Our PDF editor that you can apply was created by our finest computer programmers. It is easy to fill in the credit form application file immediately and efficiently with this software. Just comply with this instruction to get started.

Step 1: Hit the button "Get form here" to open it.

Step 2: Once you have accessed your credit form application edit page, you'll see all functions you can use with regards to your file in the top menu.

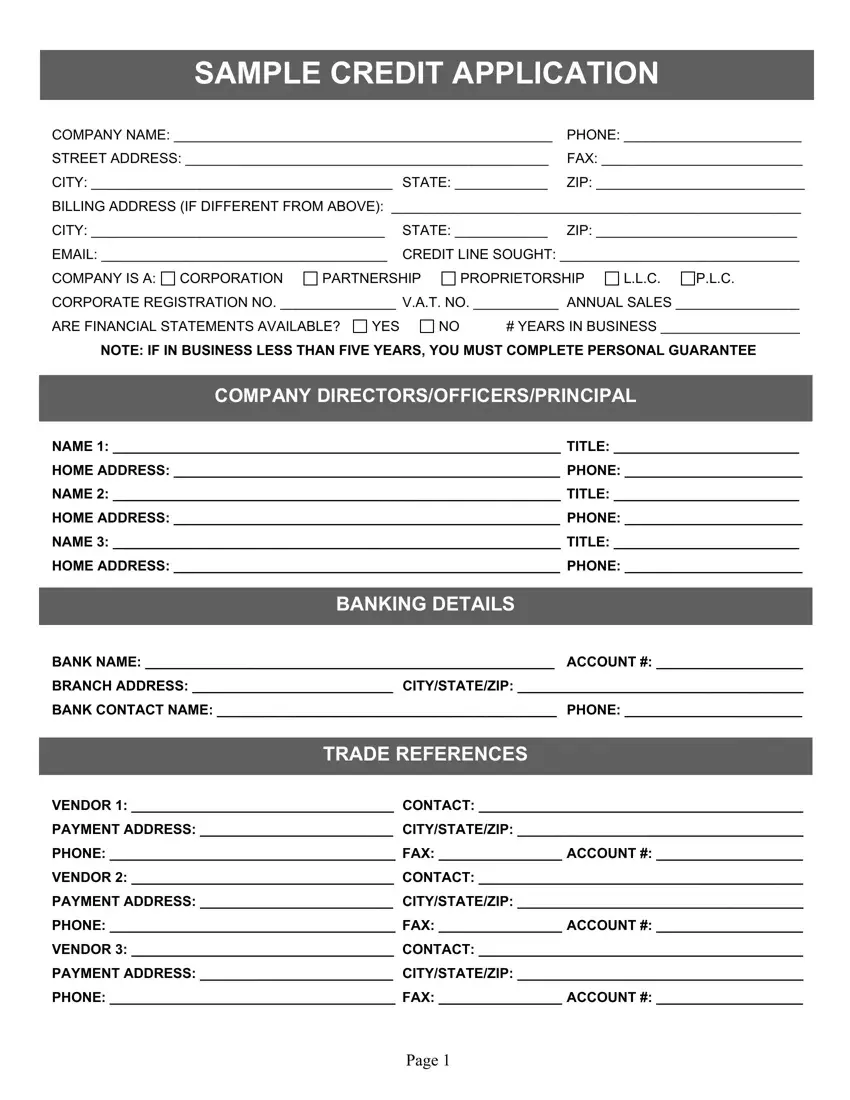

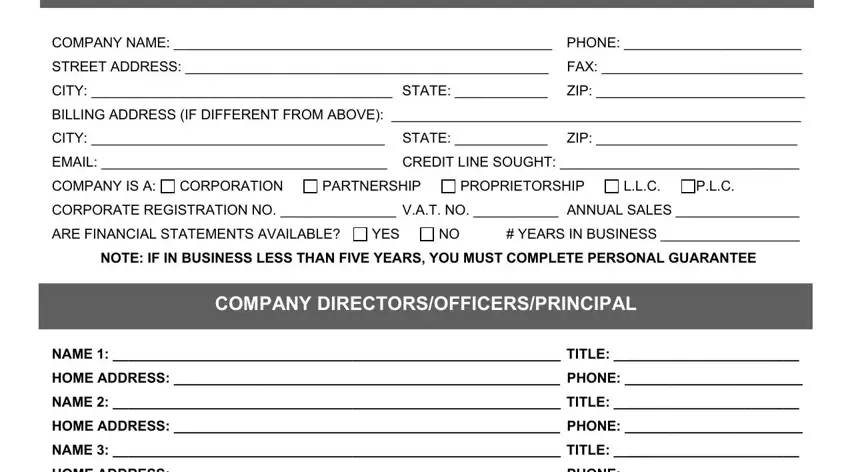

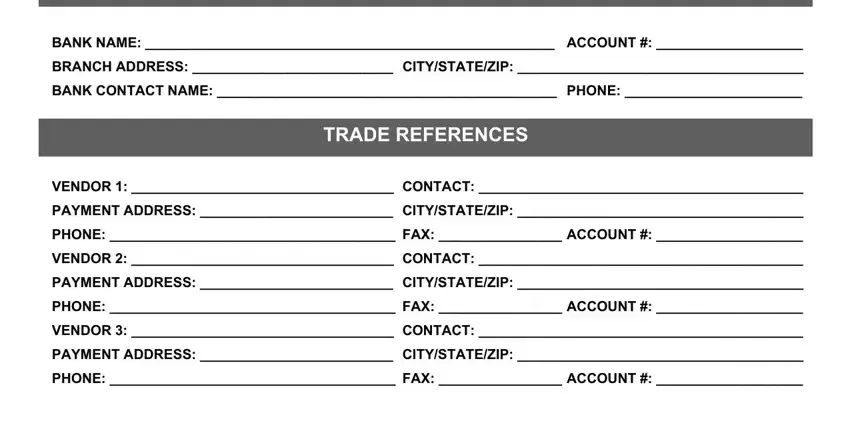

These segments are in the PDF form you'll be filling out.

Provide the appropriate information in the space BANK NAME ACCOUNT, BRANCH ADDRESS CITYSTATEZIP, BANK CONTACT NAME PHONE, TRADE REFERENCES, VENDOR CONTACT, PAYMENT ADDRESS CITYSTATEZIP, PHONE FAX ACCOUNT, VENDOR CONTACT, PAYMENT ADDRESS CITYSTATEZIP, PHONE FAX ACCOUNT, VENDOR CONTACT, PAYMENT ADDRESS CITYSTATEZIP, and PHONE FAX ACCOUNT.

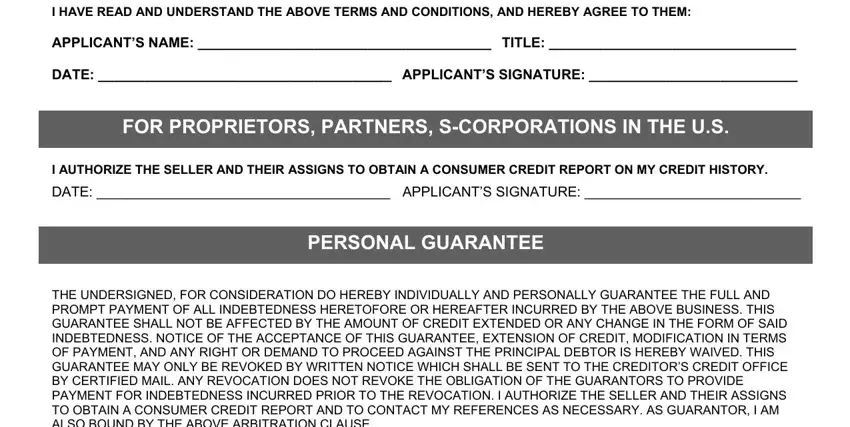

Jot down the main details in I HAVE READ AND UNDERSTAND THE, APPLICANTS NAME TITLE, DATE APPLICANTS SIGNATURE, FOR PROPRIETORS PARTNERS, I AUTHORIZE THE SELLER AND THEIR, DATE APPLICANTS SIGNATURE, PERSONAL GUARANTEE, and THE UNDERSIGNED FOR CONSIDERATION area.

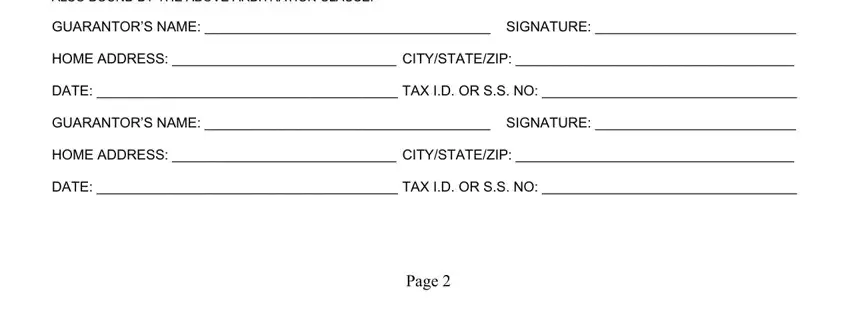

You'll have to identify the rights and obligations of all parties in box THE UNDERSIGNED FOR CONSIDERATION, GUARANTORS NAME SIGNATURE, HOME ADDRESS CITYSTATEZIP, DATE TAX ID OR SS NO, GUARANTORS NAME SIGNATURE, HOME ADDRESS CITYSTATEZIP, DATE TAX ID OR SS NO, and Page.

Step 3: The moment you select the Done button, your final document is simply exportable to each of your gadgets. Alternatively, you can deliver it by using mail.

Step 4: You will need to make as many copies of your document as you can to remain away from potential worries.