You could work with az 140nr easily with the help of our online tool for PDF editing. Our tool is consistently evolving to provide the very best user experience possible, and that's due to our commitment to continuous development and listening closely to testimonials. To start your journey, go through these basic steps:

Step 1: First of all, access the pdf editor by pressing the "Get Form Button" in the top section of this page.

Step 2: With our advanced PDF editor, you may do more than merely fill out forms. Try each of the functions and make your documents look high-quality with custom text added in, or modify the original input to excellence - all comes along with an ability to insert stunning graphics and sign it off.

This document requires particular info to be entered, hence make sure you take the time to provide exactly what is requested:

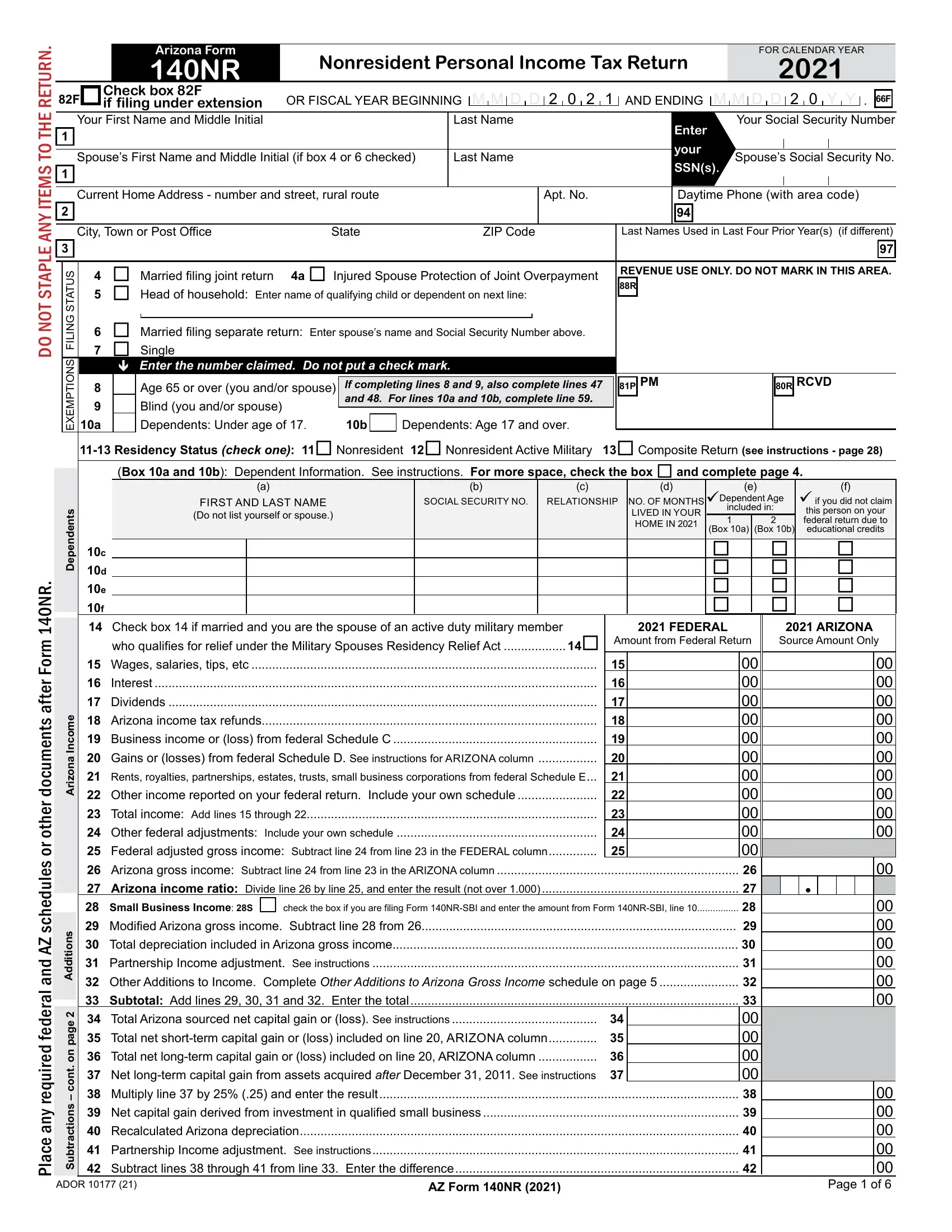

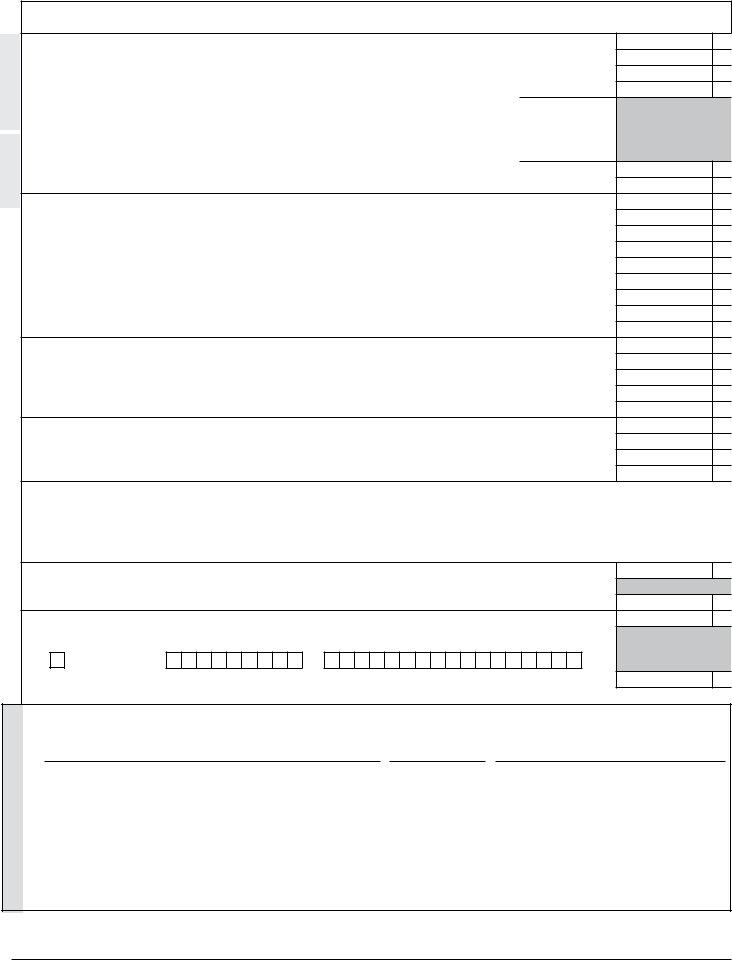

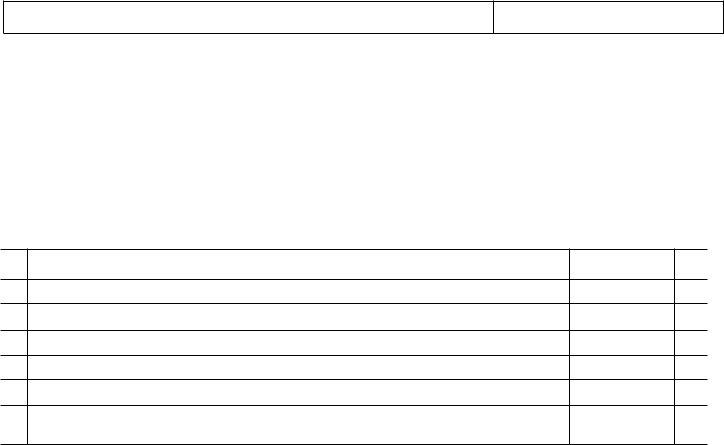

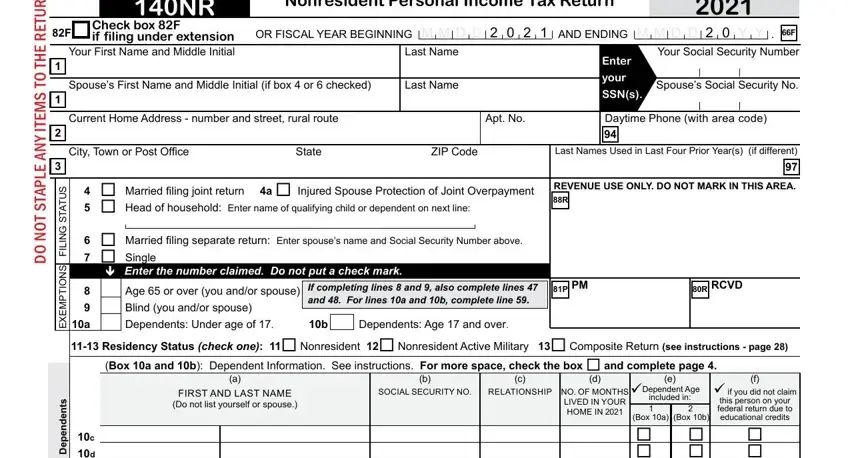

1. For starters, when filling out the az 140nr, beging with the page that has the next fields:

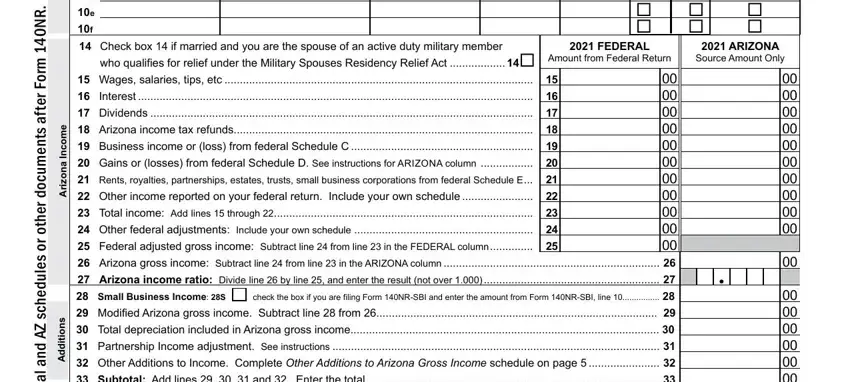

2. Once your current task is complete, take the next step – fill out all of these fields - e m o c n, I a n o z i r A, s n o i t i d d A, R N m r o F, r e t f a s t n e m u c o d r e h, u d e h c s, Z A d n a, a r e d e f d e r i, FEDERAL, Amount from Federal Return, ARIZONA Source Amount Only, Check box if married and you are, who qualifies for relief under the, Gains or losses from federal, and Arizona income tax refunds with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be really mindful when filling out u d e h c s and Amount from Federal Return, since this is the part where most people make some mistakes.

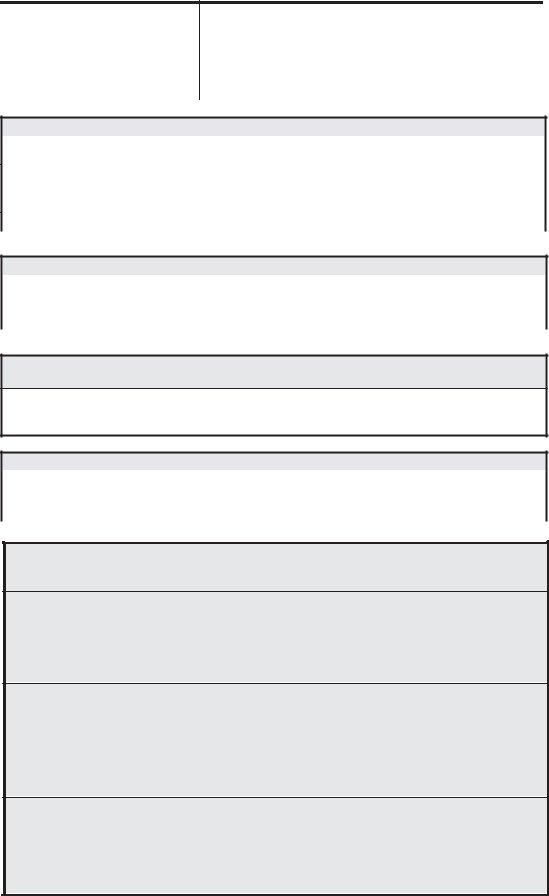

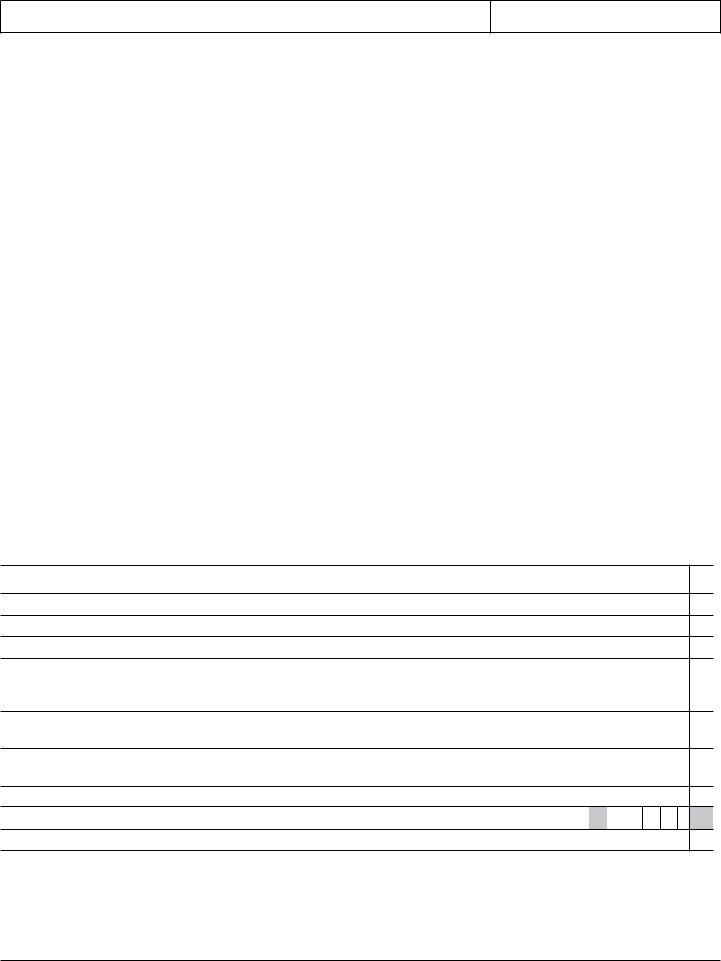

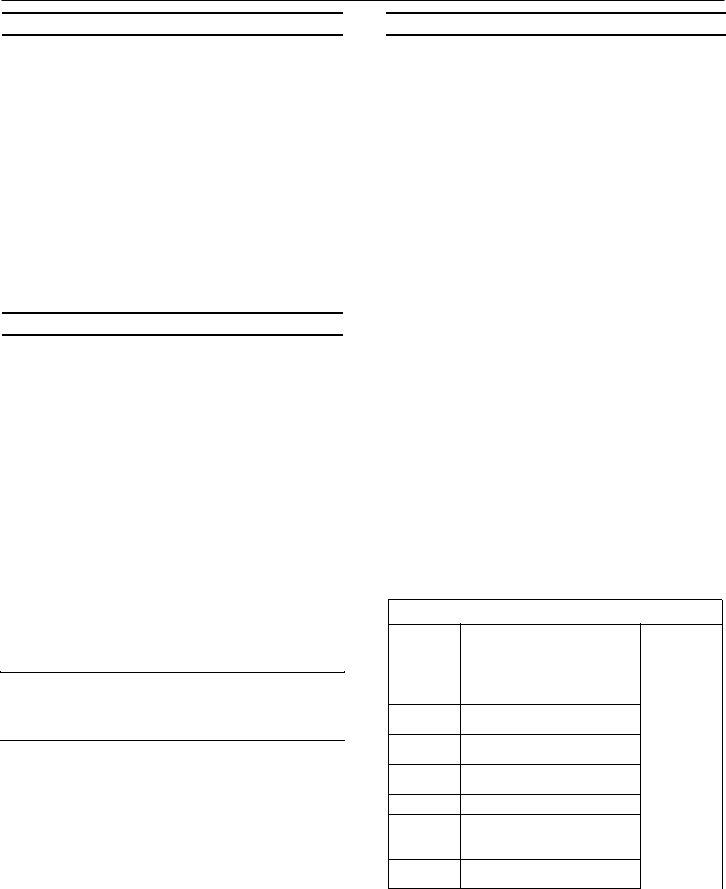

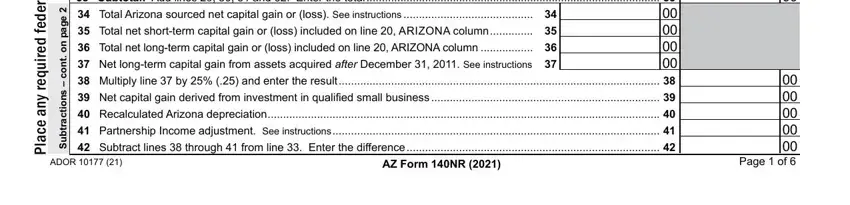

3. The following step should also be pretty straightforward, e g a p n o, t n o c, s n o i t c a r t b u S, a r e d e f d e r i, u q e r y n a e c a, Total net shortterm capital gain, Total Arizona sourced net capital, Subtotal Add lines and Enter, Total net longterm capital gain, Net longterm capital gain from, Net capital gain derived from, Recalculated Arizona depreciation, Partnership Income adjustment See, Subtract lines through from, and ADOR - these fields has to be completed here.

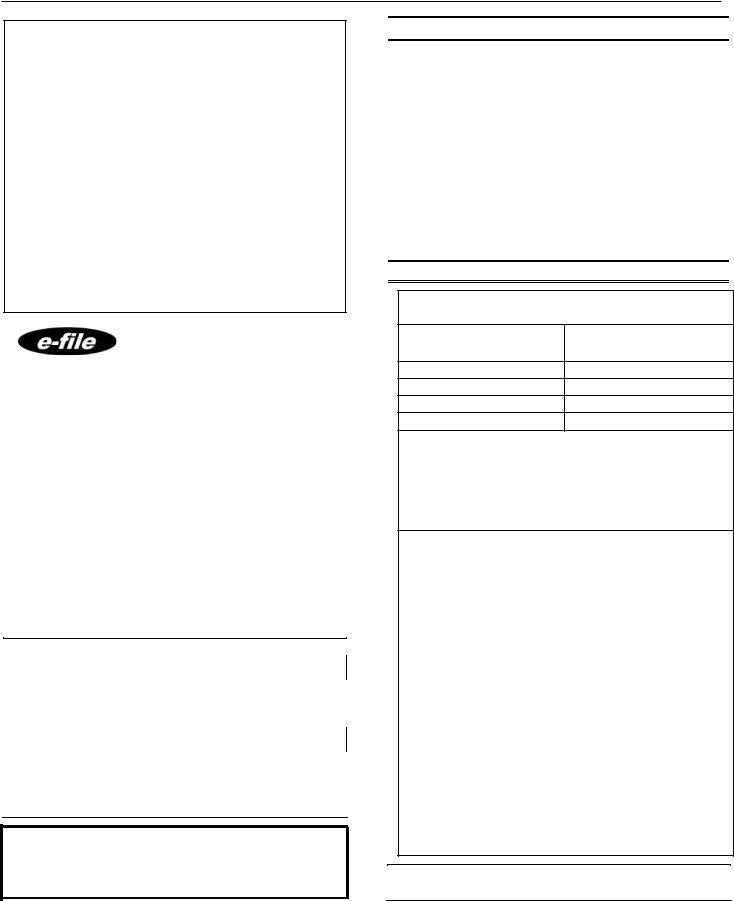

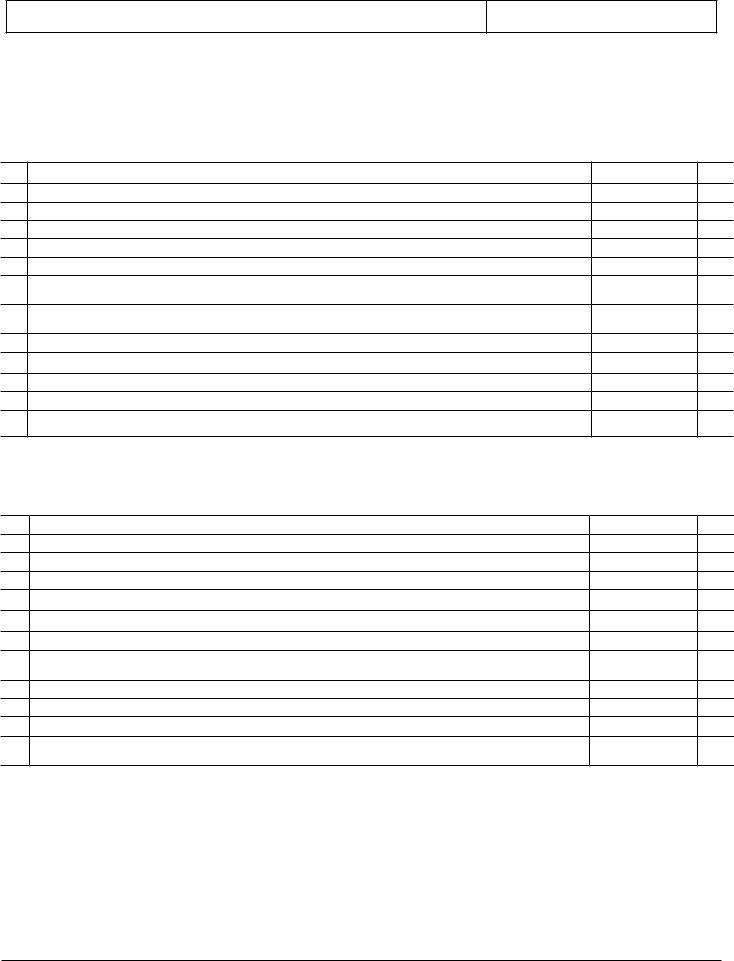

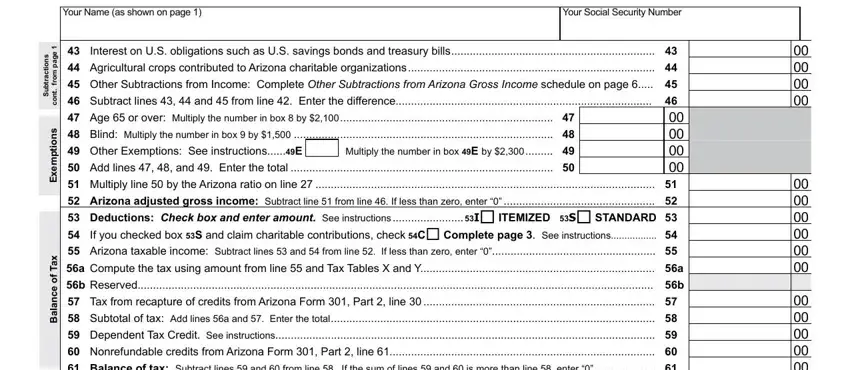

4. All set to fill out the next portion! Here you will have all of these Your Name as shown on page , Your Social Security Number, Interest on US obligations such, Agricultural crops contributed to, Other Subtractions from Income, Age or over Multiply the number, Subtract lines and from line , Blind Multiply the number in box , Arizona adjusted gross income, a Compute the tax using amount, b Reserved b, Tax from recapture of credits, Subtotal of tax Add lines a and , Dependent Tax Credit See, and Nonrefundable credits from form blanks to complete.

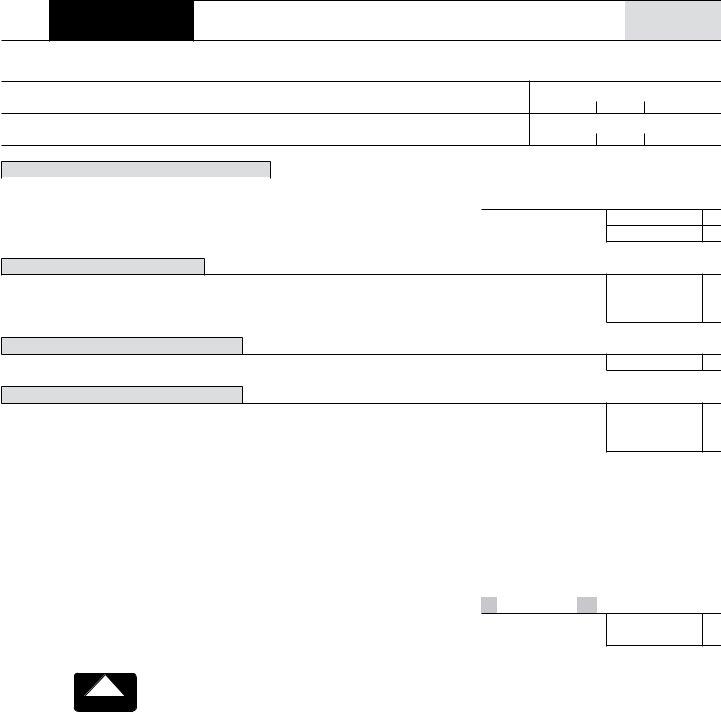

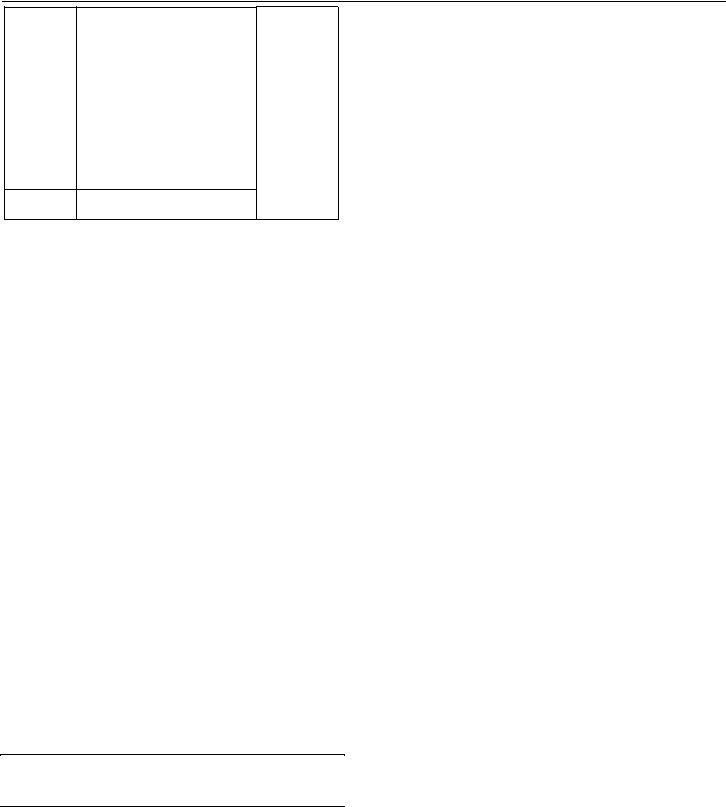

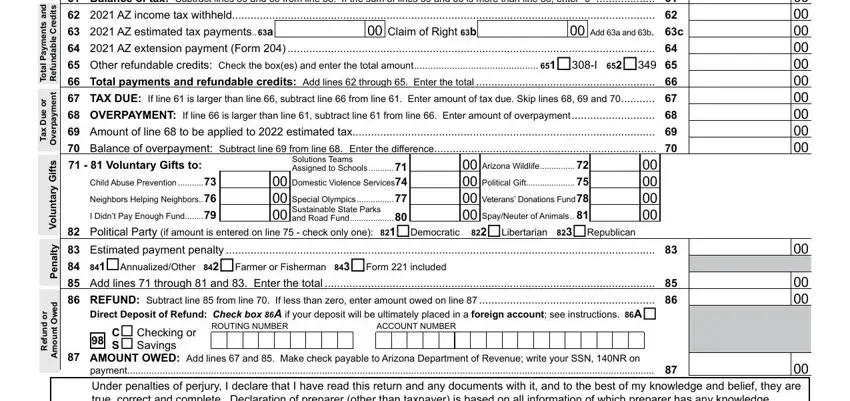

5. This last point to finish this form is essential. You need to fill out the appropriate fields, consisting of Balance of tax Subtract lines , AZ income tax withheld Add a, Claim of Right b, d n a, s t n e m y a P, a t o T, s t i d e r C e b a d n u f e R, r o e u D x a T, t n e m y a p r e v O, TAX DUE If line is larger than, OVERPAYMENT If line is larger, Amount of line to be applied to , Balance of overpayment Subtract, Voluntary Gifts to, and Child Abuse Prevention , prior to using the pdf. Failing to do it may lead to an incomplete and potentially incorrect form!

Step 3: Right after taking another look at your fields you've filled in, press "Done" and you're all set! After starting a7-day free trial account here, you'll be able to download az 140nr or send it via email directly. The document will also be at your disposal in your personal cabinet with your changes. We do not sell or share the information that you use while working with forms at our website.