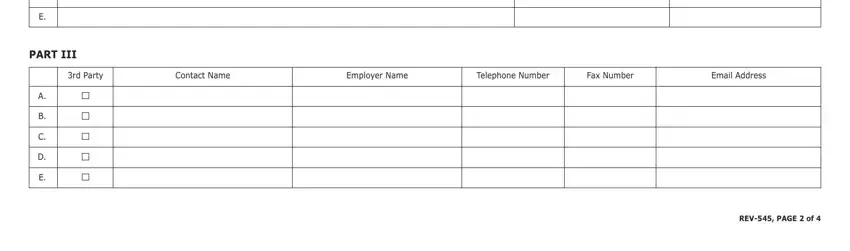

PENNSYLVANIARESEARCHANDDEVELOPMENTTAXCREDITAPPLICATIONINSTRUCTIONS

PERACT7of1997,ACT46of2003,ACT116of2006andAct84of2016

YoumaynowsubmityourResearchandDevelopment(R&D)TaxCreditApplicationviaemailtoRA-RVPACORPRD@pa.gov.Please makesuretosigntheapplication.

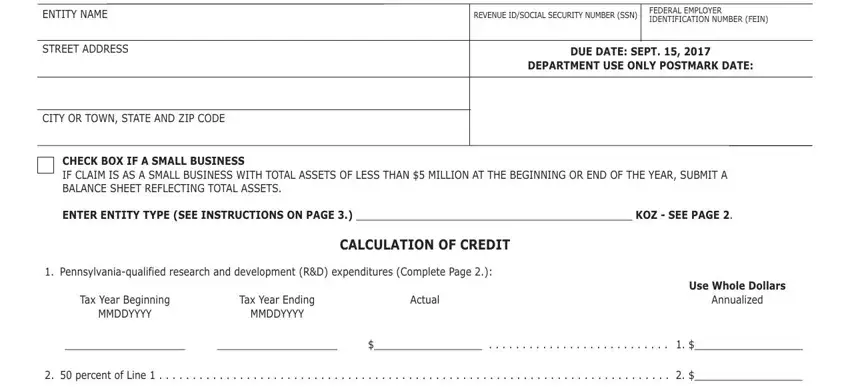

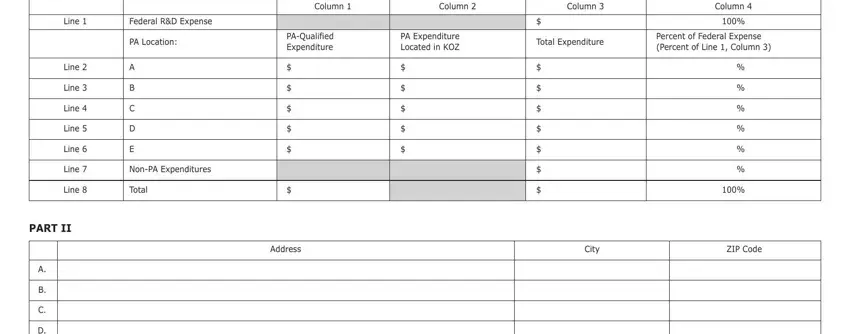

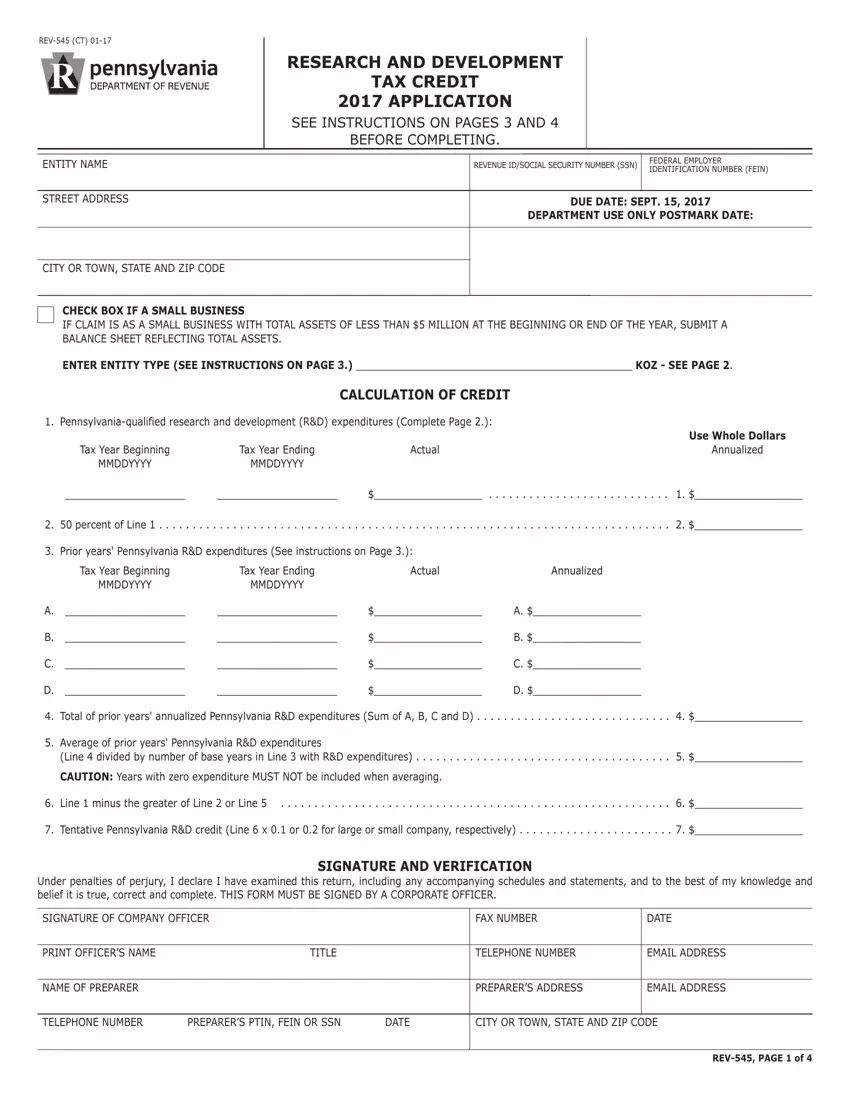

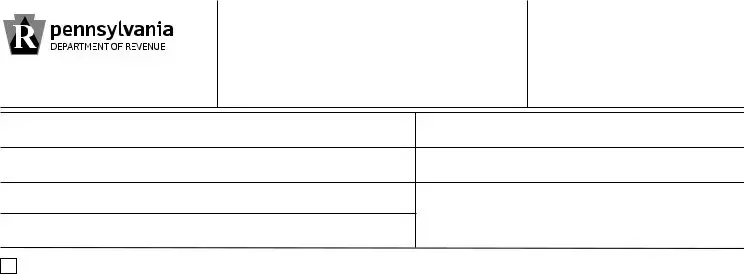

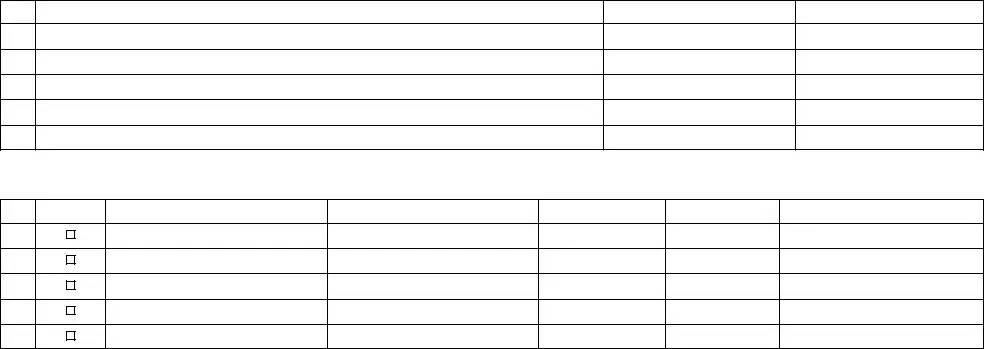

Requiredinformation: Completed and signed Page 1 of the 2016 Research and Development Tax Credit Application, completed Page 2 of the 2016 R&D application, completed Page 2 (all three sections) of REV-545 for each year that was not previously submitted with an application, federal Form 6765 or pro forma 6765, balance sheet for a small business and any applicable partnership information (percentage owned). If this is the first year you are submitting this application you must also include federal Form 6765, or a pro forma 6765, for all previous years, as well as Page 2 (all three sections) of REV-545 for each previous year. This information is required even if zero credit is claimed on Line 7 of the application. If you have filed a REV-545 in a prior year and there is a change in the amount of R&D expenditures (Line 3, a-d on Page 1 of REV- 545) between this filing and the prior filing(s), provide a detailed explanation for each change, including supporting documentation.

NOTE: Verify the address on Page 1; it will be used to mail the award letter.

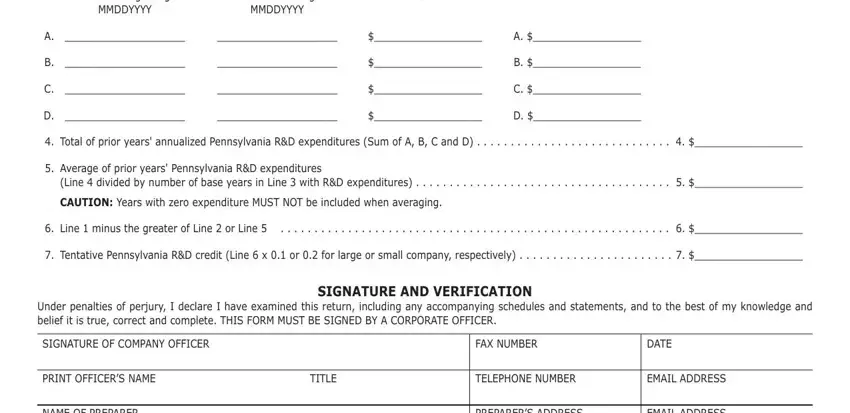

Prior year expenses must be four taxable years immediately preceding the taxable year in which the expense is incurred.

To apply for a PA R&D tax credit, a taxpayer must have qualified PA R&D expenses in the current tax year (Line 1) and in at least one preceding tax year (Line 3). NOTE:IfPAR&DexpenditureswereincurredinaKeystoneOpportunityZone(KOZ),thetaxpayerisnotentitled

to an R&D credit. If you have questions regarding combining a Keystone Opportunity Zone (KOZ) tax credit and a Research and Development(R&D)taxcredit,pleasecall717-772-3896.

For purposes of the PA R&D tax credit, a taxpayer is an entity subject to PA personal income tax or corporate net income tax.

Qualified R&D expenses include research expenses incurred for qualified research and development, as defined in Section 41 (b) of the Internal Revenue Code of 1986, conducted within PA.

A 52-53 week filer whose year ends in the first week of January is considered a calendar year filer.

The department will notify applicants of PA R&D tax credit approvals by mailing award letters by Dec. 15th. A taxpayer may apply the approved credit against his/her PA personal income tax or corporate net income tax liability for the tax year in which the credit is approved. Any unused credit may be carried over for up to 15 succeeding taxable years. A taxpayer is not entitled to carry back, obtain a refund of or assign unused PA R&D tax credits awarded on or prior to Dec. 15, 2002.

Effective for awards made Dec. 15, 2003, and after, the taxpayer can apply to the PA Department of Community and Economic Development, DCED, to sell or assign a PA R&D credit if there has been no claim of allowance filed within one year from the date the Department of Revenue approved the credit. Effective for awards made Dec. 15, 2009, and after, the taxpayer no longer has to wait one year before selling or assigning the credit. However, the taxpayer cannot sell or assign credit until the tax return covering the period including the Dec. 15 award date has been filed.

To apply to sell or assign R&D credit, visit www.dced.pa.gov or contact DCED at 717-214-5422 or 400 North St., 4th Fl., Keystone Building, Harrisburg PA 17120-0225. The purchaser or assignee must use the credit in the taxable year in which the purchase or assignment is made, and the credit cannot exceed 75 percent of the tax liability for the taxable year. The purchaser or assignee may not carry over, carry forward, carry back or obtain a refund of the credit.

Effective for awards made Dec. 15, 2006, and after, pass-through entities include limited liability companies and partnerships, therefore the credit can be transferred (passed-through) in writing to shareholders, members or partners in their proportionate share. The shareholder, member or partner must use the credit in the taxable year in which the transfer is made. Also effective for awards made Dec. 15, 2006, and after, the tentative credit on Line 7 is equal to 10 percent for large companies and 20 percent for small companies.

ENTITY TYPE: Complete the Entity Type on Page 1 by selecting one of the following categories:

Individual,LLC,LLP,Scorporation,Ccorporation,Soleproprietorship

If any tax years on Line 1 or Lines 3A, 3B, 3C or 3D of Page 1 represent a period of less than a full year, (other than for full year 52-53 week filers), the amount(s) of PA R&D expenses must be annualized.

Example: Tax year beginning Jan. 1, 2016, and ending July 31, 2016

Annualized amount = $1,000,000 x 365* = $1,721,698 212

*Use 366 for leap years that include 29 days in February.

If the taxpayer has two or more consecutive short periods that equal one full tax year, the short periods should be combined as a single tax year on Line 1 and Line 3, a-d on Page 1. Submitonlyoneapplication.