It won't be challenging to obtain 1099 nec 2020 e file working with our PDF editor. Here's how you can easily easily design your file.

Step 1: Click on the button "Get Form Here".

Step 2: At the moment, it is possible to alter your 1099 nec 2020 e file. Our multifunctional toolbar makes it possible to include, delete, adapt, highlight, as well as undertake other commands to the words and phrases and fields within the form.

Provide the content demanded by the application to complete the file.

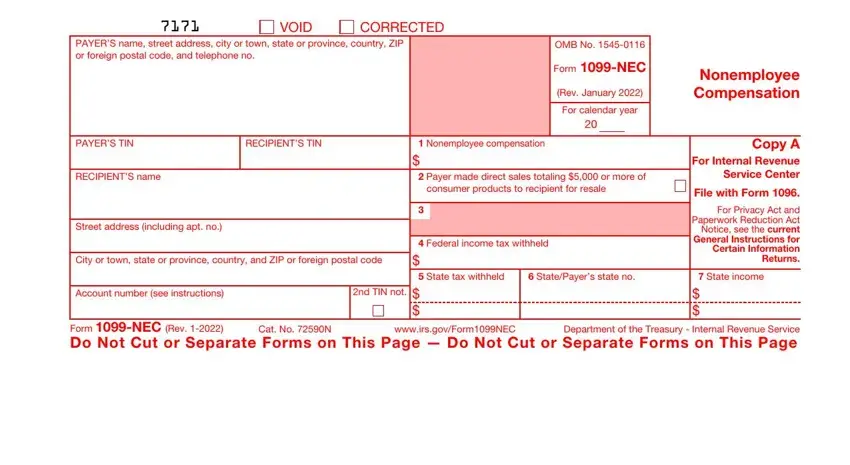

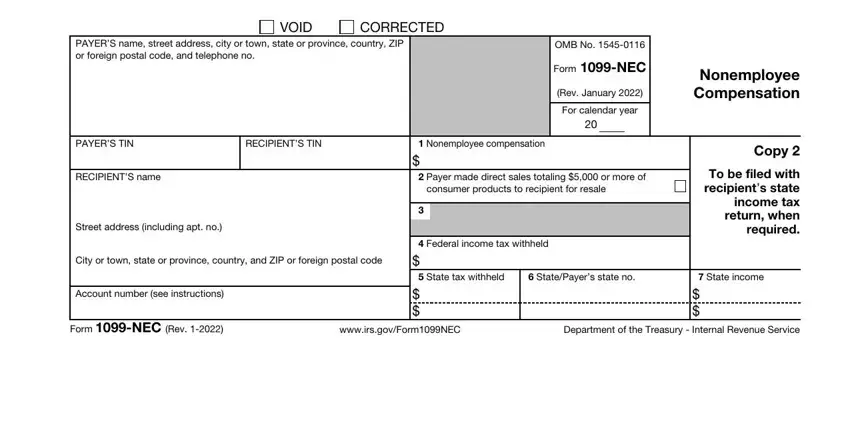

Note the necessary data in the field VOID, CORRECTED, PAYERS name street address city or, OMB No, Form NEC, Rev January, For calendar year, PAYERS TIN, RECIPIENTS TIN, RECIPIENTS name, Street address including apt no, City or town state or province, Account number see instructions, nd TIN not, and Nonemployee compensation Payer.

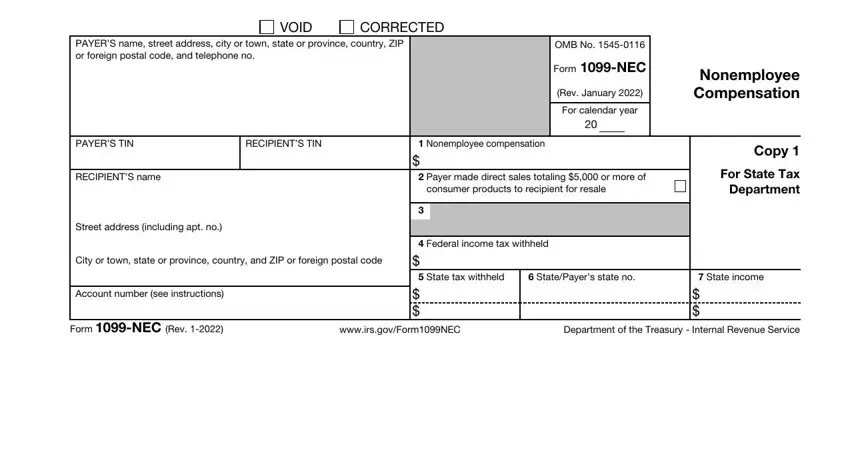

It's important to provide specific particulars within the space PAYERS name street address city or, VOID, CORRECTED, OMB No, Form NEC, Rev January, For calendar year, Nonemployee Compensation, PAYERS TIN, RECIPIENTS TIN, RECIPIENTS name, Street address including apt no, City or town state or province, Account number see instructions, and Form NEC Rev.

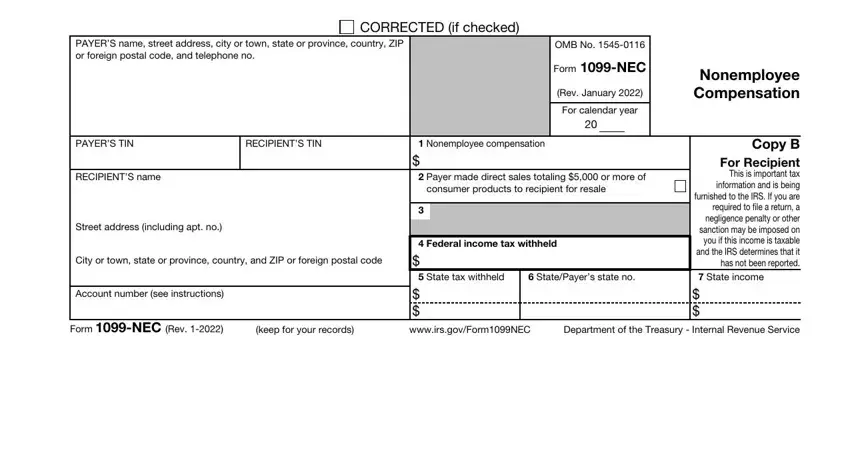

The space PAYERS name street address city or, CORRECTED if checked, OMB No, Form NEC, Rev January, For calendar year, PAYERS TIN, RECIPIENTS TIN, RECIPIENTS name, Street address including apt no, City or town state or province, Account number see instructions, Nonemployee compensation Payer, consumer products to recipient for, and Federal income tax withheld is where you include all parties' rights and responsibilities.

Finalize by reviewing these sections and filling them in as required: PAYERS name street address city or, VOID, CORRECTED, OMB No, Form NEC, Rev January, For calendar year, PAYERS TIN, RECIPIENTS TIN, RECIPIENTS name, Street address including apt no, City or town state or province, Account number see instructions, Form NEC Rev, and Nonemployee compensation Payer.

Step 3: Click the Done button to save your document. Now it is at your disposal for export to your electronic device.

Step 4: It may be simpler to have duplicates of the file. You can rest easy that we are not going to display or see your particulars.

CORRECTED (if checked)

CORRECTED (if checked)