1065b can be completed online very easily. Just make use of FormsPal PDF editor to finish the job without delay. The tool is continually upgraded by our team, getting new awesome functions and turning out to be greater. Should you be seeking to get going, this is what it will take:

Step 1: Firstly, access the tool by clicking the "Get Form Button" in the top section of this site.

Step 2: With our handy PDF tool, you'll be able to accomplish more than merely complete blanks. Try all the features and make your docs seem sublime with customized text added in, or optimize the file's original input to perfection - all accompanied by an ability to incorporate almost any images and sign the file off.

Be mindful while filling in this document. Make sure that all necessary areas are filled out correctly.

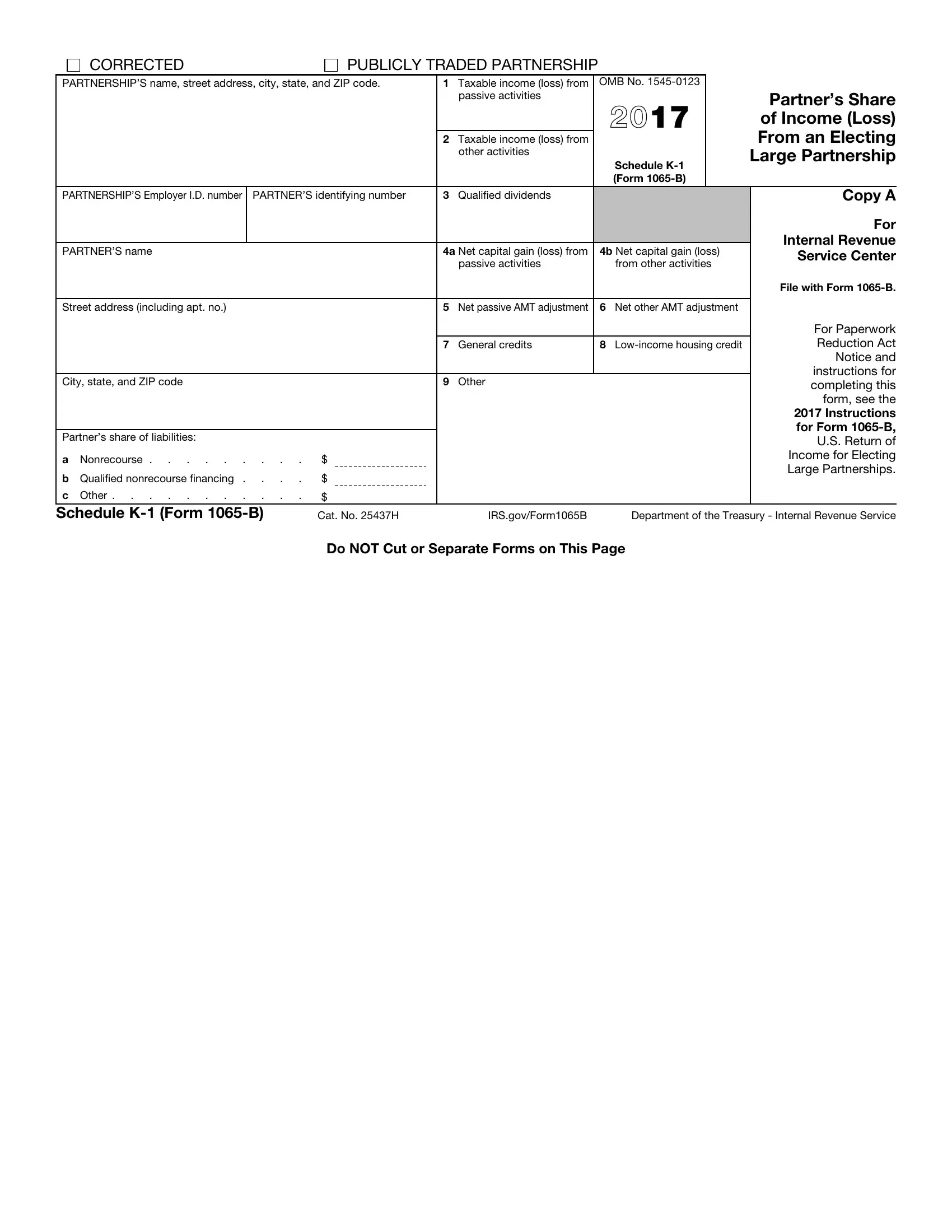

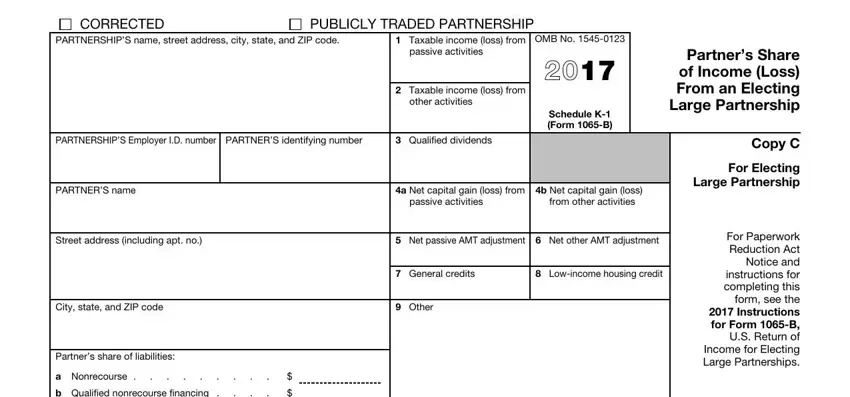

1. For starters, once filling in the 1065b, start out with the section that contains the next blank fields:

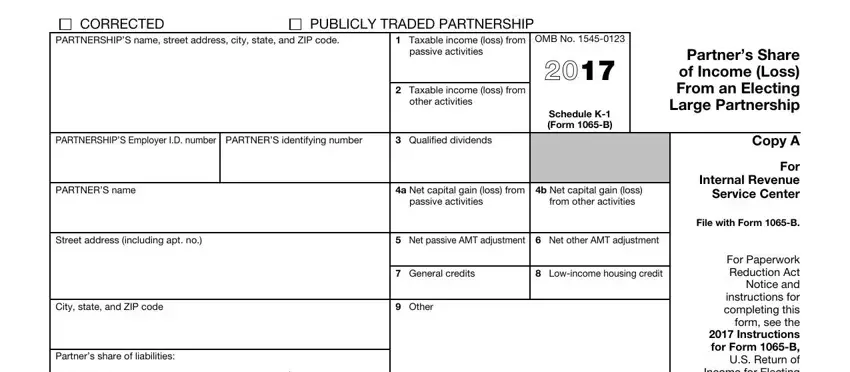

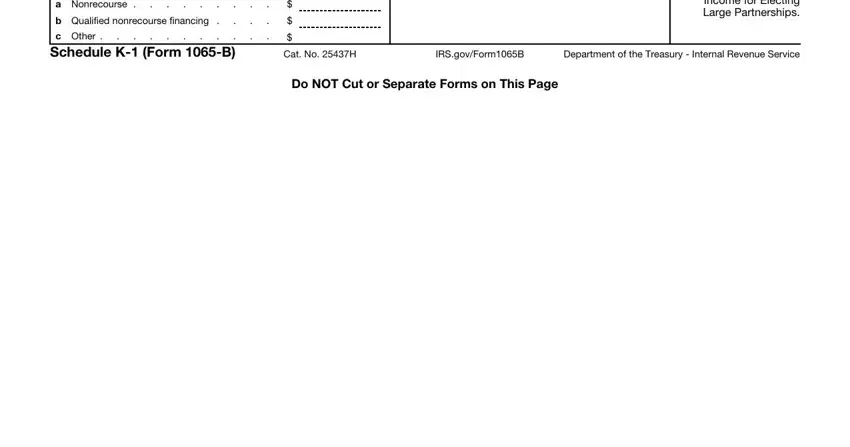

2. After this section is filled out, go on to enter the relevant information in these: For Paperwork Reduction Act Notice, a Nonrecourse , b Qualified nonrecourse financing , c Other Schedule K Form B, Cat No H, IRSgovFormB, Department of the Treasury , and Do NOT Cut or Separate Forms on.

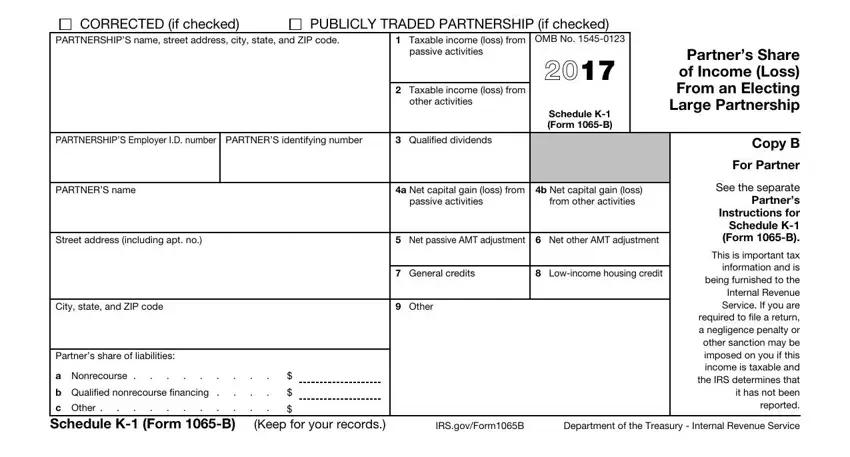

3. This next section is all about CORRECTED if checked, PUBLICLY TRADED PARTNERSHIP if, PARTNERSHIPS name street address, Taxable income loss from, OMB No , passive activities, Taxable income loss from, other activities, Schedule K Form B, Partners Share of Income Loss From, PARTNERSHIPS Employer ID number, Qualified dividends, PARTNERS name, a Net capital gain loss from, and b Net capital gain loss - type in every one of these fields.

4. The next paragraph needs your attention in the subsequent places: CORRECTED, PARTNERSHIPS name street address, PUBLICLY TRADED PARTNERSHIP , passive activities, Taxable income loss from, other activities, OMB No , Schedule K Form B, PARTNERSHIPS Employer ID number, Qualified dividends, PARTNERS name, a Net capital gain loss from, b Net capital gain loss, passive activities, and from other activities. Just remember to give all required information to move further.

5. This very last stage to finish this PDF form is pivotal. You need to fill out the necessary blank fields, for example b Qualified nonrecourse financing , c Other Schedule K Form B, IRSgovFormB, and Department of the Treasury , before using the file. Neglecting to do this can contribute to an unfinished and probably unacceptable document!

Always be very mindful while completing Department of the Treasury and c Other Schedule K Form B, as this is where a lot of people make mistakes.

Step 3: Prior to obtaining the next stage, make certain that blank fields have been filled out correctly. When you’re satisfied with it, click on “Done." Go for a free trial subscription with us and acquire direct access to 1065b - downloadable, emailable, and editable from your personal account. At FormsPal.com, we do everything we can to be sure that all of your information is kept protected.