a daily basis.

Although we always recommend delegating this process, circumstances you face may force you to complete the template by yourself; that is why we give you a set of guidelines below. They are quite general, so you still have to consult professionals if there is something that bothers you or something you do not understand.

Download the Template

Nowadays, getting the majority of legal templates is easy: you do not have to go anywhere and take the actual paper; downloading it from the governmental institutions or company’s official website is sufficient.

Moreover, sometimes you can find it on sites made specifically for forms’ generating and downloading: for instance, you can get the Schedule K-1 here using our advanced form-building software. It is even easier than visiting other sites and looking for the template there.

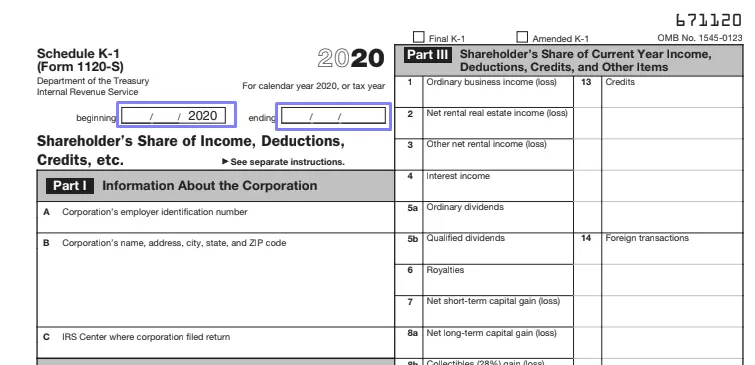

Determine the Considered Year (or Tax Year)

You should start with defining the year for which this document is being made. Insert the beginning and the ending of your entity’s tax year below the form’s heading.

Indicate the Corporation

You have to describe the entity for which this form is made in the first part. Write the employer identification number (EIN), name, and full address with a postal code. Then, indicate in which Center of the IRS the corporation has submitted its tax return previously.

Introduce the Shareowner

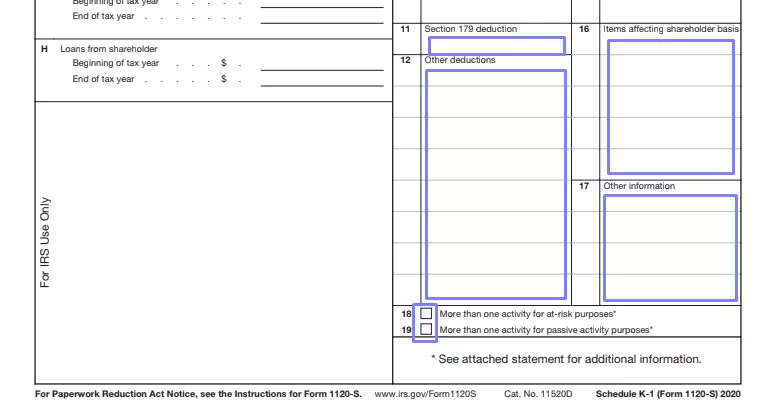

The next block is for the shareowner’s info. Insert their ID: it can be the above-mentioned EIN, social security number, or individual taxpayer identification number. Then, line by line, add the allocations in percent for the considered year, a number of shares, and loans at the start and end of the year.

Leave the field below blank because it will be used by the Service’s workers to make their notes and records.

Describe the Shareowner’s Share in Detail

The form’s third part is included so you can describe in detail what share belongs to this specific owner in terms of the entity’s income, credits, deductions, and so on.

Complete this part by filling in the required data: ordinary income (or loss), net rental estate income (or loss), interest income, royalties, dividends, capital gain (or loss), foreign transactions, credits, and other elements.

Below the chart, read the two options regarding the owner’s business activities and mark the relevant option.