You could work with mn property tax refund 2020 easily with our online PDF editor. Our expert team is relentlessly endeavoring to develop the tool and help it become even better for people with its multiple functions. Unlock an endlessly innovative experience now - take a look at and uncover new possibilities along the way! Here's what you'll need to do to start:

Step 1: Press the "Get Form" button at the top of this page to get into our PDF tool.

Step 2: This editor offers the opportunity to modify your PDF form in various ways. Modify it with personalized text, adjust original content, and place in a signature - all readily available!

Completing this document typically requires care for details. Ensure that each field is filled out accurately.

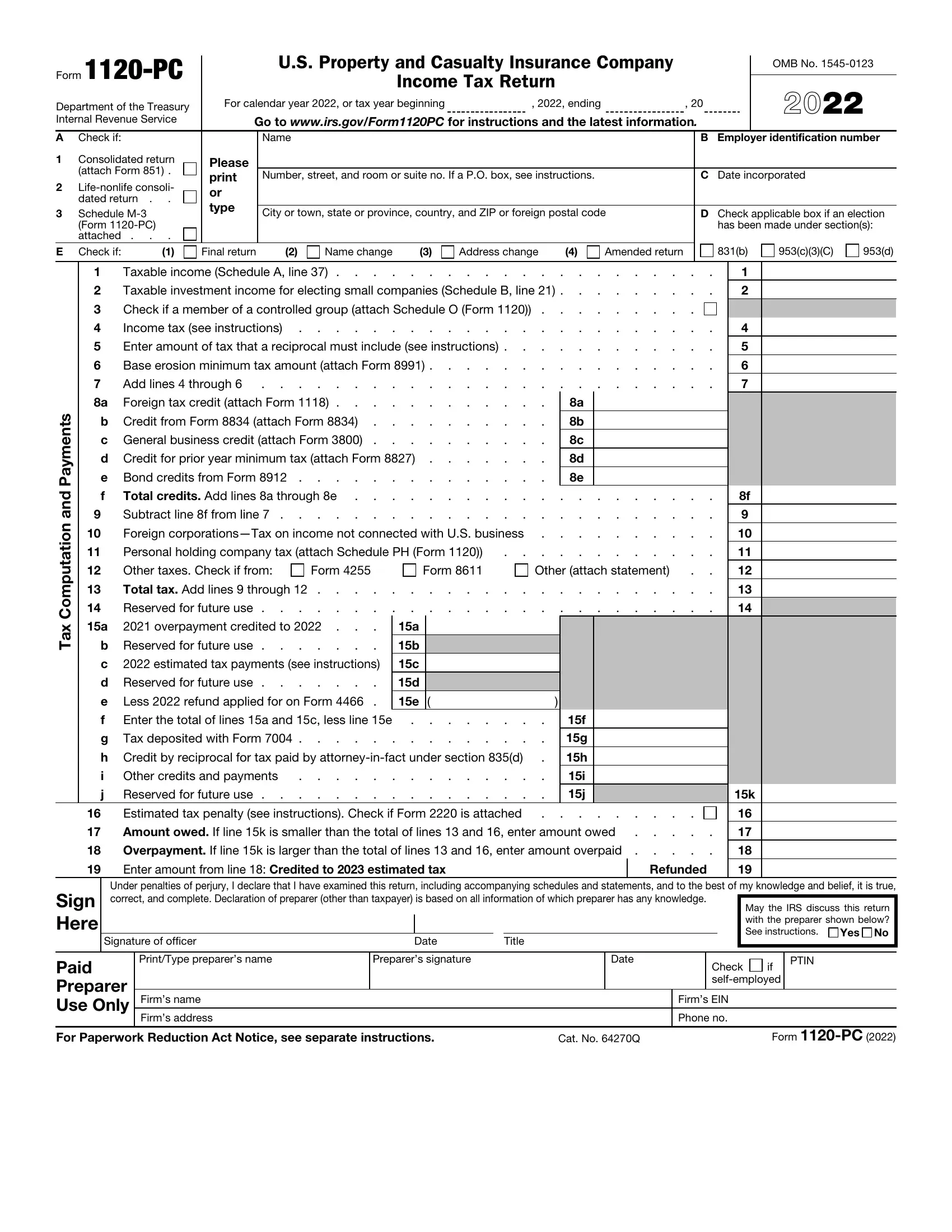

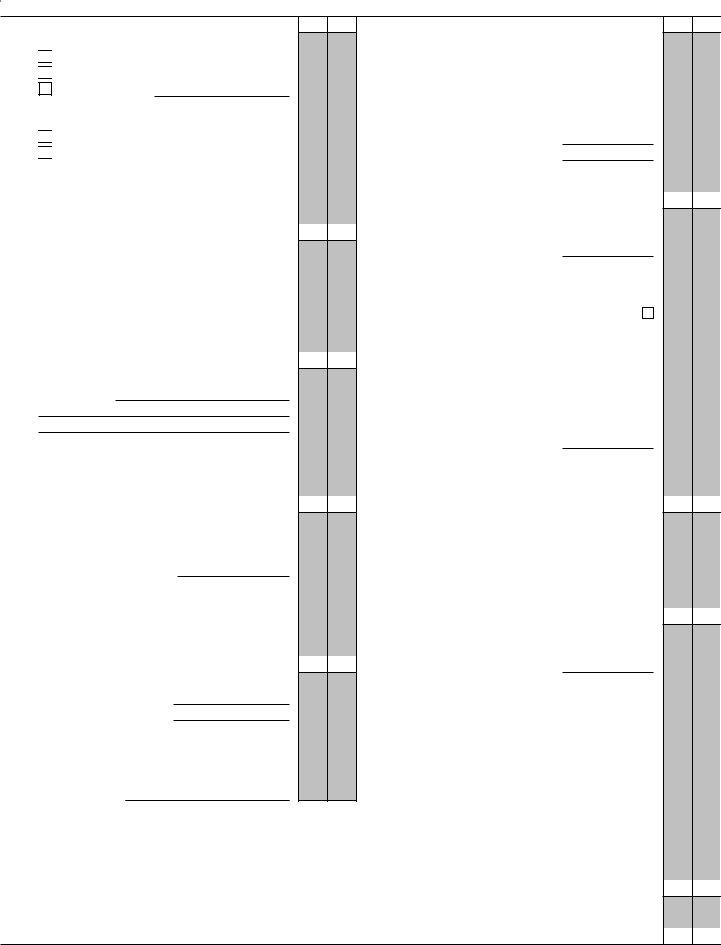

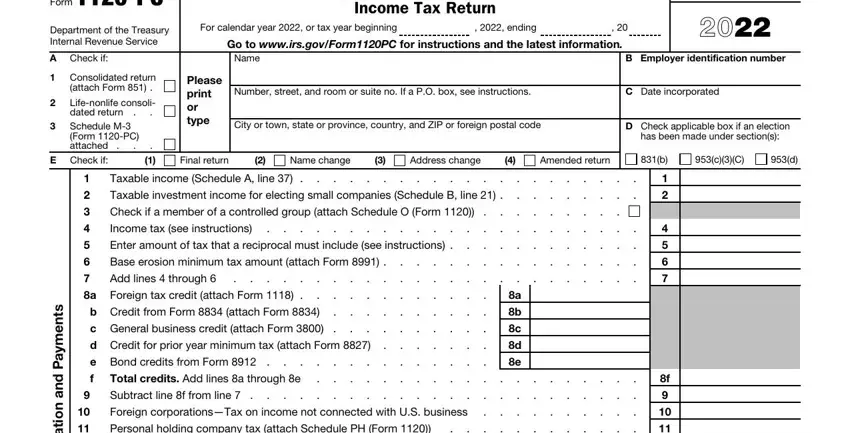

1. To get started, while filling out the mn property tax refund 2020, start out with the area that includes the subsequent blanks:

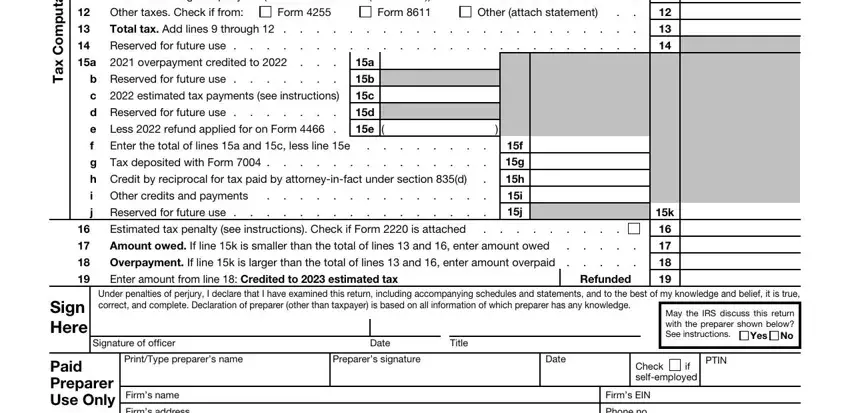

2. The next part is to submit all of the following blank fields: Taxable income Schedule A line , Total credits Add lines, b Reserved for future use , Form , s t n e m y a P d n a n o i t a t, Other attach statement , estimated tax payments see, e , d Reserved for future use , Less refund applied for on Form , g Tax deposited with Form h, Refunded, Sign Here, Under penalties of perjury I, and May the IRS discuss this return.

Concerning Total credits Add lines and b Reserved for future use , ensure that you double-check them in this current part. Those two could be the most significant fields in this PDF.

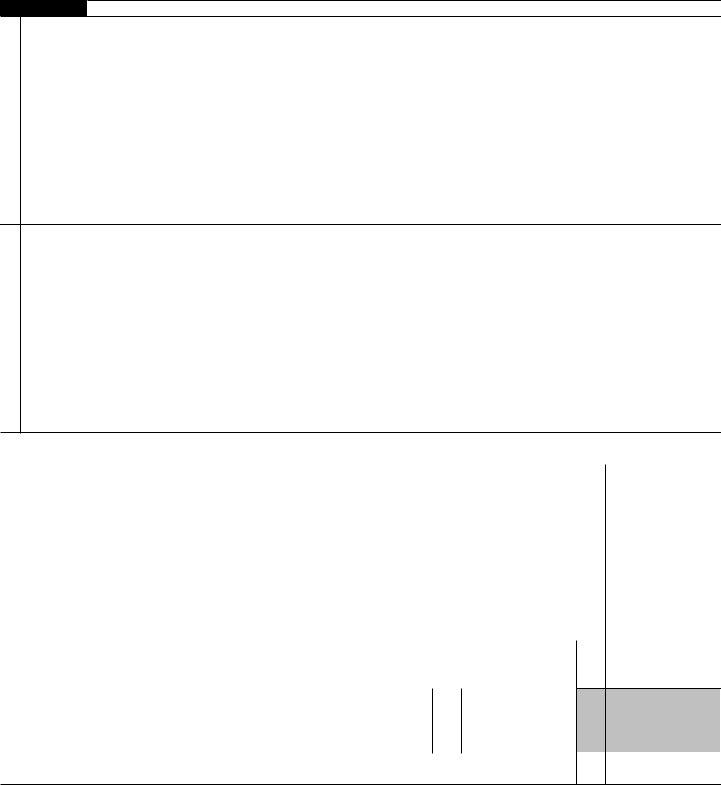

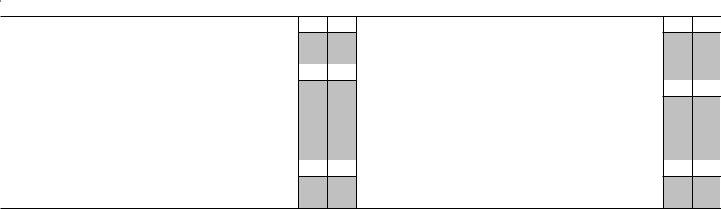

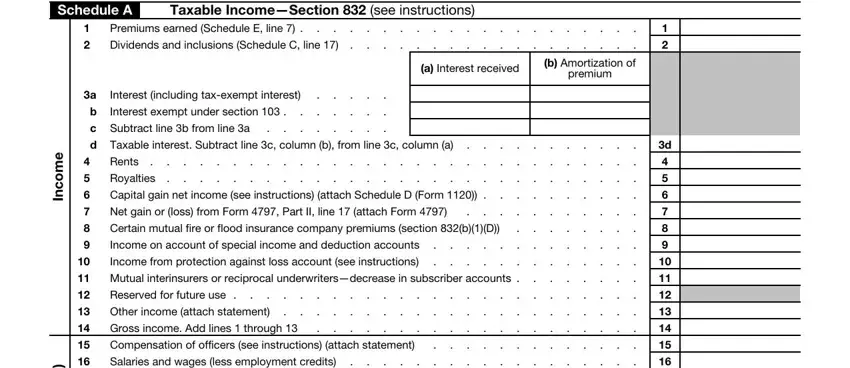

3. This next step will be hassle-free - fill in all the blanks in Schedule A, Premiums earned Schedule E line , Taxable IncomeSection see, a Interest received, Interest including taxexempt, b Interest exempt under section , Rents Royalties Capital, e m o c n, s n o i t c u d e d n o s n o i, b Amortization of, premium, and c Bal to conclude this process.

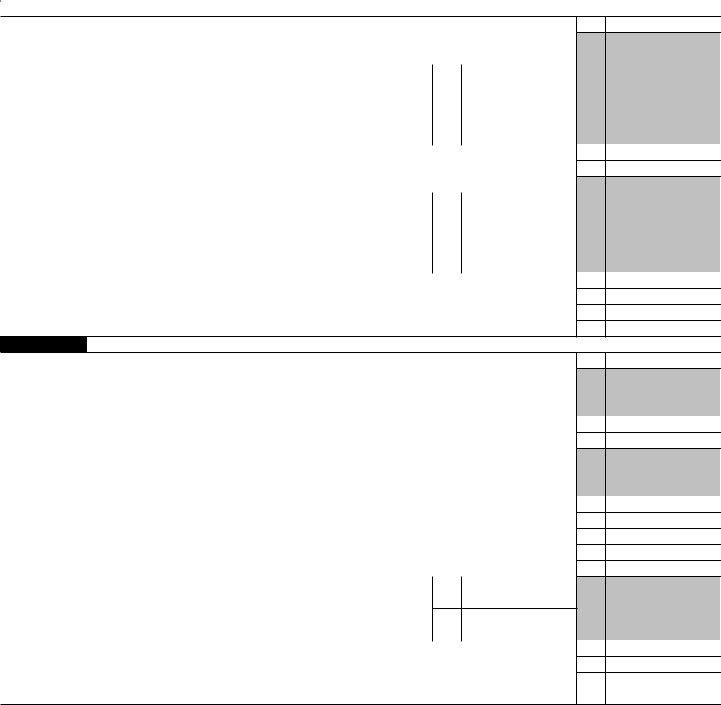

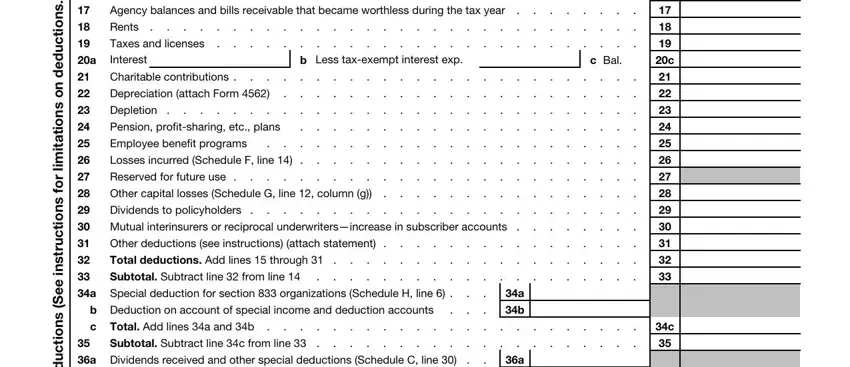

4. The following paragraph needs your information in the following areas: Rents Royalties Capital, b Less taxexempt interest exp , a Special deduction for section, b Deduction on account of special, Total Add lines a and b Subtotal, a Dividends received and other, s n o i t c u d e d n o s n o i, i l r o f s n o i t c u r t s n, e e S, s n o i t c u d e D, and c Bal . Make certain you fill in all required info to move further.

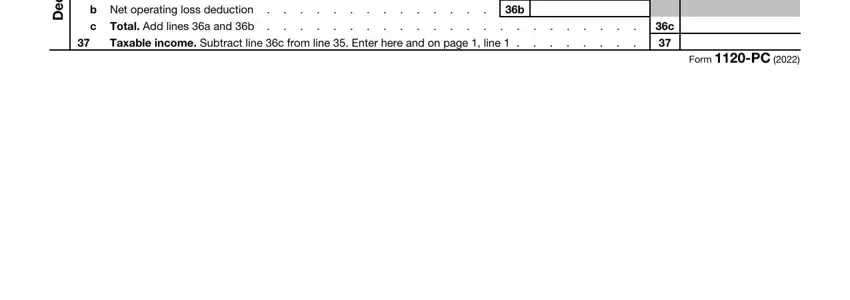

5. To conclude your form, this last segment incorporates a few extra blanks. Filling out b Net operating loss deduction, s n o i t c u d e D, and Form PC is going to wrap up everything and you will be done quickly!

Step 3: Proofread what you've inserted in the blank fields and then click the "Done" button. Grab your mn property tax refund 2020 once you register online for a 7-day free trial. Readily gain access to the pdf form from your personal cabinet, along with any modifications and adjustments being conveniently saved! When you work with FormsPal, you can certainly fill out documents without needing to worry about personal information breaches or data entries being distributed. Our protected software makes sure that your personal information is maintained safely.