There's nothing complicated related to filling out the 21st mortgage app once you open our PDF tool. By simply following these clear steps, you can receive the ready PDF file within the least time period feasible.

Step 1: Click the button "Get Form Here".

Step 2: At the moment you are on the form editing page. You may enhance and add information to the file, highlight specified content, cross or check specific words, add images, put a signature on it, get rid of unrequired fields, or eliminate them altogether.

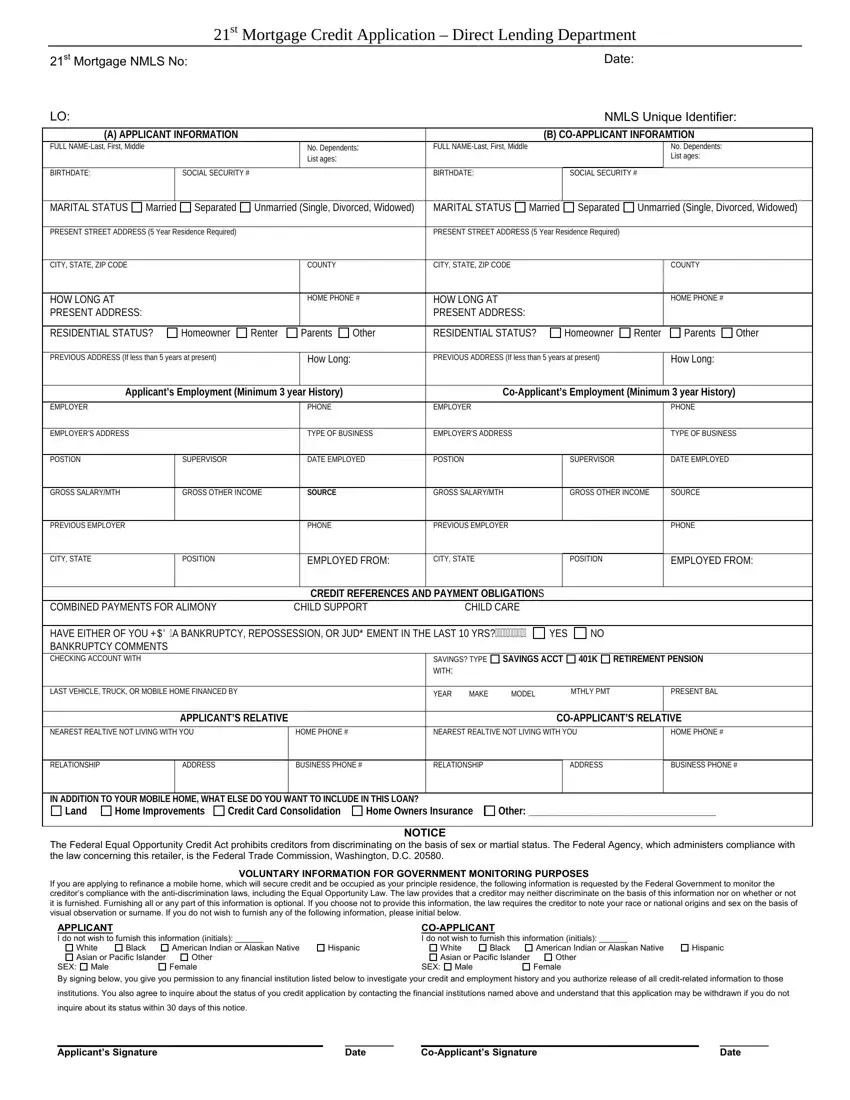

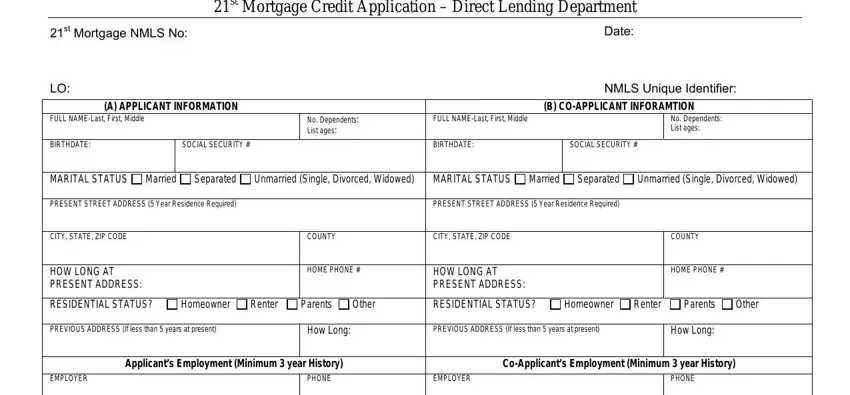

These particular areas are in the PDF template you'll be creating.

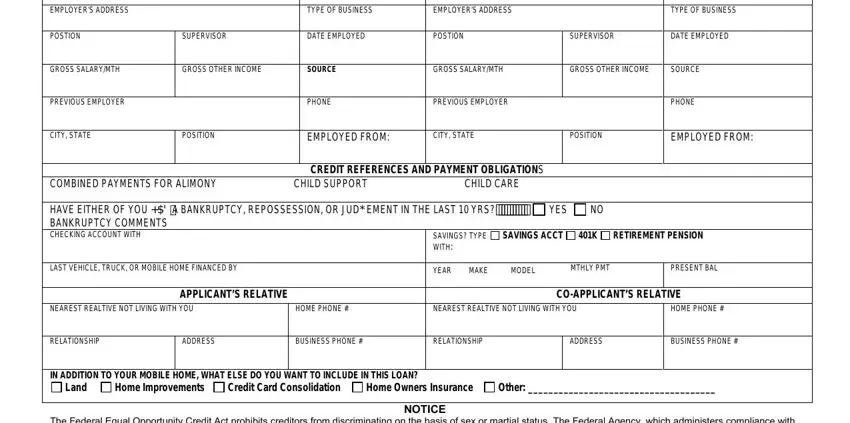

Feel free to prepare the EMPLOYERS ADDRESS, TYPE OF BUSINESS, EMPLOYERS ADDRESS, TYPE OF BUSINESS, POSTION, SUPERVISOR, DATE EMPLOYED, POSTION, SUPERVISOR, DATE EMPLOYED, GROSS SALARYMTH, GROSS OTHER INCOME, SOURCE, GROSS SALARYMTH, and GROSS OTHER INCOME box with the required details.

Step 3: When you are done, select the "Done" button to upload the PDF file.

Step 4: You could make copies of your document tostay clear of all upcoming problems. Don't get worried, we don't publish or monitor your information.