Form 1099-NEC is mostly for payments made to independent contractors and other nonemployees.

To ensure compliance and fill out this form correctly, follow the steps below. We'll walk you from top to bottom, so nothing important is missed.

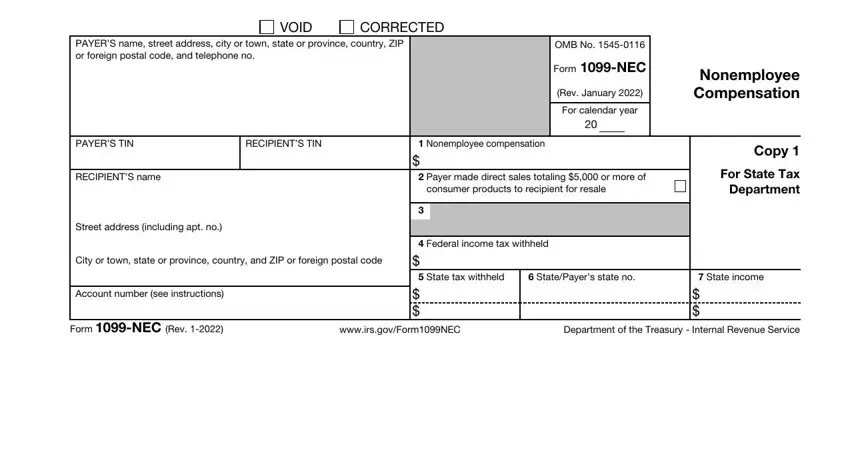

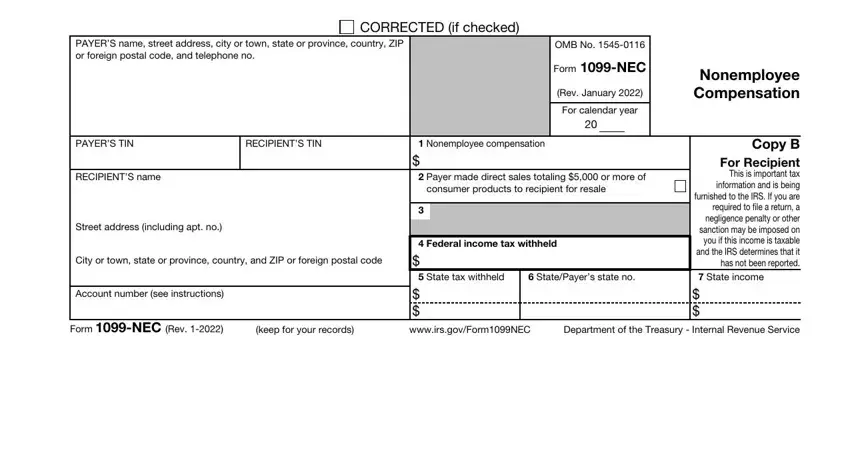

Step 1. Confirm the Reporting Year

At the top of the form, enter the calendar year for which the payments are being reported. This must reflect the year the payments were actually made. Using the correct year is essential for accurate tax reporting and proper matching of self-employment income and self-employment taxes.

Step 2. Void and Corrected Boxes

These checkboxes are only used in specific situations:

- Select Void when you want to stop the IRS from processing the form.

- Use Corrected when you need to fix information on a form you already filed.

If you are filing an original 1099-NEC, leave both boxes unchecked.

Step 3. Enter the Payer’s Information

Complete the payer section with the legal name of the business or individual making the payment, along with the full mailing address and telephone number. This information should match IRS records to avoid issues with tax reporting or tax liability.

Step 4. Payer's Taxpayer Identification Number

Enter the payer’s EIN or Social Security Number in the Payer's TIN field. This number identifies the party responsible for reporting the payment, and the IRS requires it for proper processing.

Step 5. Enter the Recipient’s Details

Fill in the recipient’s legal name and current mailing address exactly as provided on Form W-9. This applies to contractors and other nonemployee, typically paid service providers, including real estate agents. Accurate recipient details help ensure income is correctly attributed.

Step 6. Provide the Recipient’s TIN

Enter the SSN, ITIN, or EIN in the Recipient’s TIN field. The IRS uses this info to track self-employment income and determine self-employment taxes and Medicare taxes, where applicable. Incorrect TINs may trigger backup withholding rules.

Step 7. Report Payment and Federal Income Tax Withheld

Complete only the boxes that apply to the payment:

- Box 1 is for non-employee compensation.

- Check Box 2 only if the payer made $5,000 or more in direct sales of consumer products to the recipient for resale; otherwise, leave it blank.

- Box 3 is only for excess golden parachute payments (if applicable).

- Box 4 is used to report federal income tax withheld when the payer withholds federal income tax under backup withholding rules.

- Complete Boxes 5 through 7 only if state income tax was withheld and the state tax department requires reporting.

Amounts such as military differential wage payments, business travel allowances paid to employees, or the cost of current life insurance protection are not reported on Form 1099-NEC and belong on other forms, such as Form W-2.

Remember that staying compliant with reporting requirements helps avoid errors, penalties, and extra costs down the line.

Step 8. Final Review Before You File Form 1099 NEC

Before filing, review all names, identification numbers, and dollar amounts. Confirm totals match your records and that all required fields are complete. A careful review reduces the risk of corrections, penalties, and future tax reporting issues.

CORRECTED (if checked)

CORRECTED (if checked)