Dealing with PDF files online is definitely simple using our PDF editor. You can fill out 11440U here effortlessly. To make our editor better and simpler to use, we continuously work on new features, with our users' feedback in mind. Getting underway is effortless! All you have to do is take the next simple steps down below:

Step 1: Just click on the "Get Form Button" in the top section of this page to see our form editing tool. This way, you will find everything that is required to work with your file.

Step 2: The editor provides you with the capability to work with most PDF files in a range of ways. Transform it by including customized text, correct what's originally in the PDF, and add a signature - all when you need it!

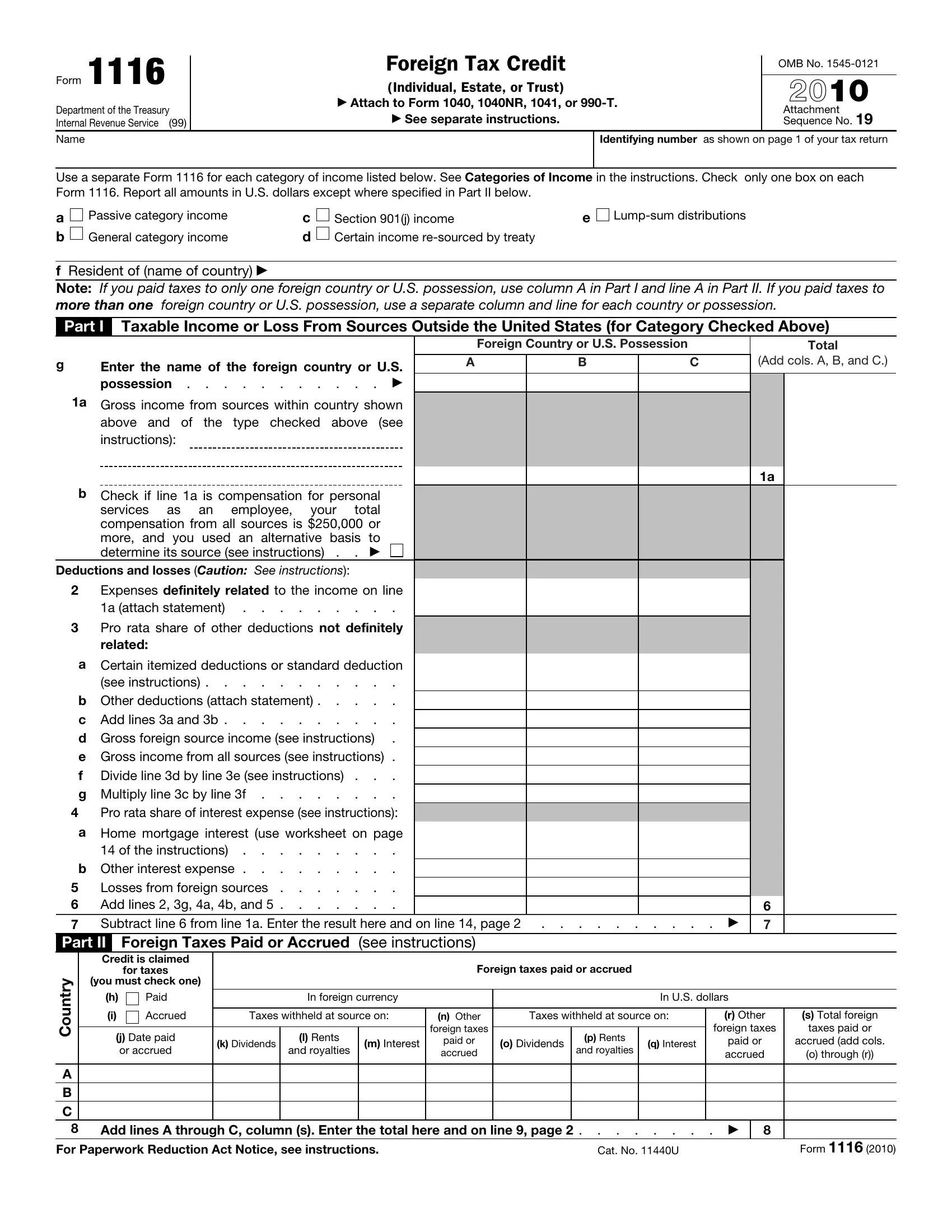

When it comes to fields of this specific form, here's what you should know:

1. Fill out the 11440U with a selection of necessary blank fields. Get all the necessary information and ensure nothing is omitted!

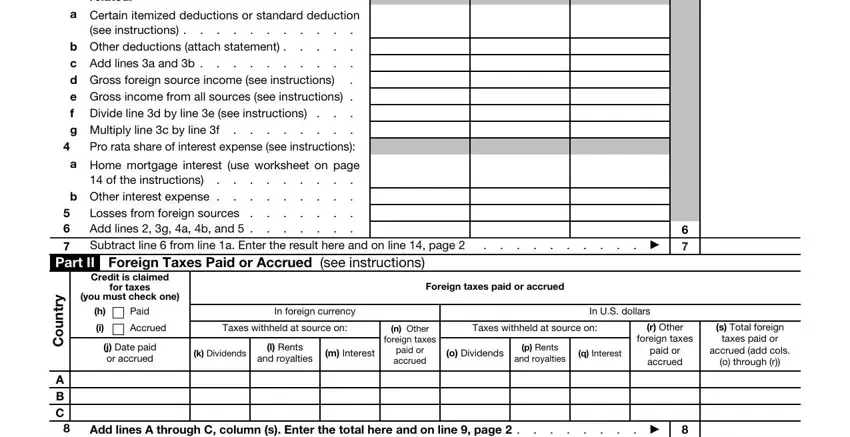

2. When this part is done, go to type in the relevant information in these - Pro rata share of other deductions, Certain itemized deductions or, a b Other deductions attach, a b Other interest expense , Home mortgage interest use, Losses from foreign sources Add, Part II Foreign Taxes Paid or, Credit is claimed, for taxes, you must check one, Paid, Accrued, In foreign currency, Taxes withheld at source on, and Foreign taxes paid or accrued.

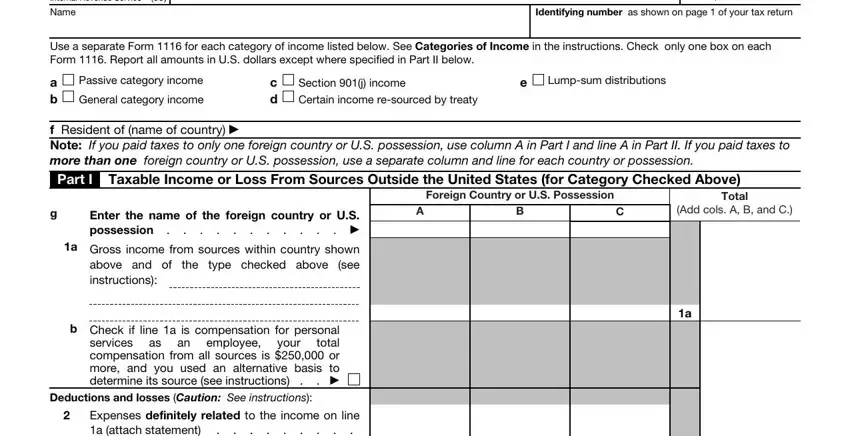

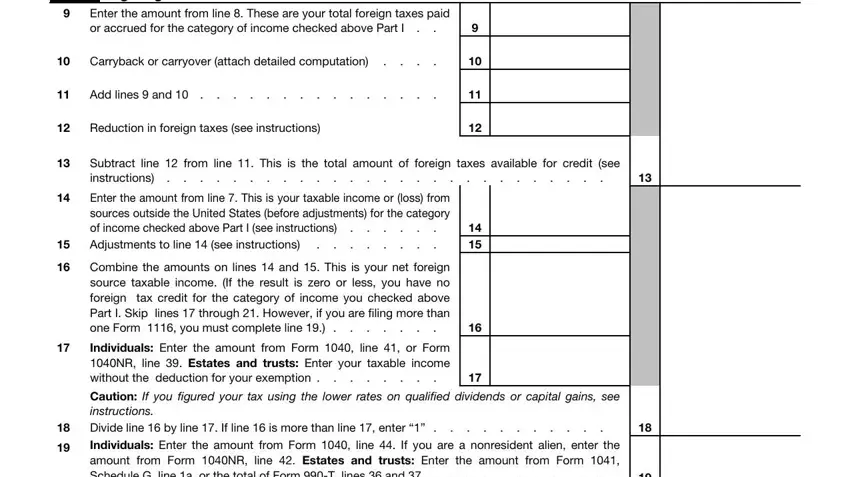

3. The following section is focused on Part III Figuring the Credit, Enter the amount from line These, Carryback or carryover attach, Add lines and , Reduction in foreign taxes see, Subtract line from line This is, Enter the amount from line This, Combine the amounts on lines and , Individuals Enter the amount from, and Caution If you figured your tax - fill out all of these blank fields.

As for Individuals Enter the amount from and Reduction in foreign taxes see, be certain you get them right in this section. The two of these could be the most significant ones in this page.

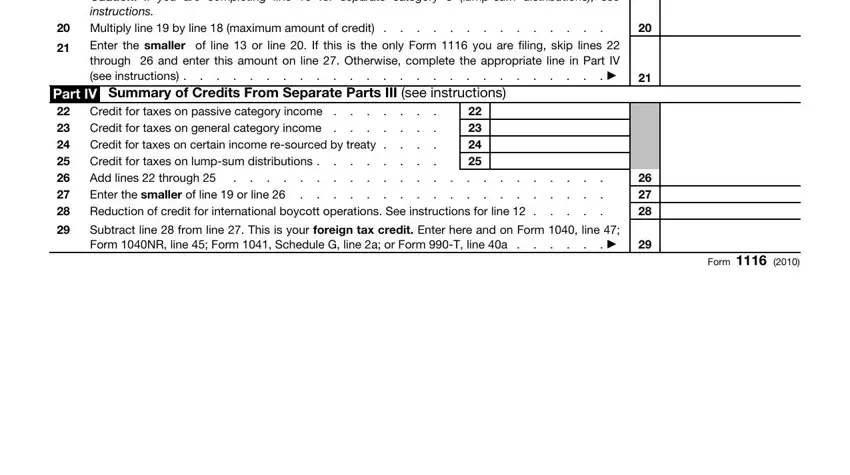

4. This next section requires some additional information. Ensure you complete all the necessary fields - Caution If you are completing line, Multiply line by line maximum, Enter the smaller of line or line, Part IV Summary of Credits From, Add lines through Enter the, Subtract line from line This is, and Form - to proceed further in your process!

Step 3: Right after taking another look at your entries, press "Done" and you're all set! After registering a7-day free trial account here, it will be possible to download 11440U or email it right off. The form will also be available in your personal account menu with your every single modification. If you use FormsPal, you'll be able to complete forms without stressing about personal information breaches or data entries getting shared. Our secure system makes sure that your personal data is stored safely.