Dealing with PDF forms online is easy with this PDF tool. Anyone can fill in kra p9 form excel download here within minutes. In order to make our editor better and easier to use, we constantly design new features, with our users' feedback in mind. Here's what you will want to do to start:

Step 1: Just hit the "Get Form Button" at the top of this page to open our form editor. There you'll find everything that is necessary to fill out your file.

Step 2: As soon as you access the tool, you will get the document prepared to be filled in. Apart from filling out different blank fields, you may also do several other things with the form, namely writing your own words, changing the original text, adding illustrations or photos, placing your signature to the PDF, and much more.

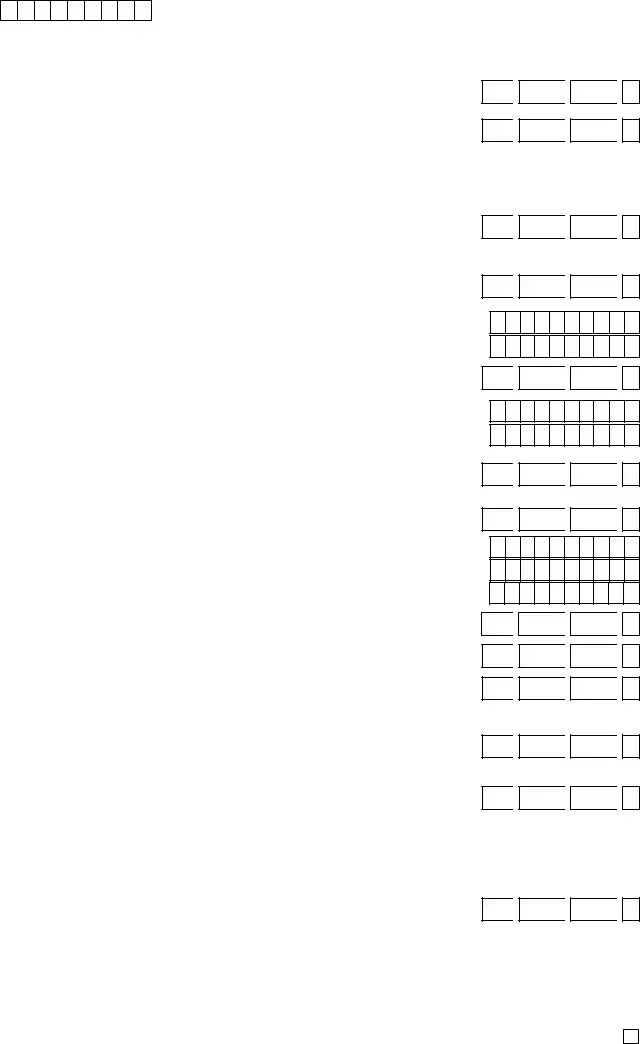

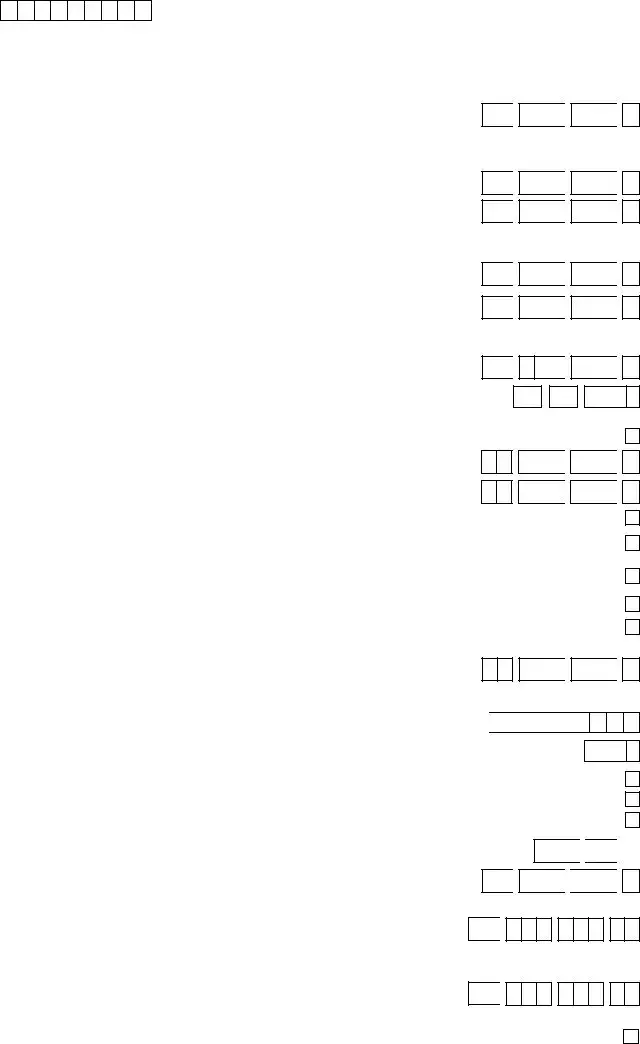

With regards to the blanks of this specific PDF, here's what you need to know:

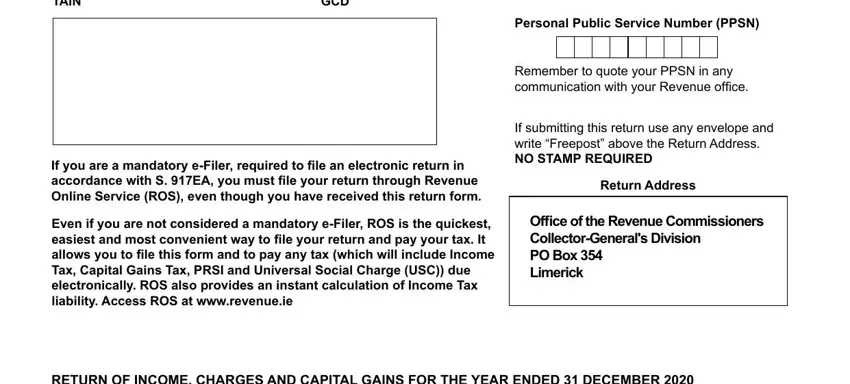

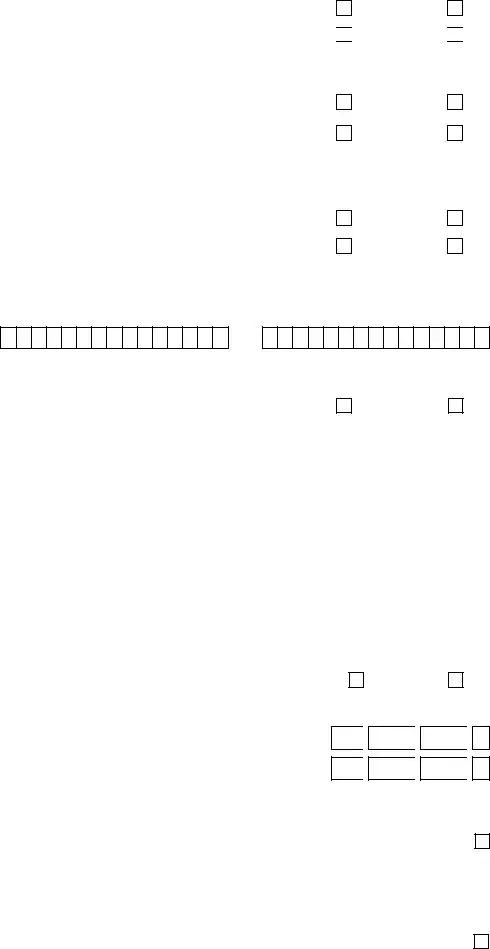

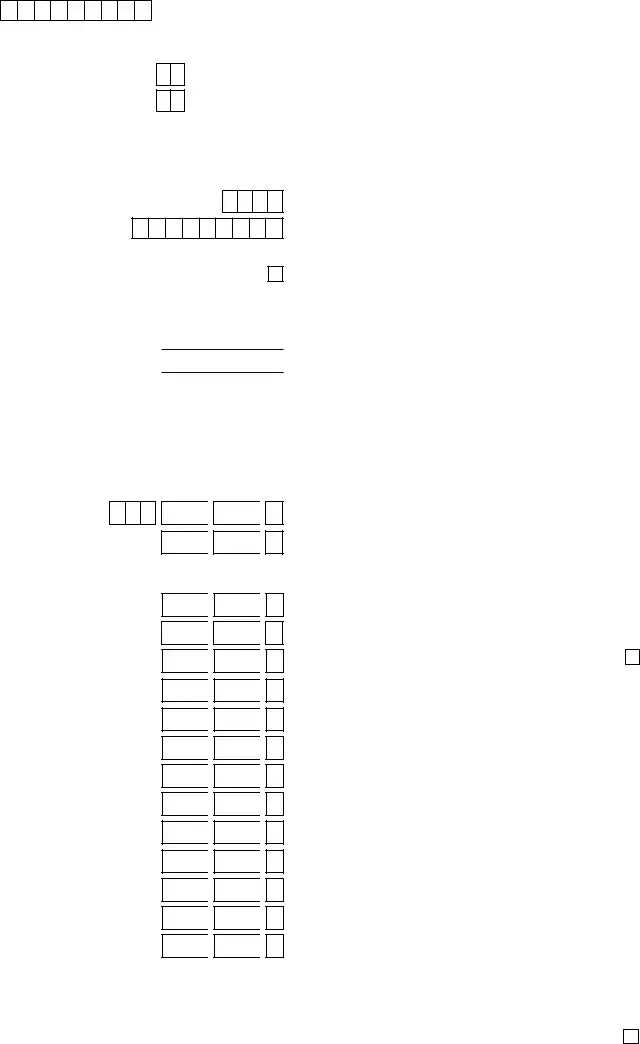

1. Start filling out your kra p9 form excel download with a selection of major fields. Collect all of the information you need and make certain nothing is forgotten!

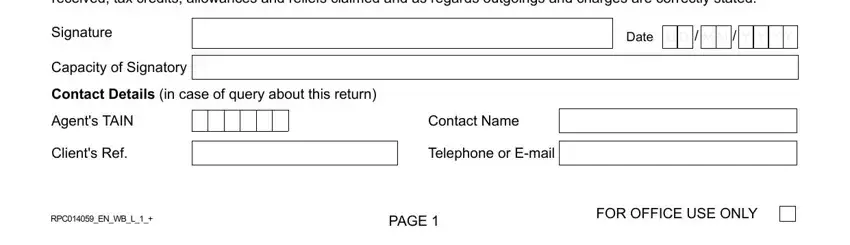

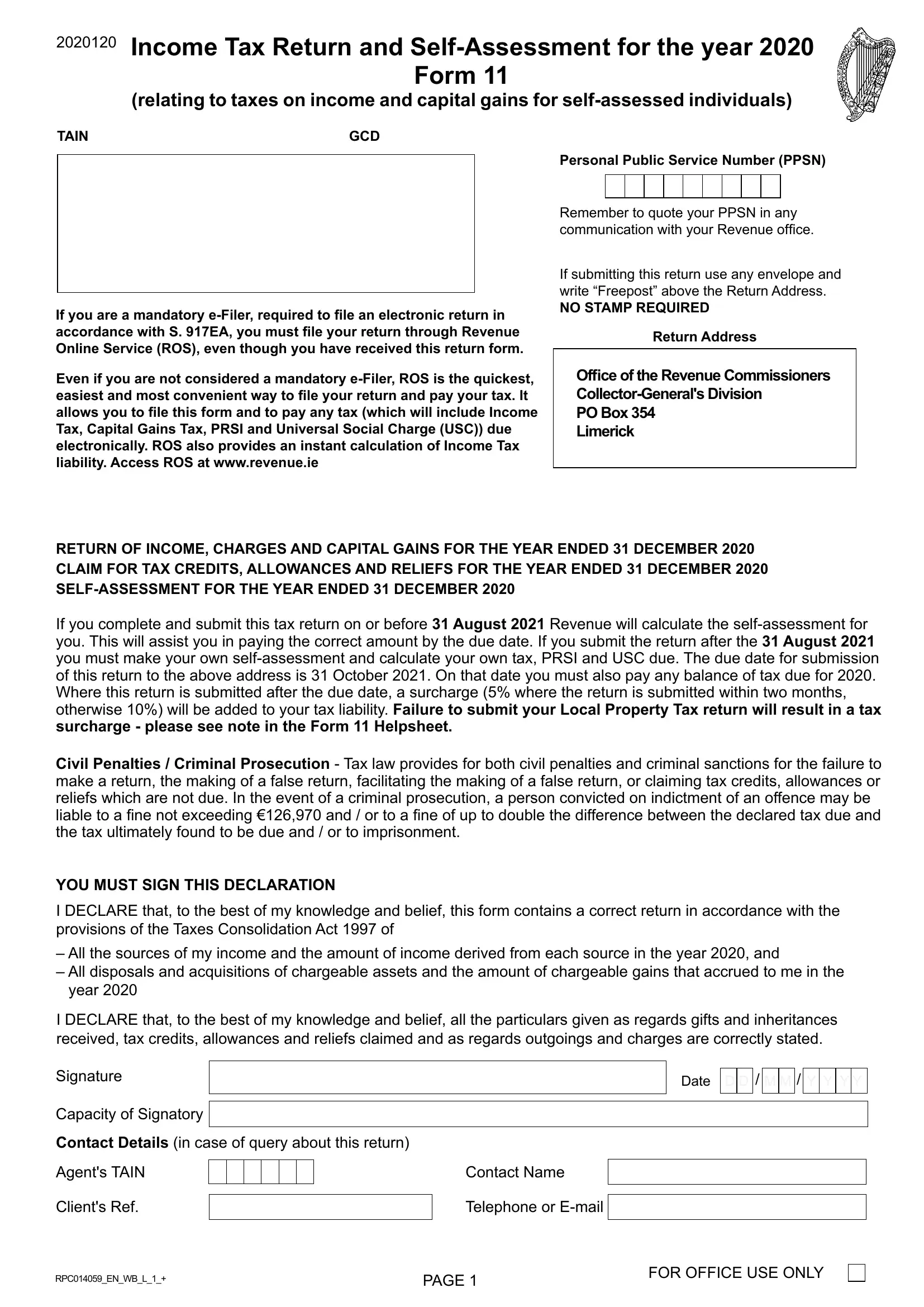

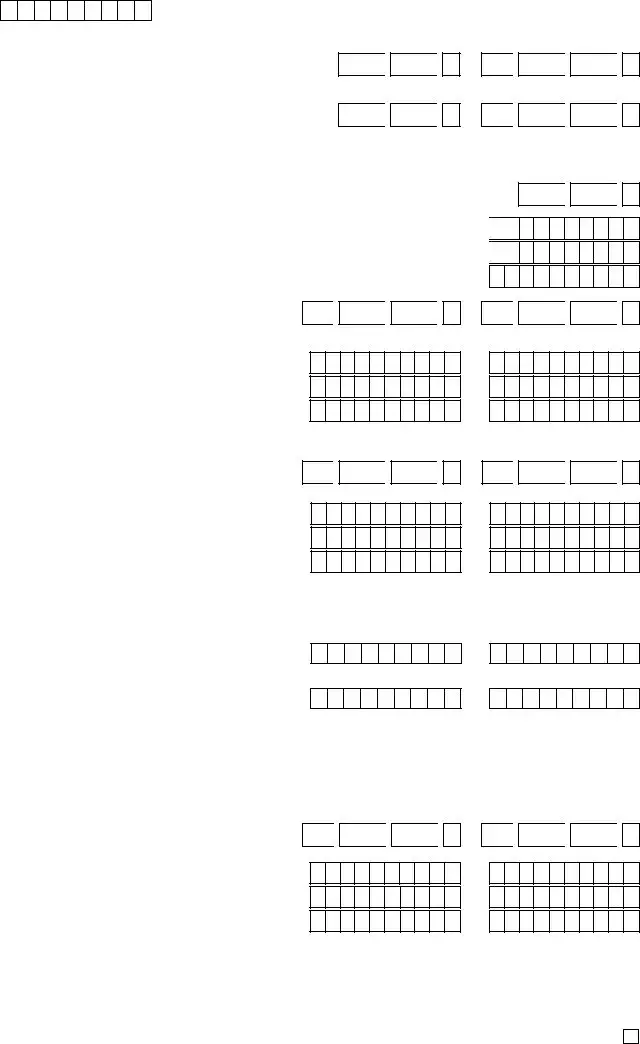

2. Soon after filling in this step, go to the next step and fill in all required details in these fields - I DECLARE that to the best of my, Signature, Capacity of Signatory, Contact Details in case of query, Agents TAIN, Clients Ref, Contact Name, Telephone or Email, Date, D D M M Y Y Y Y, RPCENWBL, PAGE , and FOR OFFICE USE ONLY.

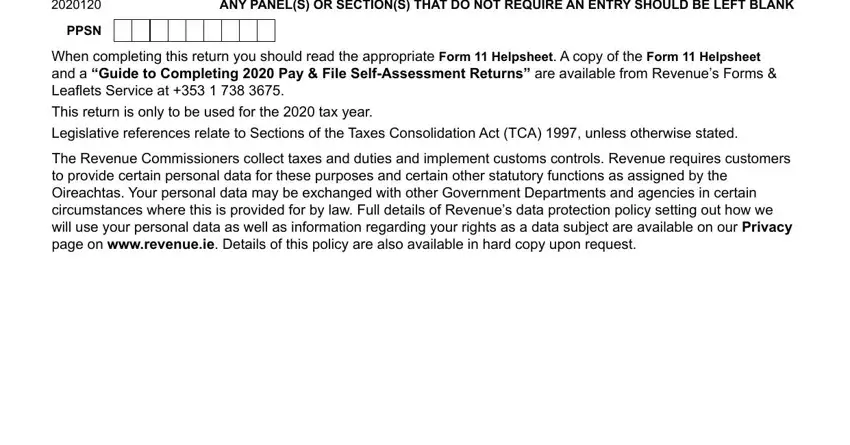

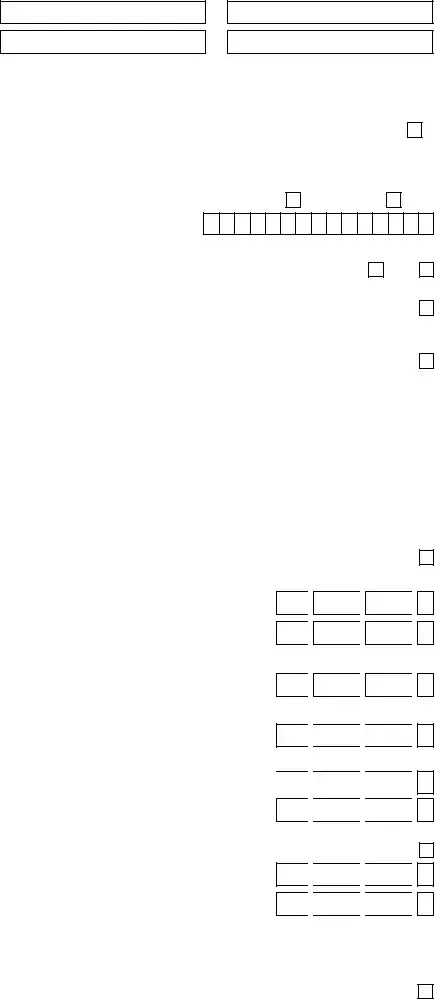

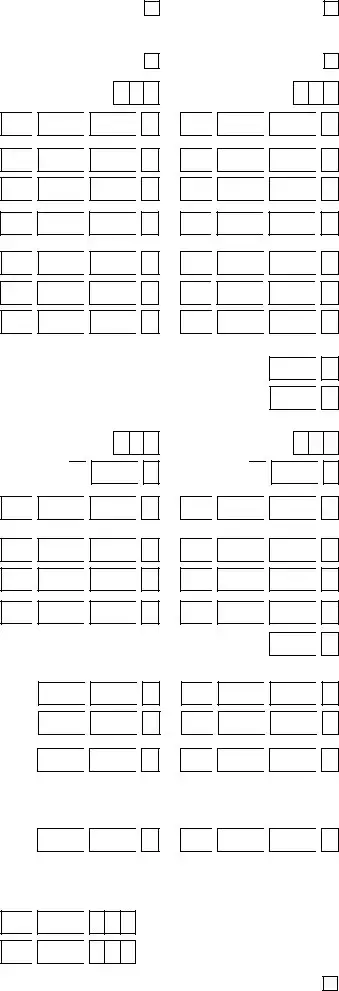

3. Completing PPSN, ANY PANELS OR SECTIONS THAT DO NOT, When completing this return you, and The Revenue Commissioners collect is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

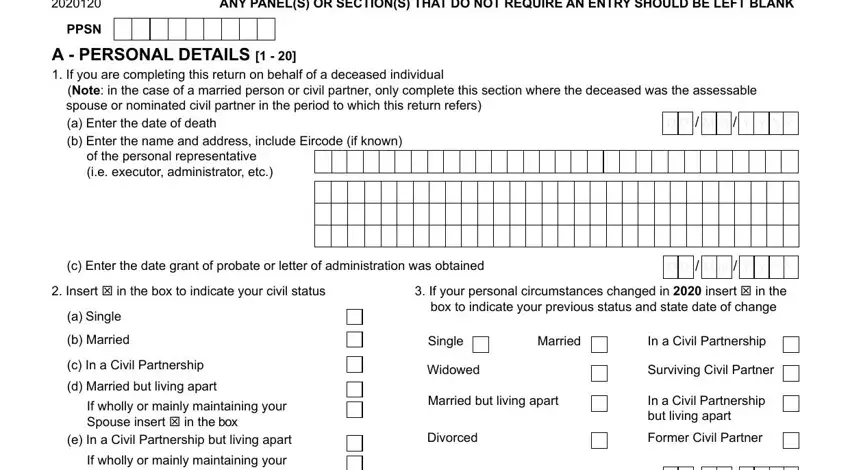

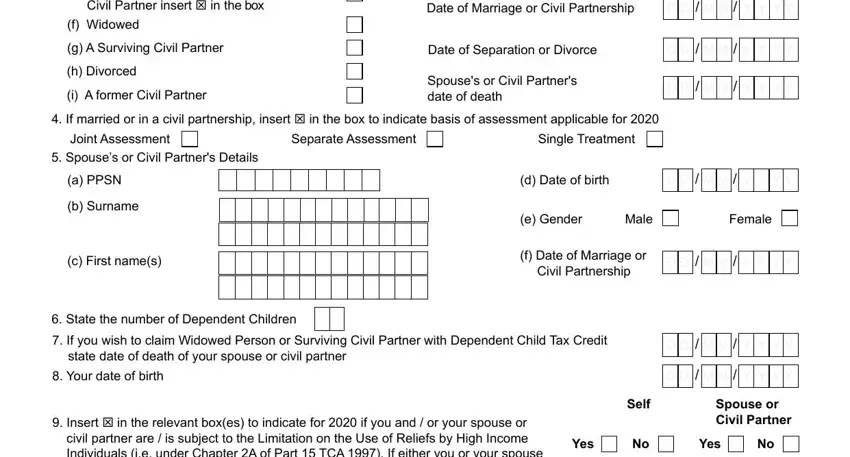

4. Now complete this fourth section! In this case you've got all of these PPSN, ANY PANELS OR SECTIONS THAT DO NOT, A PERSONAL DETAILS If you are, Note in the case of a married, D D M M Y Y Y Y, of the personal representative ie, c Enter the date grant of probate, D D M M Y Y Y Y, Insert T in the box to indicate, If your personal circumstances, box to indicate your previous, Single, Married, In a Civil Partnership, and Widowed form blanks to do.

Always be very careful when filling out box to indicate your previous and Single, as this is the section where many people make errors.

5. The form must be finished by going through this section. Below you can see a detailed listing of blanks that require correct information in order for your document submission to be faultless: Date of Marriage or Civil, Date of Separation or Divorce, Spouses or Civil Partners date of, D D M M Y Y Y Y, D D M M Y Y Y Y, D D M M Y Y Y Y, If wholly or mainly maintaining, f Widowed, g A Surviving Civil Partner, h Divorced, i A former Civil Partner, a PPSN, b Surname, c First names, and d Date of birth.

Step 3: Ensure your information is right and then just click "Done" to progress further. Join FormsPal today and instantly access kra p9 form excel download, prepared for download. Every last modification you make is conveniently preserved , so that you can change the pdf further anytime. We do not share any information you type in while working with forms at FormsPal.

D

D

Y

Y

Y Y

Y Y

D

D

Y

Y

Y Y

Y Y

D

D

D

D

Y

Y

Y Y

Y Y

Y

Y

Y Y

Y Y

D

D

D

D

M

M

Y

Y

Y Y

Y Y

M

M

Y

Y

Y Y

Y Y

D

D

D

D

,

,

,

,

,

,

,

,

. 00

. 00

. 00

. 00

,

,

,

,

,

,

,

,

. 00

. 00

. 00

. 00

,

,

,

,

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

,

,

,

,

,

,

,

,

,

,

,

,

. 00

. 00

. 00

. 00

. 00

. 00

,

,

,

,

. 00

. 00

,

,

,

,

. 00

. 00

,

,

,

,

. 00

. 00

,

,

,

,

. 00

. 00

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

,

,

,

,

,

,

,

,

,

,

,

,

. 00

. 00

. 00

. 00

. 00

. 00

,

,

,

,

,

,

,

,

. 00

. 00

. 00

. 00

,

,

D

D

,

,

. 00

. 00

Y

Y

Y Y

Y Y

,

,

,

,

,

,

. 00

. 00

. 00

. 00

. 00

. 00

Y

Y

Y Y

Y Y

,

,

(%)

(%)

. 00

. 00

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

.

.

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

.

.

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

,

,

,

,

,

,

,

,

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

,

,

,

,

,

,

,

,

,

,

,

,

. 00

. 00

. 00

. 00

,

,

,

,

,

,

,

,

. 00

. 00

. 00

. 00

,

,

. 00

. 00

,

,

,

,

. 00

. 00

,

,

,

,

. 00

. 00

,

,

,

,

. 00

. 00

,

,

,

,

. 00

. 00

,

,

,

,

. 00

. 00

,

,

,

,

. 00

. 00