The PDF editor can make filling in files stress-free. It is extremely effortless to change the [FORMNAME] file. Keep up with all of these steps in an attempt to do it:

Step 1: On the following web page, click the orange "Get form now" button.

Step 2: When you have accessed the fidelity self employed 401k contribution form editing page you can discover the different options you may perform relating to your file from the upper menu.

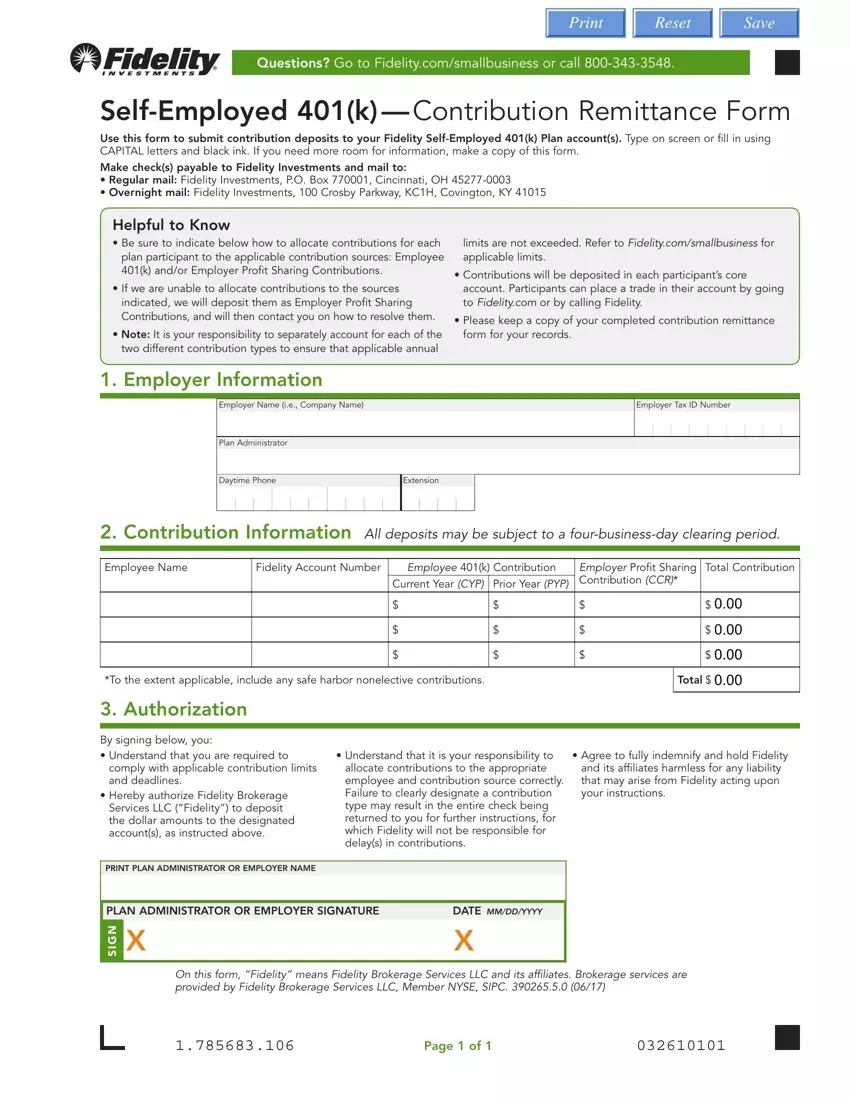

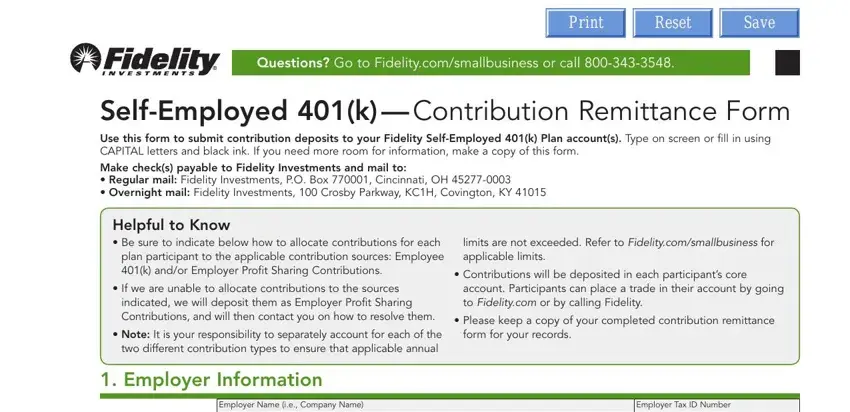

The PDF file you are going to prepare will consist of the next segments:

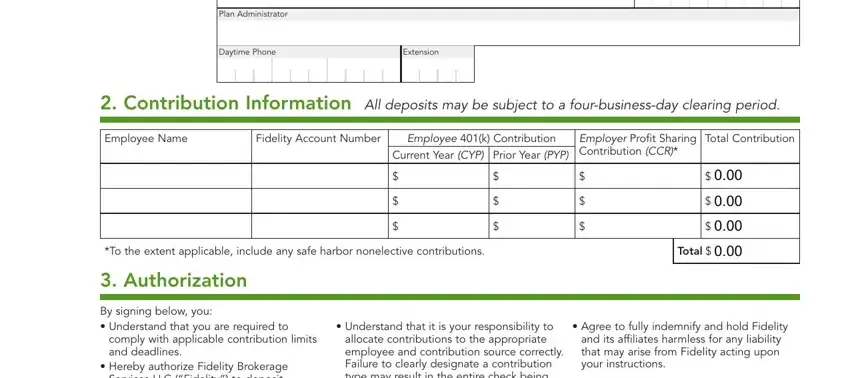

Complete the Plan Administrator, Daytime Phone, Extension, Contribution Information All, Employee Name, Fidelity Account Number, Employee k Contribution, Current Year CYP Prior Year PYP, Employer Profit Sharing, Total Contribution, To the extent applicable include, Total, Authorization, By signing below you Understand, and comply with applicable areas with any details that can be asked by the program.

The program will ask you to write certain relevant information to easily fill in the area PRINT PLAN ADMINISTRATOR OR, PLAN ADMINISTRATOR OR EMPLOYER, DATE MMDDYYYY, N X, I S, On this form Fidelity means, and Page of.

Step 3: Click the button "Done". Your PDF document may be transferred. It is possible to upload it to your device or send it by email.

Step 4: To prevent probable future problems, you should hold at least several copies of each separate form.