With the goal of making it as simple to apply as it can be, we built the PDF editor. The procedure of filling the 104pn is going to be easy when you use the following actions.

Step 1: Click the button "Get Form Here".

Step 2: After you've entered the 104pn editing page you may discover the different functions you may carry out concerning your document from the top menu.

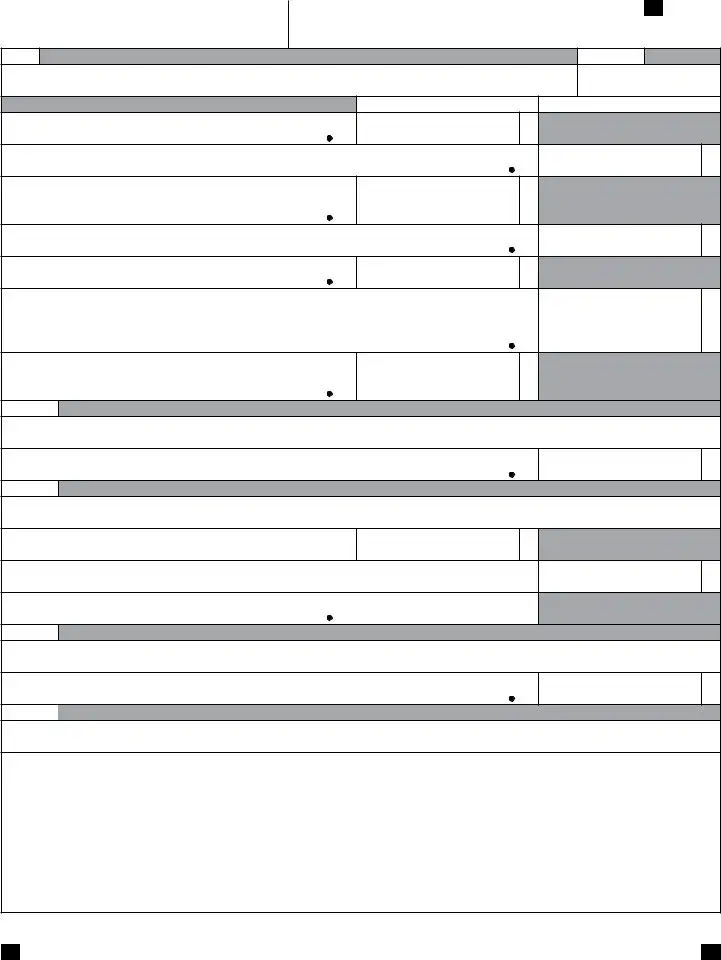

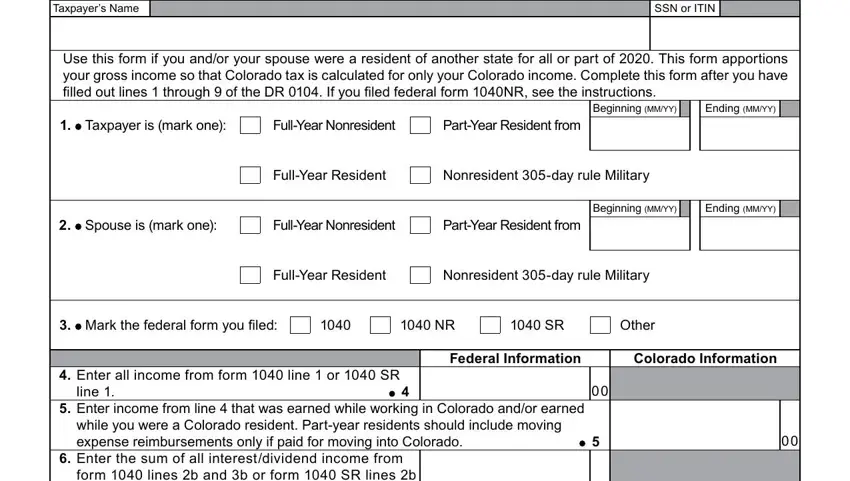

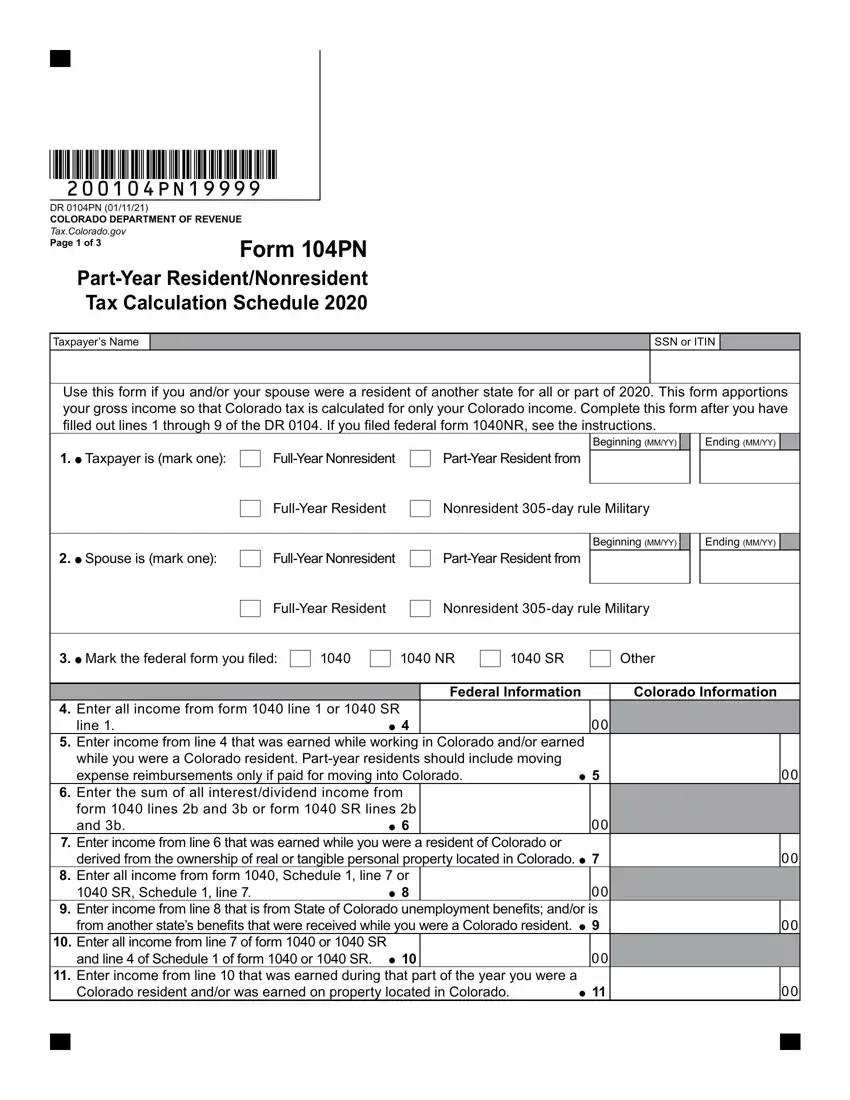

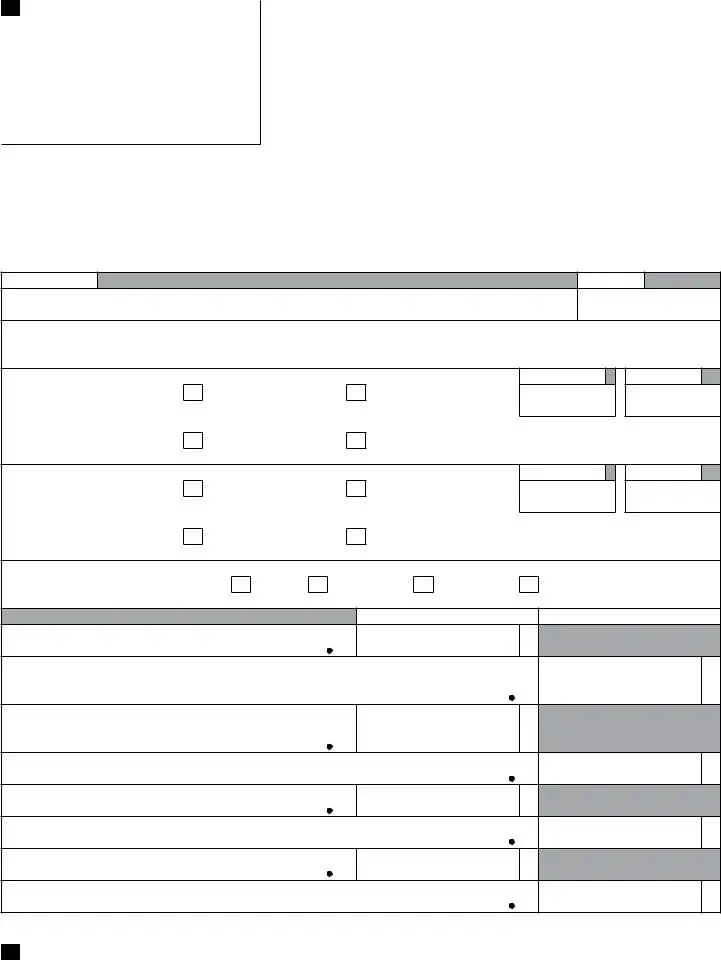

The following segments are going to make up your PDF form:

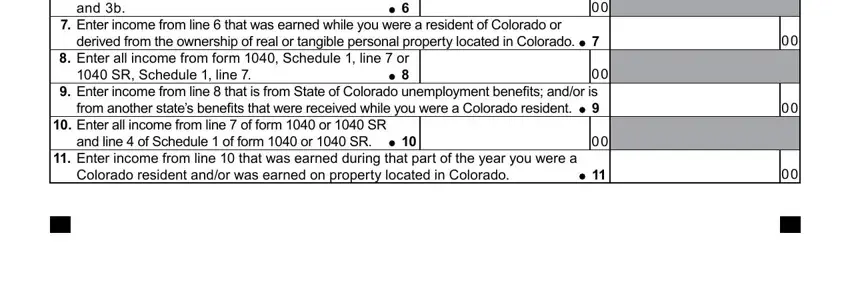

In the form lines b and b or form SR, Enter income from line that was, derived from the ownership of real, Enter all income from form, SR Schedule line, Enter income from line that is, Enter all income from line of, Enter income from line that was, and Colorado resident andor was earned box, put in writing your information.

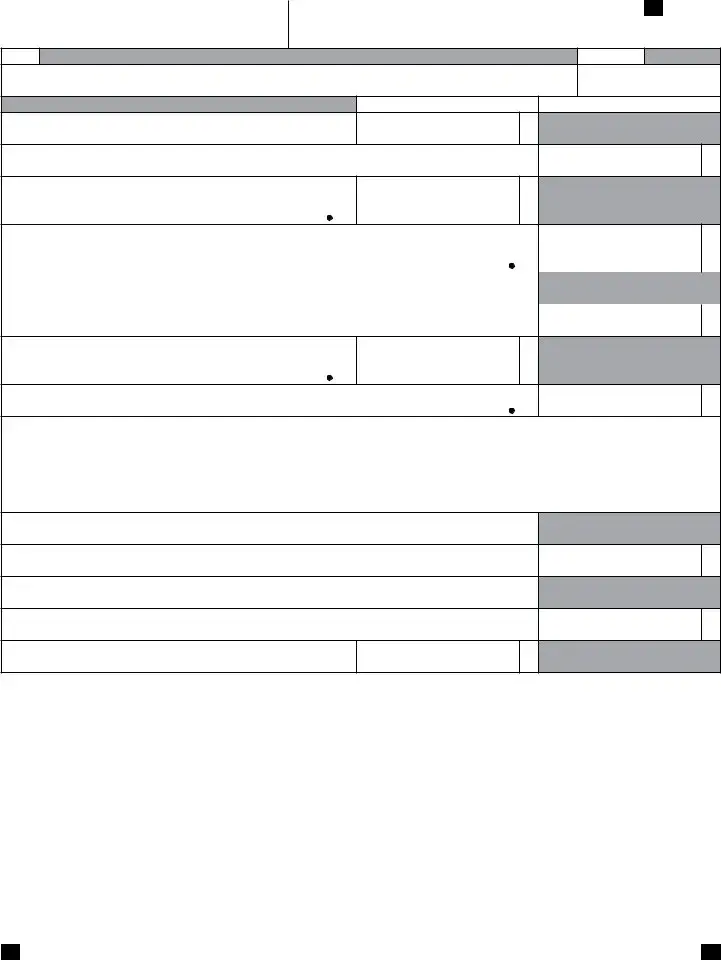

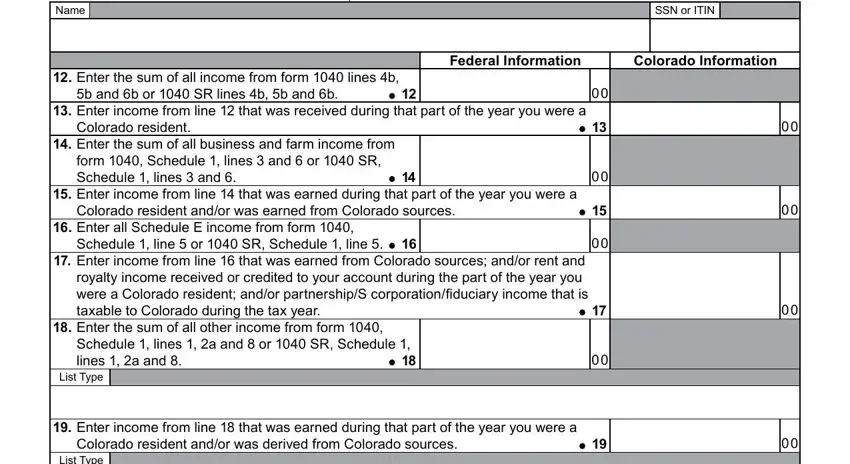

Emphasize the most essential data the PN Name, SSN or ITIN, Federal Information, Colorado Information, Enter the sum of all income from, b and b or SR lines b b and b, Enter income from line that was, Colorado resident, Enter the sum of all business and, Enter income from line that was, Colorado resident andor was earned, Enter all Schedule E income from, Schedule line or SR Schedule, Enter income from line that was, and Enter the sum of all other income section.

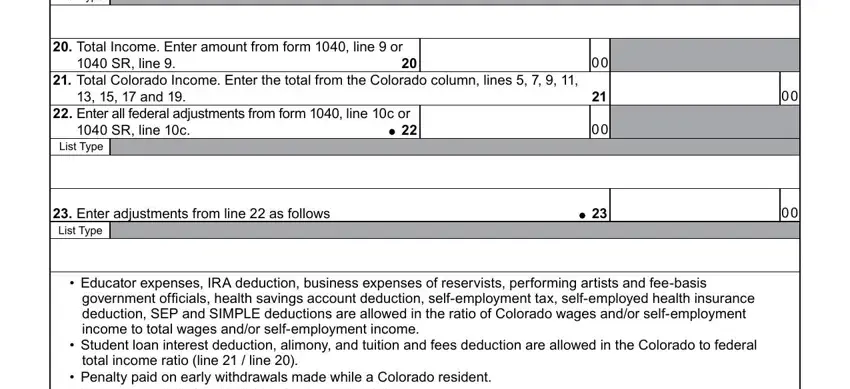

The List Type, Total Income Enter amount from, SR line, Total Colorado Income Enter the, and, Enter all federal adjustments, SR line c, List Type, Enter adjustments from line as, Educator expenses IRA deduction, government officials health, Student loan interest deduction, total income ratio line line, and Penalty paid on early withdrawals box is the place where each party can put their rights and responsibilities.

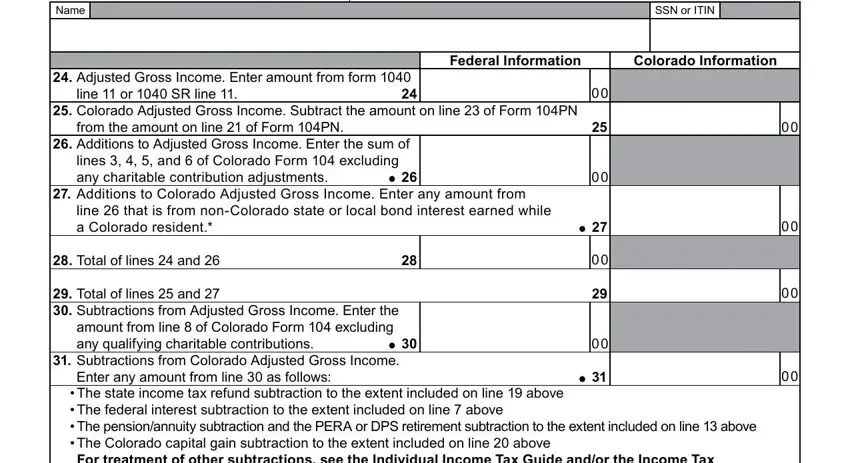

Finalize by taking a look at these fields and filling them in as required: PN Name, SSN or ITIN, Adjusted Gross Income Enter, line or SR line, Colorado Adjusted Gross Income, Federal Information, Colorado Information, from the amount on line of Form PN, Additions to Adjusted Gross, Additions to Colorado Adjusted, line that is from nonColorado, Total of lines and, Total of lines and, Subtractions from Colorado, and Enter any amount from line as.

Step 3: Select the button "Done". The PDF document is available to be transferred. You may save it to your pc or email it.

Step 4: Produce copies of the file. This may prevent upcoming worries. We cannot watch or disclose your information, thus be assured it will be safe.

Taxpayer is (mark one):

Taxpayer is (mark one): Spouse is (mark one):

Spouse is (mark one): Mark the federal form you filed:

Mark the federal form you filed: